Iowa Insurance Division’s handling of shop’s complaint raises questions about agency

By onBusiness Practices | Insurance | Legal | Repair Operations | Technology

Update: The Iowa Insurance Division explained March 21 that spokesman Chance McElhaney went on paternity leave at about the same time as his initial March 6 response and our follow-up questions that day and March 8. Out of fairness, the story has been updated to better explain the general situation and remove references to specific inquiries going unanswered.

The Iowa Insurance Division’s response to a body shop’s complaint against the IMT Group raises questions about the agency’s investigative technique and overall purpose.

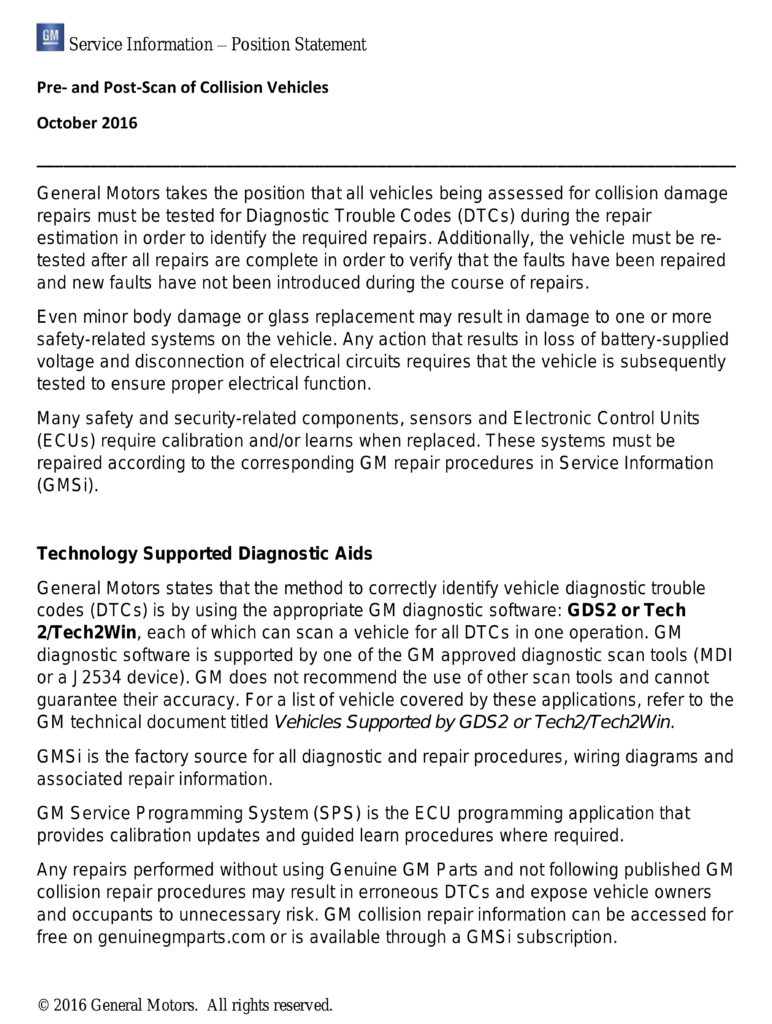

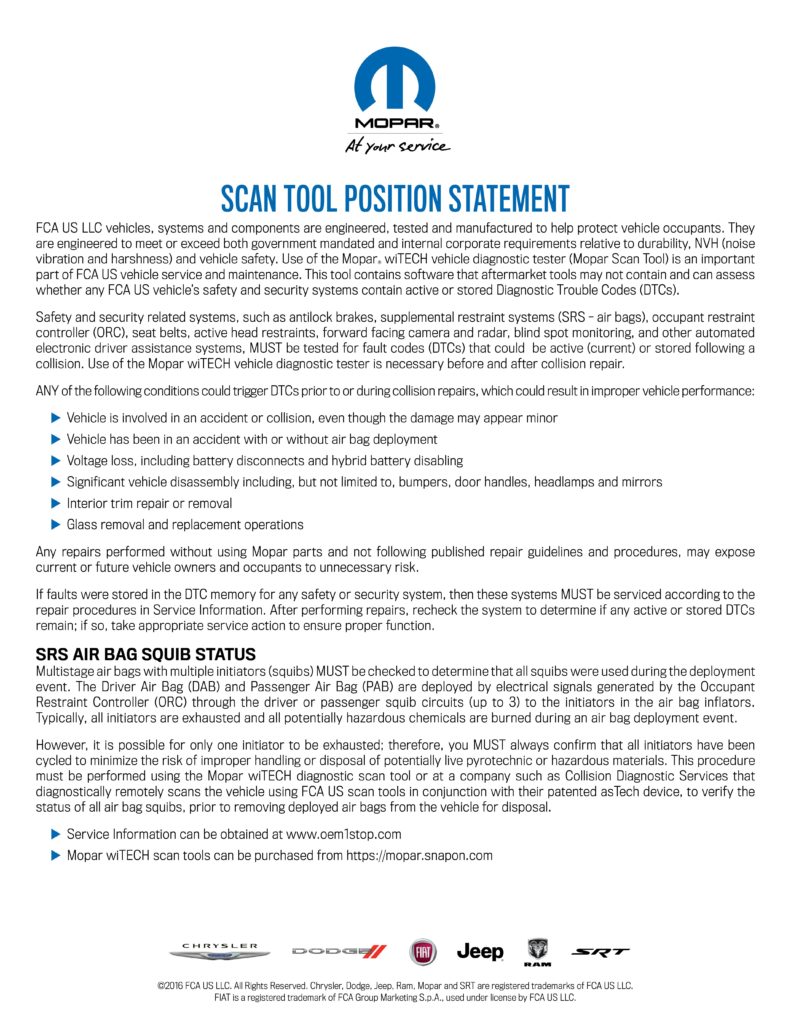

Precision Collision estimator Mark Jaeger had complained to the agency in October 2016 following then-recent IMT refusals to pay for scans of FCA and General Motors vehicles dating back to the 2012 model year. In November 2016, the agency asked for specific claim numbers so that IMT could respond.

Jaeger sent the IID six claim numbers and/or customer names. One was paid by the insurer, and is therefore moot. One was in the process of being repaired.

IMT senior claims manager Jim Todd’s Dec. 29, 2016, account to the agency regarding the four claims apparently satisfied the IID enough that it closed the investigation. However, that version contains major differences from extensive notes and correspondence collected by the shop and provided to Repairer Driven News. The IMT letter was carbon-copied to IMT CEO Sean Kennedy, Vice President of claims Chris Owenson and claims director Tim Welch.

Asked by Repairer Driven News for comment on the discrepancy, Todd wrote in an email: “It is the The IMT Group’s policy to NOT comment on pending regulatory matters. We have no comments in response to your inquiry.”

