California law protected consumers from $3 billion in auto insurer hikes, report says

By onAnnouncements | Insurance

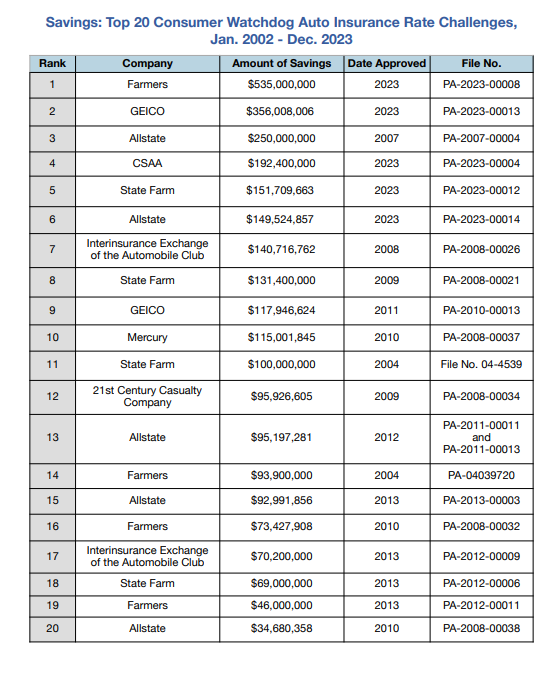

A California law has given Consumer Watchdog, a nonprofit advocacy group, the ability to block $3.16 billion in auto insurance overages since 2002, a new report from the group said.

“The savings are thanks to a provision of Proposition 103 that subjects insurance companies to public scrutiny and empowers consumers to independently challenge unjustified rate increases and other unlawful insurance company practices,” a press release from the group said.

The release said the law is essential more than ever as insurance companies seek billions in additional new rate increases and attempt to weaken the state’s consumer protections. It said insurance companies blame the protection law for slowed processes and financial shortages.

“The voters understood that the industry and its allies would do everything they could to undercut the protections of Prop 103, so they gave themselves the independent authority to monitor and enforce the law in all matters before the Department of Insurance and the courts,” said Harvey Rosenfield, the author of Proposition 103 and the founder of Consumer Watchdog. “The goal of the opponents of public scrutiny and participation is to allow insurance companies to overcharge Californians. Make no mistake: paying the insurance industry’s ransom through unjustified premium hikes is not the way to address the shortages that the companies have created in the home and auto insurance markets.”

Last month, Allstate received double-digit rate increases in New York, New Jersey, and California after CEO and President Tom Wilson threatened to leave the states if the increases weren’t approved.

Insurers claim pandemic losses from part delays, rising labor costs, and used car values are why they’ve hiked rates in recent years. The rate hikes continually receive criticism from consumer advocacy groups who’ve claimed insurers are overstating needs and overburdening the consumer.

Illinois PIRG Education Fund continues to advocate for consumer protection laws in its state. Illinois, home to State Farm, is one of two states without laws that allow regulators to reject or modify auto insurance rate increases. The advocacy group estimates insurance rates increased by $1.25 billion in Illinois in 2023.

As some insurance companies are starting to show a return on profits, a recent Value Penguin and Lending Tree study suggests the insurance industry will make a projected 12.6 % increase in its premiums in 2024.

While insurers increase rates, the collision repair industry has been vocal that it’s seeing increased consumer responsibility for out-of-pocket expenses due to short payments.

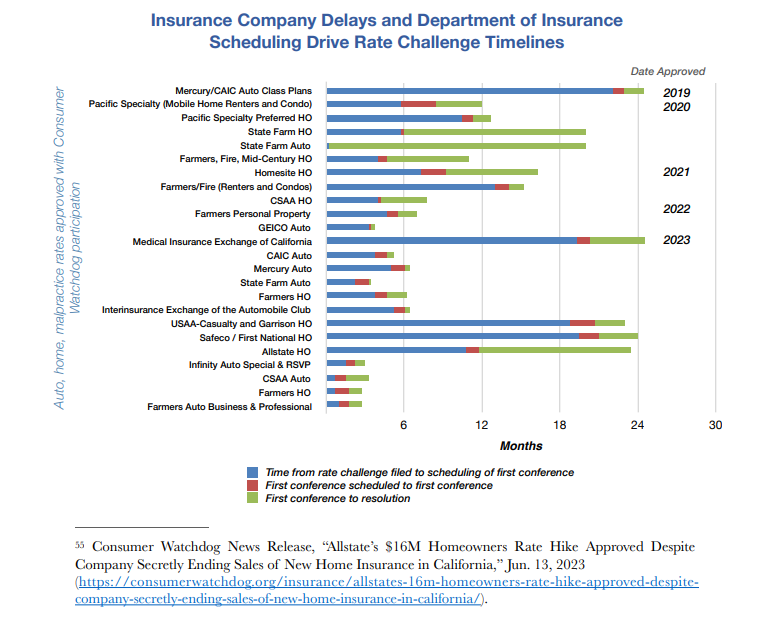

The Consumer Watchdog report said insurers were at fault for delays by routinely failing to file the paperwork required for the rate application and refusing to cooperate with state and advocacy group requests.

A nearly two-year delay by Mercury Insurance after the advocacy group questioned conflicting data and calculations is used as an example in the report.

It also noted that the California Department of Insurance (CDI) took an average of 7.2 months to schedule conferences once insurance rate challenges were filed.

The Consumer Watchdog report found insurance companies have filed more than 25,000 applications for rate increases since California Insurance Commissioner Ricardo Lara took office in 2019.

“Between then and December 2023, Consumer Watchdog completed a total of 42 challenges to those applications. Thirty-three of those challenges concerned requests for approval of rate changes (as opposed to other illegal rating practices and conduct),” the report said. “In 19 of those rate challenges, the proposed rate increase was approved at a lower percentage than the company originally requested—ranging from 0.6 to 21.6 percentage points lower. In seven of the 33 cases, the insurance company chose to withdraw its application rather than proceed to address Consumer Watchdog’s objections. And in seven instances, the Commissioner approved the rate the company originally requested.”

The report says the group didn’t intervene with rate requests between January 2022 and October 2023. It notes that the insurance companies received most of what they requested without any intervention from the group.

“In auto insurance rate applications the Commissioner approved rate increases at an average of 98% of the rate requested,” the report said. “When Consumer Watchdog participated, the Commissioner approved an average of 71% [of] the rate requested.”

IMAGES

Image courtesy of Mohamad Faizal Bin Ramli/iStock