Cox Automotive: Independent repairers gaining market share

By onMarket Trends

General repair shops are increasingly gaining market share compared to dealership shops in the U.S., according to Cox Automotive research.

In its report, “Under the Hood: Opportunities and Challenges in the Service Industry,” Cox Automotive says franchised dealerships are still the No. 1 preferred service provider, but have lost ground to service chains, such as quick lube locations and tire service centers.

During the second half of 2023, Cox Automotive surveyed 2,493 vehicle owners, including 182 electric vehicle (EV) owners, who had at least one vehicle service performed in the past year. Employees with decision-making authority over fixed operations at 525 franchised dealers were also interviewed for the research.

Dealership service accounted for 30% of all service visits in the U.S. this year, down from 35% in 2021 (the last time the service study was released). General repair and service stations were a close second this year at 28%. The last 42% are made up of tire repair stores, body shops, and specialists.

With inflation still elevated in the U.S. economy, automotive care and service costs have increased by 45% on average per service visit since 2021, according to Cox Automotive. That amount includes warranty costs, however, so the higher prices are not entirely borne by the vehicle owner.

Respondents still named cost-related issues as four of the top five reasons for not returning to a dealership for service — unreasonable total cost, expecting to be overcharged, unreasonable labor charges, and unreasonable parts charges. The reason unrelated to cost was the dealership not being in a convenient location.

“A recurring theme in the study is how cost is a major influencing factor on where service is done, and dealers believe a top reason new owners do not return for service is a fear of being overcharged,” Cox Automotive said. “However, the Cox Automotive survey and research suggest that dealership service costs are mostly on par with non-dealer providers. The average dealership service visit in 2023 costs $258; a visit to a non-dealer service provider costs an average of $249. This indicates that the suggestion dealers charge more for service is mostly unfounded.”

Thirty-three percent of owners said “general repair shops” were their preferred service provider, an increase from 32% in 2021 and ahead of dealers for the first time. Thirty-one percent of owners said they preferred dealers, down from 35% in 2021.

A key factor in where owners take their vehicles is trust, according to Cox Automotive’s findings.

The study found that trust in franchised dealer service has declined. Fifty-four percent of respondents said they returned to the dealership they bought their vehicle from because they trusted them. That’s a decrease of 8% since 2021.

Those who went back because of trust in their dealership are more likely to be very satisfied with their service experience and more loyal to the dealer than those who didn’t choose trust as the reason why they went back (83% versus 64%). Other reasons included past experience (46%), good purchase experience (43%), warrantied vehicle (33%), service contracted vehicle (22%), and being introduced to the service department when they purchased their vehicle (15%).

“The service business continues to be a key part of any dealership operation,” said Vanessa Ton, senior manager of market and customer research at Cox Automotive. “While our report lays clear some of the challenges facing service providers today, the good news is that the industry continues to grow with more customers going in for service visits, and most providers are seeing a boost in revenue for service as well.”

Forty-eight percent of respondents still said they were frustrated with at least one aspect of their recent service experience at a dealership, including service taking longer than expected, dealers pushing additional services, issues with appointment scheduling, and prices for the work being higher than estimated.

Dealerships in the U.S. are gearing up for a rise in EV service as sales are expected to surpass 1 million in a year for the first time this year, according to the study.

The survey results show that 71% of dealers have hired technicians who have gone through EV high-voltage system training and hold certifications. Sixty-seven percent have added infrastructure to support servicing EVs. However, 54% say they need more trained staff and 58% of dealers said they need more infrastructure.

