LexisNexis report: Total loss claims, damage severity rose in 2022

By onCollision Repair | Insurance

Total loss ratios worsened during the first nine months of 2022, with 27% of collision claims deemed total losses, LexisNexis said in its newly-released auto insurance trends report.

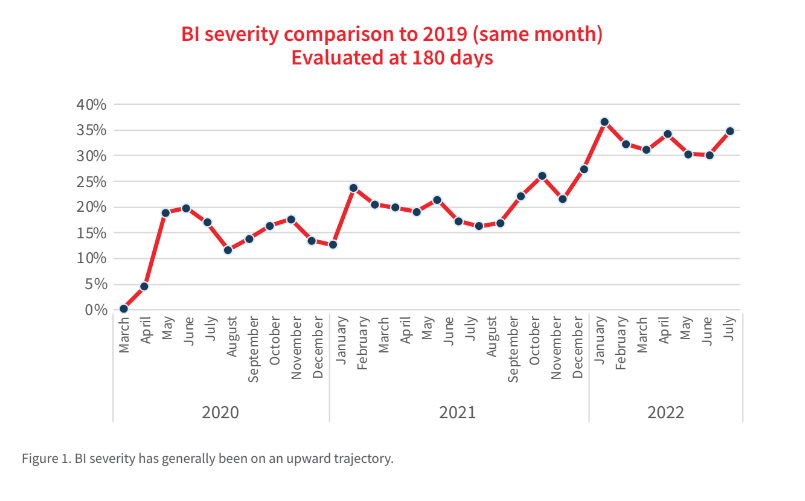

The white paper also found that bodily injury and property damage severity increased 35% since 2019, while collision severity spiked by about 40% during the same period.

“Overall, claims severity has been rising ever since people returned to the roads in 2020,” LexisNexis said. “At that time, insurers saw an uptick in speeding, car part shortages, labor shortages and total losses.

“These factors all influence claims severity. As we drill down further, we see how bodily injury (BI), property damage (PD) and collision severity (CO) patterns played out last year in the wake of the current insurance climate.”

The report noted how broader economic issues factored into 2022’s severity dynamics, noting that auto pairs, equipment and body work increased 10% year-over-year. During the same period, repair costs rose by 19% and hospital and healthcare-related services increased by 4.6%, it said.

Total losses from 2022 were up from the 24% of vehicles totaled in 2021, and although the 3% difference might seem slight, LexisNexis called the increase significant.

“Especially when you consider the time and effort required to settle these claims and current high vehicle costs,” it said. “In most cases, adjusters are required to manually search for data and source it from multiple locations. Oftentimes, this occurs outside of the more automated areas of the claims adjuster’s workflow. Manually sourcing title, lienholder details or an odometer reading isn’t an efficient use of an adjuster’s time ― especially in light of the data integration capabilities available in the market today. When data is embedded into the workflow, adjusters have access to the information they need so they can keep the claim moving.

“As you remain laser-focused on creating the best customer experience, pay attention to total loss as an area ripe for improvement.”

Claims satisfaction

Last August, LexisNexis surveyed about 1,400 customers who filed a claim within the past 12 months to ask about their experience both filing claims and receiving payouts. It found that 94% of respondents were either satisfied or somewhat satisfied, but noted that 33% switched or considered switching insurers following their claims experience.

It said it found three “notable” discrepancies between policyholders who planned to stick with their insurers and others who sought to explore their options. Top factors included professionalism, accuracy, and availability, it said.

“Customers who planned to remain with their insurer were satisfied with professionalism 57% more often, with accuracy 74% more often and with accessibility and availability 65% more often than their counterparts,” LexisNexis said.

It noted that both loyal and non-loyal customers reported the claims processes to be too slow, which LexisNexis said points to the need for a data-driven integrated claims process that eliminates “manual, confusing and unnecessary stems.”

Separately, a panel of collision repair, insurance, appraisal and rental professionals agreed in April that “fundamental change” has to happen within the collision repair and insurance sectors to move away from the reliance on supplements because they degrade customer trust and unnecessarily delay the repair process

When LexusNexus asked customers how they prefer to report claims, it found that there is not yet a strong agreement as to whether policyholders prefer to submit claims the traditional way or digitally.

Customer shopping

While customer shopping was sluggish during the first part of 2022, high rate increases caused it to rise as the year drew to a close, LexisNexis said. It noted shopping went from being down 5.2% last July to being up 5.3% in August, with another 3.5% increase reported in August.

It said the rise in shopping came as a result of rate increases insurers began implementing in late 2021 to offset increased cost claims and profitability issues.

“In fact, rates increased by more than 9% on average in 2022―twice as much as we’ve seen in recent calendar years,” it said. “We expect

that figure to continue upward in the coming months, as additional rate increases are filed.”

Bad driving habits

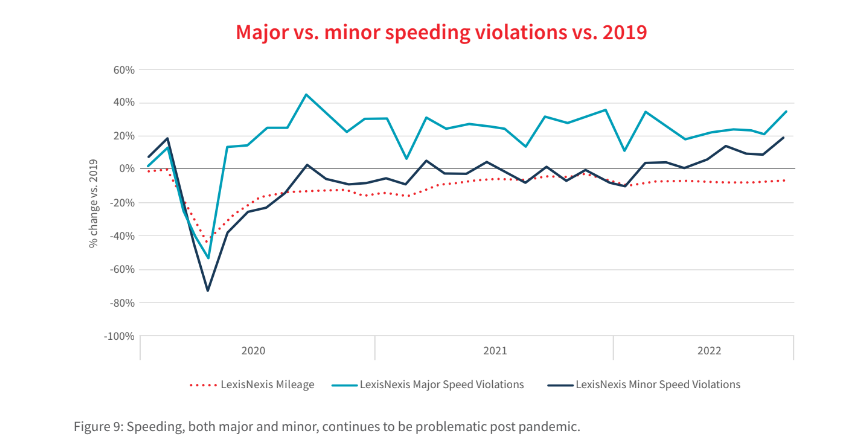

Another auto insurance trend highlighted in the report focused on driving violations, and how speeding, driving under the influence (DUIs) and distracted driving have in some cases exceeded pre-pandemic levels. It found:

-

- Major speeding violations were 20% higher than 2019 rates, with minor speeding surpassing 2019 levels for the first time in 2022.

- A steady increase in distracted driving violations in 2022, noting there “were three months during 2022 where volume exceeded 2019 for three generations: Baby Boomers, Generation Z, and Traditionalists.”

- DUI violations aligned closely with 2019 levels. “Law enforcement officials have reported seeing a steep increase in drunk driving cases since the start of the COVID pandemic that has dramatically increased each year since,” the report said.

Telematics outlook

The report also explored investments in telematics, which it said was growing among insurers of all sizes. According to its research, 43% of the nation’s top 10 insurers are using telematics, while 30% of insurers are using it overall.

LexisNexis, which markets its own telematics exchange service, said working with a telematics service provider can be especially beneficial to smaller companies.

“For insurers with limited internal resources, a telematics exchange is understandably attractive and more cost-effective than running their own telematics program,” it said. “Smaller insurers may lack enough proprietary data and capabilities to generate their own telematic

scoring. While an off-the-shelf score can help them price risk with greater accuracy, empowering them to protect their book of

business, a telematics exchange can do so much more.”

Images

Featured image: Halfpoint/iStock