CCC: Scanning grows in frequency, drops in price

By onBusiness Practices | Market Trends | Repair Operations | Technology

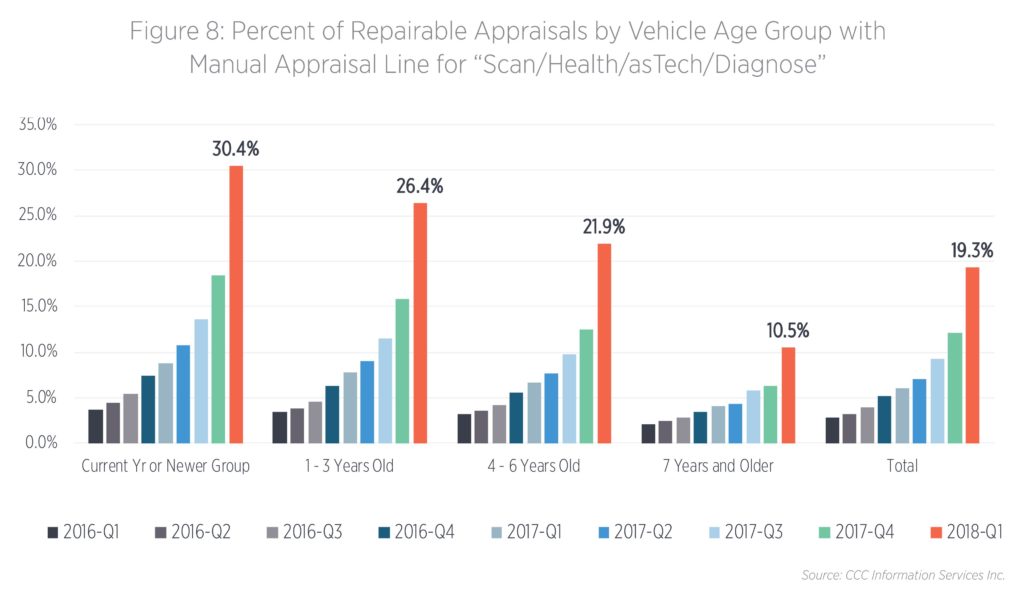

A new CCC analysis of first-quarter 2018 data reveals that about 12 percent of all appraisals included a reference to scanning the vehicle, an increase from just 4 percent in 2016 and 9 percent in 2017.

The July 1 report by CCC Director and analyst Susanna Gotsch points out that just because a scan isn’t on an estimate doesn’t mean one wasn’t done,

However, OEM position statements showed that about 70 percent of appraisals in 2017 should have indicated a scan, according to CCC.

That proportion grew in the first quarter of 2018, for Mazda and Hyundai issued position statements too in January and late March, respectively. And neither percentage would reflect OEMs like Audi and Ford, who don’t have position statements but have both expressed they want diagnostics done on their cars. (And have probably demonstrated as much in their repair procedures.)

Kia also issued a scanning position statement in June.

When one throws out total losses, the percentage of vehicles carrying a scanning line item rises. The quarter saw a major spike to 19.3 percent of all repairable CCC appraisals receiving at least one scan, up from around 12.5 percent in the fourth quarter of 2017. But that’s still far below the 70+ percent it theoretically should be.

Unfortunately, while the percentage of scanned repaired vehicles still rose dramatically, the information suggests many shops still aren’t scanning vehicles 7 years of age or older. Which is foolish, since even the OEMs who specify a scanning date range set it back more than a decade — more than two decades, in Honda’s case.

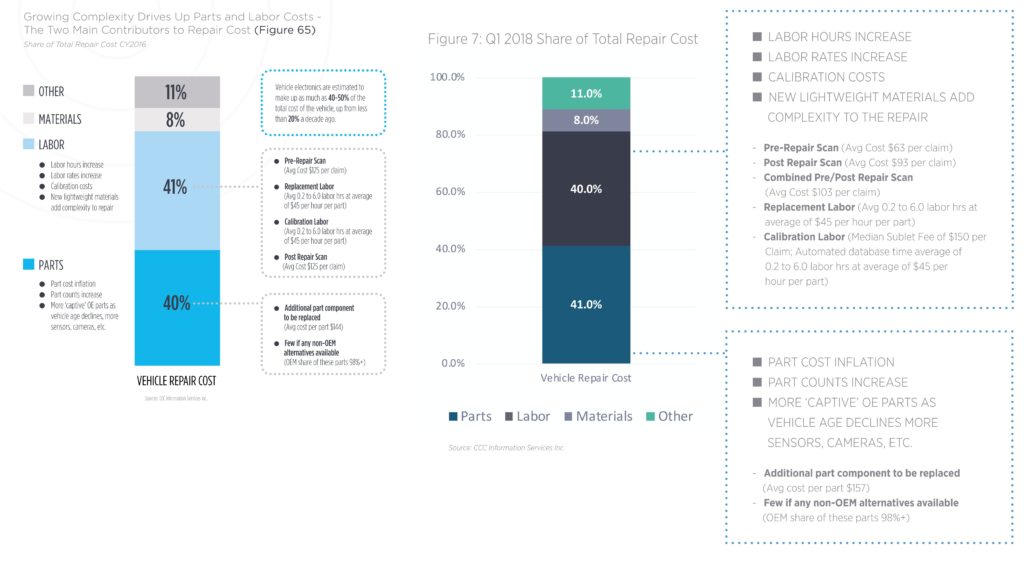

CCC’s data also suggests the cost of scanning a vehicle is falling. The first quarter saw an average pre-repair scan price of $63 and an average post-repair charge of $93, with a combined pre- and post-scan package going for $103, according to CCC. The 2017 “Crash Course” found an average pre-scan charge of $125 and the same average post-scan cost in 2016.

