Triple-I: Inflation caused liability claims payouts to rise by up to $105B

By onInsurance

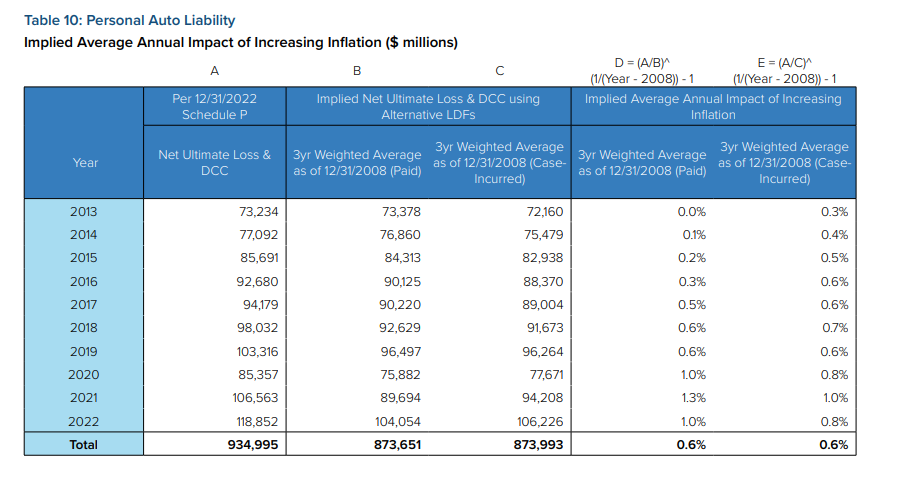

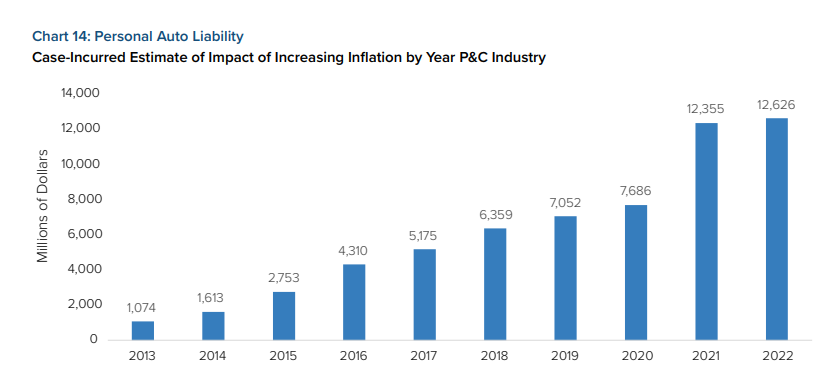

Social and economic inflation caused U.S. auto insurer liability claim payouts be to upward of $105 billion higher between 2013 and 2022, a new Insurance Information Institute (Triple-I) study says.

Its study, called the Impact of Increasing Inflation on Personal and Commercial Auto Liability Insurance, found that inflation drove personal loss and defense containment costs (DCC) up by $61 billion during the nine-year span. Commercial auto liability loss and DCC spiked by between $35 billion and $44 billion during the same period, Triple-I said.

Combined, the study found that rising inflation resulted in P&C auto losses that were between $96.1 billion and $105.2 billion during the time frame studied. The figures represent between 8.6% and 9.4% of the $1.1 trillion in booked losses during the timeframe, it added.

“For both personal and commercial auto liability lines, social inflation was the main source of increasing inflation before 2021,” the study said. “For 2021 and later, increasing inflation came from a combination of economic inflation and social inflation. There is evidence of a slowdown in claims payments in calendar years 2020 and 2021, likely triggered by slowdowns in court cases and other effects of the pandemic. The average annual impact of increasing inflation is approximately 0.6% per year for personal auto liability and between 2.3% and 2.7% for commercial auto liability.”

The study was conducted by Jim Lynch, Triple-I’s former chief actuary; Dave Moore of Moore Actuarial Consulting LLC and Dave Porfilio, Triple-I’s chief insurance officer.

It differentiates economic inflation, as measured in the study by the Consumer Price Index (CPI), from social inflation, which it said indicates how insurance claim payouts exceed the CPI.

Its yearslong analysis of claims payouts found that for personal auto liability insurers:

-

- “Losses have been growing faster than premiums in recent years;

- “Since Accident Year 2020, standardized losses rose 15% while standardized premium fell 13%; and

- “Severity, the size of losses, increased dramatically after 2019.”

As it relates to commercial auto liability, the study found that insurers experienced losses growing faster than the overall economy during the timeframe, driven largely by social influences before 2021. It said the average size of loss has increased dramatically since 2020.

The study concluded that commercial auto liability insurers saw:

-

- Losses grow faster than the overall economy;

- Social inflation as a primary influence on those losses prior to 2021; and

- The average size of loss —claim severity — increase dramatically since 2020.

“For both personal and commercial auto liability lines, social inflation was the main source of increasing inflation before 2021. For 2021 and later, increasing inflation came from a combination of economic inflation and social inflation,” the study said.

The study also detailed how the pandemic “ushered in significant changes to both commercial and personal auto liability,” with accident rate claims frequency declining in both personal and commercial lines. However, it also noted that the average claim size rose “significantly” in both categories.

Both personal and commercial auto segments experienced a slowdown in claims settlement patterns during the pandemic, followed by a speedup in 2020 and 2021, it said.

It attributed inflation to the rising cost of auto insurance.

An unrelated mid-year report from Insurify indicated that during the first six months of 2023, personal auto insurance prices have increased an average of 17% in the U.S. It projected another 4% increase before 2023’s close as Insurance Thought Leadership (ITL) said the auto insurance industry is in a state of “existential crisis.”

A more recent Insurify report, released last week, said that the ongoing Union Auto Workers (UAW) strike against General Motors, Ford Motor Co., and Stellantis could drive insurance rates even higher.

“Higher parts prices will mean it’s costlier to make and repair cars,” says Allie Feakins, senior vice president of insurance at Insurify. “This will drive up the severity of insurers’ losses, and lead insurance companies to raise rates.”

According to Insurify, rate increases have reached 34% in some parts of the U.S. this year.

Its data indicates drivers are cutting back on coverage to save money, with the number of drivers searching for full-coverage policies declining by 51% year-over-year.

Insurify listed factors beyond inflation that have contributed to the insurance spike, including supply chain issues, a rise in catastrophe claims, and increased accidents after the COVID-19 mandates were lifted. Now, ripple effects from the UAW strikes threaten to exacerbate the issue, it said.

“The impact may be more focused on the brands produced at the striking plants,” Feakins said. “Consumers may see price increases on these specific brand makes and models as opposed to the coverage-level price increases we’ve been seeing [on all car insurance] the past few years.”

Images

Featured image courtesy Wasan Tita/iStock

Images courtesy of Triple-I