Unfortunately, the insurance department never saw the repairer’s records, assuring Jaeger that any records of the shop and carrier’s interactions would be provided by the insurer.

“I am not sure how much documentation you need, I have saved many of these emails, and I have copies of ‘letters’ that were sent to us, I also can send you all the documentation I’ve sent IMT supporting the need for scans among the other disallowed items,” Jaeger wrote Dec. 12, 2016. “If you could please respond to this email and let me know that you’ve received it and what other documents you require, I would be happy to send those.”

“We will not need the documentation you mentioned as the company should already have it,” IID market regulation analyst Ron Peters wrote Dec. 14, 2016.

On Jan. 6, 2017, the IID wrote to Precision Collision that it would close the case.

“We forwarded a copy of your initial complaint and supplemental information to IMT Insurance Group (“IMT”) and requested a response to your concerns,” Peters wrote Jan. 6 to Precision Collision. “Enclosed is the company’s corresponding response in which they have addressed each of the six individual customer vehicles that you identified in your December 12, 2016, email.”

Relying on the accused’s account alone does not seem like the most logical way to conduct an investigation: “Did you do it?” “No.” “OK, then, you’re free to go.”

Contacted to learn more about the Iowa Insurance Division’s positions regarding the complaint, IID communications director Chance McElhaney wrote in an email March 6: “The Iowa Insurance Division’s authority is to review the appropriateness of the claims handling procedures. The disputes over coverage are private disputes that need to be resolved directly between the claimants and the insurance companies. We have no authority to resolve these disputes.”

