Boyd, trade groups’ comments highlight value of shop access to cash in COVID-19 downturn

By onAnnouncements | Associations | Business Practices | Market Trends | Repair Operations

Gerber Collision’s parent company said Wednesday it would temporarily halt acquisitions due to the COVID-19 coronavirus disruption — allowing it to tap hundreds of millions in potential credit to weather a business downturn it might already be experiencing.

“Worldwide, we are all adjusting and adapting to daily changes as a result of the COVID-19 pandemic,” Boyd Group Services CEO Tim O’Day said in a statement. “While the impact on our business thus far has not been material, this could change quickly. The outbreak of contagious illness such as this can impact operations, including staffing and the volume and pace at which collision repair shops can fix damaged vehicles and may lead to the temporary closure of facilities. The pandemic could also result in decreased demand for services, as well as interruptions to the supply chain, including temporary closure of supplier facilities. In fact, over the past few days, we have noted a weakening of demand, possibly from customers deferring repairs to avoid exposure and the result of reduced miles driven and less road congestion as fewer people travel to schools , offices, sporting and other public events and places. Given this high level of uncertainty surrounding COVID-19 impacts, we are in the process of making proactive changes and contingency plans relating to the current environment and we will continue to work to address COVID-19 challenges as they evolve, so as to minimize the risk and impact to our employees, customers and shareholders.”

“Fortunately, our conservative financial strategy positions us with a strong balance sheet and financial flexibility that has been further enhanced through the increased and extended credit facility announced earlier today, which provides us with over $800 million in dry powder,” O’Day also said. “While long-term, the Company will continue to pursue accretive growth through a combination of organic growth as well as acquisitions and new store development, our immediate focus is on preserving our financial flexibility as we deal with the uncertain impacts of COVID-19. We will therefore be taking a near-term pause on closing and funding acquisitions until we have greater clarity. Our long-term goals and operational plans could be delayed due to this uncertainty surrounding COVID-19.”

O’Day said on an earnings call Wednesday that Boyd would keep having conversations with shops interested in selling. It just wouldn’t restart the actual M&A process until “ample liquidity” existed and it was safe to travel, Chief Financial Officer Pat Pathipati said.

The Boyd announcement came the same day as the Society of Collision Repair Specialists and many other industries’ trade groups called on Congress and the White House for business assistance, including unsecured credit.

“Individually and family-owned companies operate on their cash flow, and that cash flow has been severely disrupted in the past week – their costs are up and their revenue flows are down, if not shut off completely,” the trade groups wrote to Republican President Donald Trump, U.S. House Speaker Nancy Pelosi, D-Calif., and Senate Majority Leader Mitch McConnell, R-Ky., on Wednesday.

They demanded the national leaders “Immediately provide readily accessible, unsecured credit to businesses of all sizes to ensure they have the cash to pay their workers, rent, and other costs during this crisis. While Congress, Treasury and the Federal Reserve have recently announced policies to increase the availability of credit to some businesses, these policies need to be expanded to make certain they are comprehensive and that the credit is readily available to all operating businesses in the short term.” (Emphasis theirs.)

The statements should remind collision repairers to consider the liquidity constraints they may face during a business downturn.

‘Call. Your. Bank.’

As collision industry financial expert Brad Mewes of Supplement Advisory put it in a March 12 video: “Call. Your. Bank.” He was summarizing one of the seven pieces of advice consulting giant McKinsey has offered businesses during the COVID-19 issue.

“What are you doing in your business?” Mewes wrote in an email Wednesday referencing the Boyd earnings call. “Do you have cash reserves to weather the storm? Do you have cash reserves to pay your employees even when there is no work? Do you have cash reserves to pay your vendors, your property mortgage?”

“During this time, are you going to sit on your thumbs? Wait for things to pass? Hope for the best?”

“Or are you going to reinvest in your business, improve your operations, keep your people working to improve your business?”

Winnipeg, Canada-based Boyd said Wednesday it increased its existing revolving credit line to $550 million USD with an “accordion feature” allowing it to borrow another $275 million; this matures in 2025. The accordion can be used for general corporate expenses, Pathipati said. The company also has taken out a seven-year Term Loan A for $125 million USD at 3.455 percent interest, with no prepayment penalty.

