Survey: Millennials, 45 & older workers worry daily about reaching retirement goals

By onBusiness Practices

A recent analysis and survey by investment manager, Schroders Investment Management North America, has found that attaining a comfortable retirement in the U.S. is “hard to reach.”

This year’s retirement survey of 2,000 working Americans ages 27-29 showed that respondents who were 45 and older believe, on average, that it will take $1.1 million to retire comfortably. Twenty-one percent said they’ll reach $1 million while 59% said they expect to save less than $500,000, including 34% who think they’ll save less than $250,000.

“The benefits of working with a financial advisor to create a suitable asset allocation strategy that isn’t dictated by bouts of market volatility can’t be emphasized enough,” said Joel Schiffman, Schroders’ head of strategic partnerships. “Plus, imagine how much time investors can get back in their lives if an advisor helps give them greater peace of mind.”

Millennials view a comfortable retirement as having $1.3 million put away but only 29% expect to reach $1 million. Forty-nine percent said they expect to save less than $500,000, including 27% who think they’ll save less than $250,000.

Millennials are largely the age group that worries the most about retirement funds, according to Schroders, which found that 85% worry about money for about two hours every day. More than half also wish employers offered more investment guidance, which is a sentiment that has been encouraged across the collision repair industry — better pay and better benefits recruit and retain more technicians.

Workplace culture, better benefits, offering a four-day work week, and more will be covered during the Society of Collision Repair Specialists (SCRS) Repairer Driven Education (RDE) series at this year’s SEMA Show next week in Las Vegas. Topics specific to the workforce will be covered in both the IDEAS Collide Showcase on Oct. 30, two sessions on Oct. 31, and three sessions on Nov. 1 including:

-

- “A Health Plan Your Employees Can Love: Fantasy or Within Reach?” by Ben Simmons, Gravie chief strategy officer, as part of IDEAS Collide;

- “Culture: The real job market currency” by Michael Bradshaw, K&M Collision vice president, as part of IDEAS Collide;

- “Mentoring: Opportunity Amidst Labor Crisis” by Mentor Mentee CEO Ryan Weber and Business Development Manager Marc Brune, as part of IDEAS Collide;

- “The Culture Code” with Tracy Dombrowski, Collision Advice director of training, as part of IDEAS Collide;

- “Fixing the faucet: How to increase the flow of technicians into the industry” with Alex Crays, Career Technical Education Center auto body instructor, as part of IDEAS Collide;

- “Freedom to Speak? Improve Employee Retention and Engagement Through Improved Communication” with Tony Adams, AkzoNobel Performance Coatings business services consultant;

- “Doing More with Less: Operationally Addressing Workforce Shortages and Growing Backlogs” with Lee Rush, Sherwin-Williams Automotive Finishes business development manager;

- Changing the World with a 4-day Work Week?” with Fix Auto Tempe Owner Stephen Bozer; Dacus Auto Body and Collision Repair Owner Kena Dacus; Tony Adams, and AkzoNobel Senior Services Consultant Tim Ronak;

- “Building Operational Leadership” with Collision Advice CEO Mike Anderson, Casey Lund, Ron Reichen, and Andy Tylka; and

- “Talent Shortage – Ensuring We Have Collision Technicians in 5 Years” with Collision Repair Education Foundation (CREF) Managing Director Brandon Eckenrode, Contra Costa College Collision Repair Technology Professor Laura Lozano; National Institute for Automotive Service Excellence (ASE) Industry and Media Relations Vice President Donna Wagner; Jeff Wildman, BASF Automotive Refinish automotive aftermarket industry, and TechForce Foundation Executive Director Jennifer Maher.

Sixty-nine percent of those who are 45 years old or older also spend about two hours a day worrying about money.

InsuranceNewsNet notes that, according to Schroders, not having a regular paycheck in retirement is “terrifying” for 23% of the respondents surveyed.

“Part of the reason so many Americans find that prospect terrifying is their lack of confidence in the Social Security system,” InsuranceNewsNet wrote. “Even though many are aware that they will qualify for the highest Social Security payment if they wait until age 70 to start collecting payments, many are starting that process in their mid-to-late 60s — or maybe even as early as 62 — because they want to collect something from the government while the program is still viable.”

Earlier this year, the Insured Retirement Institute (IRI) touted two pieces of federal legislation — Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in 2019 and effective Jan. 1, 2020, and SECURE 2.0 Act of 2022, effective in December of last year — as “the most sweeping changes to enhance the private sector retirement system in more than a decade,” setting up U.S. workers to save billions more than before.

