EV sales may not be mainstream yet but new report says insurance claims on the rise

By onBusiness Practices | Market Trends

A new trends report from CCC Intelligent Solutions says that while 2 million electric vehicles (EVs) are currently on the road in the U.S., accounting for only 1% of all vehicles in operation, that will increase by 30-50% worldwide come 2030. Based on recent data, the report examines what collision shops and insurance carriers should consider to prepare for the uptick.

“This optimistic outlook is underpinned by growing environmental consciousness, the rapid expansion of charging infrastructure, competitive pricing expected to reduce cost, and now, government incentives aimed at amplifying these initiatives,” CCC wrote.

However, the U.S. Bureau of Labor Statistics (BLS) noted in February that projections vary widely. “S&P Global Mobility forecasts electric vehicle sales in the United States could reach 40% of total passenger car sales by 2030, and more optimistic projections foresee electric vehicle sales surpassing 50% by 2030.”

CCC has found that the number of EV charging stations has doubled and EV sales tripled since last August when an executive order from President Joe Biden was issued that calls for 50% of U.S. vehicle sales to be electric by 2030.

On top of that, in addition to emissions and climate legislation called the Inflation Reduction Act (IRA), the Environmental Protection Agency (EPA) issued new proposed emissions rules last month.

If approved, the rules would be phased in over model years 2027-2032 vehicles to cut emissions by 56% for light-duty vehicles and 44% for medium-duty. They build upon the existing MY 2023-2026 requirements that EPA says cut pollution by 13% annually.

Regarding crash trend effects on the collision industry, CCC’s report examines data based on battery electric vehicles (BEVs); plug-in hybrid, fuel cell, and hybrid EV data aren’t included.

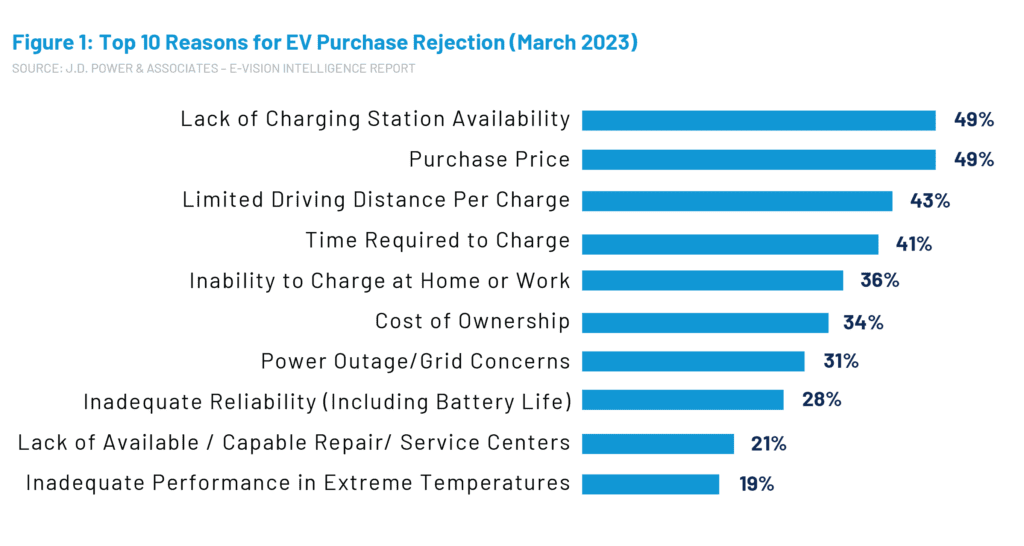

A blind spot in the industry is a lack of shops that are available and/or capable of safely repairing EVs, CCC said. EV repairs require certain PPE, specific and specialized training, and safe handling measures including assistance from the Energy Security Agency (ESA). But safety also comes down to EV drivers.

“A survey of 1,200 EV owners conducted by the French insurer AXA in Belgium revealed drivers of EVs caused 50% more collisions than ICE vehicles,” CCC notes in the report. “Drivers switching from an ICE vehicle to EV are often unaware of how quickly an EV accelerates, and the high, instant torque of electric motors can lead to loss of control which can result in a crash.”

While the added weight of EV battery packs and other components can help keep passengers safe it increases the risk of injury to the occupants of vehicles involved in a collision with an EV, CCC added. That’s because the impact from the added weight is transferred from the EV to the lighter vehicle.

