CCC, Romans data show shifts in DRP volume, revenue throughout industry

By onBusiness Practices | Education | Insurance | Market Trends

New data from CCC and the Romans Group demonstrates how DRP work and collision industry revenue have shifted to regional and national multi-shop operations.

There’s probably two things going on here. In some cases, the MSOs are just buying smaller collision companies and their associated business. However, in others, the MSOs are actually beating the smaller auto body repairers in competition for the same customer. Publicly traded Gerber, for example, consistently reports both revenue derived from new locations and increased sales at its existing shops. Both trends are worth tracking by the collision industry.

CCC’s December “CCC Trends” data shows direct repair programs shifting increasing amounts of work to national multi-shop operations. CCC director and lead analyst Susanna Gotsch defined such MSOs as franchise networks and consolidators with locations in multiple states.

“Analysis of repairable DRP volume reveals national MSOs continue to see significant growth in share,” Gotsch wrote. “Between CY 2000 and CY 2019 the share of overall repairable DRP appraisal count going to national MSO’s quadrupled, growing from 5.8 percent to 35.8 percent (see Figure 4). Share of DRP appraisal volume going to dealers reached nearly 5 percent in 2018, although recent Q3 2019 data shows volume share has fallen.”

Regional MSOs (defined as shops with at least three locations in a state) also have grown share since 2000. However, independent shops (defined as 1- or 2-location operations) have plummeted from receiving around 85 percent of DRP work in 2000 to around 50 percent of it today, based on the CCC data.

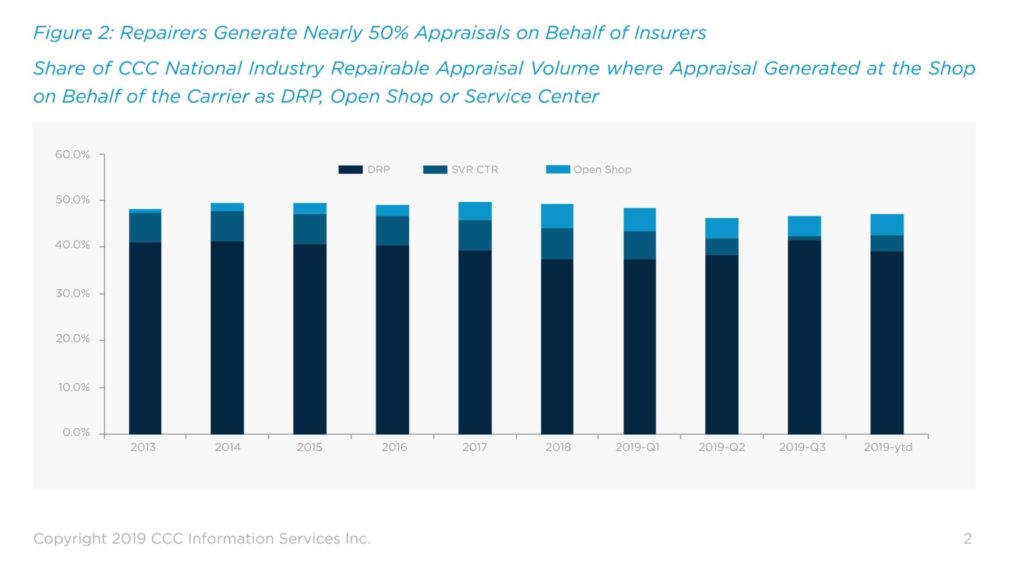

DRP trends here are derived from within the 39 percent of repairs in which a network shop prepares the initial estimate on behalf of the insurer. It wouldn’t capture other situations in which a customer chose a shop based on a referral from the carrier. (For example, an insurer wrote an initial estimate off a photo and then recommends a network shop to the consumer.) But the shift is still rather telling.

Smaller shops might also have a harder time capitalizing on the traditional DRP model because large insurers are ditching it.

PBAs

CARSTAR President Dean Fisher also said on a BodyShop Business webinar Dec. 12 that the “large 10” insurers are looking more to performance-based agreements rather than traditional direct repair programs. Those deals contractually bind a shop to deliver certain KPIs and can have a “buyback.”

