Recent uptick in 401(k) lawsuits highlights fiduciary risk to employers

By onAnnouncements | Associations | Business Practices | Education | Legal | Market Trends

Following a recent increase in 401(k) lawsuits, body shop owners seeking to stay competitive by offering retirement benefits might want to examine their fiduciary risk and consider safeguards like those within SCRS’ new association retirement plan.

The Arizona Republic drew attention to the lawsuit issue and employers’ risk in an August article reposted that month by the national USA Today newspaper. That piece keyed off of a 2018 Boston College Center for Retirement Research brief that reported 401(k) lawsuits in 2016-17 reached the highest two-year mark since the recession era last decade.

The Bloomberg Bureau of National Affairs ERISA Litigation Tracker data cited by authors Geoffrey T. Sanzenbacher of the center and George S. Mellman, an investment consultant, found 56 lawsuits in 2016 and 51 in 2017. This was the highest since 2008’s 107 and 2009’s 61, according to the authors and Bloomberg data. For comparison, in 2013, just two 401(k)-related complaints were filed.

Lawsuit targets included employers, who assume a fiduciary responsibility to their employees by offering a 401(k).

According to a 2017 center brief citing Federal Reserve Survey of Consumer Finances data, 73 percent of employees in 2016 had a 401(k) or some other defined contribution plan.

But according to Sanzenbacher and Mellman, it’s difficult for an employer to know what their fiduciary responsibility actually means.

“The (U.S. Department of Labor) is charged with creating regulations, offering guidance, and enforcing (the Employee Retirement Income Security Act of 1974), and it has historically emphasized enforcement over regulation and guidance,” the authors wrote in the Center for Retirement Research paper. “For example, instead of issuing specific guidance on how plan fiduciaries should act – such as providing concrete factors to consider in determining whether fees are reasonable – it has tended to ‘regulate by enforcement’ after the fact. Indeed, such an approach is often used by other government regulators – the Securities and Exchange Commission, for example – because it provides an agency with the flexibility to identify emerging issues as they arise and tailor any response to specific circumstances. However, it also means that fiduciaries are often left to guess what practices comply with ERISA and may only become aware of an alleged violation from a DOL investigation or a lawsuit.”

Mellman and Sanzenbacher said lawsuits they reviewed typically alleged at least one of three factors: self-dealing, excessive fees and inappropriate investment choices.

Self-dealing, excessive fees, inappropriate investments

Self-dealing claims arise when an employer or other fiduciary allegedly puts their own interests above employees’.

“A typical allegation is that a fiduciary failed to act ‘for the exclusive purpose of (i) providing benefits to participants and their beneficiaries; and (ii) defraying reasonable expenses.’ Employers that sponsor ERISA plans can also be held liable for permitting the assets in a benefit plan to ‘inure to the benefit of the employer,'” Mellman and Sanzenbacher wrote, quoting the ERISA law.

“The 401(k) plans sponsored by over 40 financial firms – including most of the largest companies in this sector – have been associated with lawsuits alleging self-dealing. In most cases, the allegations are that fiduciaries chose to offer the employer’s own investment funds that had poor performance potential, excessive fees, or both. And, in some cases, firms added their newest funds before these options had established any suitable and credible performance history.”

Recent litigation tends to focus on the excessive fees issue, according to the Center for Retirement Research article. The concern here is that the fiduciary is picking a plan in which too much of the employees’ profits are spent to cover fees.

Your employer and the other fiduciaries are supposed to make sure the investment fee is reasonable compared to what else is available on the market.

Mellman and Sanzenbacher explained further:

Courts have consistently maintained that it is not always necessary for all investment choices to have lower expense ratios than similar benchmark funds. But in choosing which funds will be offered, fiduciaries must select funds that charge no more than a reasonable fee, and the fiduciaries must periodically assess whether such fees continue to be reasonable in light of alternatives. In doing so, fiduciaries are not expected to benchmark the fees of actively-managed funds (which try to beat the market) against those of passive funds (which generally have lower fees but aim to simply match market returns). Instead, fiduciaries should compare a fund’s fees to other funds with similar risk/return and asset class characteristics.

The fiduciary also needs to make sure they got the best deal possible on the fund itself from the firm offering it, based on the Center for Retirement Research brief. If the firm offers the same fund at one fee for retail investors and at a discount to an institutional investor because of the latter’s volume, an employer should think to pursue the institutional option if possible, according to Mellman and Sanzenbacher.

“Offering a higher cost share class than is available could happen if a fiduciary does not do their due diligence and is thus unaware of lower cost options or if they are sold a plan by a broker that did not fully minimize their costs,” Mellman and Sanzenbacher wrote.