McElhaney was on paternity leave right about this time, and so wasn’t available for followup questions posed that day and March 8, the Insurance Division said Wednesday.

Jurisdiction and capabilities

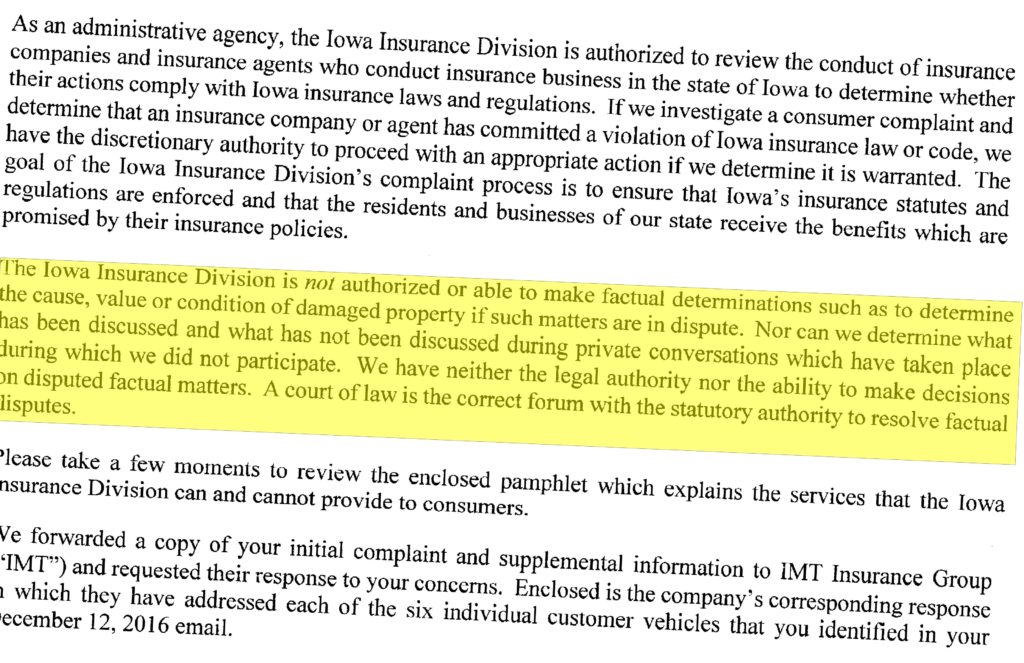

Perhaps even more worrisome than its investigative acumen is the Insurance Division’s description of its jurisdiction.

“As an administrative agency, the Iowa Insurance Division is authorized to review the conduct of insurance companies and insurance agents who conduct insurance business in the state of Iowa to determine whether their actions comply with Iowa insurance law and regulations. ” Peters wrote to Jaeger. “… The goal of the Iowa Insurance Division’s complaint process is to ensure that Iowa’s insurance statutes and regulations are enforced and that the residents and businesses of our state receive the benefits which are promised by their insurance polices. …

“IMT has also cited specific contractual language from their insured’s personal automobile policy in support of their position.

“As we are unaware of any existing state insurance laws or regulations (or insurance policy language) that has been violated by the position that IMT has taken on this matter, we are closing our file.”

IMT Group’s “specific contractual language” merely states that the insurer is liable for the damaged property’s cash value or the “Amount necessary to repair or replace the property with other property of like kind and quality,” whichever is cheaper.

“Like most personal auto policies, this is an agreement to pay for direct and accidental loss and to pay an amount necessary to ‘repair or replace the property with other property of like kind and quality’.”

The agency’s acceptance of the general term “like kind and quality” as grounds to let the IMT Group off the hook seems myopic and illogical.

Specifically to this case, it seems like “like kind and quality” here would by definition involve a vehicle without any diagnostic trouble codes or problems present that weren’t already there. The same would logically apply to any repair procedure necessary to achieve that state.

On a broader level, accepting what the IMT notes to be fairly stock contractual terms as justification for the carrier’s position seems a dangerous precedent, not to mention a determination of fact by an agency which says it doesn’t do that. In this case, the IMT Group didn’t connect the dots on why their “case-by-case” stance on the “new” scanning documentation — in FCA’s case, “new” was 6 months old — was “like kind and quality” and the repairer’s and OEM’s positions weren’t, but the IID agreed with the conclusion anyway.