If things really got bad, the Boyd Group’s “over $800 million in dry powder” would still theoretically give it enough cash to cover all or most of its operating expenses it incurred during the entire year of 2019. ($716.6 million CAD, or $820.9 million CAD under pre-2019 IFRS lease accounting rules.) Boyd also has $893.2 million CAD in debt under the new lease rules, or $379.8 million CAD under the old format.

Boyd had a “very strong balance sheet” and conservative leverage of 1.8 times adjusted earnings before interest, taxes depreciation and amortization, O’Day said on an earnings call Wednesday.

The company also might be able to raise more money through the stock market if it wished. A new corporate structure that took effect this year means shares of the Toronto Stock Exchange-traded Boyd can be bought by more non-Canadian investors.

Besides Gerber Collision, Boyd’s interests in the U.S. and Canada also include Boyd Autobody, Assured Automotive, Glass America and Gerber National Claim Services. O’Day observed that as the company’s workforce was “largely” on commission, “our variable expenses can go down fairly meaningfully.” However, he said it also had to consider factors like “long-term relationship” and the importance “employees have our our business over time.”

We took this to mean that while Boyd, Gerber, etc., could save money on paychecks as piece-rate techs flag fewer hours, it might want to find a way to cover employees during the downturn anyway. The earnings call frequently referenced Boyd’s tech shortage, and the company probably doesn’t want employees jumping ship to an hourly or more generous piece-rate system.

As of the earnings call Wednesday morning, none of the company’s locations had been closed nor had any employee contracted the disease, O’Day said.

“We’re operating generally as normal,” O’Day said, though he said shops had cut hours back to 8 a.m. to 5 p.m. Monday-Friday.

Asked if he could quantify the reduction in demand, O’Day said “we’re not prepared to do that right now.” It had been occurring for too short a time to know if it was a trend, he said.

Executive Chairman Brock Bulbuck said Boyd suspects the slowdown for now is attributable to consumer behavior like deferring a service visit rather than a true miles driven reduction.

Boyd’s MSO and single-shop competitors could have a tough time making ends meet if credit isn’t available and work dries up. An analyst asked about the industry’s ability to withstand a short-term economic shock, noting the concepts of leveraged private equity collision repair owners and mom-and-pop shops with a weaker financial position.

“Its difficult for us to say,” O’Day said. “I will say that we’re comforted by our balance sheet and our financial position.”

Pathipati said the other four major collision players are all private-equity owned, and “they’re all highly levered” at 4-7x leverage. It “certainly” would put a strain on their balance sheet, but it’s “difficult to handicap,” he said. Whether they would add more capital was the “big wild card,” he said.

Boyd was in a better position than competitors, according to Pathipati.

Smaller shops might also have lower debt, according to O’Day. He said many of the single-shop companies Boyd had spoken to or purchased historically “had very little leverage” and often own their property outright.

Nevertheless, “this situation’s gonna put a strain on, really, almost all players, probably all players in the industry,” O’Day said.

Business planning, relief strategies

SCRS and the other trade groups requested other federal actions to help businesses out during the COVID-19 situation — including suspending all business tax returns and federal tax payments,

“These suspended taxes should include taxes owed for the 2019 Tax Year, estimated payments for 2020, and all payroll tax obligations,” they wrote. “The suspension should be broad and apply to all businesses. When the pandemic is over, the repayment of any deferred taxes should be spread out over time.”

The groups also asked Trump, Pelosi and McConnell to “Amend the Tax Code to, among other items, restore the ability of businesses to carryback any net operating losses against previous year tax payments; suspend the application of the Section 163(j) limitation on interest expense deductions for tax year 2020 to avoid penalizing businesses for borrowing during this crisis; and suspend the Section 461(l) loss limitation on pass-through businesses to allow the owners of pass-through businesses to fully deduct any losses they incur this year.”

“Ensure that liquidity is sufficient to weather the storm,” McKinsey advised all businesses. “Businesses need to define scenarios tailored to the company’s context. For the critical variables that will affect revenue and cost, they can define input numbers through analytics and expert input. Companies should model their financials (cash flow, P&L, balance sheet) in each scenario and identify triggers that might significantly impair liquidity. For each such trigger, companies should define moves to stabilize the organization in each scenario (optimizing accounts payable and receivable; cost reduction; divestments and M&A).”