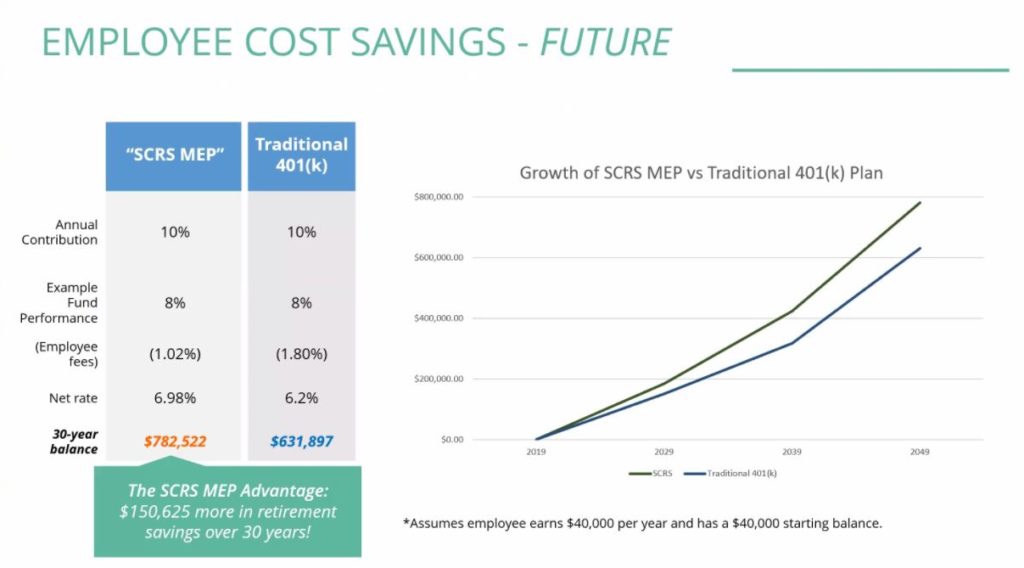

Here’s why fees magnitude matters to an employee. A recent SCRS webinar presented a slide of a shop employee making $40,000 a year and with $40,000 already saved in a retirement plan paying in 10 percent a year.

The plan earns 8 percent a year, but the employee gets charged 1.8 percentage points in fees for a net return of 6.2 percent. That employee has $631,897 at the end of those 30 years.

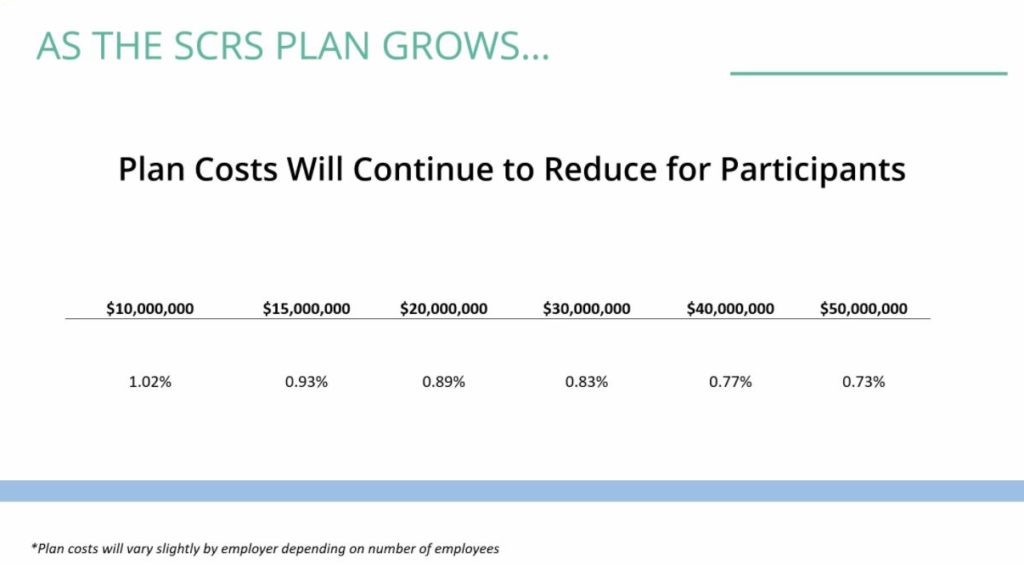

The SCRS multiple-employer plan leverages the clout of multiple member shops participating to demand a better deal from their plan’s financial management. The fee even contractually drops the more members join and assets are managed.

