Car rental industry has second record-breaking year for revenue

By onBusiness Practices | Market Trends

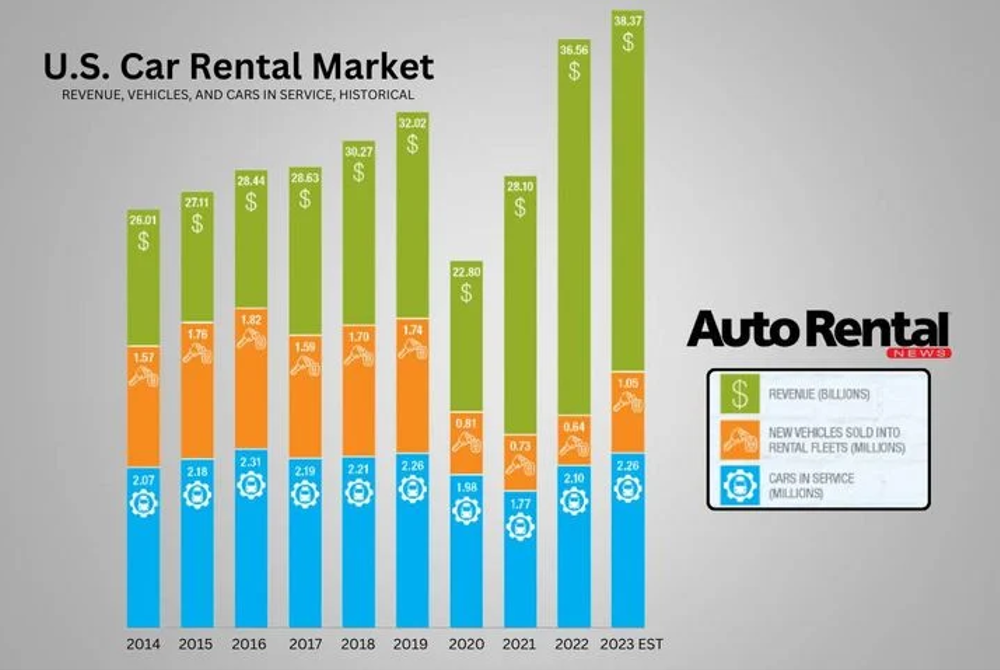

The U.S. car rental industry had record-breaking year for revenue in 2023, with an estimated $38.3 billion earned, according to Auto Rental News’ annual fact book.

The industry earned 5% more than the 36.1 million earned in 2022.

“The U.S. car rental market hit another record, yet the 5% growth over 2022 was at a much slower rate than the astounding 23% and 30% year-over-year growth in 2021 and 2022,” Chris Brown, associate publisher of Auto Rental News, said in an article. “This slower growth was expected, and even welcomed as it came with a return to more normalized seasonal fleeting and de-fleeting patterns. However, fleet and other expenses rose at least 15%, which ate into earnings.”

Financing is the biggest concern facing the industry in 2024, Brown said in the fact book.

“Financing at 8% compared to 2% adds hundreds to a car, and that money doesn’t come back at resale,” Brown said. “This is compounded by the fact that those expensive vehicles operators were forced to buy will come back to the market in greater numbers in 2024. Under-depreciated units combined with high-interest rates will be the biggest heartburn to profits this coming year.”

The industry’s fleet is estimated at about 2.2 million vehicles, the same size as the fleet pre-pandemic in 2019. Data from the past 10 years shows fleets were at their lowest in 2021, with 1.7 million vehicles.

Rental companies purchased 1 million vehicles in 2023, which remains lower than pre-pandemic years, with 1.7 million vehicles purchased in 2019. However, purchasing is higher than the 810,000 vehicles purchased in 2020, 730,000 in 2021 and 640,000 in 2022.

Enterprise Mobility, which includes Alamo Rent A Car, Enterprise Rent-A-Car and National Car Rental, led the industry with an estimated $21.4 billion. The company has 5,500 locations and 1.3 million vehicles in service. If the estimate holds true, the company will increase revenue from the $19.9 billion earned in 2022.

Avis Budget Group, which includes Payless, followed Enterprise with a revenue estimated at $8.3 billion. It has 3,000 locations nationwide and 445,000 vehicles in service. The company is projected to make about $100 million less than the $8.4 billion earned in 2022.

Hertz, which includes Dollar Car Rental and Thrifty Car Rental, had the third-highest estimated revenue at $6.4 billion. The company has 3,350 locations and 380,000 vehicles in its fleet. The company is estimated to make about $200 million more than its 2022 revenue of $6.2 billion.

The length of rental (LOR) for collision-related claims have been high for the rental car industry since the pandemic, as repair shops faced backlogs partly due to part delays. In 2023 and 2022 the LOR has lowered slightly.

Enterprise data shows the LOR for Q3 was 17.5 days, a 0.7 day decrease from Q3 2022.

“The growing trend of lowered LOR is promising, but it’s important to note these are still ‘new normal’ figures, as LOR was 15.2 days in Q3 2021 and 12.3 days in Q3 2020,” Enterprise said.

An Auto Rental News survey found 53% of 103 respondents plan to increase their fleet in 2024. Most respondents were from independent or affiliate rental businesses that averaged fleet sizes of 663 vehicles.

When asked about the biggest threat to their business, 41% said rising vehicle cap costs and fewer fleet deals. Competitors’ rates followed as the second largest concern at 13%.

The wholesale costs of used vehicles remained up 38 %

Forty-nine percent of respondents believed their revenue would increase next year, with 36% thinking it would stay the same and 15% believing it would decrease. However, 41% of respondents felt their net profit would fall, 36% thought it would increase, and 23% thought it would stay the same.

A majority, or 46%, of respondents expected their rental rates would stay the same in 2024, with 34% thinking it would increase and 20% thinking it would decrease.

Images

Photo courtesy IJzendoorn/iStock