J.D. Power says drivers are giving in to higher insurance premiums

By onInsurance

The last quarter of 2023 insurance shopping results began to confirm that consumers are getting used to the idea of higher auto insurance premiums, though slowly, according to J.D. Power.

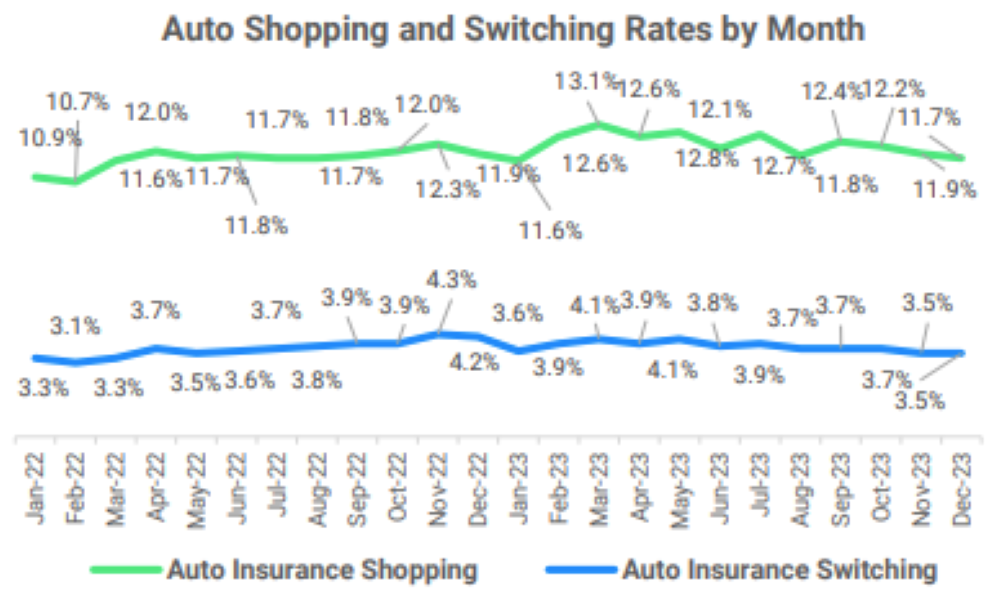

In its Q4 loyalty indicator and shopping trends (LIST) report, created in collaboration with TransUnion, J.D. Power states that the shopping rate fell from 12.3% to 12%. The shop rate decreased every month during the quarter.

Every month throughout 2023, auto insurance premiums were either one of or the leading component of increases in the Consumer Price Index (CPI), the report states.

For example, Progressive announced last year that it had a plan for “aggressive” rate increases — by 4% companywide during Q1 following an increase of 13% in 2022, and Travelers doubled its rates.

In December, Allstate announced double-digit rate increases in California, New York, and New Jersey one week after CEO and President Tom Wilson said the company would drop insurance customers in those states if rates weren’t increased.

Meanwhile, insurers are profiting by millions off the increases and seeing their stocks rise.

The inflationary rate of auto insurance climbed by 19.2% from November 2022 to November 2023, continuing to be above the total inflation rate of 3.1%, contributing 0.5 percentage points to the rate, according to the U.S. Bureau of Labor Statistics (BLS).

“The first half of the year saw consumers react by increasing their shopping of and switching from auto insurers,” the J.D. Power LIST report states. “Our Q3 report revealed the first dip in insurance shopping in a full year and explored whether this meant consumers were coming to terms with higher premiums or simply finding it too difficult to obtain a lower quote on their auto insurance. Despite this decrease, shopping in Q3 of 2023 was still higher than in Q3 of 2022.”

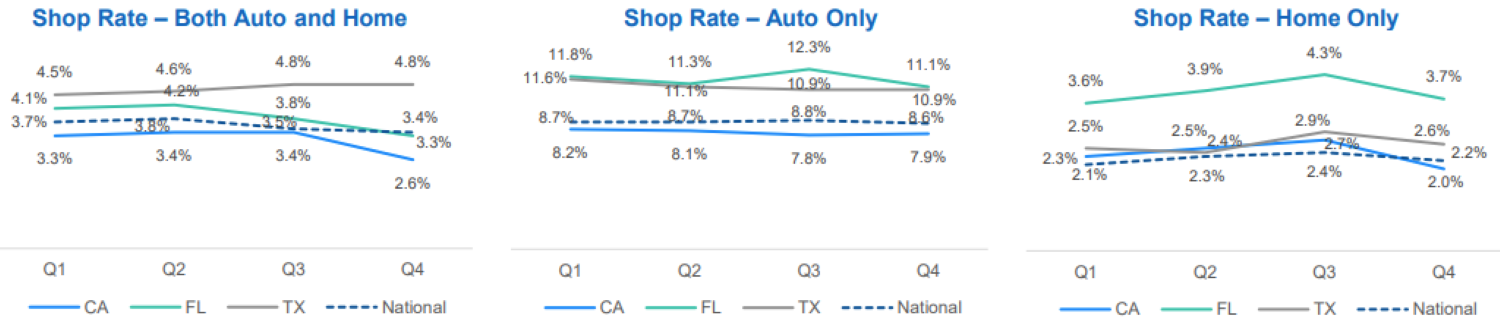

The Q4 report looked deeper into the Texas, Florida, and California markets, especially as insurers have been cutting back on policies in Florida and California. The cutbacks caused bundled home and auto insurance policy shopping to fall in both states. It remained flat in Texas, where capacity wasn’t pressured, according to the report.

Auto insurance shopping rates in Texas and Florida were the second and third highest in the nation in 2023 compared with California at 33rd, according to J.D. Power.

“Auto policy shopping was higher in Florida and Texas than in California (where auto premium increases are just beginning to approach recent increases in other states),” J.D. Power wrote. “These trends throughout 2023 are mostly flat.”

TransUnion concluded that high auto shopping rates are driven by continued premium increases, tighter underwriting, and increasing new vehicle sales, according to the credit reporting agency’s “Q4 2023 Insurance Personal Lines Trends and Perspectives” report.

“[E]levated auto shopping rates are in large part driven by record premium increases,” the report states. “However, other factors may be adding to this spike as well. Profitability actions taken by carriers, including suspended distribution channels and new business underwriting restrictions, could prompt consumers to expand the number of insurers they shop with. And then there’s the simple fact that more people are buying new cars — an act that has a large impact on who shops for auto insurance and when.”

TransUnion also found there were more shoppers last year who had higher credit-based insurance scores (CBIS) than those with lower scores. A high CBIS indicates lower risk. The trend was the opposite of 2019, when higher-risk shoppers made up the majority of those looking for insurance.

“During the height of the COVID-19 lockdowns, many individuals paid down debt and improved their credit-based scores, thanks to a combination of lower expenditure and government pandemic support,” the report states. “Thus, some of this shopping is being conducted by the same people who are now in a different CBIS segment. Another potential factor is that recent rate increases are largely driven by base rate changes, impacting all customer segments.”

J.D Power noted that the impact of GEICO’s pullback from the market took it from being the leading destination for at least one insurer’s defectors during every quarter of 2021 and 2022 from only once last year, in Q3 for shoppers who left USAA defectors.

Among the top 10 carriers, GEICO lost most of its business during Q4 to Progressive.

Images

Featured image credit: designer491/iStock

Charts provided by J.D. Power