Under one threshold of that plan, the employee is only charged 1.02 percent in fees and earns $150,625 more, retiring with $782,522, according to the slide. The employee is only charged 1.02 percent in fees and earns $150,625 more, retiring with $782,522, according to the slide.

Administrative fees for factors like recordkeeping also can be deemed excessive, and while Mellman and Sanzenbacher say courts typically defer to fiduciaries on this one, it’s not a lock.

“For example, in finding for the plaintiff, a court ruled that ABB (a robotics and heavy equipment maker) both failed to leverage the plan’s size to negotiate lower administrative costs and allowed the plan’s recordkeeping fees to subsidize the cost of non-plan corporate services,” they wrote.

Inappropriate investments: The same investment might be appropriate for one fiduciary and lawsuit-worthy for another.

Mellman and Sanzenbacher said ERISA instructs fiduciaries to have “‘the care, skill, prudence, and diligence … that a prudent man’ would when choosing investments ‘so as to minimize the risk of large losses.'” If one fiduciary researched the investment and came to that decision prudently and the other didn’t put in that time, the first might get a pass in court, according to the authors.

They wrote that fiduciaries typically get sued along inappropriate investment lines if their funds consistently aren’t beating a relevant benchmark. Another issue can arise if the employer’s own stock is included in the 401(k) plan and performs badly, though a 2014 Supreme Court ruling makes it harder to sue for that reason, according to Mellman and Sanzenbacher.

Reducing employer risks, costs

We discussed the issue of employee lawsuits with Virginia Asset Management partner Scott Broaddus, the investment adviser on the Society of Collision Repair Specialists’ association 401(k) program.

The SCRS initiative allows members to combine their buying power and get their employees lower fees, as noted above. The association’s 401(k) member liaison the Payroll Company has said an employer also might save money on the audits required on a retirement plan, for the bill would be split among all participating SCRS members.

Administrative burden and the fiduciary responsibility prompting such litigation are also reduced, according to SCRS.

As former SCRS Chairman Andy Dingman (Dingman’s Collision Center) observed during the organization’s April open board meeting, his company has grown from offering a simple IRA to a 401(k) with fiduciary responsibility on the plan provider. He called the SCRS plan a “really big benefit” to his shop, for it offered an additional layer of Employee Retirement Income Security Act compliance protection.

“A business owner offering a 401(k) plan is required to run a compliant retirement plan while often having little previous experience managing workplace benefits,” Broaddus said in a statement in an April SCRS news release announcing the plan. “Over the past 12 months, SCRS has worked hard to design an Association 401(k) plan that will save its members both time and money. With compliance and fiduciary oversight support, a business owner now has professional partners to ensure plan compliance while also saving on average 25% in total fees for its members with an existing 401k plan.”

We were curious about the fiduciary responsibility question in light of the boom in employee lawsuits. Wouldn’t the employer still assume the fiduciary liability, as the general contractor “subletting” the 401(k) to SCRS and partners like Virginia Asset Management, Decisely and the Payroll Company? Here’s what we learned about the topic during our conversation with Broaddus:

While the employer still bears fiduciary responsibility, there’s a big difference between using the association plan and going it alone.

A small business with less than 50 employees will often be sold a retirement plan by a broker — who takes zero fiduciary responsibility for the quality of the plan. It’s all on the owner.

Under the SCRS association plan, Virginia Asset Management has been hired as an investment adviser. They bring retirement plan and investing experience that a small business owner might lack. As a fellow fiduciary, they also have skin in the game to make sure the plans can survive a lawsuit. The SCRS board’s investment committee also provides another layer of fiduciary oversight.

“Employers who use the Plan will have partners who provide fiduciary services and formalize their Plans with an Investment Policy Statement, Investment Committee Meeting Minutes and Employee Education,” SCRS wrote in the April news release. “This is uncommon in employer plans under $5 million in assets.”

The plan also steers clears of potential conflicts of interest since SCRS 401(k) vendors such as Virginia Asset Management do not create or promote any proprietary investments.

There’s a fixed menu of potential investment funds for employees, and each fund encompasses so many companies that there’s no conflict of interest if, say, an SCRS member’s stock appears there. It’d be one of hundreds of businesses in a bucket developed by a third party or merely chosen by default by an index fund. (For example, a fund that robotically buys the 500 stocks on the S&P 500, whatever they happen to be.)

An employer can still go it alone and alleviate their fiduciary risk by hiring a company like Virginia Asset Management, just as SCRS did for its plan. However, that small business still would have to absorb all the costs related to establishing and maintaining a retirement plan, which can be significant. Under the association plan, businesses can split the costs.