As Fisher described it, such a deal might start at a shop granting an insurer a certain discount, followed by “trigger points” related to certain KPIs. CARSTAR in the past has said these evaluations can deliver perks and financial penalties depending on the shop’s statistics on those KPIs.

These PBAs are commonly found in insurer relationships with consolidators and are attractive in that the insurer only has to deal with a single point of contact, according to Fisher. This means the carrier needs to spend less on staffing to manage the program on the ground, he said.

Such programs are really the “wave of the future” to some degree, Fisher said.

Fisher said he didn’t think PBAs would be available to independents (though he said independents with a franchise like CARSTAR could get them). The value to insurers was being able to cut those personnel costs associated with handling numerous individual DRP shops, according to Fisher.

“They want them in a block,” Fisher said.

He said he felt “you will never see” a PBA in an “independent environment.”

Find the other carriers

The Top 10 insurers equate to 72.17 percent of all private passenger auto premiums written in the country. Thus, shops seeking to continue a DRP business model might find benefit in pursuing smaller insurers, as NuGen IT employee owner and business development executive Pete Tagliapietra has suggested.

“They all want it (DRPs),” Tagliapietra said. But the lower-share insurers can’t get priority with the big multi-shop operations.

Smaller insurers don’t institute financial penalties for failing to hit targets, according to Tagliapietra, whose company works with both shops and insurers.

“That’s not going on,” Tagliapietra said.

CCC’s December data shows that there are other insurers out there to try. The average national MSO had 9.3 DRP affiliations, with a standard deviation of 3.2, according to CCC. The average across all shops was 4 DRPs, with a standard deviation of 3.4.

The average independent of 1-2 body shops only averages 2.8 DRPs, with a standard deviation of 2.1.

Maximum DRPs ranged from 18 for the independent to an industrywide peak of 21, the same max as the national MSO/franchise segment, according to CCC.

Of course, there’s still plenty of other business out there for small shops to pursue besides going the DRP route.

In a 2016 second amended complaint and a 2017 appeal to the Eleventh Circuit Court of Appeals, the plaintiffs in Crawford’s Auto Center and K&M Collision v. State Farm et al put the defendant insurers’ DRP usage at between 25-45 percent.

“Recent figures indicate that Insurers’ utilization of DRP facilities ranges between 25%-35% on the low end, and between 40% and 45% on the high end,” the plaintiffs wrote in their 2017 appellate brief, referring back to their 2016 second amended complaint against numerous major insurers. “Thus, Insurers’ utilization of DRP facilities is approximately one-third of the total of the repairs paid for by Defendants Insurers.” (The plaintiffs’ 2014 first amended complaint had put the non-DRP share lower, at 50 percent.)

Revenue shifting

Another way to examine the shifting marketplace is to follow the money.

