P&C insurance industry worsened in 2022, $26.9B net underwriting loss

By onInsurance

Key financial results for private U.S. P&C insurers significantly worsened in 2022 compared to a year earlier, according to preliminary results from global data analytics provider, Verisk, and the American Property Casualty Insurance Association (APCIA).

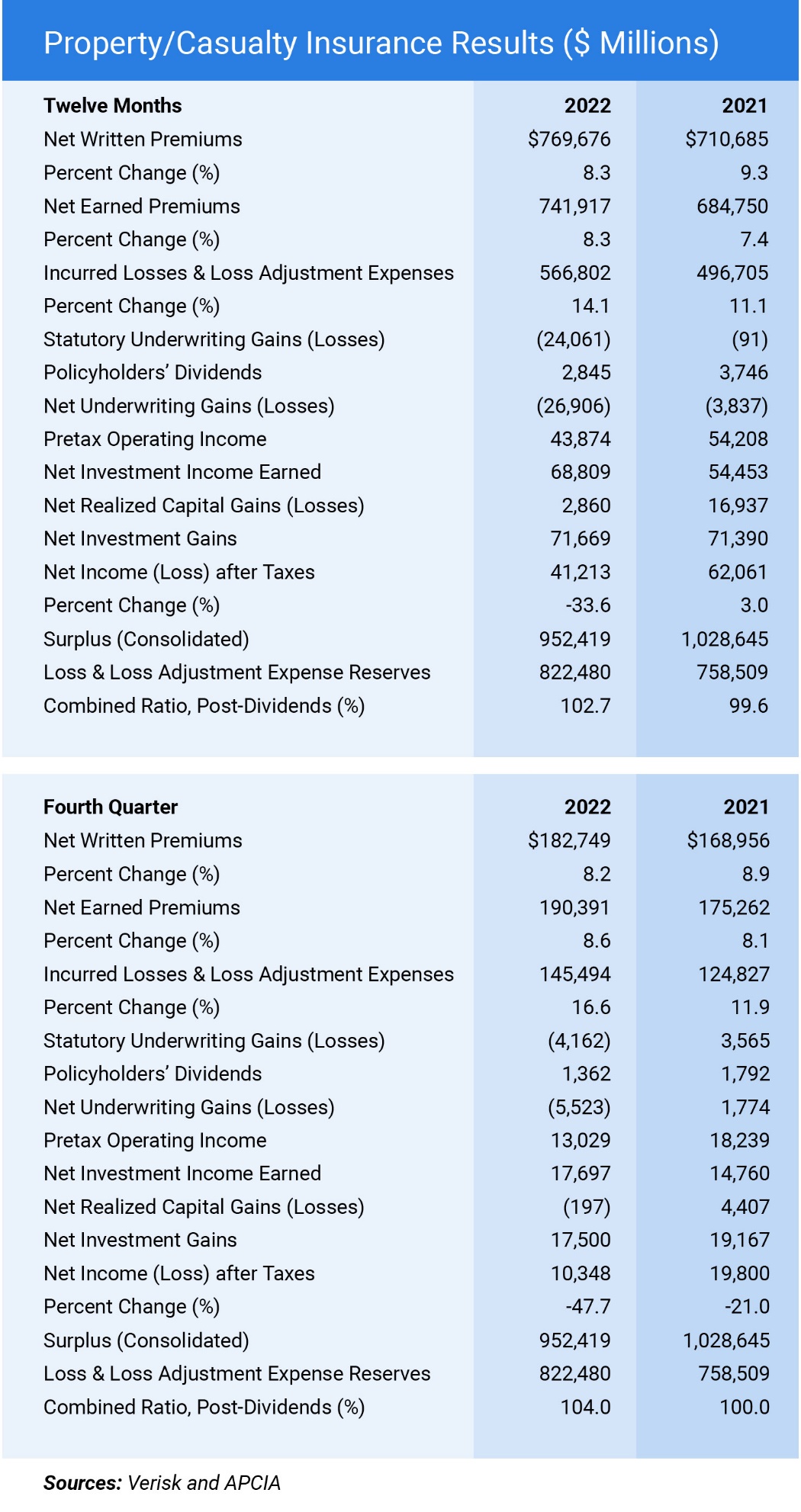

The industry experienced a $26.9 billion net underwriting loss last year — more than six times the $3.8 billion underwriting loss experienced in 2021. The loss was reportedly the largest the industry has seen since 2011.

“The insurance industry is being hammered by increasing input costs, natural catastrophes, legal system abuse, and resistance in some states to adequate rates,” said Robert Gordon, APCIA policy, research and international senior vice president. “Insurers suffered a 14.1 percent increase in incurred losses and loss adjustment expenses (16.6 percent in Q4), contributing to a more than $76 billion contraction in insurers’ surplus at a time when loss exposures are rapidly growing. In 2023, insurers are faced with a significant challenge to close the rate gap in order to meet their growing cost of capital.”

