Majority of P&C insurers surveyed plan to increase staff this year

By onInsurance

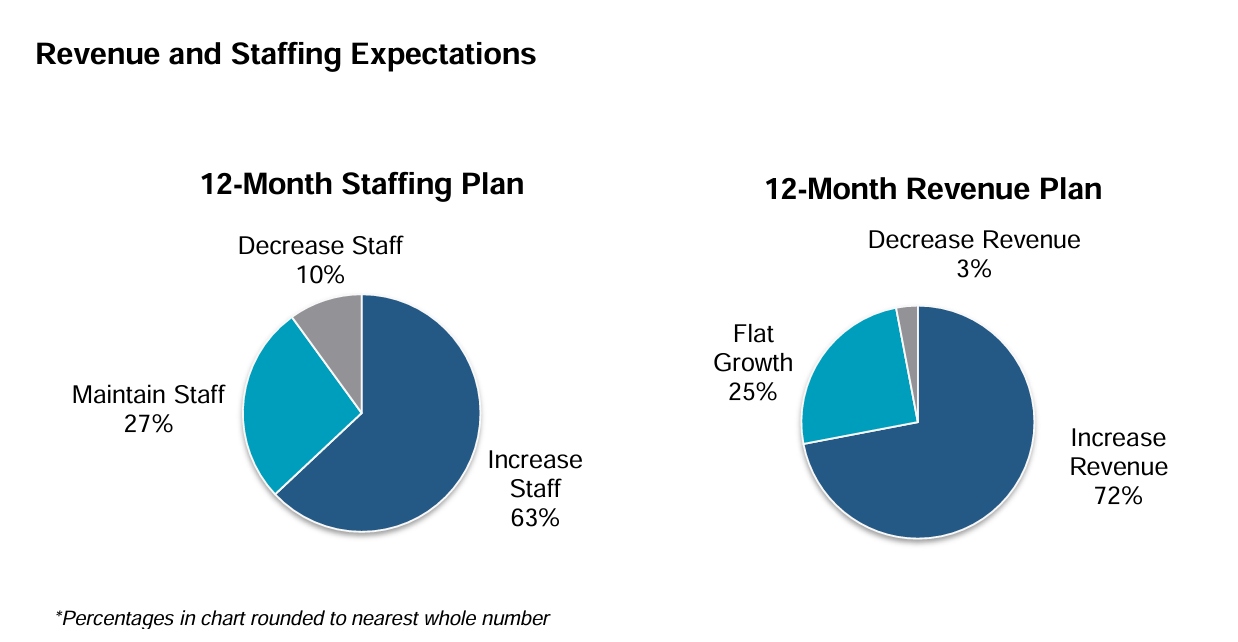

Jacobson Group CEO Greg Jacobson recently explained, according to the Insurance Journal, that 52% of carriers plan to increase staff in the next year while 38% plan to keep the staff they have without changes, and 10% plan to make cuts.

While that may seem promising, he added that it’s the lowest the number has been since 2012, not counting 2020.

“There’s been a significant change in [the] thought process as it relates to companies looking to expand their hiring,” he said. “And it’s slowed down fairly significantly. That said, this does not mean — and we have not seen this — that there are going to be mass layoffs that are going to be impacting the industry.”

