Ariz. trial Allstate Milewise telematics format yielding better drivers

By onAnnouncements | Business Practices | Education | Insurance | Market Trends | Technology

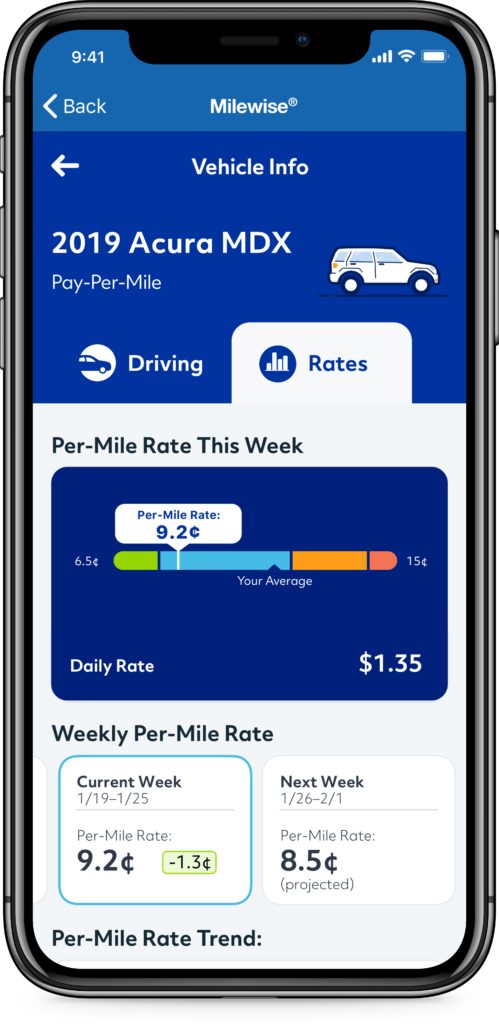

Two-thirds of policyholders on Allstate’s trial Arizona Milewise variant are seeing rates decrease from week to week because of better driving, Allstate product management Senior Vice President Ginger Purgatorio said Thursday.

It meant “customers are engaging with the experience,” she said.

The average rate decrease is about 20 percent, Purgatorio said.

Allstate’s findings bear out research that driver monitoring and coaching software can produce better drivers — which could be a threat to collision repair.

Telematics provider True Motion makes an app with features including tracking smartphone usage on the road and coaching drivers. In 2017, senior data scientist Nick Arcolano said 75 percent of drivers using the platform reduced distraction an average of 20 percent.

Competitor Zendrive insurance Vice President Rob MacKethan also in 2017 said his company’s driver feedback mechanism has reduced phone use 59 percent while driving. His company also that year reported improving commercial fleet driving via in-person and virtual feedback.

Their fellow competitor Cambridge Mobile Telematics in 2016 said it examined 20,000 users and found that after 200 days, the average user of their DriveWell program still showed more than 25 percent less phone use and hard braking. His company’s software then provided a score and “variety of features to engage users and incentivize safer driving,” including tips, leaderboards and cash prizes.

The ability for insurer, OEM, and third-party driving behavior platforms to improve motorist habits over time shouldn’t be discounted by collision repairers. The greater their success in behavior modification, the fewer wrecks shops might encounter. Of course, there’s also the possibility that drivers improve enough to mitigate what would have been a total-loss crash to a repairable one, which might help offset this. (Similar to what has been found to occur with ADAS and severity).

Bloomberg Businessweek reported Feb. 11 that Credit Suisse analyst Mike Zaremski in July 2019 “estimated that Progressive customers who use its telematics offerings are 15% to 25% more profitable than consumers who don’t—in part because telematics users’ collisions, when they happen, are at lower speeds. Zaremski suspects that’s because drivers who know they are being tracked are more careful.” He also predicted that telematics programs might also attract better drivers — and send worse ones to rivals lacking such programs, according to Bloomberg.

The potential for a decline in business could be exacerbated for repairers who are on a telematics-heavy insurer’s direct repair program participation or work in a region where such a carrier has a large market share. If your main source of crashed vehicles is suddenly cranking out a bunch of better drivers, that might present a problem.

For example, Allstate personal property-liability insurance President Glenn Shapiro told Bloomberg that feedback from an unspecified Allstate platform taught him to slow down ahead of a stretch where he was constantly hard-braking for rabbits.

Allstate has two telematics programs: Milewise and Drivewise.

Drivewise relies solely on data gathered from the user’s smartphone and is available nationwide. Allstate generally gives you a discount of 3 percent just for signing up and participating consistently. After your first 50 trips, the company will offer up to 15 percent in cash back if you drive safe; it will repeat this benefit every six months depending on how you drive. You can also earn “Allstate Rewards” for consistently driving safely, these points can be redeemed for various sweepstakes and items.

