Texas Dept. of Insurance: We can’t help on core auto claims issues; try the courts

By onAssociations | Business Practices | Insurance | Legal | Market Trends | Repair Operations

Texas Department of Insurance correspondence recently used by a body shop to support a State Farm discovery request reinforces the message of agency powerlessness advocates of an OEM procedure bill conveyed to lawmakers earlier this year.

According to a biography of Texas Insurance Commissioner Kent Sullivan, the agency “regulates the industry and protects consumers in the second-largest insurance market in the nation and the eighth largest in the world. The agency has almost 1,300 employees and an annual budget of more than $110 million.”

However, the TDI sees itself as unable to act on fundamental auto claims issues, based upon letters Pasadena, Tex.-based collision repairer Larry Cernosek presented to Harris County 8-1 Justice of the Peace Holly Williamson prior to her Dec. 5 ruling in his favor.

In April, state Rep. Travis Clardy, R-Nacogdoches, and Auto Body Association of Texas head Burl Richards told the Texas House Insurance Committee that Clardy’s House Bill 1348 was necessary given similar declarations of helplessness.

Clardy said he had thought steering and other issues including repairs were addressed in statute. However, the TDI said it didn’t have enough specifics within existing law to deal with it.

“We have exhausted every effort before we came here” with the bill, Richards (Burl’s Collision Center) told the committee. He mentioned three separate meetings with the TDI in 2018.

“We continually were told that TDI has no jurisdiction, they have no authority and ‘You’re gonna have to pass legislation,’” Richards said.

Letters used in court

Cernosek’s Deer Park Paint & Body had sued State Farm in August for $10,000 over allegations of tortious interference with a contract on five claims.

Deer Park alleged State Farm refused to pay a variety of charges, such as an additional $14 an hour for his sheet metal and refinish rates, $225 administrative and detailing charges, and operations like denibbing. Each claim was allegedly unfairly denied to the tune of between $1,031.35-$2869.47; altogether, they constituted more than $9,000.

“Defendant denies generally the material allegations contained in Plaintiff’s Original Petition,” State Farm attorney Michael Hupf (Brackett & Ellis) wrote Aug. 19 in an answer to Deer Park Paint & Body v. State Farm.

Williamson had this fall granted Cernosek’s requests for discovery into five items over State Farm’s objections. These involved State Farm adjusters’ training, the carrier’s labor rate calculation and its definitions of “reasonable and customary,” “prevailing rate in the market area,” and “pre-accident condition.”

But she demanded proof that the TDI couldn’t help before ruling on his other four requests for information. Cernosek had also sought State Farm’s estimating profile on the claims at issue and information on the carrier’s inclusion of P-pages and manufacturer procedures into its estimating software.

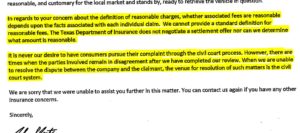

Cernosek presented the judge with four TDI letters from between 2015-19.

“Plaintiff’s Requests, 2 through 5 is pending per Plaintiff providing letters from the Texas Department of Insurance (TDI), letters from complaints that were filed that the court was the proper venue to settle the issues of this case as TDI through their consumer complaint division will not do,” Cernosek wrote Nov. 20.

“… Attached are four letters from the Texas Department of Insurance that state the civil court process is the only option a consumer has to settle the-requests in discovery questions 2 through 5.”

In 2015, John Plent of TDI complaints resolution wrote:

In regards to your concern about the definition of reasonable charges, whether associated fees are reasonable depends upon the facts associated with each individual claim. We cannot provide a standard definition for reasonable fees. The Texas Department of insurance does not negotiate a settlement offer nor can we determine what amount is reasonable.

It is never our desire to have consumers pursue their complaint through the civil court process. However, there are times when the parties involved remain in disagreement after we have completed our review. When we are unable to resolve the dispute between the company and the claimant, the venue for resolution of such matters is the civil court system.

