Mitchell: EV total losses increasing similarly to new-model ICE vehicles, claims costs still outpace in comparison

By onMarket Trends

Mitchell International’s latest electric vehicle (EV) trends report states that total loss frequency of the segment rose in Q1 compared to late last year as the price of used vehicles has fallen.

In the U.S. and Canada, EV total loss rates were 9.93% and 7.48%, respectively — an increase of 8% from Q4 2023 and 30% from Q3 2023 in both regions.

Despite the dramatic rise, EV total loss frequency remains in line with model year 2021 and newer internal combustion engine (ICE) alternatives, which ended the quarter with a rate of 9.51% in the U.S. and 7.44% in Canada.

“Slowing new sales, manufacturer price reductions, and changing consumer sentiment are impacting the value of used EVs,” said Ryan Mandell, Mitchell’s director of claims performance, in a news release. “As a result, the total loss frequency for collision-damaged EVs is increasing. However, it is also increasing for new gasoline-powered vehicles, which are comparable to EVs in terms of their complexity and cost to repair.”

Other auto claim differences between EVs and ICE automobiles last quarter, according to the report, include:

-

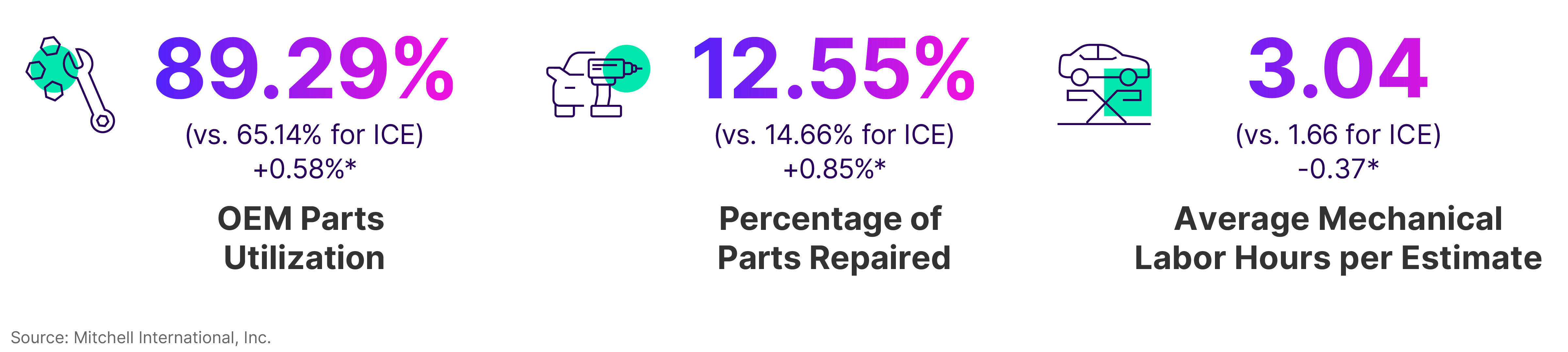

- Repair labor hours: The average number of mechanical labor hours on estimates for repairable vehicles was nearly twice as high for EVs as it was for ICE vehicles (3.04 versus 1.66 hours), which added to repair costs. The extra EV labor hours are likely due to the management of the high-voltage battery, which requires de-energization and often complete removal to protect it during collision repair and refinishing processes.

- Claims severity: Average claims severity decreased in Q1 but severity costs for EVs continue to outpace ICE vehicles. In the U.S., the severity difference between the two powertrains was $1,363, or 29% ($6,066 versus $4,703) and in Canada, it was $1,700 CAD or 33% ($6,810 versus $5,110 CAD).

