Latest “Who Pays for What?” survey finds largest jump in coverage to be PII clearing

By onCollision Repair | Insurance | Repair Operations

According to the latest “Who Pays for What?” Survey conducted by Mike Anderson of Collision Advice in conjunction with CRASH Network, phone synching with a vehicle is synonymous with it being “a cell phone on wheels” so shops are increasingly offering to erase personal data for customers whose vehicles are determined to be total losses.

The survey, conducted in July with 541 collision repair shop respondents, found that more than one-third, or 35% of shops said they are paid always or most of the time by the eight largest U.S. insurers when they charge labor for deleting personally identifiable information (PII), which is more than double compared to the first time the survey asked about the procedure last year.

“Despite this, more than 4 in 5 shops acknowledge not having sought to be paid for this work – perhaps because many shops aren’t doing it,” a joint press release from Collision Advice and CRASH Network states.

“A vehicle owner today may have their home address stored in their navigation unit of the vehicle, and their contacts get stored when they synch their phone,” Anderson said, in the release. “Garage door opener codes might be stored. So we need to be asking the vehicle owner, when the vehicle is a total loss, if they would like us to erase their personal information.”

Anderson said the steps necessary to clear this information can generally be found in the vehicle owner’s manuals.

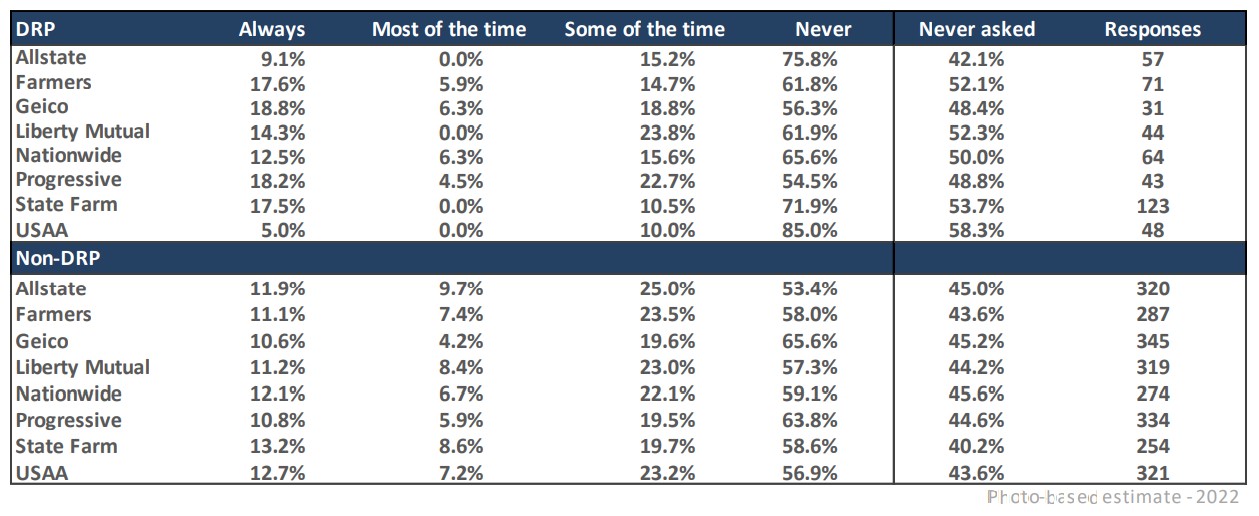

Each quarterly survey shows which not-included operations the nation’s eight largest insurers — State Farm, Farmers, Nationwide, Allstate, USAA, Liberty Mutual, Progressive, and GEICO — typically pay for.

The latest survey’s questions centered on frame and mechanical operations. Other findings of interest include increases in payment for destructive testing of welds, test drives after repairs, pre-diagnostic alignment, and stall cure time as well as a decrease in coverage for preparing a photo-based estimate at the insurer’s request.

