State Farm holds No. 1 slot in NAIC’s 2022 top 25 P&C list

By onInsurance

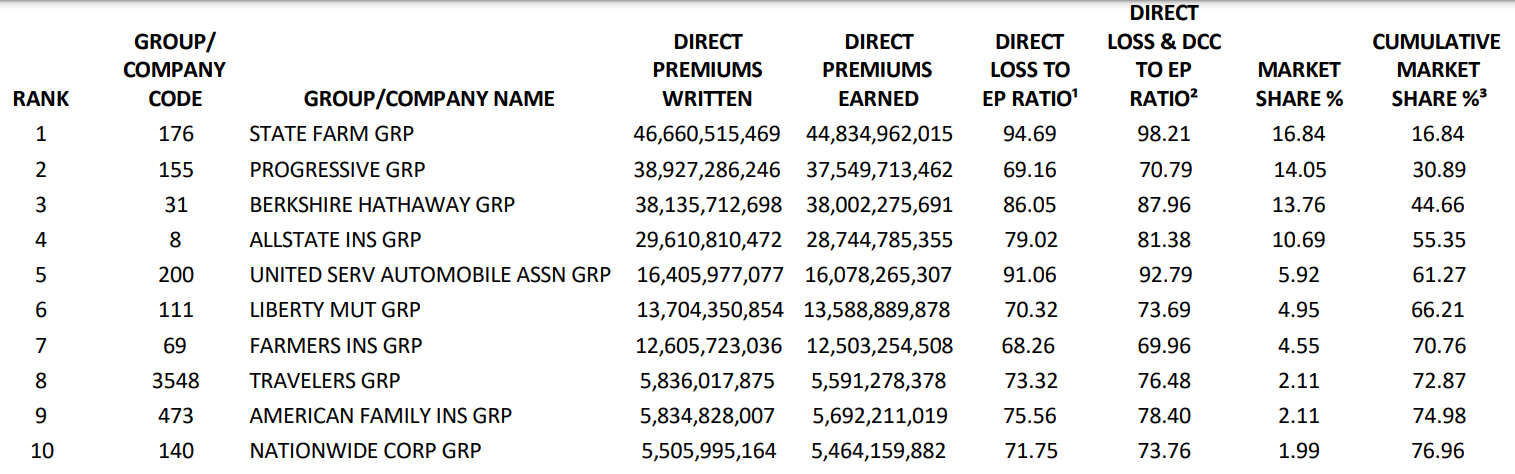

State Farm remains ranked No. 1 by the National Association of Insurance Commissioners (NAIC) and now holds more of the market share at 16.84% compared to 15.98% in 2021.

State Farm wrote nearly $46.7 billion in premiums and earned just over $44.8 billion. Overall, P&C insurers earned nearly $836.9 billion in 2022, wrote about $870.3 billion in premiums, and captured 100% of the market share.

The association’s market share data includes nationwide direct written premiums for the top 25 groups and companies as reported on the state page of the annual financial statement for insurers that report to the NAIC. The Property/Casualty Market Share report contains cumulative market share data for personal auto, commercial auto, workers’ compensation, medical professional liability, homeowners, and other liability (excluding auto liability) insurance. NAIC says the full report, available this summer, will contain more in-depth information.

Key findings, according to data received from insurers as of March 27, include:

-

- With 98.23% of property and casualty insurers reporting, direct premiums written for all lines of business are nearly $870.3 billion

- Total private passenger auto insurance has the largest amount of direct premiums written at nearly $277.1 billion, with about as much earned at $270.2 billion

Direct premiums written in 2022 were up nearly $80 billion from the previous year, according to the NAIC’s 2021 data.

Progressive came in at No. 2 followed by Berkshire Hathaway Group, which owns GEICO, then Allstate and USAA. Progressive’s market share fell only slightly by around a third of 1% to 14.05% compared to 2021.

In its letter to shareholders, included in its 2022 annual report, Progressive wrote that the company has “muscled through a pandemic that never seems to end.”

Progressive also adjusted its underwriting actions “to react to a year of severity trends like nothing we have experienced in at least the last 40 years, and, lastly, pivoted our focus to take the many actions necessary to achieve our objectives in what appeared to be an ever-changing landscape.”

“It wasn’t easy and it was often painful, but we ended the year within our target margin with a 95.8 combined ratio (CR) and grew net premiums written (NPW) and policies in force by 10% and 3%, respectively,” the letter states.

The direct loss ratio in private passenger auto as a whole was 80.16 and the direct loss and cost containment expenses ratio was 82.54.

According to State Farm’s 2022 financial results, the carrier reported record underwriting losses “due to rapidly increasing claims severity and significant additions to prior accident year incurred claims.”

“While State Farm experienced unfavorable operating results in auto, State Farm Mutual Automobile Insurance Company remains financially strong,” a State Farm news release states.

“While 2022 was a year of significant growth at State Farm, our annual operating results were not at the level we expect as we consider each affiliate’s financial strength and long-term performance,” said Senior Vice President, Treasurer and Chief Financial Officer Jon Farney, when the results were released in February. “At the same time, the organization remains financially strong. We’re pleased we could assist our customers during the pandemic and we’re there to help them navigate the current period of high inflation. As we take actions to improve our operating performance, we look forward to helping more people in more ways as we begin our next 100 years.”

State Farm and GEICO reported billions in 2022 underwriting losses. State Farm’s loss was $13.4 billion. The carrier said in March it would continue to adjust for inflation and supply chain trends while Berkshire Hathaway had a brighter outlook.

State Farm is increasing its insurance prices by an average of 6% in Illinois after finalizing a $178 million car insurance rate increase. It represented the company’s second auto rate hike in the state this year. The first, which will take effect in June, is a $182 million rate increase expected to impact more than 3 million drivers throughout the state.

In its 2022 annual report, Berkshire included a letter from Chairman Warren Buffett, who wrote that it had been “a good year” with operating earnings, exclusive of capital gains or losses from equity holdings, set a record at $30.8 billion.

In April, Allstate announced “catastrophe losses” of more than $1 billion during the month of March and said Q1 losses total $1.69 billion.

The insurer attributed its bleeding bottom line to 10 events, and said it recouped some of its finances by “favorable reserve estimates for prior events.”

Allstate’s response was to implement 7.6% auto rate increases throughout 10 locations, resulting in a 0.5% brand premium impact.

According to ValuePenguin’s State of Auto Insurance in 2023 report, auto insurance carriers are expected to raise premiums by an average of 8.4% this year.

Images

Featured image: JHVEPhoto/iStock