Romans guest column: Looking back, ahead on auto body repair industry consolidation

By onBusiness Practices | Market Trends

Editor’s note: This is the second part in a two-part series. See Part 1 here.

By Vincent Romans

The last nine years of multiple-location collision industry platform transactions by the larger multiple-location operators with revenue of $100 million or more reflect the following:

- There were 1,883 locations acquired, representing $5.485 billion or 14 percent of the 2019 market size of $38.3 billion. This 14 percent does not include single-location acquisitions, organic growth, or brownfield/greenfield development.

- Average revenue for these MLO transactions was $2.91 million per location, compared to the industry average of $1.2 million per location for the collision repair industry target addressable market.

- 2019 was a pinnacle year for acquisitions due to ABRA being merged with Caliber.

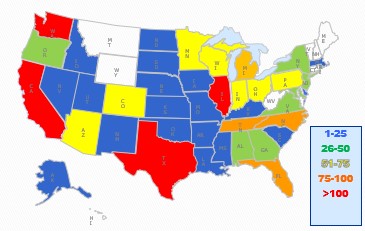

The following heat map shows the number of repair facilities that have been acquired within each state since 2010. The hottest states where repair facilities have traded hands are in red and include Illinois, Texas, California, and Washington. The next states with the most activity in orange are Florida, Tennessee, North Carolina, and Michigan.

On a revenue-processed and segmented basis, from 2012 to 2019, the multiple-shop operators bringing in $20 million or more grew their share by 16.66 basis points from 14.67 percent to 31.33 percent of the U.S. target addressable market.

When we combined all of our tracking segments that do $10 million or more in annual sales, including the multiple-location franchise networks, we see this larger segment growing by 18.57 basis points from 25.35 percent to a strong 42.10 percent market share. The segment representing the remaining collision repairers outside of this larger combined segment decreased its share by 18.57 basis points from 76.47 percent to 57.90 percent during the same time frame.

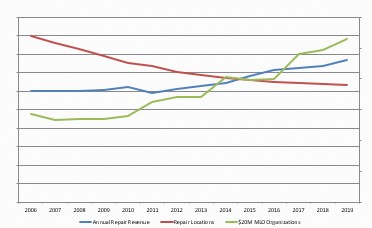

The following 14-year timeline graph shows three major trends from 2006 to 2019.

- The upward blue line slope of the collision repair target addressable market has been growing every year since 2011 and grew just over 3 percent from 2018 to 2019. We expect a significant decrease in 2020 due to COVID-19.

- The upward green line trend reflects the ≥$20 million MLOs. This segment had 106 separate MLO organizations in 2019.

- The downward sloping red trend line shows the shrinking number of collision repair industry locations within our TAM, which has begun to plateau over the past three years. Shop reduction for both the U.S. and Canada has slowed during the last several years. COVID-19 and its increasing number of variants continue to create uncertainty moving into 2021. Ongoing consolidation and the aggressive interest of new private equity entrants into the U.S. industry will contribute to the further decrease in the number of remaining collision repairers.

The industry today and in the future

In 2019, U.S. MSO private equity investors represented a total annual revenue market share of almost $11 billion or 28.4 percent of total addressable market.

Canadian investors represented a 19.8 percent share of Canada’s TAM.

Together, the U.S. and Canadian market investors represented 27.8 percent of the combined $41 billion North American collision repair industry revenue. There are numerous other active private equity firms currently focused on investing in MSO platforms.

The following chart identifies the top 10 U.S. repair organizations for 2019.

The Top 10 ≥$20 million MLOs increased their segment market share by $7.4 billion since 2006 to $8.4 billion, 22 percent of the total 2019 collision repair industry market size. Their revenue share of the total total addressable market since 2006 rose some 18.4 basis points from 4.3 percent to 22.7 percent market share.

The number of collision repair centers for these Top 10 MLOs grew from 461 in 2006, a 7.6 percent share, to 2,417 in 2019, a 22.7 percent share. Simply stated, this segment processes more business through fewer locations than do repairers outside of this Top 10 segment.

The following chart identifies the Top 10 MSOs in 2019 based on consolidated revenue for U.S. and Canada. We see there are three independents, three franchise, one banner, and three dealers MSOs.

Collision Solutions Network will be repositioned in 2020 as a U.S.-Canada banner organization due to its merger with 1Collision, a growing U.S. banner MSO. If Mondofix Canada holds true to its announcement, we should see ProColor, a Mondofix portfolio business, enter the U.S.

In 2019, the combined ≥$10M MLO segments represent 42.1 percent of the 2019 collision repair TAM. We believe that by 2024, this combined segment group will conservatively increase their share to 47.75 percent, with a more aggressive forecast reaching a 58 percent market share.

We expect MSO acquisitions in 2021 to continue at a constant, if not accelerated, pace.

What is driving private equity and their interest in the collision repair industry? It is a strong, convincing model that we believe will continue to justify private equity investment in the collision repair and the broader APD landscape.

- Private equity’s recent and current record level of available investment capital, dry powder, is at an all-time high.

- Prolonged low interest rates support financing and closing deals.

- During the past five years, hedge funds realized a 5.5 percent return versus private equity returns of 14.4 percent.

- Healthy, growing pre-COVID collision repair industry target addressable market.

- Strong, positive cash flow and strong EBITDA across a broad number of target MSOs.

- Collision repair industry is relatively recession-friendly.

- Government designation of the collision repair industry as a COVID-19 essential business.

- The collision repair industry’s consolidation continues its high-velocity momentum.

- Currently there are 18 committed private equity, strategic pension funds, and public company investors within the collision repair industry in the U.S and Canada.

Vincent Romans is the founding partner of the Romans Group.

More information:

“A 2019 Profile of the Evolving U.S. and Canada Collision Repair Marketplace”

Romans Group, Nov. 29, 2020

Images:

Romans Group data indicates 1,883 collision industry locations were purchased between 2010 and 2019. (mucahiddin/iStock)

The following heat map shows the number of repair facilities that have been acquired within each state since 2010. (Provided by the Romans Group)

This chart shows how the collision industry total addressable market grew from 2006-19. Meanwhile, the number of shops shrank and the number of multiple-location operations doing $20 million or more in sales grew. (Provided by the Romans Group)

The Top 10 U.S. repair organizations for 2019. (Provided by the Romans Group)

The Top 10 U.S. and Canada repair organizations for 2019. (Provided by the Romans Group)