Ontario taps into Temporary Foreign Worker Program to fill auto repair talent gap

By onCollision Repair | Education

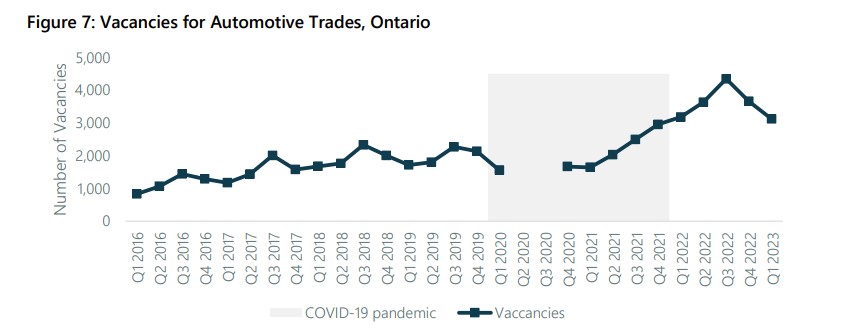

The automotive trades sector in Ontario, Canada had double the amount of job vacancies during the first three months of 2023 than it faced prior to the pandemic, according to a new Motor Vehicle Retailers of Ontario (MVRO) report.

The newly-released analysis details how the 3,000 openings during Q1 compared to the 1,500 jobs available pre-COVID as the number of cars on provincial roads grows.

Between 2017 and 2021 the number of light- and medium-duty vehicles registered in Ontario grew by 8.5%, from 8.2 million to 9 million, making it reasonable to expect the demand for technicians and repairs to grow alongside it, the report said.

However, the number of people in the labor force for service technicians and mechanics simultaneously dropped by 3.2%, decreasing from 56,680 in 2016 to 54,855 in 2021.

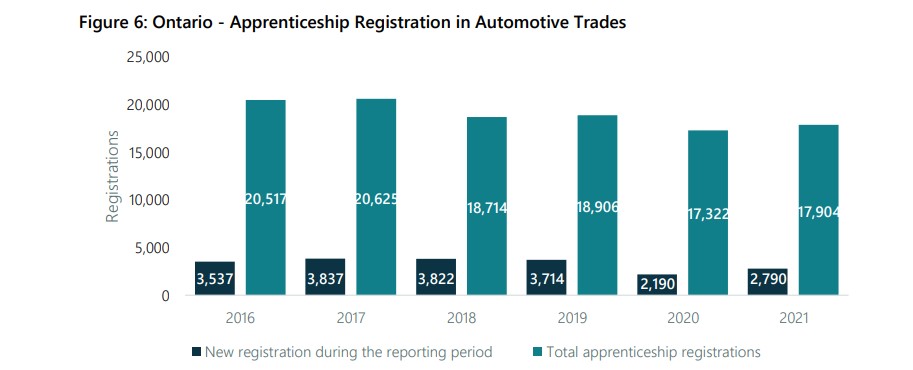

“The automotive trades labor force is aging and the number of people entering apprenticeships is declining,” the report said. “As a result, the number of people in the automotive trades labor force is declining and vacancies are increasing. This is occurring both in Ontario and across Canada.”

It added: “Employers are training apprentices and recognize the need to attract youth to the industry, but it takes time to train technicians and there is concern that there are not enough apprentices to fill current and future labor needs.”

The study again underscores the need to attract and retrain more repairers to meet a need that’s only growing.

A 2022 survey commissioned by the Collision Engineering Program (CEP) indicated that there is a lack of awareness about collision repair careers, although people are open to exploring them. It found just 17% of survey respondents were “very familiar” with collision repair or engineering. The survey revealed that those who were familiar with the industry were more likely to pursue a career within it.

It also found that respondents with less than 10 years of work experience are more likely to switch their careers to collision engineering when compared to others who’ve worked in a separate industry for more than a decade.