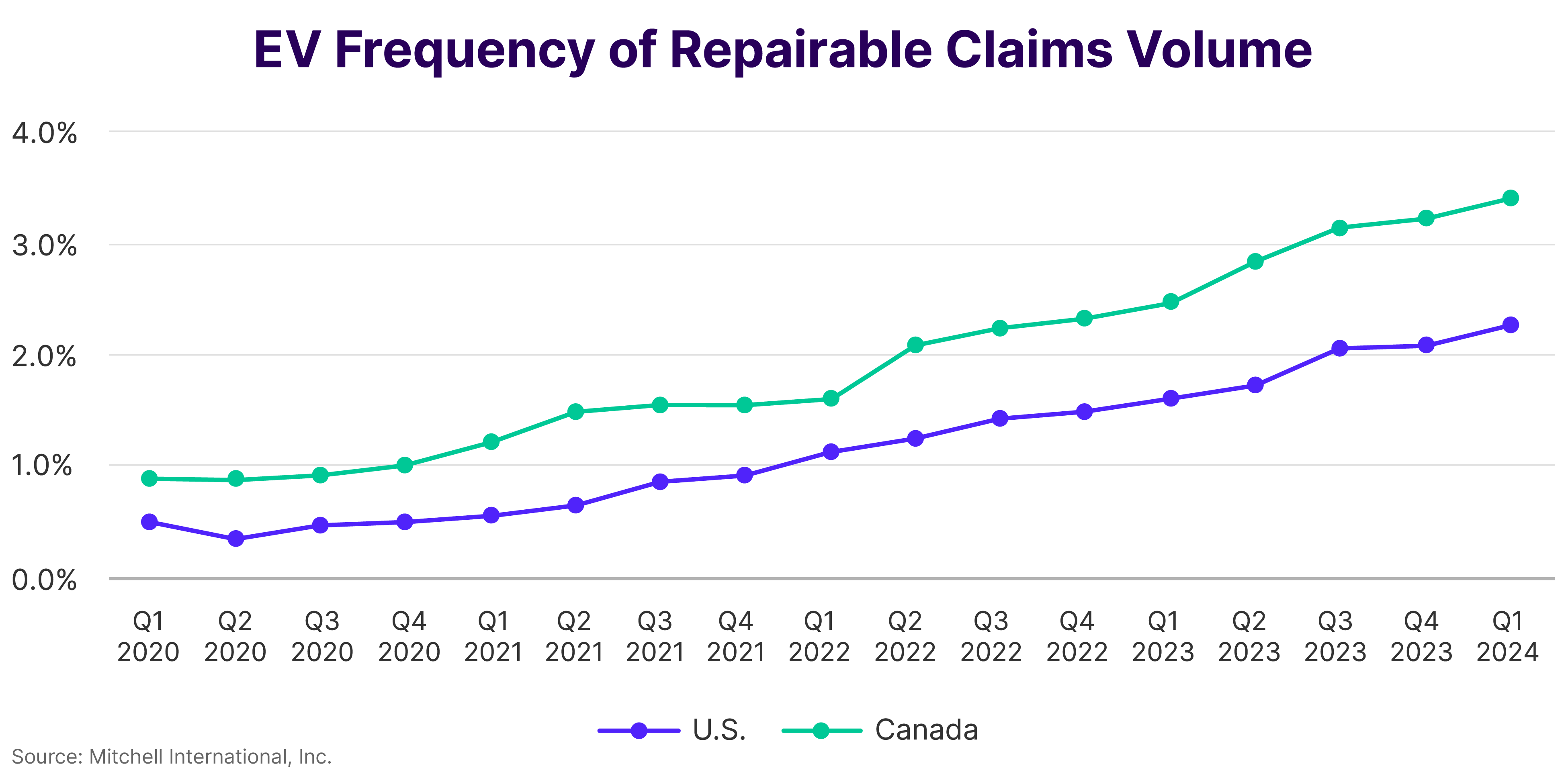

- Claims frequency: Even as EV sales slow, claims frequency is growing steadily, rising to 2.26% in the U.S. and 3.41% in Canada. This represents an increase of 40% and 38%, respectively, over Q1 2023.

- Parts utilization and repair: Without a robust inventory of aftermarket and recycled parts, EV collision repairs are more likely to include OEM parts than those completed on ICE alternatives (89.29% versus 65.14%). EV parts tend to be of lighter weight to offset a much heavier battery making them more difficult to repair. In Q1, the percentage of EV parts repaired versus replaced was nearly 13% and, for ICE vehicles, was closer to 15%.

Mandell found that price reductions of Tesla EVs late last year spurred price decreases across the entire EV segment. As a result, he predicts price parity between EVs and ICE vehicles may be coming faster than previously thought.

However, price changes also caused weakened consumer confidence in the financial viability of used EVs as prices fell by more than 30% year-over-year compared to a 3.6% decline for used ICE vehicles.

Range anxiety continues to be a barrier to EV adoption but the rising cost of fuel and availability of charging ports (22% in the U.S. and 30% in the U.S. last year) could spur an increase in EV purchases especially as “exorbitant EV premiums are seemingly a thing of the past,” Mandell wrote.

The “Plugged-In: EV Collision Insights Q1 2024” and previous reports are available to download on Mitchell’s website.

A report released in January by the Alliance for Automotive Innovation (Auto Innovators) found more EV models were available on the market and sales were up in Q3 2023 compared to Q3 2022.

In addition to summarizing sales, the “Get Connected Electric Vehicle Report” highlights EV purchasing trends across all 50 states. More than 378,000 EVs were sold nationwide during Q3, which was a 63% increase over Q3 2022, according to the report.

Images

Featured image credit: Ruslan Sidorov/iStock