CCC’s Susanna Gotsch shares data trends repairers should keep an eye on

By onBusiness Practices | Collision Repair | Market Trends

CCC Intelligent Solutions Industry Analytics Senior Director Susanna Gotsch will retire at the end of the year after 30 years with the company. Repairer Driven News caught up with her to discuss what data and trends collision repairers should pay attention to moving forward into the new year.

“I think the biggest issues right now are obviously finding the proper staffing that they need for people that are starting out because they’re competing with Walmart or Target or Amazon where they’re offering benefits,” Gotsch said. “That’s one of the number one topics that we hear from repairers is that they are still struggling to find people.”

She added that repairers will need to continue to look closely at their wage structures to consider offering higher pay and to ensure that their technicians have the proper training to work on electric vehicles (EVs), Level 2 autonomous vehicles, and vehicles equipped with advanced driver assistance systems (ADAS).

The “great resignation” and “quiet quitting” also emerged alongside soaring wages as issues facing the industry this year, Gotsch notes in a December trends report.

“[Accident] frequency numbers are continuing to sort of slowly build back to pre-pandemic [levels] for the full year,” Gotsch said. “I think we’re going to end up around 11% down below where we were in 2019 with expected continued growth in claim counts next year but the average repair order ticket has gone up substantially.”

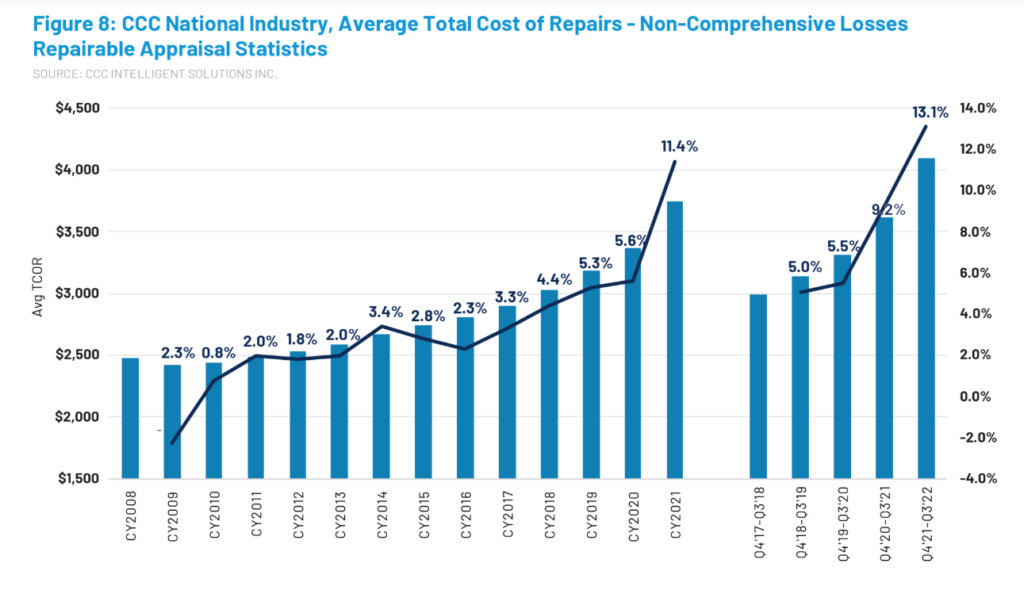

The average repair cost is currently more than $4,100 and non-comprehensive loss repair costs through Q3 2022 for the rolling 12-month period were up nearly 14%, according to Gotsch’s data.

Earlier this month, Gotsch shared in a CCC report five trends that changed the auto repair industry this year — inflation, shifting consumer vehicle purchase behavior, increased repair costs, rising insurance premiums, and higher gas prices.

Earlier this month, Gotsch shared in a CCC report five trends that changed the auto repair industry this year — inflation, shifting consumer vehicle purchase behavior, increased repair costs, rising insurance premiums, and higher gas prices.

She wrote that overall inflation hit a 40-year high and the 6.6% increase in September caused by the Russian invasion of Ukraine cause oil and other raw material costs to shoot up. Gotsch told RDN she expects to see further inflation in parts costs because of the cost of raw materials and shipping, though down some, are still high in addition to labor costs also being higher. Moving into 2023, Gotsch predicts a 4-5% increase in parts, labor, and paint materials costs not including inflation. Add in inflation and those figures would at a minimum double, she said.

Higher interest rates and a more expensive vehicle mix have also led to larger and longer new and used vehicle loans payments and terms.

“Should the U.S. experience a recession in late 2022–early 2023, vehicle sales will likely decline or stay flat, and new and used vehicle prices may soften further. However, supplies of new and used vehicles remain below pre-pandemic levels, so declining demand will likely have only marginal impact on pricing.”

Also throughout 2023, Mark Fincher, CCC’s market solutions vice president, shared in a separate report published in November that parts and material shortages from supply chain disruptions will continue as well as staffing challenges, the need for new training and tooling to repair increasingly complex vehicles, pressure from consumers for more digital experiences, and consolidation across the industry “as demand for capital investment for training and equipment grows.”

Shifts in the collision repair industry

Gotsch also shared with RDN changes she’s noted and worked through during her 30 years with CCC. When she began in 1992, one of the most advanced add-ons in high-end vehicles were heated seats, vehicles had basic halogen lights, and electronic stability control hadn’t been developed yet.

“You had a very sort of basic analog; a lot more mechanical parts versus electronics,” she said. “Over the years, the car has changed from a basic transportation piece to, essentially, almost like a smartphone on wheels. If you look at where a lot of the automakers are making their investments, they’re looking to make connectivity… and telematics as a potential revenue source.

“The new EVs that are being developed, all the bells and whistles on those; the fact that we went from basic seatbelt stuff to all vehicles required to have a driver and passenger airbag minimally. And then to cars where we have airbags throughout the car to now a active focus on crash avoidance versus just crashworthiness. All of that has, from a vehicle perspective, changed the nature of the requirements as it relates to the repair.”

Gotsch noted another significant change has been the materials used in vehicles and the need for calibrations and scanning.

On the insurance side of repairs, smartphone and internet customer communication capabilities during claims processing has improved customer experiences and helped focus staffing needs, Gotsch said. More vehicle owners are also switching to user-based insurance (UBI) as they’re becoming more comfortable with sharing their data to save money on their insurance costs.

Following Gotsch’s retirement, the CCC trends and insights team will continue to be led by Jason Verlen, vice president of product marketing, and has expanded to include Kyle Krumlauf who will focus on auto physical damage as well as Erik Bahnsen who will focus on casualty. Both Krumlauf and Bahnsen have experience in the insurance sector. Bahnsen has been with CCC since 2014, first as a manager with Auto Injury Solutions, and Krumlauf started with CCC in October.

A cross-functional team of subject matter experts will also contribute to information shared with CCC clients and the broader industry.

Images

Featured image: Susanna Gotsch. (Provided by CCC Intelligent Solutions)