Debate over CIC parts classifications proposals illustrates impasse in industry

By onAssociations | Business Practices | Education | Insurance | Legal | Market Trends | Repair Operations

A stalemate in the Collision Industry Conference Parts and Materials Committee over what to call certain new auto body replacement parts was echoed in a testy and tense CIC discussion Nov. 5 following the presentation of the panel’s two competing definitions proposals.

After being deadlocked, the Parts and Materials Committee charged with defining categories of parts that otherwise might be lumped into vague — and in California, illegal — terms like “Opt-OEM” split into two working groups. Both groups’ representatives on Nov. 5 expressed distaste for imprecise concepts like Opt-OEM; there doesn’t seem to be any dispute on that regard.

Working Group I drew representatives of “Shops, Suppliers, Insurers & Info Providers,” according to a slide presented to the CIC Nov. 5. That working group generated six part descriptions presenter and Committee Co-Chairman Ken Weiss (SSF Imported Auto Parts) described as focused on business-to-business communications.

OEM Dealer: New vehicle manufacturer part, in that manufacturer’s packing, from that manufacturer’s supplier and carrying that manufacturer’s warranty.

OEM Non-Dealer: A new vehicle manufacturer’s part in the original packaging. However, it’s sold by a third-party supplier and carries a third-party warranty.

Tier One- OEM: A new part made by the vehicle manufacturer’s supplier, with identical specifications and engineering to the version provided the automaker. It carried the OEM brand, but would be sold in the Tier 1 company’s packaging, by a third-party supplier, carrying a third-party warranty.

Tier One- OEM with Branding Differences: A new part built by the vehicle manufacturer’s supplier, with identical specifications and engineering to the one provided the automaker. However, the branding is different. The part is sold in the Tier 1 manufacturer’s packaging, by a third-party supplier, with a third-party warranty.

Aftermarket Certified: An aftermarket manufacturer’s part certified by a separate entity other than the manufacturer, such as by CAPA or NSF. It’s sold in aftermarket packaging by a third-party supplier and carries a third-party warranty.

Aftermarket Non-Certified: An aftermarket manufacturer’s part lacking certification from a separate entity. It’s sold in aftermarket packaging by a third-party supplier and carries a third-party warranty.

All six types of parts have at one time or another turned up classified along the lines of Opt-OEM, according to Weiss.

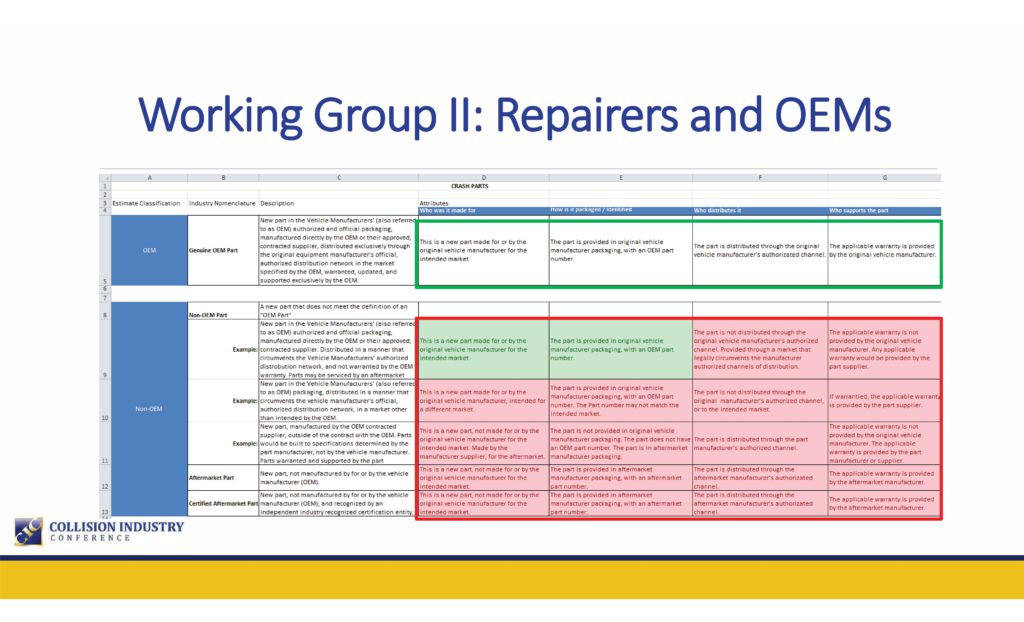

Committee Co-Chairman Aaron Schulenburg (Society of Collision Repair Specialists) said he created a second subcommittee comprised of OEMs and all of the committee’s repairers who weren’t invited to participate in Working Group I. That panel focused on business-to-consumer communications rather than B2B messaging, and it ultimately divided all parts into two categories: OEM and non-OEM.

According to a Working Group II slide, an “OEM” part had to meet the following criteria:

New part in the Vehicle Manufacturers’ (also referred to as OEM) authorized and official packaging, manufactured directly by the OEM or their approved, contracted supplier, distributed exclusively through the original equipment manufacturer’s official, authorized distribution network in the market specified by the OEM, warranted, updated, and supported exclusively by the OEM.

Everything else was deemed “Non-OEM.” It could be explained further through four attributes a slide listed as “Who it was made for,” “How is it packaged/ Identified,” “Who distributes it” and “Who supports the part.” Matching the group’s OEM definition 4 for 4 means a part is OEM.

Debate

The following Q&A session triggered lively debate which gives a good sense into both sides’ perspectives and criticisms.

Asked if the OEM/Non-OEM division created a large bucket of parts that a consumer understood but a body shop didn’t, Schulenburg said he felt there were ways to work out the B2B element, but consumer understanding was more important. He said no offense was met, but after looking at the Working Group I categories, “I’m more confused than I am clear.”

