Paint and materials costs increase over 22% since Q1 2022

By onBusiness Practices | Market Trends

Based on company announcements from the five major refinish brands, collision repair customers were notified that Q1 2024 weighted average paint and material (P&M) costs would increase at an average of 6.9%.

During the Collision Industry Conference (CIC) meeting in July, 2022, companies shared that the increases were caused by supply chain issues, rises in raw material costs, and labor rates not maintaining pace with inflation.

At the time, P&M reimbursements were only 18.5% higher than in 2017, compared to the 43.9% increase in P&M costs that collision repair facilities experienced in the same period of time, according to information shared at the April 2022 CIC meeting.

Paint material increase announcements tracked since Q1 2022 have resulted in an additional average cumulative increase of nearly 22.2%, on top of nearly 44% increases between 2017 and 2022.

Letters sent out by industry P&M companies from January to March of this year attribute the cost increases to impacts on raw material prices, cost increase and inflationary pressures, and labor and operating costs.

Q1 2024 individual company increases range from 4.9-9.6%.

Kyle Krumlauf, CCC director of industry analytics, recently told Repairer Driven News said inflation likely accounts for most of the supply rate increase.

“A few years ago we could also attribute cost increases to supply challenges,” he said. “However, those have mostly recovered. Labor and manufacturing costs, shipping costs, and similar factors should also be mentioned as contributing factors to these inflationary cost increases.”

There was a 7.1% increase in paint labor rates last year compared to 2022, Krumlauf said. The paint supply rate, the rate that is paid per paint hour for paint materials, rose by 9.2%. Overall, labor rates increased by 7.4% last year, according to Krumlauf.

Paint supplies represented around 7% of the total cost of repairs in 2023 while paint labor accounted for around 11%, Krumlauf added.

That pricing challenge for shops might be mitigated somewhat for those using a paint and materials invoicing system instead of the dollars-per-refinish-hour multiplier method, as increased costs would automatically be reflected on the invoice.

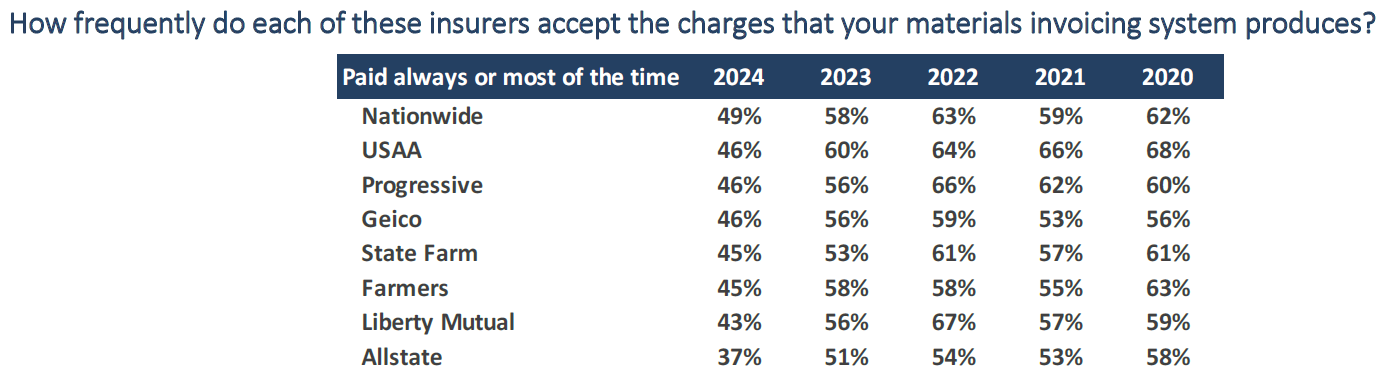

According to Collision Advice and CRASH Networks’ latest “Who Pays for What?” survey results, 37% of shops this year only use the multiplier method while 23% of shops said they always use a materials calculator.

The remaining 40% use a mix of both methods and of those, 35% said they usually use their materials calculator, in favor of the multiplier method, according to the survey results.

“Among shops that use the multiplier method, most (80%) charge between $38 and $55 per refinish hour,” the findings state. “The average amount charged per refinish hour is $48, up from $44 in 2023 and $39 in 2022.

“Of those shops that reported using materials calculators, we asked which system they used. The percentage of shops using a paint company scale has increased dramatically (from 25% to 69%) since we began asking the question in 2016.”

Collision Advice President Mike Anderson attributes the increase of shops using a mix of both methods to multiple paint price increases experienced by most shops in recent years.

In a 2022 Society of Collision Repair Specialists (SCRS) Quick Tip video, Anderson and Database Enhancement Gateway (DEG) Administrator Danny Gredinberg discussed the shift away from hourly materials billing to invoicing. Several software companies allow the creation of invoices to be sent to third-party payers, Anderson said.

“Most shops using the invoicing system are finding out that they should’ve been charging more for materials than they had based off of the multiplier method. One of those reasons is because we see that average paint labor hours has been declining a little bit in the industry,” Anderson said.

Labor is also becoming more expensive.

“Labor increases are, in part, being driven by inflation,” Krumlauf added. “The demand for talent in the collision repair industry remains very high, meaning that talent can demand a higher wage. Providing competitive wages, benefits, and training to employees are only part of repair shops’ plight, not to mention overhead costs, administration, and modernization expenses which include tooling and shop configurations to support diagnostics.”

Anderson also said one question to ask the software companies is whether they have a generic bill calculation or if your invoices will be based on the specific paints you use.

Images

Featured image credit: Ruslan malysh/iStock

More information

‘Who Pays’ survey: More shops billing and paid for feather, prime and block