The report noted how there were approximately 1,277 new car and truck retailers, 5,139 automotive repair shops, 1,593 collision repair shops and 324 auto glass repair shops in Ontario last year.

“Automotive repair, collision repair and auto glass repair shops typically operate with

fewer than 10 employees,” it said. “The difference in number of employees is due in part to the differences in the ranges of services offered.”

Among those shops, the need for technicians, mechanics and auto body collision repairers rose steadily between 2016 and 2022, the report said. It said this worsened temporarily during the pandemic, when fewer skilled workers were granted visas to work in Canada.

To help fill the need for more employees working in such shops, Ontario employers are using Canada’s Temporary Foreign Worker (TFW) program to bring in skilled labor for other countries, the report noted, added that it also has its challenges.

It can take between a year and 16 months to fill a position through the program, for example, and employers must be able to prove there’s a lack of available local talent available before being permitted to sponsor an employee through a Labor Market Impact Assessment (LMAI). Another consideration is that it can cost between $20,000 and $30,000 per candidate to recruit, according to the report.

The report said that eliminating the necessity of an LMAI could help reduce the amount of time it takes to fill vacant positions, while saving employers money and improving financial stability.

“At present fees associated with a LMIA account for approximately 20 to 30 percent of the total cost of recruiting TFWs,” it said. “Eliminating the LMIA would eliminate these costs. Reducing the length of time it takes to recruit would reduce the amount of foregone revenue from each vacant position and could support the financial sustainability of the affected businesses.”

More hints that the number of people entering the trades is dropping is reflected in data that shows Ontario’s total apprenticeship registrations and new registrations in the automotive services sector, which dropped 12.7% between 2016 and 2021.

Of job vacancies within the automotive trades in Ontario from 2016 to 2022, service technicians and mechanics accounted for 81% of job postings, while repairers and estimators accounted for the remaining 19%, the report said.

“Just about every new car and truck retailer I speak to can’t hire an automotive technician today,” Todd Bourgon, MVRO executive director, said in a press release. “We know there is a massive shortage of automotive technicians, and the problem won’t be solved overnight.

He added: “That’s why we needed specific data to document the problem, and get the facts to determine what needs to be done going forward. This study clearly demonstrates we have a crisis on our hands. This ground-breaking study will also help our members plan and navigate the service side of their business for the coming years.”

The vacancy increase within the industry is being attributed to an aging workforce exiting the sector as fewer new talent enters it.

The issue is not unique to Canada.

The TechForce Foundation’s most recent tech gap study, released in November 2022, found that 232,000 techs were needed in 2021 across automotive, diesel, and collision but schools were graduating only 42,000. In collision alone, the demand was 35,000 techs while only 4,500 graduated.

A 2022 survey commissioned by the Collision Engineering Program (CEP) indicated that there is a lack of awareness about collision repair careers, although people are open to exploring them. It found just 17% of survey respondents were “very familiar” with collision repair or engineering. The survey revealed that those who were familiar with the industry were more likely to pursue a career within it.

It also found that respondents with less than 10 years of work experience are more likely to switch their careers to collision engineering when compared to others who’ve worked in a separate industry for more than a decade.

The Society of Collision Repair Specialists (SCRS) and I-CAR currently hope to gain some understanding of what collision repair technicians think about working in the industry; specifically, job satisfaction, earning capacity, and other aspects that either encourage or diminish retention. The deadline to take the survey has been extended through Aug. 31.

Meanwhile, LKQ Corp. announced last week that it has entered into a strategic partnership with TechForce to support students pursuing careers in technical education, including transportation technicians.

According to a press release, LKQ donated $50,000 to support TechForce Foundation’s charitable programs, including some meant to help boost awareness about trades careers.

“Not everyone wants to go the four-year university path,” said Jennifer Maher, TechForce’s executive director. “For those who love problem-solving and working with their hands, a technical career may be a perfect fit.”

Images

Main image: iStock/RichLegg

Graphics courtesy of the Motor Vehicle Retailers of Ontario