O’Day on Wednesday said Boyd would also be “very careful” about near-term capital spending.

The company’s plans for 2020 included capital spending of 1.6-1.8 percent of sales and $5 million CAD in LED lighting to “enhance the shop work environment” and save money. It also intended to expand its “WOW” operating system to include “corporate business process,” and spend $9-$10 million CAD on a “related technology and business efficiency project.”

O’Day said Boyd would pause these until it knew the impact of the coronavirus on its business.

More information:

Boyd Group Services, March 18, 2020

Boyd Group fourth-quarter 2019 earnings call

Boyd Group, March 18, 2020

McKinsey, March 2020

Images:

The Society of Collision Repair Specialists and other trade groups have asked the federal government to provide unsecured credit to all businesses during the COVID-19 coronavirus issue. (Stefano Spicca/iStock)

Boyd Group Services CEO Tim O’Day. (Provided by Boyd Group)

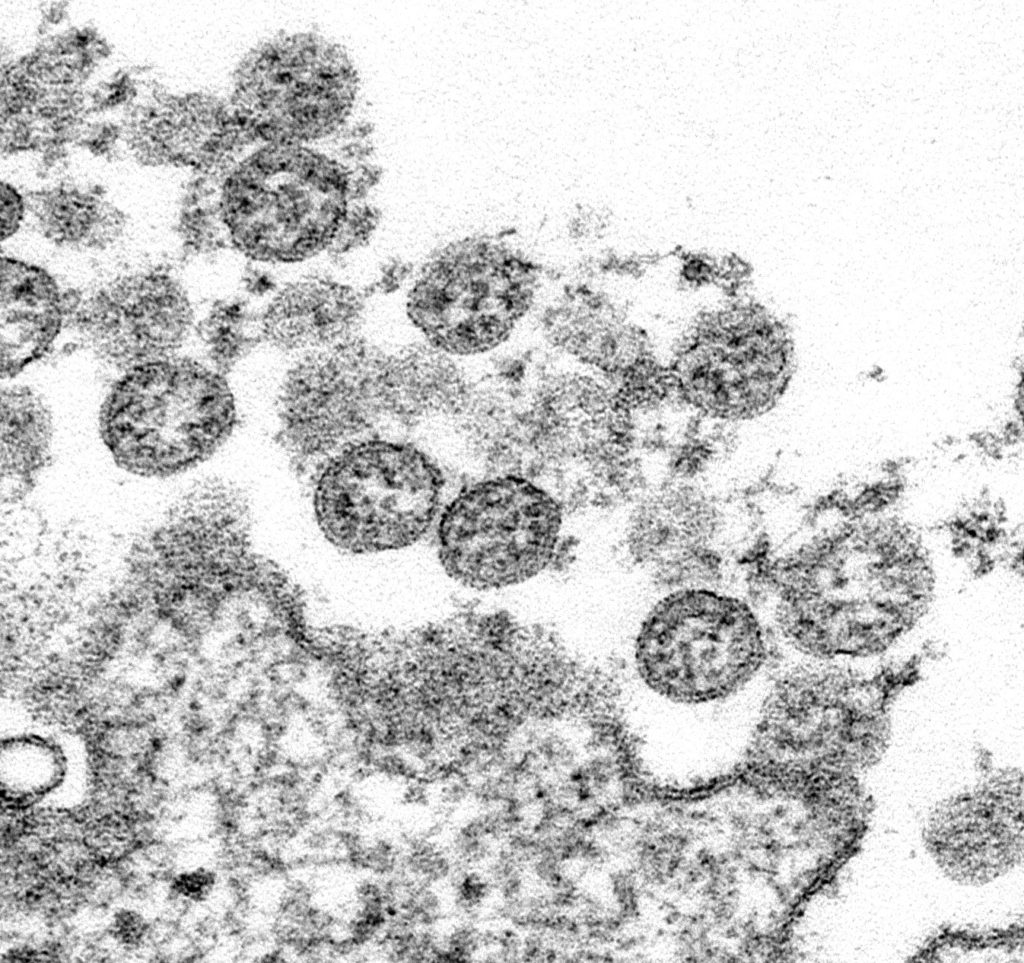

Virus particles from the first U.S. case of COVID-19 are seen in this transmission electron microscopic image. (C.S. Goldsmith and A. Tamin/Centers for Disease Control)