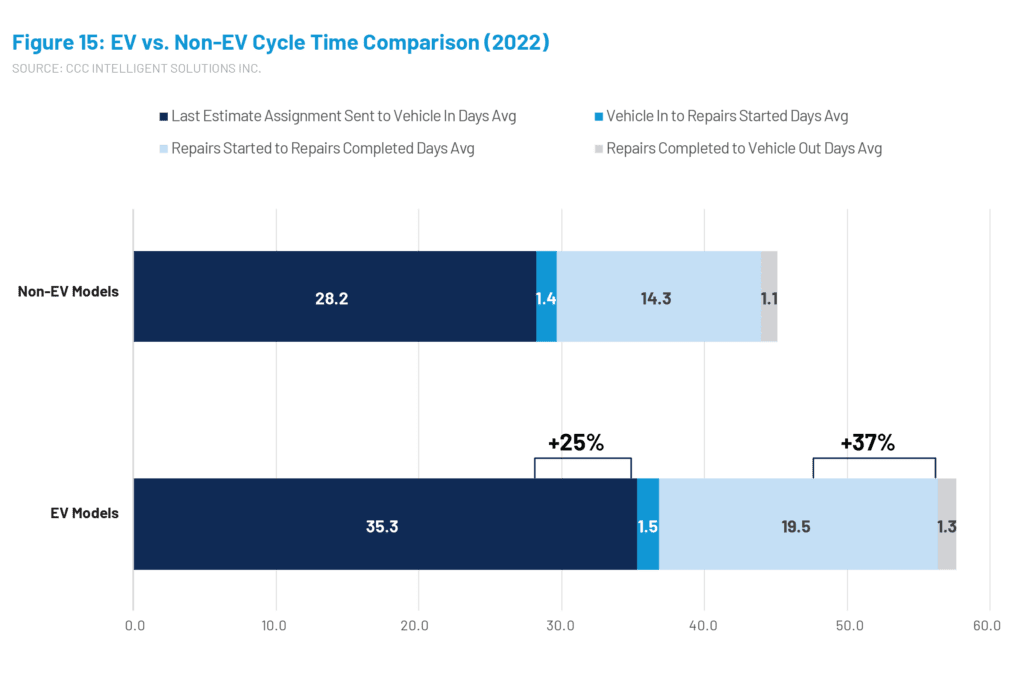

That added force is likely to add up in claims and repair costs, caused in part by more damage, thus increasing already high cycle times, according to CCC. In 2022, the average time from the last estimate to vehicle pickup was nearly 58 days — more than 12 days above non-EVs, adding seven full days to get EVs into the shop plus five additional days for repairs, CCC said.

In addition, the higher purchase prices of EVs will add to claims costs. Nearly half of 2022 EV claims had a sticker price greater than $50,000.

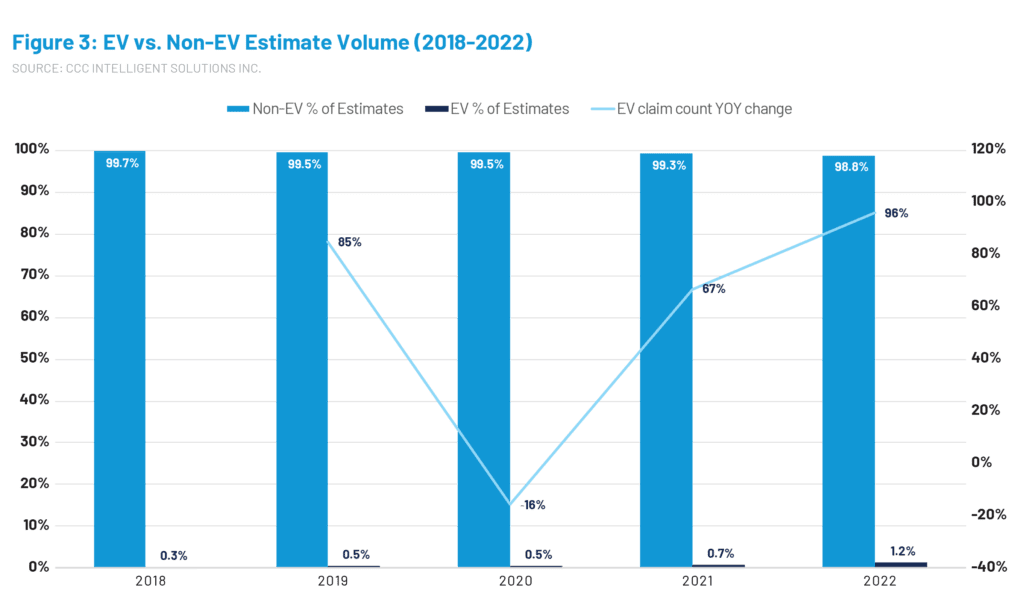

While seemingly insignificant that EVs represented 1.2% of all repairable estimates processed through CCC last year that was a 96% increase over 2021.

