SCRS webinar: New law makes 401(k) changes for auto body employers, employees

By onAnnouncements | Associations | Business Practices | Legal

A new federal law in effect Jan. 1 expanded 401(k) tax credits for auto body shop owners offering them, increases the ceiling for automatic retirement contributions and lets employees make withdrawals without penalty, a financial expert said on a Society of Collision Repair Specialists webinar last month.

The “Setting Every Community Up for Retirement Enhancement Act” appears to have been incorporated into the House Resolution 1865 spending bill, which passed Congress on Dec. 19, 2019, and became law Dec. 20, 2019. The retirement rules took effect Jan. 1.

According to a slide from the SCRS webinar “401(k) – Everything You Need to Know About Switching From an Existing Plan” on Feb. 26 (see a replay), the bill gave employers a bigger startup cost tax break for offering a retirement plan for the first time.

Prior law gave businesses up to $500 a year for three years. The revised version offers between $500 and $250 per non “highly compensated employee” up to $5,000 for three years.

The bill also offers a $500 tax credit for a plan that automatically enrolls workers in a 401(k) unless the employee opts out, according to the slide.

“They are trying to entice businesses,” Virginia Asset Management partner and certified financial planner Scott Broaddus said of the credit.

Broaddus is working with SCRS as a financial adviser for companies participating in the trade group’s multiple employer 401(k) option. That plan pools the buying power of multiple small businesses to help those individual companies offer retirement benefits with lower fees, administrative burden and audit charges than might have been possible going it alone. It can be set up to offer features like auto-enrollment too.

Broaddus called the response from SCRS member businesses to the plan “exciting.”

Retirement plans can also be structured to automatically contribute more of one’s salary over time until a particular cap is reached. The SECURE Act changes Jan. 1 raised the maximum deferral cap from 10 percent to 15 percent.

Broaddus said audience members should check the wording of their retirement plan. As Broaddus put it, does the plan stop auto-escalating after a specific percentage, or does it simply peg the cap to verbiage like “whatever the IRS limits are?”

“That may need to be addressed,” he said, referencing the new IRS rules.

The SECURE Act language in the spending bill also gave employees greater flexibility. They may now withdraw up to $5,000 for qualified medical expenses related to a child’s birth or adoption, according to a slide.

“Employees may come asking,” Broaddus said.

Finally, the law lets anyone who didn’t turn 70.5 until Jan. 1 wait on taking mandatory minimum distributions until they reach 72.

Broaddus in the webinar highlighted an interesting state-level trend along with the new federal retirement laws.

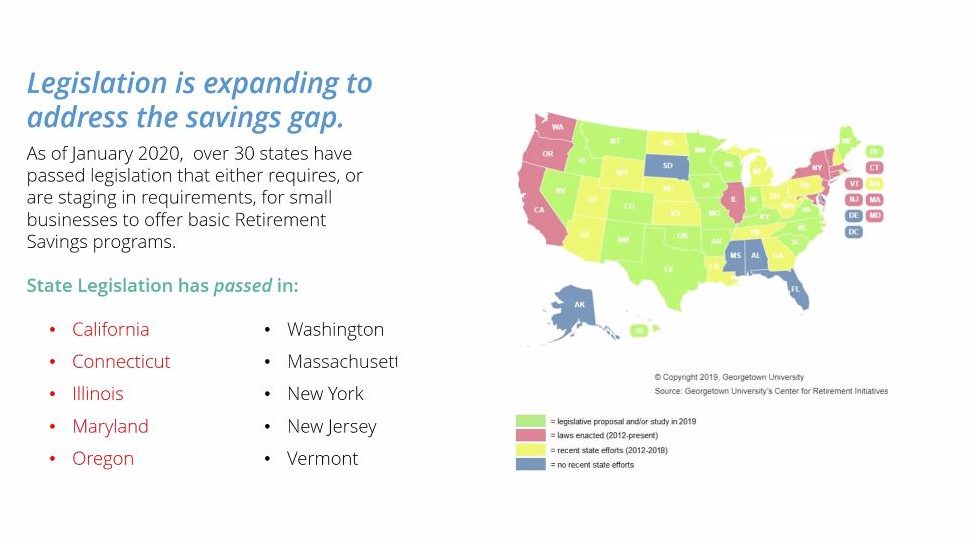

As of January, more than 30 states have passed legislation related to the concept of small businesses retirement plans, according to a slide.

Broaddus indicated that such legislation resembles what has been under way in California: If companies don’t offer employees retirement plans, the workers will be automatically enrolled in state default retirement plans unless the employees opt out. In California, anyone with at least five employees will have to offer such a plan or facilitate their employees auto-enrolling in a state option by 2022.

State-backed plans tend to have “very few options,” according to Broaddus.

“We’ve had a lot of interest from businesses in these states,” he said. They want to set up a more customized plan before the new rules kick in.

Broaddus said a multiple employer plan like SCRS’ “feels” and “acts” like a typical 401(k) and offers much customization. Some companies participating in the SCRS plan offer employees immediate eligibility, while others wait for a year, he told the webinar. Some are matching a high percentage of the employee’s contributions, while others aren’t matching any of it. Some offer features like loans or a Roth IRA.

“We can pull all those levers” to make an SCRS plan act like the one that’s currently in place at your business, Broaddus said.

Find out more by watching the webinar replay here.

Another SCRS retirement plan webinar is scheduled for 2 p.m. ET March 17. Register for “Starting a New Retirement Plan with SCRS” here.

More information:

“401(k) – Everything You Need to Know About Switching From an Existing Plan”

Society of Collision Repair Specialists, Feb. 16, 2020

Images:

The U.S. Capitol is shown. (Matt Anderson/iStock)

A February 2020 Society of Collision Repair Specialists webinar featuring Virginia Asset Management personnel highlighted state laws related to retirement requirements for businesses. (Screenshot of SCRS webinar)