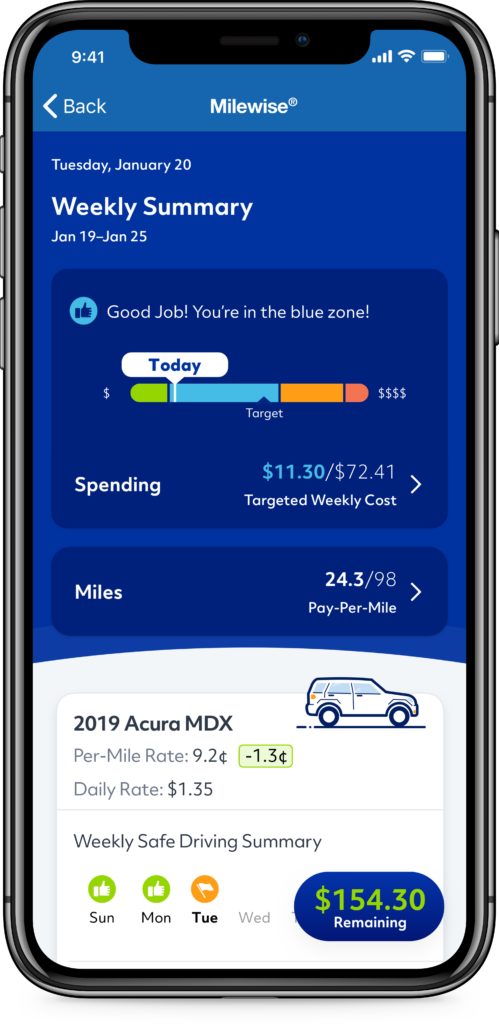

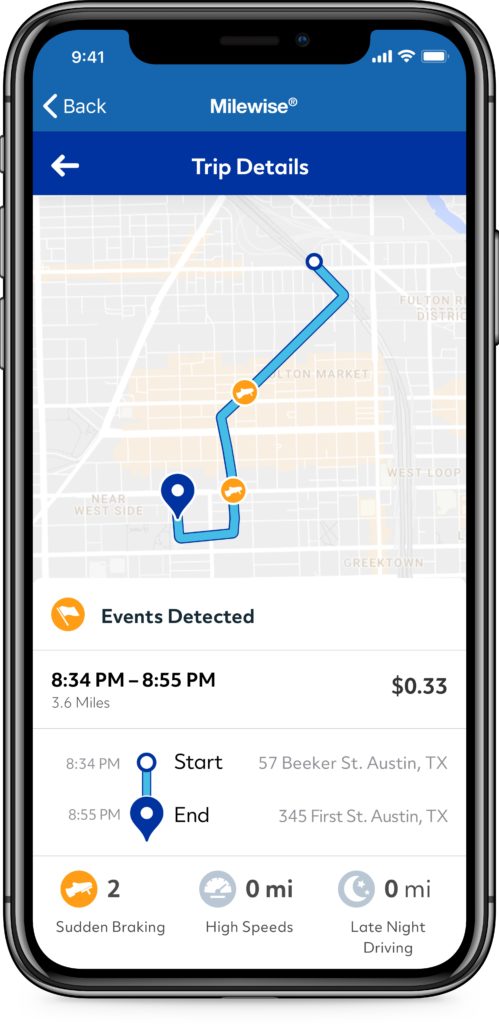

Milewise uses an OBD-II plugin and is available in 14 states counting Arizona. In the other 13 states, it charges you a daily flat rate and an additional amount per mile up to a daily cap. Both are “based on characteristics such as driver age, vehicle type and driver history,” according to Allstate. It also provides feedback based on how you drive.

In Arizona, Allstate has since September 2019 been testing a Milewise variant where the per-mile rate fluctuates weekly based on how well and how much the user drivers.

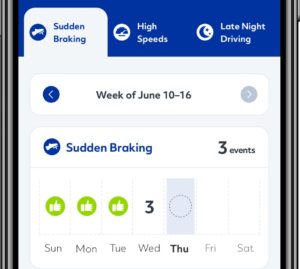

Customers on both Milewise and Drivewise on average interact with Allstate weekly to check their stats, according to Purgatorio. She said this was much more frequent than traditional policyholders, who might only talk to the insurer during a claim or to add a new endorsement.

It almost becomes a type of “gamification for yourself,” Purgatorio said of the telematics program. Purgatorio said those who were interacting with the software were more likely to attempt to change their behavior.

Purgatorio reported being “pretty pleased” with the customer response to the Arizona program. They’ve mentioned changing behavior because of the transparency, she said. The reductions in rates would seem to bear this out.

Existing Allstate customers are switching to the carriers’ telematics-based policies, and new customers are opting to start with such products, Purgatorio said. “We’re really seeing both.”

About 20 percent of new business is using Drivewise, and that percentage has increased over time, she said.

Asked about Allstate recalculating Drivewise rates weekly, Purgatorio said the company hadn’t explored the idea recently. However, she called the Milewise approach appealing in that the consumer saw the relationship between behavior changes and price “relatively immediately.”

Allstate thinks there’s “something to that,” she said. So a Drivewise shift might be possible, she said.

More information:

“Reducing Distracted and Unsafe Driving Behaviors with Positive Incentives”

Cambridge Mobile Telematics, Aug. 25, 2016

“Drive Safely and This App Can Lower Your Insurance Premium”

Bloomberg Businessweek, Feb. 11, 2020

Images:

A Milewise screenshot reports sudden braking incidents. (Provided by Allstate)

A Milewise Arizona home screen is shown. (Provided by Allstate)

A Milewise screenshot shows a trip with hard braking incidents. (Provided by Allstate)

A Milewise Arizona screenshot shows how the per-mile rate had decreased in a week. (Provided by Allstate)