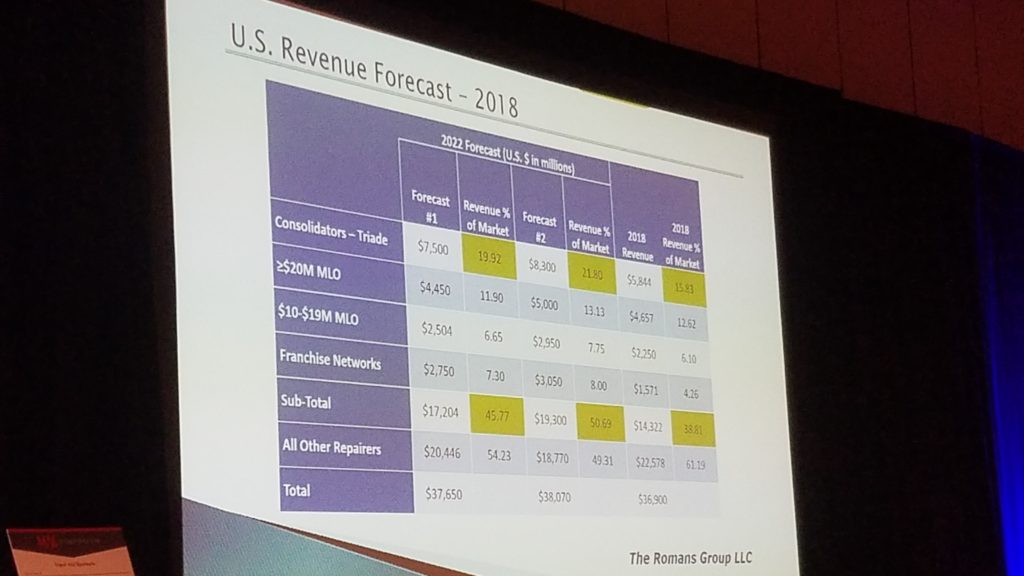

Romans Group data presented at the 2019 MSO Symposium calculated Boyd, Caliber and Service King combined represented more than $5.84 billion in sales, or 14.83 percent of the market in 2018.

Throw in the MSOs doing more than $20 million in sales, smaller MSOs making $10-$19 million and franchise networks, and you have the industry’s bigger guns altogether making more than $14.32 billion, or 38.81 percent of the market, according to the Romans Group

That leaves nearly $22.58 billion, or 62.29 percent of the market, for everyone else.

This is interesting because these numbers don’t sync with the actual number of locations on the ground held by such shops, a point Romans Group founder Vincent Romans has also made in the past.

Romans told the MSO symposium Nov. 4 his firm estimated 32,000 shops existed in 2018, a number which should fall to about 31,500 by 2020. He anticipated 27,256 weren’t in any of the major segments — not franchisees, banners, nor $10 million-or-higher MSOs.

That means 15 percent of the industry is closing in on nearly 39 percent of its revenue, based on Romans’ data.

Census data tells a similar story. 2016 projections, the last available, count 32,287 auto body repair businesses — and 93 percent of them had less than 20 employees. Eighty percent had less than 10 workers.

The Romans Group predicted that by 2022, the top three consolidators would by 2022 control between $7.5-$8.3 billion — near or slightly more than a fifth of the market. All major multi-shop businesses would represent between more than $17.2 billion and $19.3 billion, or between 45.77 and 50.69 percent of the revenue.

One of Romans’ slides at the 2019 MSO Symposium declared the industry to be in a state of structural transformation, and he encouraged shops to “lean forward,” and “don’t wait” for something to happen.

His slide suggested shops who didn’t wish to sell or quit pursue strategies like DRP or OEM certification programs, self-funded growth, a strategic financial partner (for example, a private equity firm), or alignment with a banner or franchise.

They could also continue to try to go it “fiercely and possibly foolishly” completely alone, the slide noted.

“Don’t go it alone….develop strategic partnerships and alliance that help grow your business and its scale,” it stated. Forms of scale — broadly defined as competitive advantages — exist for all shop sizes, even single-shop locations, Romans said last year.

More information:

“COLLISION REPAIR INDUSTRY EXPERIENCES GROWTH, CHANGE”

CCC, Dec. 9, 2019

“Industry Trends with Susanna Gotsch – December 2019”

CCC YouTube channel, Dec. 9, 2019

Images:

15 percent of the collision repair industry is closing in on nearly 39 percent of its revenue, according to the Romans Group. (liulolo/iStock)

CCC data through the end of the third quarter of 2019 suggests a rise in photo estimating and virtual appraisal methods has come at the expense of service center and insurer staff repairable appraisal volume. (Provided by CCC)

CCC data through the end of the third quarter of 2019 suggests the percentage of repairable appraisals handled by shops on behalf of insurers has held fairly steady. (Provided by CCC)

The December 2019 “CCC Trends” indicated the average national MSO had 9.3 DRP affiliations, with a standard deviation of 3.2, in the third quarter of 2019. The average across all shops was 4 DRPs, with a standard deviation of 3.4. (Provided by CCC)

Romans Group projections of collision repair industry revenue in 2018 and 2022. (Slide by the Romans Group; photo by John Huetter/Repairer Driven News)