CCC Industry Analytics Director Kyle Krumlauf told Repairer Driven News that in 2022, the average repairable EV estimate was $6,600, or 4% above 2021.

“Looking at the data for 2023 so far, EV estimates have shown a slight increase compared to 2022, with an average of $6,624, reflecting a marginal growth of 0.3%,” he said. “Depending on how supplements and the rest of the year unfold, we could potentially see the average total costs of EV repairs remaining flat.”

More than 39% of 2022 estimates were made in California, where 40% of all U.S. EV sales take place since 2011, according to CCC.

EV sales were also up last year in Florida, Texas, Washington, New York, and New Jersey.

Tesla accounts for around 65% of EV sales in the U.S. followed by Nissan, Chevrolet, Ford, Hyundai, Kia, Volkswagen, Audi, and BMW comprising 1-4% of 2022 estimates that used CCC, respectively.

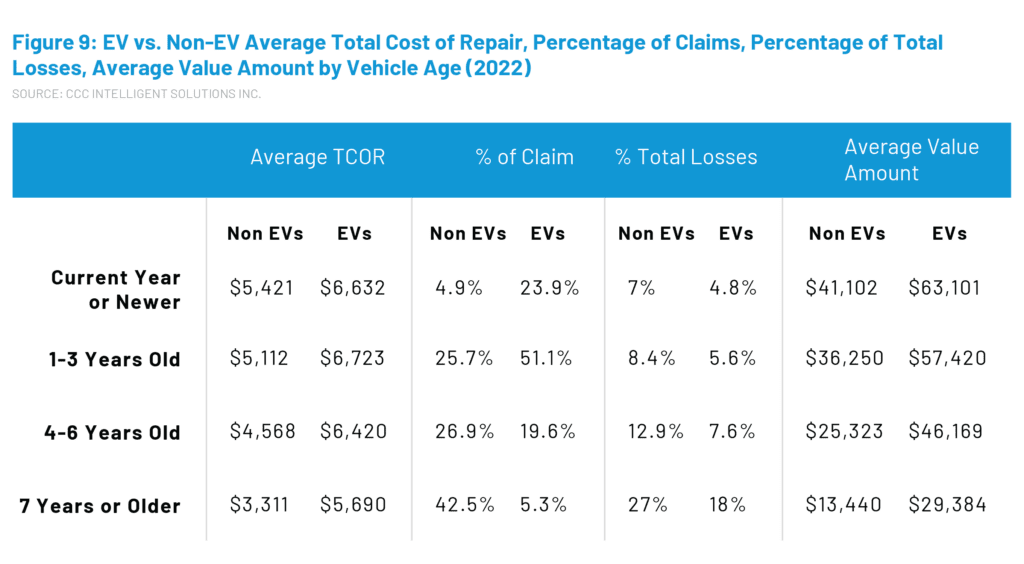

The average total cost of repair for EVs last year reached $6,587, up more than 56% compared to all non-EVs. However, CCC notes that could be misleading because EVs are, on average, four-and-a-half years newer than the average vehicle estimated and have an average value that is more than $30,000 greater.