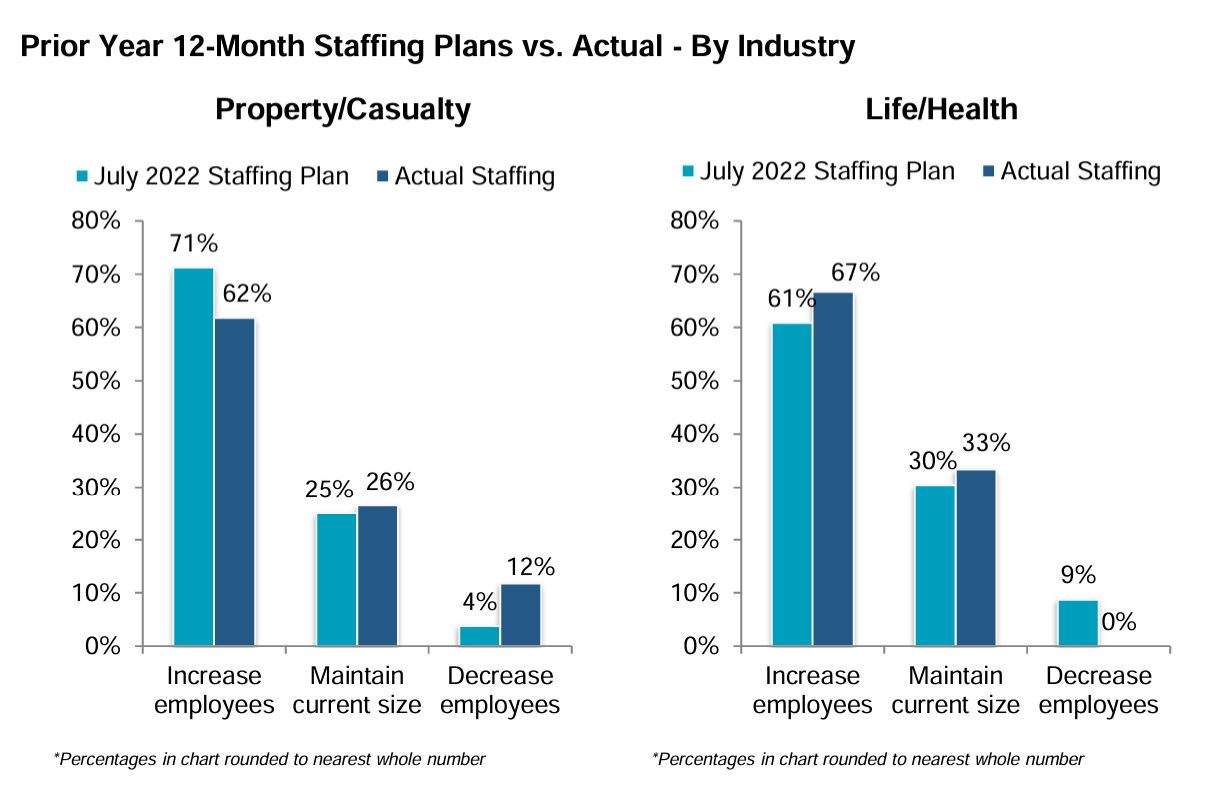

The results of a labor market survey given by Jacobson Group and Aon during Q3 2023 (released in August) found that 65% of P&C insurance companies planned to increase their staff over the next 12 months while 10% planned to make cuts. In July 2022, 71% of P&C companies planned to increase staff, but only 62% of companies did, according to the Q3 2023 results.

In reference to the 10% planning to make cuts, which is comparable to recent years, he said, “I think that overall, what this is saying is that there’s a significant pause, at the very least, in terms of the amount of growth that’s going to be taking place in the industry, but not necessarily mass layoffs, as 38% of companies are planning on just keeping the same number of staff that they had over the last 12 months.”

In January, Jacobson Group and Ward said P&C companies expected to see 84% in commercial lines revenue growth and 54% in personal lines during the same time frame.

Overall, including life and health insurance lines, the Q3 survey found the primary reason companies plan to increase staff is an expected increase in business volume (47%) followed by expansion of business/new markets.

Automation was the most common reason listed for why companies plan to reduce staff, followed by reorganization. Technology, claims, and underwriting roles are expected to grow the greatest within the next year.

“Carriers are navigating the evolving market amid a strong and stable talent landscape,” the survey results report states. “Industry unemployment remains low and job openings are elevated compared to pre-pandemic numbers.”

