Analysis: P&C sector represented the bulk of this year’s insurance layoffs

By onAnnouncements | Insurance | Market Trends

Property and casualty (P&C) insurers represented the largest portion of insurance-related layoffs this year, according to a new analysis.

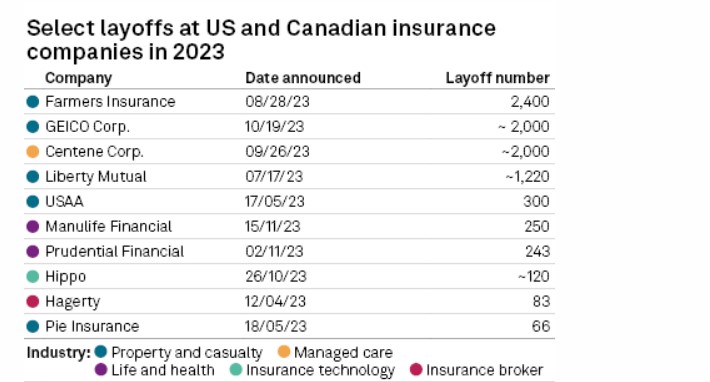

The S&P Global Market Intelligence analysis found that at least 6,800 jobs were lost throughout the year in the P&C space, with approximately 20 companies trimming back on staff to “refocus their businesses or decelerate cash burn.”

“For larger carriers, the layoffs were less about conserving cash so that they can survive longer and more about, in some cases, refocusing the business,” according to Kaenan Hertz, managing partner at Insurtech Advisors LLC, told S&P.

Farmers Insurance topped its list of layoffs after the company let go 2,400 people in August, or approximately 11% of its employees through all its businesses lines. It said at the time that it was shifting to a “more simplified and streamlined organizational structure.”

“Given the existing conditions of the insurance industry and the impact they are having on our business, we need to take decisive actions today to better position Farmers for future success,” said Raul Vargas, president and CEO of Farmers Group Inc., said in a press release “Decisions like these are never easy, and we are committed to doing our best to support those impacted by these changes in the days and weeks to come.”

It was not clear how the company’s new approach will affect repair professionals, or their customers who work with insurance adjusters daily on claims and repair plans.

GEICO represented the company with the second-highest layoffs after approximately 2,000 workers lost their jobs in October. The company’s CEO said in an internal email shared with Repairer Driven News at the time that GEICO’s remaining staff was ordered to return to the office.

Todd Combs said in his letter to employees that the move was made to “better position ourselves for long-term profitability and growth,” and that the layoff represents 6% of the company’s workforce.

“We have seen significant changes to our company over the past few years, and we have evolved our business practices to help address a very difficult period across the industry,” Combs wrote. “Levels of inflation that we haven’t seen in decades, delays in parts or labor shortages extending time to repair, rising medical costs, and other factors have caused our loss costs and combined ratio to increase, alongside the entire industry.”

Other P&C insurers to make cutbacks last year included Liberty Mutual, USAA, and Pie Insurance.

Earlier this month, the credit rating agency AM Best said in its latest property insurance report that the market segment continues to have a subpar outlook, driven by a number of factors working against the industry.

“The outlook for the personal lines segment remains negative amid deteriorating personal auto and homeowners results,” AM Best said in its report.

The agency’s outlook is a reflection of how current trends are likely to impact insurers throughout the next year. It said its less than favorable outlook for personal lines doesn’t necessarily mean all companies will do poorly, but that they’ll likely be impacted by ongoing conditions.

It said: “Carriers that are slow to address the challenges ahead or do not have the means, expertise or technical capabilities to keep pace with changes in the segment will likely face ratings pressure.”

Images

Featured image courtesy of Bill Oxford/iStock