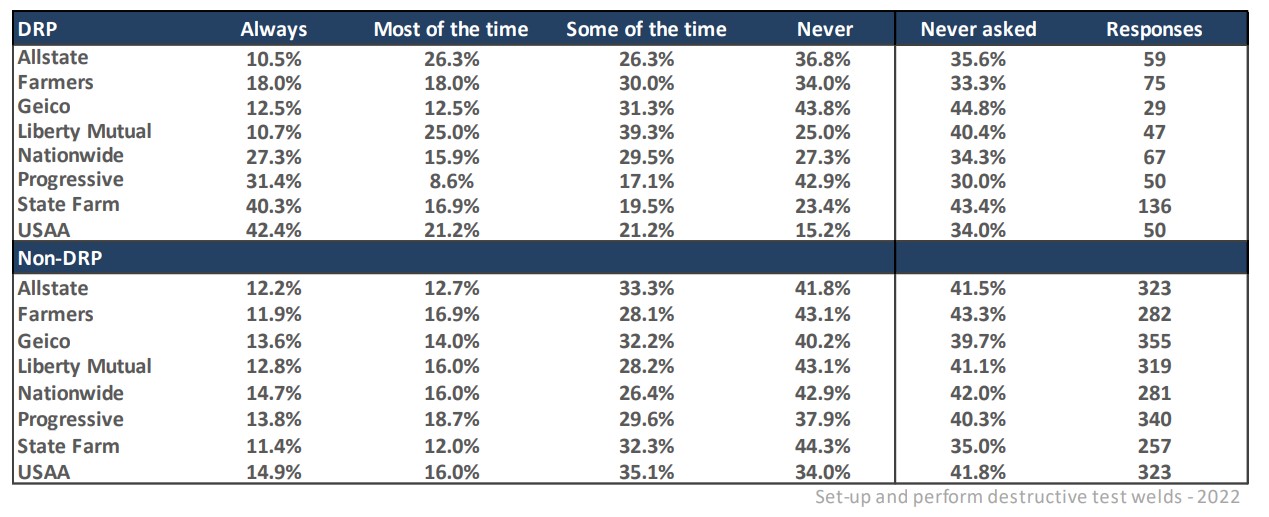

Destructive testing of welds

Of those that said they negotiate for payment of the procedure, 32% are paid “always” or “most of the time.” State Farm and USAA are the top two insurers to pay for the procedures with 20.7% and 19.3% of shops who asked for payment, respectively, saying they always pay.

However, Anderson remains concerned. “While this procedure did increase 2.4 points this year, just 32% being paid regularly is still very, very concerning,” he wrote in the survey results. “We need to WAKE UP on this one. This is a non-negotiable procedure. EVERY OEM states that we need to do this (though the actual testing process itself will vary by OEM). If your techs aren’t doing this, don’t delay, get them doing it today!

However, Anderson remains concerned. “While this procedure did increase 2.4 points this year, just 32% being paid regularly is still very, very concerning,” he wrote in the survey results. “We need to WAKE UP on this one. This is a non-negotiable procedure. EVERY OEM states that we need to do this (though the actual testing process itself will vary by OEM). If your techs aren’t doing this, don’t delay, get them doing it today!

“A proper weld involves so many factors (the correct type of welder, at the correct settings, with the correct wire, and the correct gas mixture) that it is nearly impossible to tell if the settings are correct without first performing destructive test welds. I would highly encourage shops to use an electronic quality control app to document via photos the test welds performed. I have seen some repaired cars with welds that could be popped loose simply by prying on them with a screwdriver. That is a scary situation that can be avoided by verifying the welder settings

with a destructive test weld.”