That seems to suggest that an insurer could deny anything, vaguely cite “like kind and quality,” and get a pass from the Iowa Insurance Division.

As the IID noted to Jaeger, the agency “is not authorized or able to make factual determinations such as to determine the cause, value or condition of damaged property if such matters are in dispute. Nor can we determine what has been discussed and what has not been discussed during private conversations which have taken place during which we did not participate. We have neither the legal authority nor the ability to make decisions on disputed factual matters. A court of law is the correct forum with the statutory authority to resolve factual disputes.” (Emphasis IID’s.)

But the appropriateness of claims handling is within the IID’s jurisdiction. An insurer deciding to disregard vehicle manufacturer repair procedures directing a certain procedure be done every time or never be done and instead “evaluate the need for vehicle health scans (VHS) on a case-by-case basis” would seem to be bad-faith or improper claims handling.

Given the blanket OEM language, there’s no subjectivity here that the IID would be unable to interpret. For the agency to argue otherwise is absurd. That would suggest that in the eyes of the Iowa Insurance Division, the IMT Group’s opinion of how to repair a car takes equal weight to not only a body shop’s, it supersedes the instructions of the FCA and General Motors engineers which built the cars and tested how to repair them correctly in developing these repair procedures.

Worse, the answer IMT did provide was inconclusive.

“In IMT’s enclosed response, they have advised that they are presently working on, but have not yet formulated, a solid and firm position as to how to evaluate and compensate for the time that shops spend on the pre-scanning and post-scarming of (claim-related) vehicles. However, the company has also advised that they will continue to evaluate the need for vehicle health scans (VHS) on a case-by—case basis and will continue to pay claims which involve VHS scans accordingly.”

So not only does the state of Iowa suggest that an insurer’s position is equivalent to the vehicle manufacturer’s on technical questions, it lets an insurer which admits it doesn’t know the answer also carry the same weight. (Following the conclusion of the complaint, the IMT Group did in February articulate a formal position — though it’s also “case-by-case.”)

By this logic, an insurer can study an issue indefinitely, and the Iowa Insurance Division will let it pay whatever it feels like paying.

Finally, the agency’s “we can’t help you; go to court to resolve a complaint” raises the question of if the agency has any teeth at all to protect consumers or body shops. In this case, Jaeger was also given a pamphlet and the contact information for the agency’s consumer advocate. So what the does the investigations division do? Why even have an insurance department if it can’t actually enforce anything or pass judgement on facts, at least on auto claims?

Hopefully, new Iowa Insurance Commissioner Doug Ommen, who was appointed to the job Jan. 30, will be more useful to consumers and auto body shops in the future. He had been serving as the interim commissioner following the late December 2016 resignation of Commissioner Nick Gerhart,

Hopefully, new Iowa Insurance Commissioner Doug Ommen, who was appointed to the job Jan. 30, will be more useful to consumers and auto body shops in the future. He had been serving as the interim commissioner following the late December 2016 resignation of Commissioner Nick Gerhart,

“I thank Governor Branstad and Lt. Governor Reynolds for the great opportunity to lead the hard-working staff at the Iowa Insurance Division,” Ommen said in a statement. “I’ve spent my career in public service ensuring that consumers are protected and I’m very happy to continue that work for Iowans.”

More information:

Iowa Insurance Division response

Emails between Precision Collision, IMT, IID

Precision Collision Customer 1 claim information

Precision Collision Customer 2 claim information

Precision Collision Customer 3 claim information

Precision Collision customer 4 claim information

Images:

The Iowa Insurance Division logo is shown. (Provided by Iowa Insurance Division)

The Iowa Insurance Division’s response to a body shop’s complaint against the IMT Group raises questions about the agency’s investigative technique and overall purpose.

General Motors, the nation’s No. 1 auto producer, in 2016 issued a position statement requiring all collision repairers to scan vehicles before and after every repair. (Provided by General Motors)

FCA confirmed in 2016 auto body shops, glass replacers and even someone disconnecting a battery must scan a vehicle before and after every repair. (Provided by FCA)

Iowa Insurance Commissioner Doug Ommen. (Provided by Iowa Insurance Division)