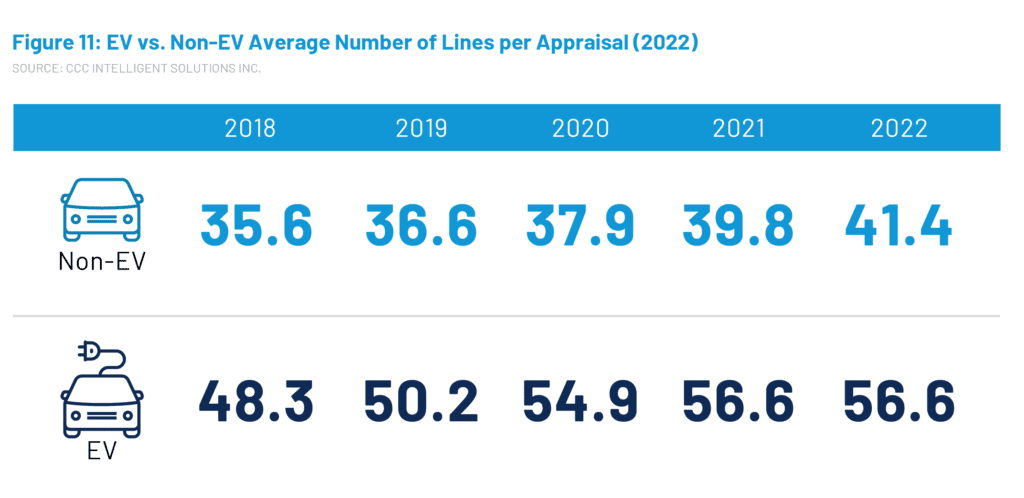

So, when comparing EVs to non-EVs by vehicle age, the increase is $1,211 for current year or newer and $1,611 for EV models that are 1-3 years old and valued at $20,000 more than non-EVs. CCC also found that EV estimates average more than 15 additional lines per appraisal, and increase by model year.

CCC also found that EV estimates average more than 15 additional lines per appraisal, and increase by model year.

“An initial analysis revealed that EV estimates tend to include line items for parts, operations, and disposable goods that don’t typically appear on non-EV estimates,” the report states. “The average number of parts per estimate can be 33-50% greater for EVs. Parts costs account for [around] 30% of the TCOR difference between EVs and non-EVs but the major driver of cost differences resides in labor, where EV non-paint labor time is over double the non-EV average and paint labor time is over 50% higher.”

CCC takes the position that lawmakers didn’t consider the challenges and demands the IRA will put on collision repair shops and insurance carriers from funding for training as well as shop and equipment upgrades. Not to mention the ongoing technician shortage keeping many shops understaffed and limited on the time they can spend on training and classes.

“EVs are equipped with advanced driver assistance systems (ADAS) like most newer vehicles as well as other sophisticated technologies,” Krumlauf said. “Collision repairers should consider investing in technology and software tools to diagnose and calibrate these systems correctly.”

Understanding elements such as towing, storage, charging, and battery maintenance as well as labor and parts cost considerations are also likely to improve shop and customer expectations and results.

“Increasing awareness around the existing technician shortage and emerging need to support EV fleets might be the right place to start,” CCC said. “Corresponding grants and funding — like those provided to scale EV adoption through the IRA — could be pursued at both local and national levels to enlist would-be technicians and modernize shops to perform work on EVs.”

Krumlauf added that grants for shops might be limited but there are programs available to collision industry individuals, sponsored by stakeholders.

“By raising awareness about the labor gap and the need for EV technicians, the industry can address the challenges posed by the increasing presence of EVs,” he said. “Investing in education and training is crucial to ensure a skilled workforce for the evolving automotive landscape.”

Carriers, on the other hand, need to understand that EVs and internal combustion engine (ICE) vehicles are different and should be underwritten as such, including towing, storage, charging, battery maintenance, and labor and parts cost, CCC said.

“The addition of ‘small batch’ EV models — each with their own unique parts and systems — might require a more thoughtful approach when it comes to assessing EV risk, determining coverage, managing claims, and underwriting policies based on limited historic data, and could also present even bigger challenges that impact an already strained collision repair industry,” the report states.

For example, Krumlauf said, the availability of EV parts is limited because the number of vehicle models and manufacturers continues to increase while, at the same time, non-OEM options such as aftermarket or recycled parts can be limited or non-existent.

As for claims, Krumlauf said: “Initial repair estimates reflect the damage seen by the estimator and any additional unseen damage likely associated with the crash they can see — this is based on an estimator’s experience with a certain make and model. As EVs will be new to many in the industry, there will be less experience with EVs initially. As repair professionals tear down and further inspect a vehicle, it’s likely additional damage will be identified.

“In 2022, 70% of EV claims required a supplement, which was [around] 9% higher than non-EVs. Supplements accounted for over 37% of the total cost of repair for EVs, which was over 15% greater than non-EVs (over 22%),” he said.

Click here to read the full report.

Images

Featured image: An illustration shows an electric vehicle (EV) charging station and a worker soldering a lithium-ion battery that will go in an EV. (Credit: Fahroni/iStock)

EV shares of car sales and stock, 2011-21 graph provided by the U.S. Bureau of Labor Statistics and the International Energy Agency.

All graphs and charts provided for publication by CCC Intelligent Solutions