NC DOI rejects Rate Bureau auto insurance rate requests, negotiates lower increases over 2 years

By onInsurance

Insurance Commissioner Mike Causey has reached a settlement with the N.C. Rate Bureau on non-fleet private passenger automobile insurance rate increases through 2024 at nearly two-thirds less than insurance companies requested, saving drivers $1.6 billion.

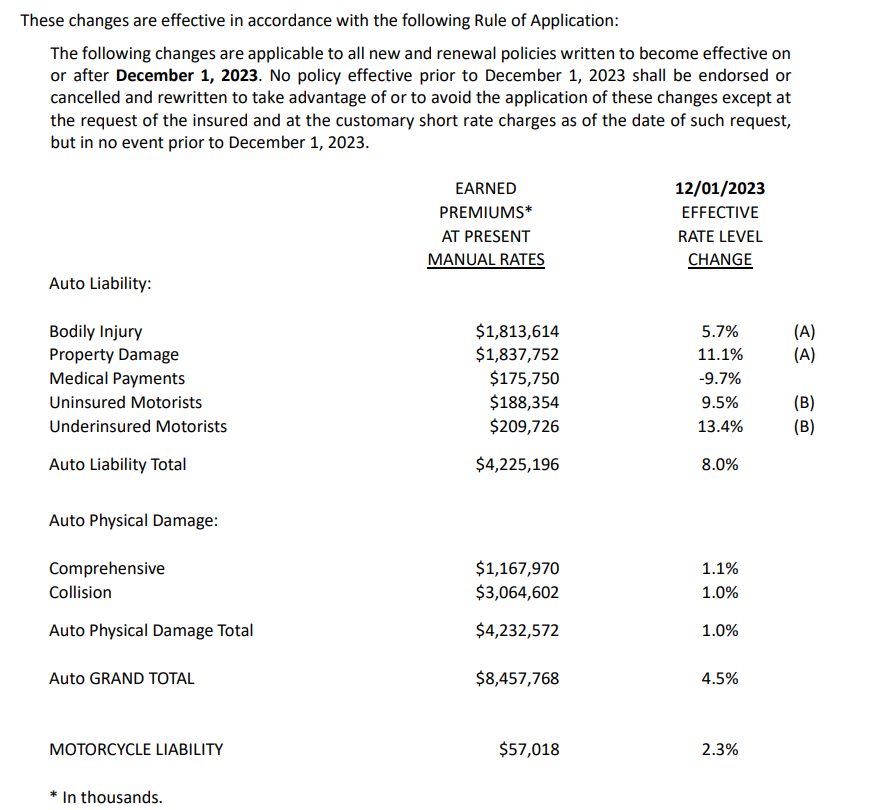

The settlement provides an average overall increase of 4.5% this year and another 4.5% in 2024. For liability coverages, the increases will be 8% in 2023 and 7.9% next year. There will also be a 1% increase both years for physical damage coverages. Motorcycle liability increases will be 2.3% both this year and next.

The Rate Bureau represents the insurance industry in North Carolina and is not a part of the NC DOI.

The bureau requested an increase of 28.4% for overall auto and 4.7% on motorcycle liability. In addition, it wanted to raise auto liability coverage rates by 31.4% and physical damage coverages by 25.5%.

Rate level changes effective this year for bodily injury (BI) basic limit is 0.8% and 4.9% for higher. Property damage (PD) will go up another 10.3% for basic and 0.7% for higher. In 2024, BI basic will increase another 5.2% and PD basic another 10.2%. Higher won’t be increased next year.

Full details on each base rate change effective this year and next are laid out in the document linked above.

The auto rate increase for this year will take effect on new and renewed policies beginning on or after Dec. 1. By law, the bureau must submit auto rate filings with the department every year by Feb. 1.

The settlement also cancels a hearing scheduled for later this year, which the NC DOI says means avoiding a lengthy administrative legal battle that would cost consumers time and money.