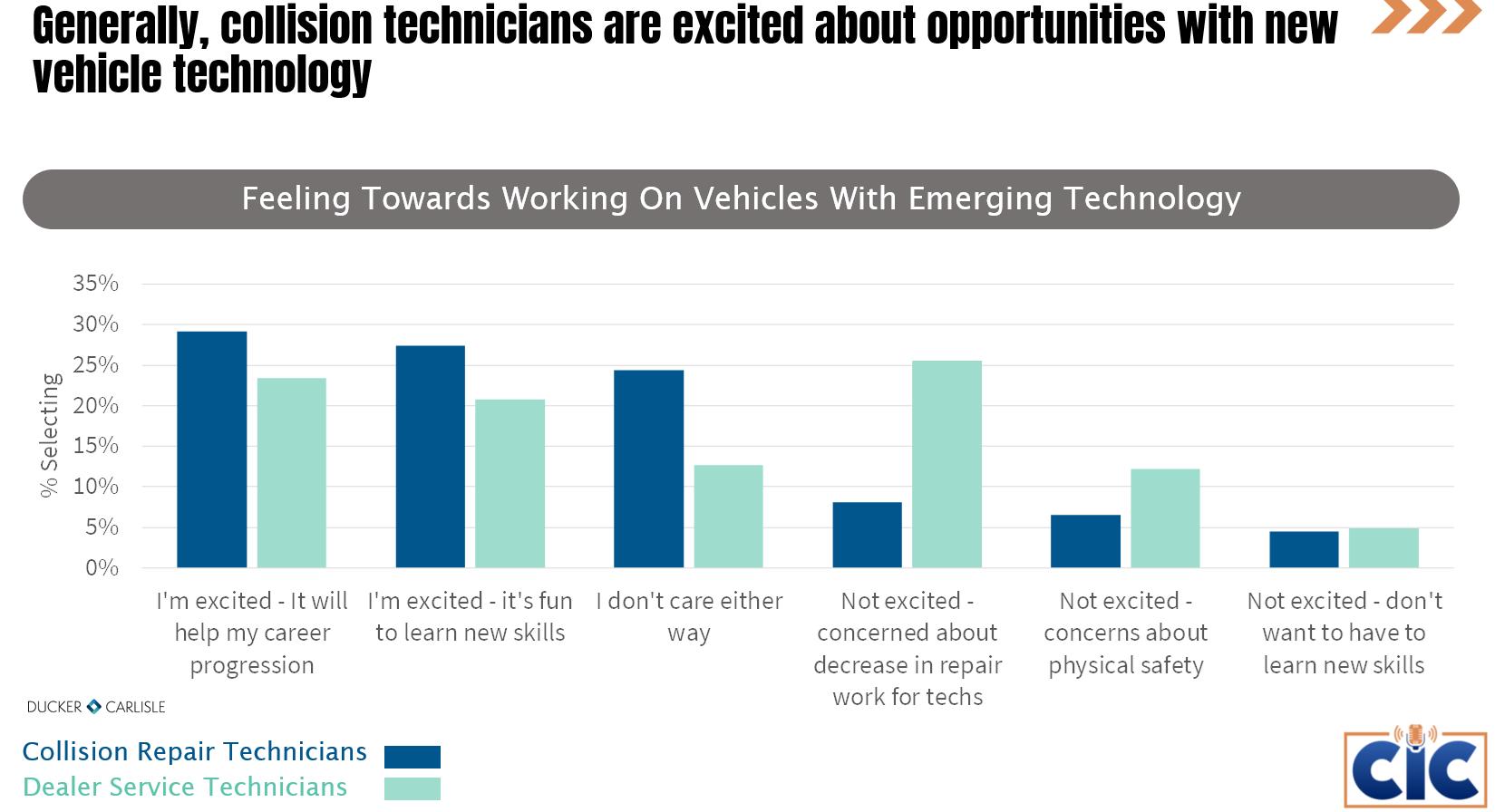

Another recent survey had similar results. Held in July and August, the survey of collision repair technicians was conducted by the Society of Collision Repair Specialists (SCRS) and I-CAR and then compiled by Ducker Carlisle. Overall, the 839 respondents said they’re excited about new vehicle technology and agreed that it will help progress their careers, and it’s fun to learn new skills.

Dealer repair technicians responded in the opposite direction saying they’re concerned new vehicle technology will decrease repair work, pose threats to physical safety, and that they don’t want to learn new skills.

“There’s definitely a correlation between how much training technicians have gotten on new technology and their excitement about it,” said Meredith Collins, Ducker Carlisle managing director, earlier this month. “The more you understand it and the more you know about it, the more excited you are.

“Getting technicians exposure to it and some training, even if it’s not something that they’re working on immediately, does a lot to one, make them more comfortable with it and two, get them that excitement of long-term career trajectory — ‘Oh there’s a future here, there’s these different paths. I’m always learning. I have new opportunities to grow my skills.’”

More than half of the dealers surveyed by Cox Automotive said they expect average repair and service costs to be higher with EVs, but the expectation is that the number of service visits for EVs will be lower, evidenced by 28% of dealers stating they believe EVs will require more service than internal combustion engine (ICE) vehicles.