Gotsch also has reported that the average scan line item carried a charge of $90 in 2017, down from $125 in 2016.

CCC research also indicates that part replacement and calibration labor has held remarkably constant between the 2016 calendar year and Q1 2018. Both the 2017 Crash Course and the new report state that the average replacement and calibration item was 0.2-0.6 labor hours at $45 an hour per part. The July report did note that the median calibration sublet fee was $150 per claim.

The average parts cost rose from $144 in the 2016 calendar year to $157 in the first quarter. Parts also rose 1 percentage point to 41 percent of the average repair cost, while labor fell a percentage point to 40 percent between the two time periods.

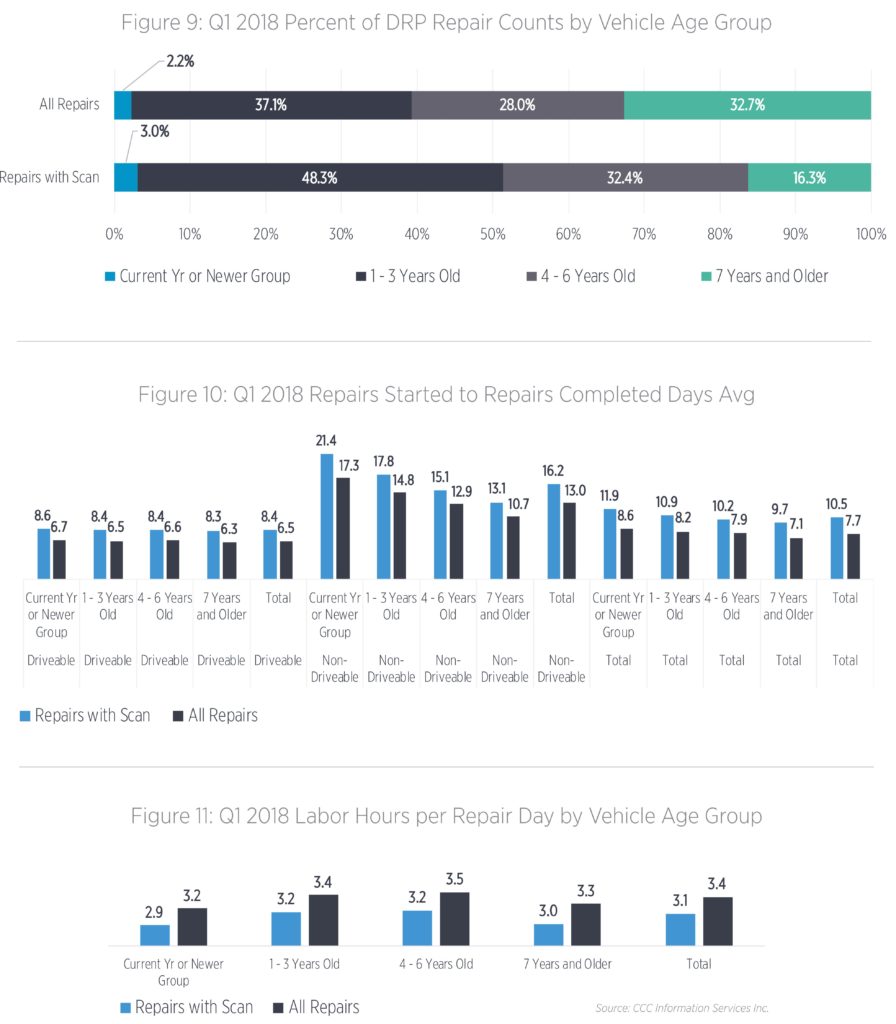

Direct repair program appraisals with a scan show a longer repair time in the first quarter, which is interesting.

“And yet, even within each age group the repair time for repairs that included a scan was higher than the overall average repair time per vehicle age, with productivity lower across the board,” Gotsch wrote. (References to figures removed.)

DRP repairers took an average of 10.5 days on scanned repairable vehicles, compared to 7.7 hours on all repairable vehicles, according to CCC. They spent only 3.1 hours per repair day on scanned repairable cars, compared to 3.4 hours on all repairable vehicles.

This might not necessarily be a bad thing. The longer times might be a function of the scans detecting problems and shops fixing them, rather than unknowingly leaving the issues remaining within the customer’s vehicle. Repairers who are scanning cars are likely also to be more educated and possibly know to perform other operations dictated by OEM repair procedures. The extra cycle time experienced by the carrier and customer might deliver a higher-quality repair — i.e., it was worth the wait.

More information:

CCC, July 1, 2018

Position statements on OEM1Stop repair procedure portal

Images:

CCC director and analyst Susanna Gotsch presented findings related to front-end crash frequency decreases in vehicles with ADAS at the the Collision Industry Conference in April 2018. (John Huetter/Repairer Driven News)

The percentage of repairable appraisals in CCC carrying a scanning line item saw a major spike to 19.3 percent, up from around 12.5 percent in the fourth quarter of 2017. (Provided by CCC)

CCC’s data also suggests the cost of scanning a vehicle is falling. The first quarter saw an average pre-repair scan price of $63 and an average post-repair charge of $93, with a combined pre- and post-scan package going for $103, according to CCC. The 2017 “Crash Course” found an average pre-scan charge of $125 and the same average post-scan cost in 2016. (Provided by CCC)

Direct repair program appraisals with a scan show a longer repair time in the first quarter of 2018, based on CCC data. (Provided by CCC)