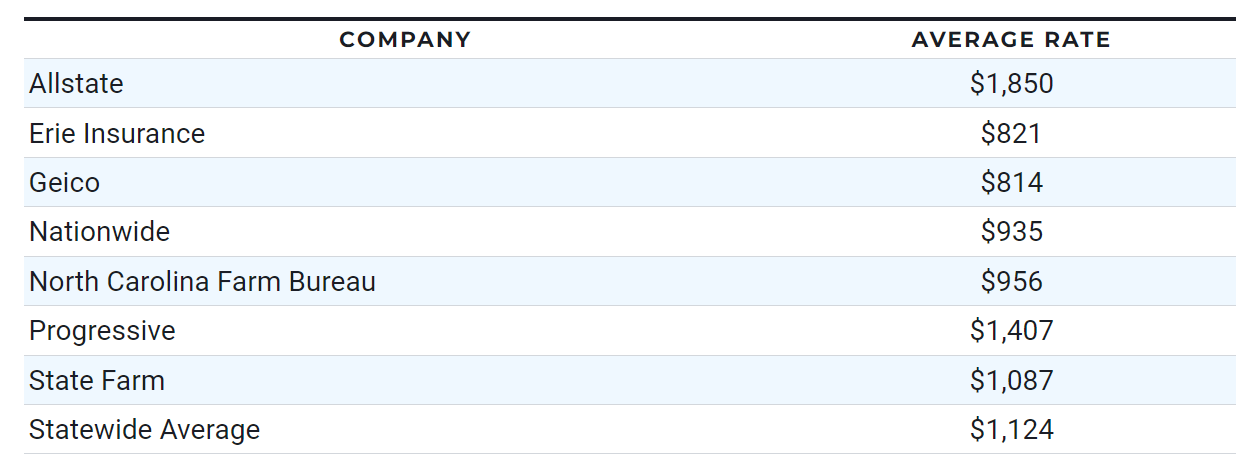

In a news release about the settlement, the NC DOI noted a 2023 U.S. News & World Report study that ranks North Carolina as offering the sixth lowest average annual automobile insurance costs in the U.S. North Carolina drivers pay an average of $1,124 per year, compared with the national average of $1,442, according to U.S. News & World Report.

Rates by carrier in North Carolina, according to the publication are:

“I’m proud that North Carolina is consistently among the lowest annual average rates for private passenger vehicles in the nation,” Causey said. “In recent years, we’ve seen some rate increases due to more accidents and fatalities in North Carolina. This can be attributed to factors such as excessive speeding and driving under the influence.

“However, the No. 1 cause of accidents and, thus, rate increases, is distracted driving. It is unlikely that we will see rate decreases in the future unless some of these trends change. Drivers and driving habits impact the rates the most, in addition to increased repair costs due to excessive inflation. We don’t wish for any rate increases but we are doing everything we can to protect consumers.”

During national Distracted Driving Awareness Month in April, Causey promoted the following tips in an effort to curb distracted driving:

Earlier this month, Commissioner Causey offered a few tips to help drivers avoid the pitfalls of distracted driving:

-

- Ask other passengers in the car to help you stay focused;

- Select a passenger as your “designated texter” to send and receive texts for you;

- Set your navigation system and radio station preferences before you start driving;

- To avoid the temptation to scroll through apps or social media while driving, turn your phone off, or put it in the glove box, the back seat, or trunk before getting behind the wheel; and

- Ask someone else in the car to tend to the needs of children if the need arises.

“Driving any vehicle always requires a lot of concentration, whether you’re a novice or highly experienced on the road,” Causey said in April. “I’m asking every driver to focus on the road and not let distractions break their concentration from safely getting to their destinations.”

According to a new analysis of 2021 fatal crash data released by the National Highway Traffic Safety Administration (NHTSA) in April, fatalities that occurred in distraction-affected crashes increased by 12% from 3,154 in 2020 to 3,522 in 2021. That accounted for 8.2% of all fatalities reported.

A distraction-affected crash is any crash where a driver was identified as distracted at the time of the crash, according to NHTSA. The administration said the number of fatalities may have actually been higher because distracted driving is difficult to detect during crash investigations and police reports likely understate when it occurs.

Images

Featured image: North Carolina Insurance Commissioner Mike Causey speaks during the April 12, 2023 Society of Collision Repair Specialists (SCRS) open board meeting in Richmond, Virginia. (Lurah Lowery/Repairer Driven News)

Rate level changes chart provided by N.C. Rate Bureau in its Aug. 3, 2023 letter sent to its member companies about revised auto and motorcycle rates.

More information

Insurance projected to increase another 4% by year-end amid industry ‘existential crisis’

Drivers with bad credit are being charged up to 263% more for insurance, report finds

NC & VA commissioners highlight department duties, how repairers can help educate consumers