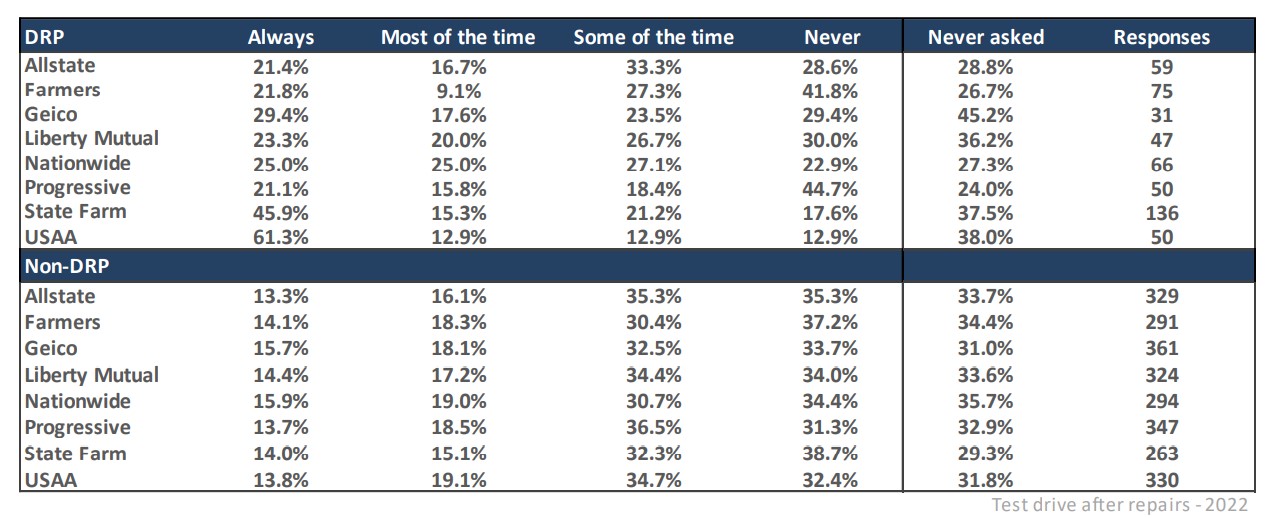

Test drives after repairs

Of those that negotiate for this, 34% are paid “always” or “most of the time.” Taking test drives after repairs is typically to check for suspension or drivability problems, wind noise, function or recalibration of autonomous braking, adaptive cruise control, blind spot monitoring, et cetera or to ensure set conditions are met prior to post-repair scanning, the survey results state.

Respondents said State Farm (23.5%) and USAA (19.3%) always pay for test drives while respondents answering for seven of the eight carriers, excluding USAA, said more than 30% of the time they’re never paid for test drives.

“It’s important to remember that most automakers have very specific guidelines for how their vehicles must be test-driven prior to scanning or in order to perform/check some system calibrations post-repair,” Anderson noted. “In determining a fair and reasonable labor time for test drives, use the OEM requirements to consider five factors: the speed, distance, time, driving pattern and road conditions required as part of the test drive. Do you have to, for example, drive the vehicle in a straight line for 10 minutes or two miles above 20 mph? Or do you have to drive it in three figure eights? Test drive requirements can vary widely in the time required.”

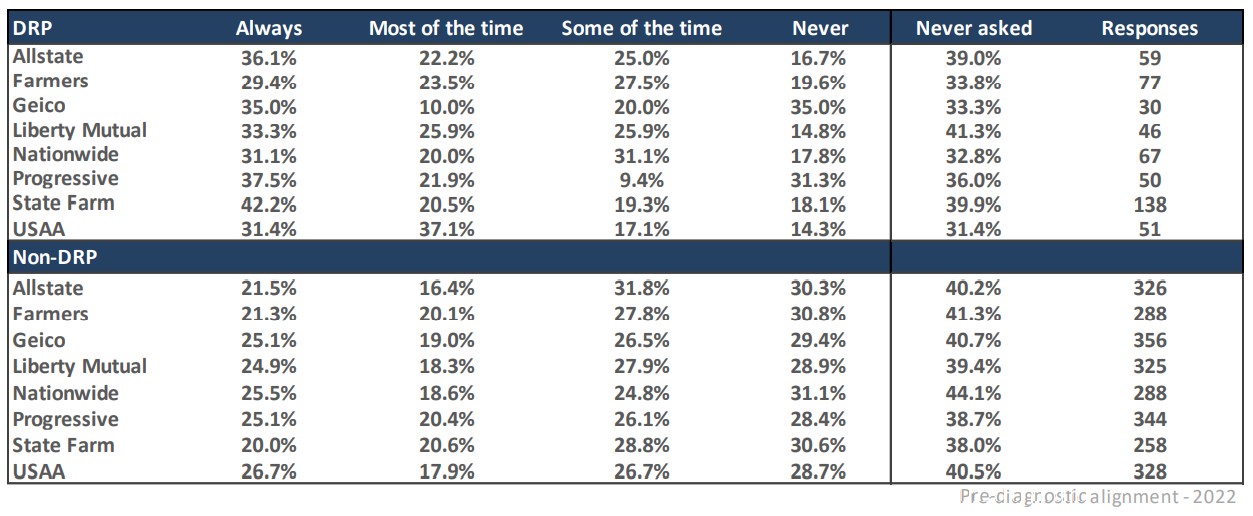

Pre-diagnostic alignment

Of those that negotiate for pre-diagnostic alignment, 45% of shops said they’re “always” paid or paid “most of the time.” That’s up less than 1% over last year. All eight carriers are neck in neck on payment of this procedure with all respondents that negotiated for every carrier saying they’re paid 23.1-27.4% of the time for it.

Anderson said he expects pre-diagnostic alignment to become more prevalent in the future as “the ADAS in today’s vehicles are reliant on proper suspension alignment as well as steering angle sensors.”

