EV startups, Tesla detail higher demand, improving supply chain & production timing

By onMarket Trends

Lucid CEO, CTO and Director Peter Dore Rawlinson said Monday during the company’s call with investors that brand awareness and cost efficiency continued to be the automaker’s two goals this year and have improved.”We saw another strong increase in the number of test drives sequentially through Q2 and the third-party data shows that our brand awareness in the luxury and premium segment is growing to a much stronger place,” he said. “And as our fleet size grows, so does the number of Lucid Air sightings.”

During Q2, $3 billion in capital was raised “removing financial concern and demonstrating the strength of our partnership with our core partner, the Public Investment Fund,” Rawlinson added.

Based on brand awareness success, CFO Sherry House said Lucid has lowered the prices of the Air AWD, starting at $82,400.

“We have reinstated pricing levels to those which we contemplated in our original business plan,” she said. “The early reception has been very strong with three times the increase in orders in the first full day of the program as compared to the end of July. The return on investment that we’re now seeing gives us more confidence in the next steps of our plan to further improve brand awareness and importantly, conversion.”

Investors were interested in Lucid’s recent partnership with Aston Martin to provide it with the Lucid powertrain — an agreement that Rawlinson said reaffirms the commercial value of the Lucid’s patented technologies.

“We believe this could represent a harbinger of future opportunities, not only in applications for the automotive market, but also in markets such as commercial transportation and even aviation,” he said.

In September, production of the Lucid Air Pure rear wheel drive is slated to begin. Rawlinson said it will have an EPA-estimated range of 419 miles from an 88 kilowatt-hour battery pack.

“Because the battery is smaller, this means in turn that the car weighs less, is more agile, and more importantly can cost less than a vehicle of similar range which needs a larger battery pack,” he said, adding that it will be better for the environment and have lower total cost of ownership.

Also in September, Lucid plans to begin production of its luxury super-sports sedan, the Air Sapphire. Pre-production has already begun.

The Lucid Gravity is planned to be unveiled in November at a launch event that will be live streamed. Rawlinson said the price tag will be similar to the Air but didn’t disclose any figures.

Rawlinson said mid-size EV development is on schedule for mid-to-late decade while development of Lucid’s next-generation powertrain is already underway.

Manufacturing efficiencies overall have improved due in part to workforce cuts earlier this year, House said.

Key financial takeaways from Q2 include:

-

- Revenue of $150.9 million;

- 1,404 vehicles delivered to customers; and

- $6.25 billion in total liquidity as of June 30.

During Rivian’s Q2, CEO Robert Joseph “RJ” Scaringe told investors 13,992 vehicles were produced, which was a 50% increase compared to the Q1 and was the first time R1S quarterly production was higher than R1T. Seventy percent were R1S EVs. Of those produced, 12,640 were delivered to customers.

Because of that progress, Scaringe said 2023 production guidance has been increased to 52,000 vehicles. Q2 revenue was $1.1 billion.

“On a quarter-over-quarter basis, delivered vehicles grew by 60%, while gross profit per vehicle improved by about $35,000,” he said. “We achieved meaningful reductions in both R1 and EDV [Electric Delivery Van] vehicle unit costs across the key components, including material costs, manufacturing labor, overhead and logistics.”

Wassym Bensaid, Rivian’s software development senior vice president, said 22 major software updates have been sent to R1s since the platform was launched in the fall of 2021.

“These updates have been filled with features such as Bird’s-Eye Camera View, Drive Cam, Snow Mode, Camp Mode, Pet Mode and much more, all designed to enhance our customers’ experience,” he said. “Most recently, this included the integration of a Better Routeplanner, which we expect to meaningfully improve our customers’ charging and routing experience. This technology will give our customers the ability to plan and compare charging stops along the way. It also provides us data to help with the site selection of our Rivian Adventure fast charging network.”

In the coming months, there will be two major software upgrades: a towing mode update and the launch of a drone mode.

