Repairers & insurers share claims handling challenges, are estimates still needed?

By onCollision Repair | Insurance

Following long-discussed conversations in the collision repair industry about the need for transparency and trust in the insurance claims process, repair facilities and carriers recently shared the problems as well as their suggested solutions for better claims handling, including challenges with undervalued damages and supplements.

Jim Keller, Collision Industry Conference (CIC) Industry Relations Committee chair, said during CIC’s Oct. 31 meeting that discussions throughout the life of claims aren’t easy and can get emotional at times because of a broken process.

“It may be real broken sometimes but the claims process has got a lot of pain and anxiety for shop owners and insurance companies as well,” he said.

Three repair facilities — Barsotti’s Body & Fender Service, located in California; K&M Collision, located in North Carolina, and DCR Systems, with locations in Ohio, North Carolina, New York, and Massachusetts — talked about some drawn-out claims that they believe could’ve been avoided and represent what repairers commonly deal with.

A claim Barsotti’s Manager Amber Alley spoke about involved a dissatisfied customer from the beginning of the claim because the carrier’s estimated time for repairs didn’t match the repair facility’s. Barsotti’s let them know that there was a delay because the carrier had left off repairs that needed to be done. A supplement was submitted twice with photos and documentation of damages that were found during teardown, which added up to double the insurer’s estimated amount.