Net income fell to $41.2 billion in 2022, compared to $62.1 billion a year earlier, or a 33.6% decline. That decline would have been $11 billion worse if investment income were not bolstered by various one-time transactions from outside the P&C insurance industry, according to APCIA.

Incurred losses and loss adjustment expenses grew 14.1% while earned premiums grew 8.3%. The combined ratio, which APCIA says is a key measure of profitability for insurers, deteriorated to 102.7% last year from 99.6% in 2021.

APCIA says the preliminary results, presented in the table below, are consolidated estimates based on annual statements filed by insurers with insurance regulators. The results are based on about 94% of all businesses written by U.S. P&C insurers.

“Hurricane Ian and the effects of inflation resulted in major losses for property insurers last year, while accident severity continued to plague personal and commercial auto lines,” said Neil Spector, Verisk underwriting solutions president. “To remain profitable in these challenging times, many insurers are looking for new ways to reduce expenses, increase efficiencies, and enhance the customer experience. And they’re finding help from an ecosystem of advanced technology and analytics that is growing every day.”

“Hurricane Ian and the effects of inflation resulted in major losses for property insurers last year, while accident severity continued to plague personal and commercial auto lines,” said Neil Spector, Verisk underwriting solutions president. “To remain profitable in these challenging times, many insurers are looking for new ways to reduce expenses, increase efficiencies, and enhance the customer experience. And they’re finding help from an ecosystem of advanced technology and analytics that is growing every day.”

The results show that policyholders’ surplus recovered somewhat from Q3 2022’s $911.7 billion to $952.4 billion but still remains below year-end 2021 “driven primarily by the large amount of unrealized capital losses accrued during 2022.” Insurers’ rate of return on average policyholders’ surplus, a measure of overall profitability, declined to 4.2% in 2022 from 6.4% in 2021.

The industry’s net income fell to $10.3 billion in Q4 2022 from $19.8 billion in Q4 2021. The annualized rate of return on average surplus fell to 4.4% from 7.9%.

Net written premiums rose $13.8 billion in Q4 2022, or 8.2%, compared to 2021. Net underwriting losses declined to $5.5 billion in Q4 2022 from $1.8 billion in gains a year earlier, and the combined ratio deteriorated to 104% from 100%.

AM Best reported similar 2022 losses for the industry — $26.5 billion net underwriting loss, which was $21.5 billion more than the $5 billion underwriting loss reported in 2021, according to their report.

Earlier this year, both GEICO and State Farm reported billions in 2022 underwriting losses but detailed differing business moves and outlooks for this year.

Despite the losses to GEICO, Berkshire Hathaway Chairman and CEO Warren Buffett called 2022 “a good year,” and said he had a positive outlook for 2023. GEICO is a subsidiary of Berkshire Hathaway.

Moving forward, State Farm said it plans to continue to adjust for inflation and supply chain trends.

The Insurance Information Institute (Triple-I) says slow underlying growth and inflation are among the biggest challenges facing U.S. auto, home, and business insurers, according to its Q1 2023 Economic Outlook report.

Key takeaways from the report include:

-

- The P&C insurance industry saw its cyclical underlying growth rebound fail to materialize during the second half of 2022 as interest rate tightening depressed housing starts, corporate spending, and vehicle expenditures;

- Increases in P&C replacement costs, such as vehicle parts and housing construction materials, slowed down during the last two quarters of 2022 but remained up 40% compared to 2019; and

- U.S. Gross Domestic Product (GDP) growth is likely to remain depressed for at least the next two quarters of this year following the Federal Reserve’s shift away from its “hawkish stand” on interest rates with the Fed’s three-year Consumer Price Index (CPI) expectations remaining “overly optimistic.”

“We expect long-term growth to remain below 2 percent and long-term inflation to remain above 2.5 percent,” said Michel Léonard, Triple-I chief economist and data scientist. “A recovery by year-end 2023 remains unlikely as the Fed continues its hawkish policy and bond yields increase. However, the Consumer Price Index is likely to decrease as pandemic supply chain disruptions ease, and commodity and energy prices reach a precarious war-time equilibrium.”

Triple-I is slightly more optimistic than the U.S. Federal Reserve when it comes to the GDP, forecasting it to grow slightly above Fed expectations between now and 2025.

The macroeconomic fundamentals for P&C insurers are forecast to be mixed for the balance of this year, according to Triple-I’s analysis.

“Property and casualty insurer net premiums written are forecast to continue to grow due to hard market conditions regardless of slowing underlying growth,” said Dale Porfilio, Triple-I chief insurance officer. “Underwriting losses, however, are expected to persist, driven by challenging results in personal lines.”

Triple-I explained that net premiums written are premiums written after reinsurance transactions. “A hard market is a seller’s market. It describes an environment in which insurance is expensive and in short supply,” the institute said.

Images

Featured image credit: Darren415/iStock

Table provided by APCIA