The towing update will apply to trader profiles, backup camera views, adaptive range estimation, and towing charge stations discovery in the navigation app. Drone mode will create an immersive camera experience powered by Rivian’s computer vision and augmented reality technologies, Bensaid said.

“We own every single computer on the vehicle,” he said. “So we’re able to not only update the infotainment or the connectivity but we can update the vehicle controls, we can update the vehicle dynamics, the energy management, ADAS, the way the vehicle drives, the way the vehicle navigates, communicates with the entire world.

“We’re able to create end-to-end unique experiences that really redefine the ownership with our customers and really creates that regular connection with our community of customers. We have those capabilities to continue enhancing the feature set.”

During Q&A with investors, a lack of EV demand was brought up as a concern and whether Rivian’s backlog of orders will sustain the company into next year. Scaringe had a different view. He said he’s excited about how well Rivian vehicles have been received, including J.D. Power’s highest level of customer satisfaction in the premium EV space.

“We see it through the day-to-day interactions we have with the owners of our vehicles and they become the biggest advocates and essentially marketers, if you will, for our brand and what we’re building,” he said. “We feel very confident in the continued backlog that we have. We have clear visibility deep into 2024 with that backlog that’s established. And as more and more vehicles are on the roads, and we now have tens of thousands of R1s on the roads, it continues to feed the flywheel of awareness about the brand.”

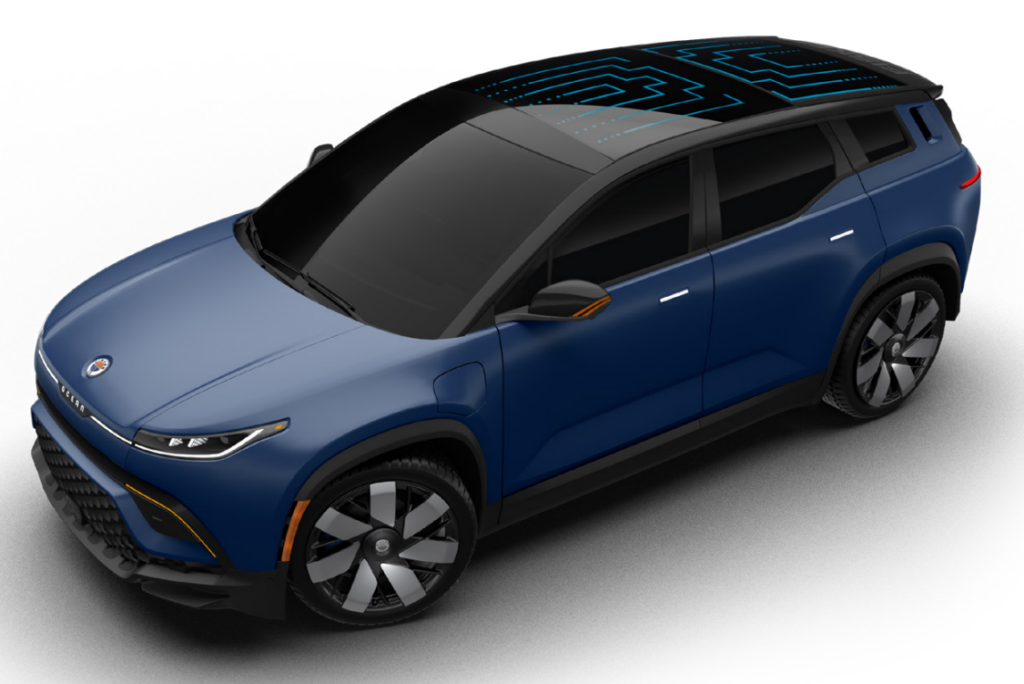

Perhaps a lesser known EV startup, Fisker, said as part of its earnings report that its first deliveries of the Ocean One EV were made in the U.S., Austria, Denmark, and Germany during Q2. Additional customer facilities will be added in North America and Europe later this year.