He said professionals with decades in the industry had been arguing “bitterly” about it for more than a year, and rather than clarify it, those definitions “validate” parts a consumer should know aren’t OEM.

“Why the smokescreen?” asked Mark Olson (Vehicle Collision Experts) also asked at one point. Just tell the customer a part was non-OEM, then explain its qualities, and “that’s how it is.”

CIC Administrator Jeff Hendler earlier had declared the conversation a “game” being played “from all sides.”

He criticized the idea of giving a consumer “17 different definitions,” calling a part either OEM or not. Call a Tier 1 part Tier 1 non-OEM, he said — it would be the “best non-OEM tier there is. But it’s not OEM.”

The consumer knows it wasn’t OEM, he said.

He gave the example of his auto insurance policy declaring the carrier won’t pay for OEM parts. Nomenclature describing a part as a variation of OEM wouldn’t be covered, but the term non-OEM would mean they’d pay for it — “and I might know what the hell I’m getting.”

Weiss replied if a part was classified as non-OEM but its list of attributes and description remained intact, he probably wouldn’t have an issue with it. But Hendler was talking about an identical part, he said.

“It’s not identical,” Hendler interrupted.

If it was OEM, it would be made by the OEM, sold by their supplier and warrantied and backed by the OEM — “and not some third party warranty,” he said.

Referencing his golf background, he continued: “It’s either a goddamn Callaway driver, or it’s an aftermarket.”

This was why there were two working groups, Weiss joked. And you would have two factions forever until the industry reached the conclusion that the consumer understood it — “the consumer,” Hendler countered.

Why couldn’t the shop just explain parts to the consumer, Weiss argued. Such part descriptions were used “every day” on the mechanical service and repair side, he said. The shops explain them and the consumer chooses a part there, he said; was the collision industry not as good?

“We’re every bit as good as they are,” Hendler said.

Why not just explain the part, then, Weiss asked.

“Tell that to the Seebachans. … I want to sleep at night,” Hendler said, drawing applause. Matthew and Marcia Seebachans, the motorists whose injuries were mostly attributed by a jury to a body shop’s failing to follow OEM procedures, had appeared at the CIC session immediately before the parts discussion.

“Jeff, that’s a cheap shot,” Weiss replied.

Hendler disagreed. “It’s exactly what we have to do, Kenny,” he said. Insurers wouldn’t back a shop. “We have to live with it (as a shop).”

If you want to tell the Seebachans about a part, “you take the liability for it. ‘Cause that’s what you’re asking us to do,” Hendler said.

“I think that that’s unfair,” said Paul Folino of LKQ.

“You would think it’s unfair,” Hendler interrupted.

Folino said that “we all feel for the Seebachans,” and it was a “low blow” to say someone didn’t care, he said. Hendler disputed that was what he said.

The consumer had the right to make a choice, and they needed “good, accurate information,” Folino said.

If a consumer was told by a shop they could have an OEM headlamp for one price, or get the same product on a “different truck,” would the consumer really care? he asked.

That’s basically the authorized distributor argument, he said, and “it just doesn’t make sense.”

Wouldn’t the shop want to give a customer a warranty that “in many cases, is above and beyond,” Folino said. They’re asking a consumer to pay more because it came on a different truck and had a different warranty, he said.

You’re not asking a consumer to spend more, you’re asking them to make a decision, Schulenburg said. Consumers choose parts every day, with some seeking aftermarket, others aftermarket performance and others OEM, he said. He said his group was arguing to define parts in a way consumers can understand and “clearly decide and choose” an appropriate part.

Everyone in the room could give examples of parts most of the audience would agree were not OEM being classified by suppliers such and ending up on an estimate, Schulenburg said.

He gave the example of a part in an aftermarket box being labeled “OEM surplus” because the supplier had made a different part for the automaker. There’s no such designation under the parts procurement platform being used, so the part is reclassified “Opt-OE,” and because the state doesn’t allow Opt-OE, the part is converted to “OEM” on the estimate, he said. The part delivered doesn’t reflect what’s expected, he said.

Weiss said he agreed, and said customers needed to be told the attributes about the part they were buying

“Nobody’s disagreeing with that,” he said.

Weiss said he would bet most customers “don’t even know what OEM is,” pointed to an earlier discussion which showed consumer unfamiliarity with the idea of a good repair. SCRS board member Michael Bradshaw (K&M Collision) shot back that in his 16 years in the business, every customer at his shop “damn well knows” what OEM was.

“This is exactly what committee meetings feel like,” Schulenburg joked.

More information:

“Parts & Material Committee Update” slides

Collision Industry Conference, Nov. 5, 2019

Images:

Collision Industry Conference Administrator Jeff Hendler (JD Hendler/Associates) speaks at the Nov. 5, 2019, CIC. (John Huetter/Repairer Driven News)

Collision Industry Conference Parts and Materials Committee Working Group I drew representatives of “Shops, Suppliers, Insurers & Info Providers,” according to a slide presented to the CIC Nov. 5. That working group generated six part descriptions focused on business-to-business communications. (Provided by CIC)

Collision Industry Conference Parts and Materials Committee Working Group II drew shops and OEMs and generated two broad part categories focused on business-to-consumer communications. (Provided by CIC)

Collision Industry Conference Parts and Materials Committee Co-Chairmen Ken Weiss (SSF Imported Auto Parts) and Aaron Schulenburg (Society of Collision Repair Specialists) presented competing visions of parts classifications at the Nov. 5, 2019, CIC. (John Huetter/Repairer Driven News)

Paul Folino of LKQ speaks at the Nov. 5, 2019, CIC. (John Huetter/Repairer Driven News)