Majority of survey respondents not happy with carrier claim process explanations

By onInsurance

Hi Marley analyzed thousands of four-star claim survey responses in its database and identified 1,300 claims in which policyholders relayed issues that, had they been handled differently, would’ve resulted in a higher rating.

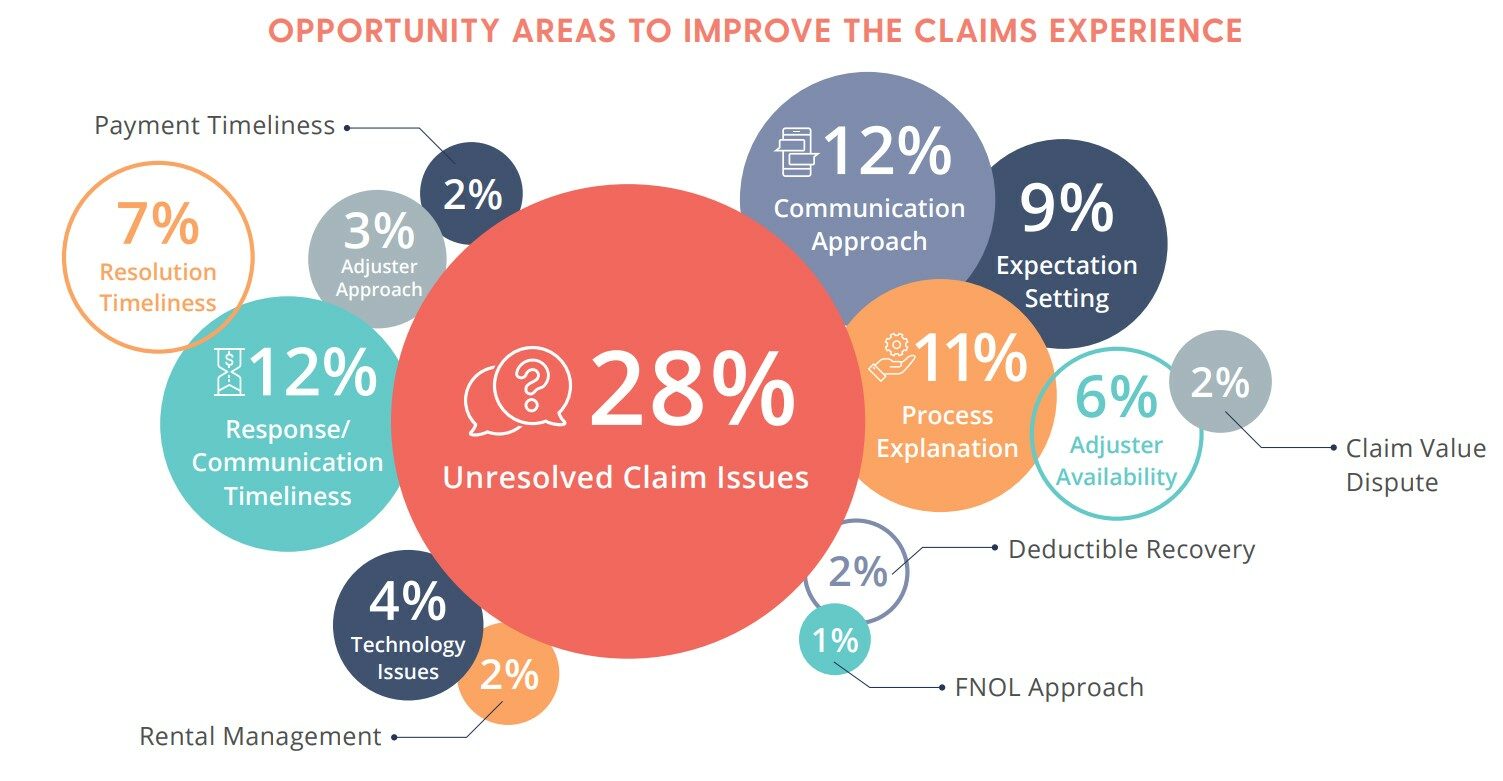

Of those, 95% fell into four categories: process explanation and expectation setting (34%), unresolved claim issues (28%), responsiveness and availability (18%), and adjuster attitude, approach and level of knowledge (15%).

To improve claims experiences for their customers, carriers should improve communication and resolution timeliness, adjuster approach and availability, and explanation of the claims process, according to Hi Marley.

“The process differences that separate five-star from four-star claims experiences are subtle yet critical, and they mostly all boil down to communication,” said Mark Snyder, Hi Marley principal consultant and claims subject matter expert. “Carriers need to empower employees to communicate effectively, set expectations, [and] be responsive and transparent. Empathy is a major factor in creating five-star experiences and serving customers with kindness, giving them attention and making them feel heard can go a long way.”

Through its research, Hi Marley has also found that carriers can improve their customer satisfaction scores by waiting until claims close to send out surveys.

As for adjusters, the most common issues reported were customers wanting more regular status updates and outreach or that they preferred to communicate in an alternative fashion.

“This is important to note because Hi Marley’s recent study on the impact of ‘time to first contact’ found that adjusters who ignore customers’ communication preferences are more likely to demonstrate poor responsiveness throughout the claim’s lifecycle, longer cycle times and lower customer satisfaction scores,” Hi Marley’s findings state. “Adjusters who listen and are patient, understanding and considerate will create better customer experiences. Carriers should hire, train and retain adjusters who demonstrate empathy and strive to make the claims process as stress-free as possible.”

For example, one survey respondent said, “Not enough communication RE: claim status. Apparently hit by a fraudulent driver. Little information given about the subsequent investigation and its status.”

Another respondent said a representative with their carrier provided incorrect deductible information and lacked knowledge on one of their coverages.

Westfield Insurance National Claims and Customer Service Leader Robert Bowers told Hi Marley, “Our ultimate goal is to make everybody happy. If you hire the right people with the right hearts and treat them fairly, customers will get the service that they want.”

Forty-five percent of Westfield Insurance’s five-star reviews “are driven by positive or empathetic adjuster attitude and approach,” according to Hi Marley.

The 18% of customers who gave their carrier a four-star rating noted issues related to communication as the primary reason for not giving a five-star review including timeliness of communication, responsiveness, unanswered questions, or a negative trend around getting a hold of their adjuster or appraiser.

Hi Marley has found that it benefits carriers to prioritize communication and responsiveness by implementing tools, such as text messaging, that streamline the claims process.

Other common comments made by respondents included:

-

- “Claim handler did a suboptimal job setting expectations;

- “Claims resolution took longer than expected, unclear timelines; and

- “If the process were explained better, including steps and clarity on who handles which aspect of the claim, the rating would be higher.”

Hi Marley concluded that failing to properly explain the claim process and set expectations likely also contributed to the 6% of respondents who had issues with payments from accuracy to timeliness and the expectation of a deductible recovery on no-fault accidents.

To address this, Hi Marley recommends carriers describe each step of the process and what it entails; outline clear, reasonable timeframes with specific dates and times; explain expected outcomes, be transparent when things may change, and provide ongoing updates throughout the process; answer questions, and make sure all customer concerns are addressed.

Carriers can learn more about Hi Marley’s services to help streamlines claims processes at himarley.com.

IMAGES

Featured image credit: ipuwadol/iStock

“Opportunity Areas to Improve the Claims Experience” infographic (Credit: Hi Marley)