Q2 was also the first quarter Fisker generated automotive sales revenue of $825,000 from 11 Ocean vehicle deliveries. However, $87.9 million was lost during the quarter.

Fisker produced 1,022 vehicles during the quarter, nearly all of which were manufactured in July. Its Ocean production forecast was decreased to 20,000-23,000 from 32,000-36,000 for the calendar year due to supply constraint from one supplier.

The Ocean is built under contract with Magna Steyr, a unit of Magna International, but Fisker manages the supply chain and is working to resolve the parts issue.

As for Tesla, CEO Elon Musk told his investors that Q2 saw record vehicle production and deliveries leading to record revenue of nearly $25 billion. He noted that during Q1, Model Y became the best-selling vehicle of any kind globally, surpassing the likes of the Toyota Corolla and Volkswagen Golf.

“We continue to target 1.8 million vehicle deliveries this year, although we expect that Q3 production will be a little bit down because we’ve got some shutdowns for a lot of factory upgrades,” Musk said. “In the long-term, autonomy, we think, is going to just drive volume through the ceiling next level… the way we’re going to manufacture the robotaxi is also itself a revolution.”

The automaker’s ongoing Full Self-Driving Beta testing had acquired more than 300 million driven miles as of the earnings call on July 19. During Q3, Tesla will allow its vehicle owners to transfer their FSD subscription to another Tesla vehicle, which Musk said will be a one-time-only deal.

Tesla has been previously accused of falsely advertising Autopilot and Full Self-Driving advanced driver assistance system (ADAS) features in California. However, Musk told investors FSD will “go from being as good as a human to then being vastly better than a human.”

“We see a clear path to Full Self-Driving being 10 times safer than the average human driver,” he said.

Autopilot is also under investigation by the National Highway Traffic Safety Administration (NHTSA) for allegedly causing crashes. Another recent NHTSA investigation of Tesla involves loss of steering.

The first deliveries of the long-awaited Cybertruck are slated to begin later this year.

Outgoing CFO Zachary Kirkhorn said during the earnings call that Q2 set another record number of vehicles produced and delivered despite “a period of economic uncertainty, rising interest rates, volatility in consumer confidence, and regulatory change.”

Tesla announced on Monday that Kirkhorn will leave the company at the end of the year after helping transition his job to Chief Accounting Officer Vaibhav Taneja. Taneja took over Aug. 4 and in addition to CFO, will continue to serve as chief accounting officer.

Speaking specifically to collision repair of Teslas, an investor asked if the giga-casted vehicles are harder and more costly to repair as critics have said.

“That’s simply not true,” said Lars Moravy, Tesla’s vehicle engineering vice president. “There’s a misconception that traditional bodies are easy to repair but they are made of multiple materials and multiple joining methods — spot wheels and rivets have to be drilled out, panels and structural adhesive have to be chiseled out, dried adhesive has to be removed, stampings cut.

“Putting that back together means time and money. Using an example of replacing a rear cast rail on a Model Y, to do that versus like what we replaced it with from the Model 3, it’s 10 times cheaper and three times faster to do it with the cast rail. My design team works with our collision repair team since we’re closed-loop on this with insurance.”

Musk added that traditional vehicle body construction is a “crazy patchwork quilt” and that closing the loop on Tesla vehicle collision repairs is crucial.

“We design specific parts that make it easier and faster to repair,” Moravy said. “We have an incentive to do that because we have our own insurance and our own body shops. We expect that we’ll continue to do this and collision repair will continue to become cheaper and faster over time. And we already make this available to all body shops through our Tesla-approved body shop training.”

Images

Featured image credit: martin-dm/iStock

Lucid Air Sapphire (Provided by Lucid)

2022 Rivian R1S (Provided by Rivian)

Fisker Ocean One, the startup’s first EV. (Provided by Fisker)

Tesla Model Y (Provided by Tesla)