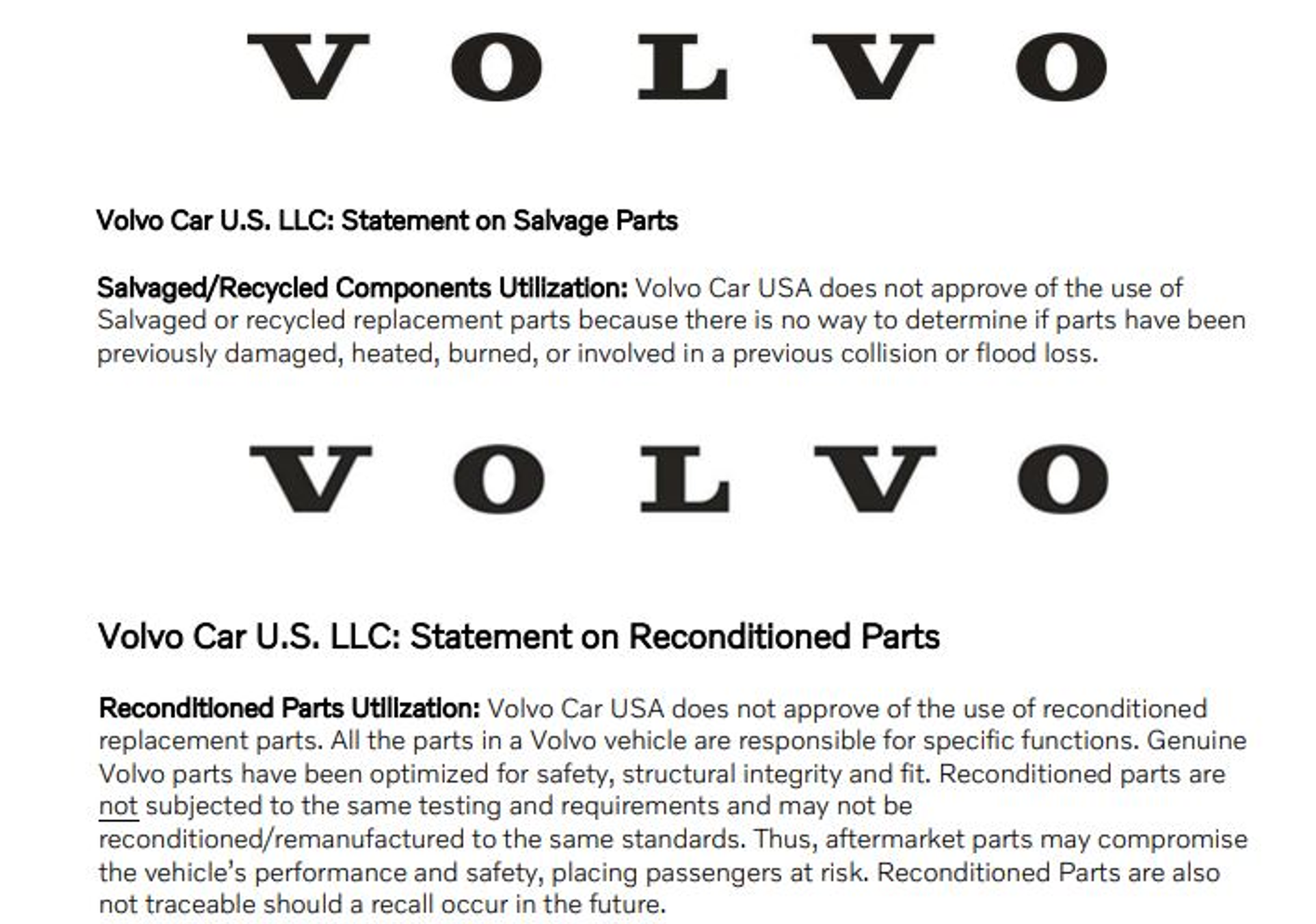

For 10 days, the carrier communicated nothing and then responded with $500 less than the facility’s estimate. The decrease came from including aftermarket and used parts instead of OEM parts in the repairs. At the time of the meeting, the length of the claim had already reached nearly 30 days.

“Volvo has a very firm statement on both salvage and aftermarket reconditioned parts so it puts us as the shop, again, in a position of trying to mediate that and trying to turn a bad situation into a good one,” Alley said.

K&M Collision Vice President Michael Bradshaw shared information on a claim that took almost four weeks to complete. K&M determined from the beginning that the 2017 Honda Accord should be totaled because damages of nearly $16,500 reached CCC’s total loss threshold. After three weeks, with no communication in between, the carrier returned its estimated repair cost which was about half as much that included aftermarket parts instead of OEM parts.

“We provided the Honda position [statements] on aftermarket parts, advised the carrier [of] prior issues with fitment and quality of aftermarket parts within our facility, and reiterated to the carrier that the estimate was incomplete and the vehicle was a total loss,” Bradshaw said.

The next day, the carrier responded that the use of aftermarket parts was only a recommendation but that they should proceed with repairs using aftermarket parts. The parts were ordered and K&M’s prediction was confirmed — there were issues with fit and quality. OEM parts were approved with three revisions to the supplement but still came in at nearly $6,000 under K&M’s estimate.

During teardown, additional damage was found and the estimate went up to $20,000. By then, the customer had filed a complaint with the North Carolina Department of Insurance because they had been without their car for almost three months. The carrier’s response to the DOI was that they were considering a total loss.

However, 10 days later they provided a supplement. More damage was found in structural parts after this, resulting in another supplement.

By three-and-a-half months, the carrier totaled the vehicle.

“I have zero incentive for a vehicle to be a total at the front end yet the carrier doesn’t want to listen to what I say,” Bradshaw said. “They want to tell me they know better with their guy that they just hired three months prior that has no repair training. They want to argue with us over repairability on a vehicle.”

Had the carrier initially totaled the vehicle, it would’ve cost them $1,500 but by the end, it cost them $20,000, he added.

“This, ladies and gentlemen, is indicative of the battle that many collision repairers face each and every day,” Bradshaw said. “I have no incentive to total a vehicle. I want to repair cars. That is how I make my living. That is how my technicians feed their families. And so, if they will not listen on something that obvious, think about the fights that take place and the battles that take place within collision repair facilities where there actually is a motivation to repair a vehicle.”

Cheryl Boswell, DCR Systems CFO, started off her portion of the presentation by saying that estimates serve no purpose and only confuse customers.

“They get an estimate then they go to the shop and they’re like, ‘It’s going to cost $10,000 to repair my car? The estimate’s at $1,200.’ They’re angry. Then they’re like, ‘Do I trust you, collision repairer, or are you trying to cheat me?’ It’s kind of this battle that starts between the insurance company and the collision shop. It is not efficient, it’s not effective — and unfortunately — our customers are not trusting any party at that point in time.”

Boswell said the industry as a whole — carriers and collision repairers alike — need to come to the consensus that the only way to repair vehicles is by following OEM repair procedures.