Most lawsuits occur against larger companies, but the risk still remains. They often arise when an employee leaves and later speaks to, say, a brother-in-law who happens to be an ERISA attorney. But if the brother-in-law takes a look at the plan and finds the kind of oversight and documentation intended for the SCRS option, he might conclude it looks good and move on.

Plan review

As part of Virginia Asset Management’s relationship with SCRS, it has offered to provide a free comparison in “hard dollars” between a company’s current retirement plan and the SCRS plan.

The review is completely free; all that’s needed is a list of plan investments and balance and a 408(b)2 annual plan expense statement. (Available through your plan’s website or by asking your plan provider.) Visit www.scrsbenefitscenter.com or email Broaddus at Scott.Broaddus@vamllc.com to get started.

SCRS Executive Director Aaron Schulenburg has said non-members could take advantage of this as well, allowing them to see if the SCRS plan would be a good fit before committing to membership.

If the SCRS program would represent a savings, the employer will have that information and can consider being a member and participating in the association plan. If the owner is shown to be getting a better deal under their current benefits program, they can keep doing what they’re doing and just use the review as documentation for a fiduciary.

SCRS membership starts at $45 a month or $475 a year.

More information:

“Understanding the Benefit of Retirement Solutions for your Business”

Society of Collision Repair Specialists, July 18, 2019

“401(k) lawsuits are rising: Why so many workers sue their employers over savings plan”

Arizona Republic via USA Today, Aug. 28, 2019

“401(k) LAWSUITS: WHAT ARE THE CAUSES AND CONSEQUENCES?”

George S. Mellman and Geoffrey T. Sanzenbacher, Boston College Center for Retirement Research, May 2018

Images:

Employers might stay competitive but open themselves up to lawsuits over their fiduciary responsibility by offering 401(k)s. (matt_benoit/iStock)

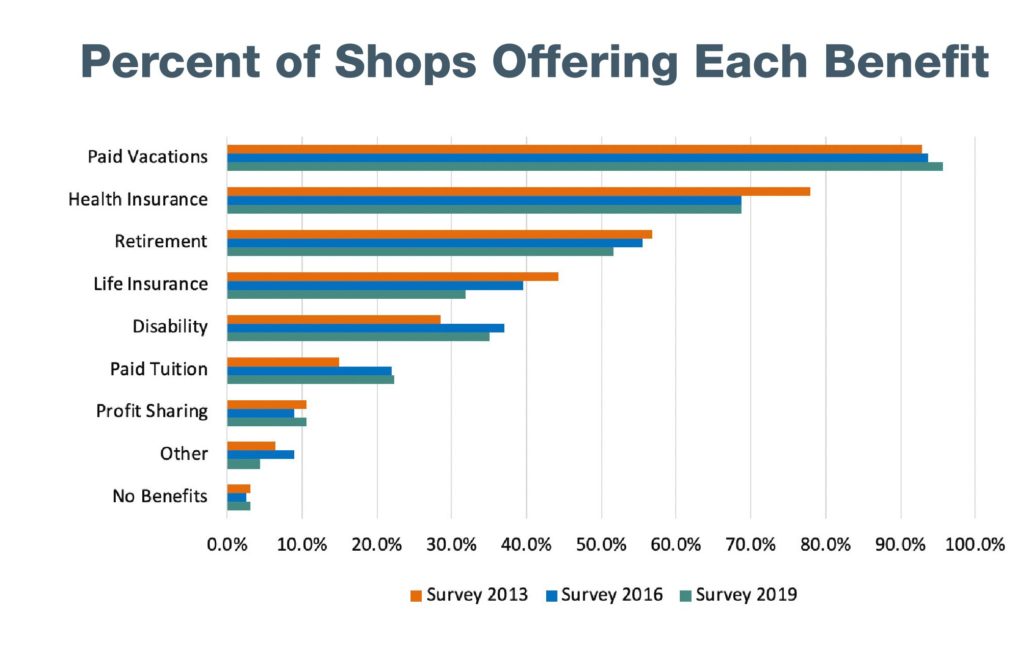

A smaller percentage of shops reported offering life insurance and retirement in 2019 than in 2016, according to a Collision Repair Education Foundation and I-CAR study that polled more than 675 shops. (Provided by CREF)

This slide presented on a SCRS July webinar by Virginia Asset Management looks at how compounded returns and investment fees could play out over time for a shop trying to go it alone versus using an SCRS plan. (Provided by SCRS)

As more SCRS members take advantage of its retirement plans, the financial fees will drop further thanks to a deal the association has negotiated, according to this slide presented on a SCRS July webinar by Virginia Asset Management. (Provided by SCRS)