Beginning after Dec. 31, 2024, SECURE 2.0 requires employers with more than 10 employees that have been in existence for at least three years and offer a new 401(k) or 403(b) plan, to automatically enroll workers in a 401(k) retirement plan with an opt-out option. The deduction would be at least 3%, but not more than 10% of an employee’s pretax earnings, as soon as they become eligible. That amount would then be increased annually by 1% until it reaches at least 10%, but not more than 15%.

Businesses that employ 10 or fewer people and companies that have been in business for less than three years would be excluded from the mandate.

Also next year, most Americans will be surprised to learn Social Security benefits will get a 3.2% cost-of-living adjustment (COLAs) in 2024 to help recipients keep up with inflation, according to The Motley Fool. However, more Federal Insurance Contribution Act (FICA) taxes will be deducted from paychecks next year. An increase to the Social Security tax cap of $8,600 from $168,600, effective next year, will make the largest tax bill $10,453.20, an increase of $520.80, according to The Motley Fool.

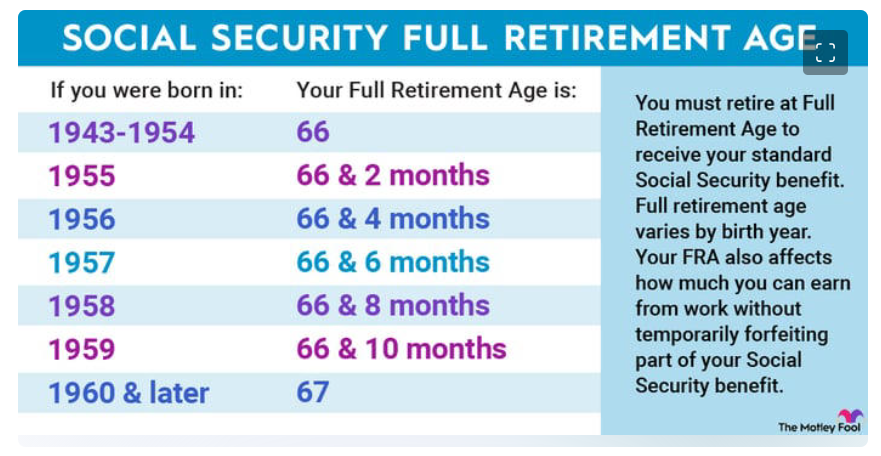

Retirement age increases will also continue into 2027:

Recent research from Resume Builder found that 51% of Millennials and Gen Zers want to lower the full retirement age with 6 out of 10 saying it should be changed to age 60 or younger.

Eight in 10 office workers said they prefer a four-day work week and nearly one-third of companies said they planned to implement the shorter work week by the end of this year, according to Resume Builder.

Around half to over 60% of each age group surveyed by Schroders:

-

- Are concerned that financial stress will negatively affect their overall health;

- Said the 2022 stock market greatly increased their anxiety;

- Said they’ve lost sleep worrying about their financial situation;

- Said their workplace retirement plan performance in 2022 caused them anxiety; and

- Worry a workplace retirement plan won’t grow to the amount of savings they hope to achieve.

Twenty-four percent of workers ages 60-67 told Schroders they’ve saved enough for retirement.

“The fact that, once again, so few Americans nearing retirement are confident they have enough money speaks volumes about the work we still need to do to make it easier for American workers to reach retirement security,” said Deb Boyden, Schroders’ head of U.S. Defined

Contribution.

One way for the collision repair industry to assist employees in reaching their retirement goals is through the Society of Collision Repair Specialists’ (SCRS) 401(k) Multiple Employer Plan (MEP) prior to making 2024 elections. The Savings Incentive Match Plan for Employees (SIMPLE) IRA deadline is Oct. 31.

The plan offers:

-

- Administrative support to help with transition, onboarding, and employee education;

- Pre-negotiated declining fee schedule (as the plan grows, costs automatically go down);

- Tax filing and audit handling;

- The ability for employees to make Roth 401K contributions;

- Increased savings limits for both business owners and employees;

- A wide range of employer match options, including the ability to add a vesting schedule; and

- Automatic enrollment for employees, which provides owners with a $500 tax credit.

SCRS’ said it launched the MEP on April 1, 2019, to “help participating businesses and employees save expenses relevant to their 401k balances, reduce administrative responsibilities for companies, and provide fiduciary support.”

It also gives businesses the ability to customize their own plan features, offers administrative support to help businesses with the transition, and requires one audit for the entire plan saving companies that do their own audits both money and time.

Visit www.scrs.com/401k to contact the advisory team and fill out a basic request for more information.

Images

Featured image credit: Dilok Klaisataporn/iStock

Retirement age chart provided by The Motley Fool