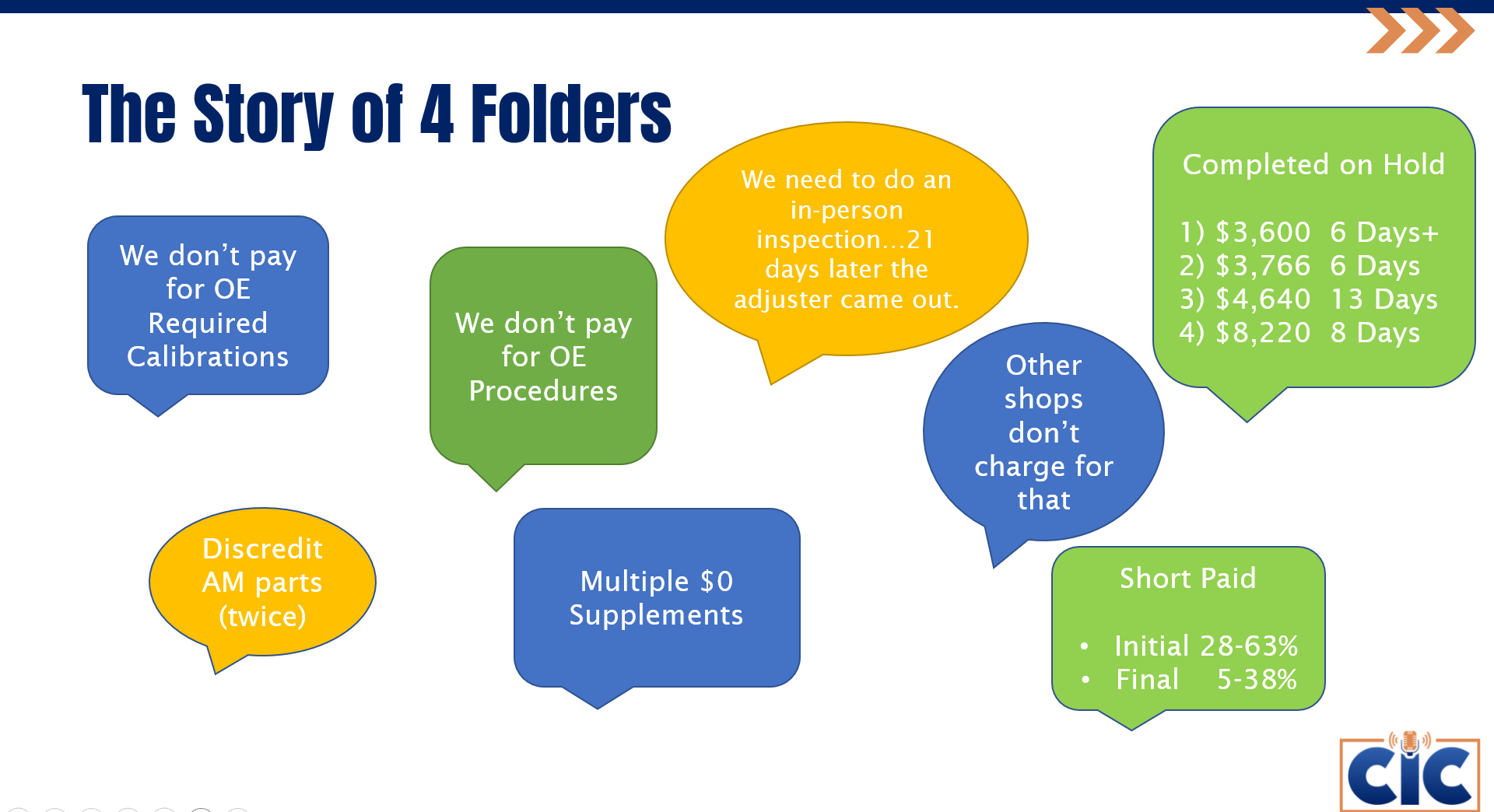

“I think we’re all hearing similar things in the industry,” Boswell said. “We heard things like, ‘We don’t pay for OE-required calibrations.’ We heard, ‘We don’t pay for OE procedures.’ We heard, ‘Other shops don’t charge for that.'”

Examples that Boswell shared of claims DCR Systems has handled resulted in arguments over why aftermarket parts shouldn’t be used that went on for upwards of two weeks and resulted in significant shortpays.

“We basically said, ‘We’re not negotiating how we’re fixing the car. We’re fixing the car this way and we’re going to fix it the right way but we also deserve to be paid for it,'” she said. “At the end of the day, we took significant shortpays because we’re going to put cars on the road safely. We’re going to take care of our customers. But, as you all know, collision repair shops don’t have really thick margins. We have thin margins and we deserve to be paid for the work that we’re doing for the certifications, for the training, for the equipment, and the work that we’re doing. We believe there is one way to repair a vehicle — we have to repair it the right way.”

“These cars were completed, sitting on the curb and, meanwhile, we had provided the complete repair plan at the beginning before we even ordered the parts. This is additional, unnecessary waiting. From a customer standpoint, they’re distrustful, they’re unhappy, and it’s our mutual customer that we’re really disappointing at this point in time.”