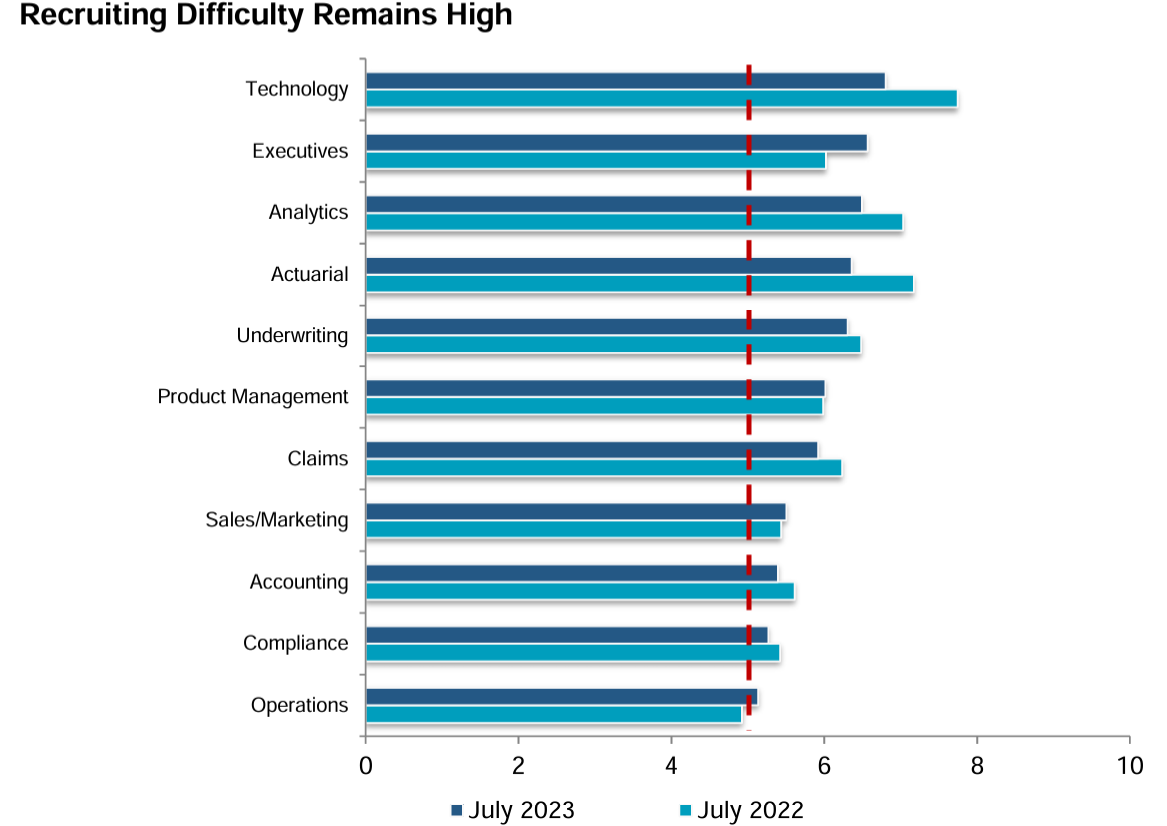

Actuarial and product management were the top two areas where companies said they’re looking to add experienced staff while operations and claims roles will be most likely to bring in entry-level positions. Technology, executive, and analytics positions are the most difficult to fill.

Seventeen percent of companies feel the ability to hire talent has become more difficult compared to the prior year, down from 48% in the July 2022 survey.

In total, the industry’s greatest need is technology staff, the survey found. “Large companies are most likely to hire technology roles followed by underwriting and analytics in the next 12 months. Medium-sized companies are looking toward technology then analytics while small-sized companies have the greatest need in claims followed by technology.”

Key: On a scale of 1–10 (10 being the most difficult), positions rated five or above are considered moderate or difficult to fill.

During Q3 2023, 92% of companies offered a hybrid office and remote work model to their employees. Sixty-eight percent required full-time remote work and 54% offered flexible work hours.

Sixty-five percent of employees said they would expect office work at least one day a week within the next six months from the time of the survey. Nineteen percent planned to require their employees to work in the office more.

As inflation moderates, Aon partner Jeff Rieder told Insurance Journal that P&C insurers will realize the rate increases they’ve implemented in the past two years, which will make for a much stronger position by the end of this year, barring any major catastrophe or other event, and carry into 2025 to allow for more expansion.

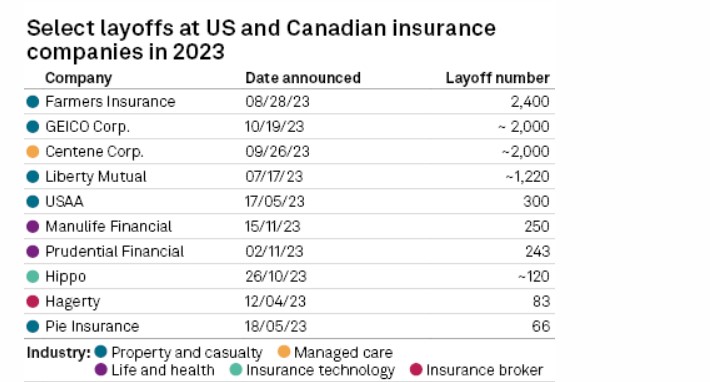

The survey results make for an interesting comparison to news from S&P Global Market Intelligence in December that P&C insurers represented the largest portion of insurance-related layoffs in 2023.

The analysis found that at least 6,800 jobs were lost throughout the year in the P&C space with approximately 20 companies trimming back on staff to “refocus their businesses or decelerate cash burn.”

Farmers Insurance topped its list of layoffs after the company let go 2,400 people in August, or approximately 11% of its employees through all its business lines. It said at the time that it was shifting to a “more simplified and streamlined organizational structure.”

In October 2023, GEICO let 2,000 employees go — 6% of the company’s workforce — due to “better position ourselves for long-term profitability and growth,” according to CEO Todd Combs.

Liberty Mutual was the next company to make cuts, letting 850 employees go as part of a long-term transition to minimize risks, according to the insurer. The layoff followed a previous cut of 370 positions earlier in the year.

Images

Featured image credit: Perawit Boonchu/iStock

Charts courtesy of Jacobson Group and Aon