Responses from EV owners to the survey show they visit service centers more often than ICE owners and have more services performed with each visit.

In the past year, the average EV owner visited a service center 2.6 times compared to the average ICE vehicle owner visit count of 2.3 times. The number of services performed per visit, which was 2.8 for EVs, was higher than the average 2.4 for ICE vehicle owners.

EV owners spent more time waiting for both maintenance (34 minutes longer) and repair work (51 minutes longer) compared to ICE owners, according to the survey results.

EV owners also reported fewer service visits that result in out-of-pocket (OOP) expenses, but those costs for EVs are higher.

“For example, 65% of owners of EVs four years or older reported OOP service expenses, whereas 87% of ICE owners driving four-years-or-older vehicles reported OOP expenses. However, EV owners typically paid more than $300 in OOP expenses per service visit. ICE owners’ expenses were closer to $250.”

Mitchell International’s “Plugged in: EV Collision Highlight,” released in August, found that during Q2 2023, severity costs were higher for EVs by $963 in the U.S. and $1,328 in Canada. For Tesla specifically, costs were $1,589 and $1,600 higher respectively.

“When we looked at EVs compared to ICE vehicles, they’re significantly more expensive,” Ryan Mandell, Mitchell’s claim performance director, previously told Repairer Driven News. “We also have to keep in mind that these are newer vehicles, and their average cash value vehicles are much greater than the average ICE vehicle in general.”

“And so when we see that, it makes sense that we’re going to expect there to be a higher cost of repair for these vehicles just based on those facts alone.”

The report also noted that EVs continue to take more time to repair with an average of 8.51 refinish hours, compared to 8.02 refinish hours for ICE vehicles.

In November, Rivian and Lucid Motors said EVs aren’t necessarily always more expensive to repair.

Lucid Body Repair Technical Manager Matthew Pitta said some procedures can be a little more difficult, but common procedures such as to quarter panels, rear ends, and quarter skins aren’t. For example, quarter skins take 2.5 hours to replace after teardown with all the tools laid out and ready to go, he said.

“The reason the repairs are getting expensive is the technology side of it — all the ADAS stuff, all of the programming, all of the firmware,” Pitta said. “You replace a module on a car, you might have to do firmware updates for two days sometimes to get everything else up to that level.”

He added that if all of that and ADAS calibrations can be streamlined to bring labor times down, costs should come down some.

Rivian Collision Service Engineering Senior Manager Dan Black agreed and said that Rivian is always investigating ways to bring costs down.

Cox Automotive’s study found that, with newer vehicles, the occurrence of OOP expenses is nearly identical between EV and ICE — 47% and 49%, respectively, but EV owners paid more than twice as much at $443 per occurrence and that isn’t solely auto body repair.

One reason for this difference is that EV owners are often more affluent, focused on the latest technology, and likely to have aftermarket accessories added as part of a service visit, particularly on newer products, according to the study.

Overall, EV owners report more frustrations with service work than ICE owners. A top frustration with EV owners is finding out how much service costs.

“There is a general expectation that EVs don’t require service or have minimal service needs, but that is not the case,” said Kayla Reynolds, manager of market and customer research at Cox Automotive. “EVs are new technology and, at this point at least, are in for service more often for warranty work and updates. EVs also tend to require more tire rotation and replacement, as EVs are heavier and harder on their tires.”

Thirty-nine percent of ICE owners suggested they had at least one frustration with their recent service experience, compared to 56% of EVs. Tesla owners were particularly frustrated, with 59% reporting at least one frustration, whereas 50% of non-Tesla EV owners noted a frustration.

Tesla owners were particularly frustrated with service work that took longer than expected, a lack of amenities in the waiting room during service, and struggles with scheduling appointments.

“Overall, our latest look at the service industry suggests that providers have an opportunity to focus on price transparency and grow trust with their customers,” Ton said. “When it comes to vehicle ownership, repairs and maintenance are important but can present challenges. To overcome these challenges, car dealerships should focus on expanding their service capacity by ensuring they have an adequate number of service bays and well-trained technicians, especially as the demand for electric vehicle services continues to rise.”

Images

Featured image: Zephyr18/iStock

Presentation slides on the SCRS and I-CAR survey results were shown during the Collision Industry Conference (CIC) November 2023 meeting in Las Vegas. (Provided by CIC and Ducker Carlisle)