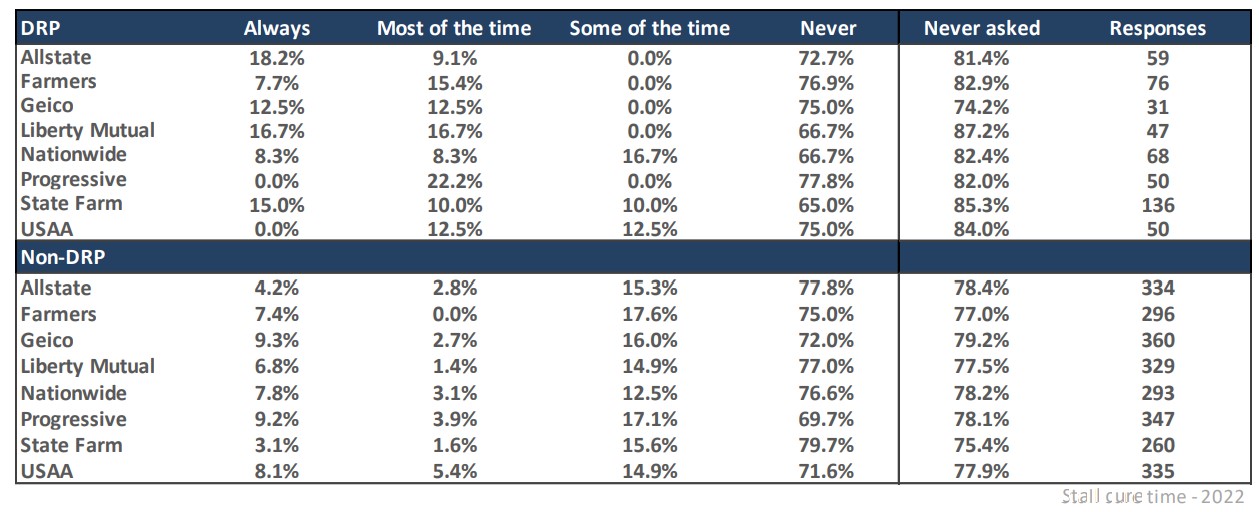

Of those that negotiate for this, 11% are paid “always” or “most of the time.” This procedure involves sharing a fee for the time a vehicle has to remain stationary to allow structural and/or adhesive bonding to cure. In some cases, OEMs require 36 to 48 hours, according to Collision Advice.

GEICO and Progressive are the top two carriers that always pay for the procedure at 9.4% and 8% of the time.

“As we start to see more manufacturers use riveting with structural adhesives, it’s important to know what the cure time is for those adhesives,” Anderson said. “It’s very OEM-specific. …So, make sure you research the OEM repair procedures (including the “Precautions” sections) to ensure you’re following the guidelines for approved products as well cure times and (just as important) temperatures.”

“As we start to see more manufacturers use riveting with structural adhesives, it’s important to know what the cure time is for those adhesives,” Anderson said. “It’s very OEM-specific. …So, make sure you research the OEM repair procedures (including the “Precautions” sections) to ensure you’re following the guidelines for approved products as well cure times and (just as important) temperatures.”

Preparing a photo-based estimate at the insurer’s request

Of those that negotiate for this, 19% are paid “always” or “most of the time,” which is down 1.7% over last year. GEICO (64.9%) and Progressive (62.8%) are the top two carriers to never pay for the procedure with State Farm close behind at 62.2%. However, State Farm always pays for it 14.4% of the time, according to respondents, and both Farmers and Nationwide pay 12.2% of the time.

“We are seeing an increase in photo-based estimating as shops are dealing with staffing shortages and don’t want to see their time wasted preparing estimates for jobs they may not capture from an insurer they may have issues with,” Anderson said.

The final “Who Pays for What?” survey of 2022 is now open through the end of October. It focuses on labor operations related to scanning, system calibrations, and labor. Shops can take the survey here. Survey participants receive a free report with complete survey findings as well as analysis and resources to help them better understand and use the information presented.

The final “Who Pays for What?” survey of 2022 is now open through the end of October. It focuses on labor operations related to scanning, system calibrations, and labor. Shops can take the survey here. Survey participants receive a free report with complete survey findings as well as analysis and resources to help them better understand and use the information presented.

The results of previous surveys are also available online.

IMAGES

Featured image credit: abdoudz/iStock