Chris Evans, with State Farm, agreed that there’s a lack of transparency and trust within the industry. He highlighted eight types of waste that State Farm considers when handling claims:

-

- Waiting on information, parts, or others;

- Producing too much too soon;

- Reworking any process or product;

- Any “motion” of a worker that doesn’t provide value;

- Overprocessing or process variability;

- Holding more than the minimum inventory;

- Failure to use the time and talents of workers;

- Any wasted movement in the process.

Wait times stemming from these elements, he added, are caused by a range of issues from virtual versus physical inspections, appraiser and technician shortages, MOI distribution, vehicle complexity, third-party appraisal services, and estimating versus blueprinting to multiple supplements on the same items and policy growth increasing the number of claims and supplements.

Newer vehicles also may have more parts, some twice as much, than older vehicles, which can cause delays just as a spike in actual cash values means more repairs and greater costs to carriers, Evans said. Delays also mean higher rental costs and storage fees for carriers and a negative impact on repair facility customer satisfaction.

“We’re all affected in this industry by these eight elements of waste so it’s not lost on us that we have a lot of work to do,” he said. “We look at them with real intent to remediate.”

State Farm has hired 500 appraisers over the past two years but that comes with learning curves that take time, including with new leaders learning the ropes as well, so it’s taking the company a while to get back where it was pre-COVID he added. State Farm is working on using third-party appraisal firms less because managing them is more difficult than their own employees, Evans said.

“The reality is we’re not fixing the car… I would love to see this get to the point someday where our appraisal work is as close to your blueprinting as it can possibly be but the reality is our appraisers are not in a position to do blueprinting,” he said. “The obligation that we have is to pay the claim and so the way we get the claim paid is we need to prepare an estimate. Our appraisers are trained to prepare estimates.”

Historically, about 20% of all auto claims that come through State Farm are total losses but in the last two years that dipped down to about 17%. “Fifty percent of all claim dollars go to total losses so when there’s a 1% or 2% change in total losses, it’s a big deal,” Evans said. “Delays [and] lack of trust can cause customer defection, brand impact, and tension in the industry.”

State Farm sees some promise with artificial intelligence (AI) in claims processing and is considering that along with attempting to create greater transparency in the claim supplement process and better business-to-business solutions and technology, he added.

“We put a lot of time and effort into considering collision theory and how the impact occurred — rate of speed, angle, what’s behind these parts and those parts [to] give more flexibility and latitude to our teams and our staff,” Evan said.

For example, even if a damaged bracket can’t be seen, State Farm appraisers can go ahead and include that in the estimate “because it makes logical sense, or approve that supplement.”

LeRoy Hamilton with Acuity Insurance and Bob Smith with Ford planned to participate in the panel discussion but weren’t able to so Keller shared what they planned to say.

Hamilton’s overview of the claims process involved insurance supplements that can be very confusing to customers so Acuity makes sure claimants are aware that there could be changes to the carrier’s estimates based on their appraisals due, in part, to hidden damages discovered by repair facilities during teardown. This ensures claimants know repair delays, typically between two and seven days, could occur, according to Hamilton.

“A lot of this stuff is just block and tackle simple common sense but it doesn’t happen in our industry,” Keller said.

Keller shared slides sent in by Bob Smith, with Ford’s The American Road Insurance Company (TARIC), to be shared with the audience in his absence.

Smith’s presentation focused on insurers and repairers working as a team.

TARIC’s process includes, according to Smith:

-

- Minimizing the number of times the vehicle has to be touched by the insurer;

- An initial inspection is done via photos/AI for “triage purposes;”

- Waiting to prepare a locked estimate after a teardown or blueprinting has been completed;

- Communication between the repairer and insurer through the ISP provider software so the repairer doesn’t have to stop the repair;

- Estimates prepared using OEM parts and following OEM repair procedures and position statements; and

- Supplemental item finalization during the final repair stages ahead of the repair.

Images

Featured image: A 2017 Honda Accord that was brought to K&M Collision for repairs. (Courtesy of CIC/Michael Bradshaw)

(From left) Jim Keller, Amber Alley, Cheryl Boswell, Chris Evans, and Michael Bradshaw participated in an Industry Relations Committee panel discussion during CIC’s Oct. 31, 2023 meeting.

A 2020 Volvo XC40 was brought into Barsotti’s Body & Fender Service for repairs. (Courtesy of CIC/Amber Alley)

Presentation slides courtesy of CIC