In 2018, TDI consumer protection complaints specialist Gamaliel Martinez wrote:

The Texas Department of Insurance does not negotiate settlement amounts and cannot determine covered damage, cause of damage, or the value of repairs as those are question of fact issues, i.e., whether what is alleged can be proved as being factual. As a regulatory agency, TDI is not able to decide or mediate such claims.

TDl does not determine what the exact labor rate is or should be in a particular geographical area. When two parties continue to disagree on what is a reasonable cost or price for a particular service, the ultimate resolution must be obtained in a court of law. Any additional documentation that you can submit to the company for review may help support your position. If you are unwilling to accept the company’s decision, you may wish to take legal action in an attempt to recover what you feel is a full amount owed.

In 2018 and in January, the agency wrote:

Please understand that when investigating your complaint, there are some things we cannot do. The Texas Department of Insurance cannot:

• Act as your personal adjuster or lawyer

• Provide legal advice

• Resolve a complaint or dispute if a lawsuit has been filed

• Make liability decisions, including who was at fault or negligent

• Determine damage or repair amounts or determine the value of vehicles deemed a total loss

• Make judgments about medical necessity (Minor formatting edits. Emphasis ours.)

Jerry Hagins of TDI media relations confirmed Wednesday that the passages referenced above still essentially reflected the agency’s position. It “looks similar and consistent” with what the TDI tells consumers, he said.

“That’s still consistent with what we can do,” he said.

He said the agency in recent months issued a portal of links to information for consumers who do need to resort to the legal system.

“The communications you cite describe the kinds of issues we can’t help with through our complaint process,” he also wrote in an email Tuesday in response to our inquiry. “In general, we can only help resolve complaints with the insurance companies, agents, and adjusters we regulate.

“• We can’t make a company pay a claim unless the failure to pay violates a law or the terms of your policy.

“• We can’t help with complaints against another person’s insurance company. For instance, we probably won’t be able to help you if you’re in an accident and the other driver’s insurance company won’t accept liability.

“• We can’t decide who was at fault in an accident.” (Minor formatting.)

Other communications with TDI

Clardy in April told the House Insurance Committee he had a “fundamental disagreement” with the TDI’s view of itself, arguing it should be an “advocate” and “protector” of consumers over insurers rather than a “go-between” for the two.

But in deference to the agency’s comments, Clardy was trying to provide that specificity in the bill, he said.

Lawmakers had a chance to give TDI the authority to “do the right thing” with HB 1348, Clardy said.

Richards said he was told repeatedly that TDI doesn’t recognize or enforce prevailing rate language but allows the term to appear in policies. He said he was instructed to provide definitions.

The committee in a 6-1 vote backed an amended version of the bill, but the legislation failed to get a second reading in the full House and died this session.

HB 1348 would have inserted a definition in state law that holds a “(p)revailing rate” to be a “transparent and unbiased” one “conducted by a third party” that uses the “posted retail labor rates and not direct repair program shop rates that operate under a contract with an insurer.”

It also defined “like kind and quality” for aftermarket parts and addressed steering and questionable prevailing rate surveys.

HB 1348 will hold insurers to OEM repair procedures but offered an exemption on parts. Otherwise, a carrier couldn’t disregard a repair operation or cost identified by an estimating system, including the system’s procedural pages and any repair, process, or procedure recommended by the original equipment manufacturer of a part or product.In addition to demanding insurers acknowledge repair procedures, the bill defines “(r)easonable and necessary amount” as “the amount determined by the original equipment manufacturer’s manufacturer and estimating systems required to repair a vehicle to the condition before the covered damage to the vehicle occurred.”

The bill also would have enacted more antisteering provisions.

More information:

Texas Department of Insurance “Getting legal help” webpage

Images:

Texas Department of Insurance correspondence including this 2015 letter was in 2019 used by a body shop to support a State Farm discovery request. (Provided by Texas Department of Insurance; rotated and highlighted by Repairer Driven News)

Larry Cernosek, owner of Pasadena, Tex.-based Deer Park Paint & Body, poses at left with a sign for his company. (Provided by Cersonek)

Texas Insurance Commissioner Kent Sullivan. (Provided by Texas Department of Insurance)