Considering offering, switching a 401(k) at your body shop? Check out SCRS webinars

By onAnnouncements | Associations | Business Practices | Market Trends

The Society of Collision Repair Specialists on Wednesday announced two webinars on its multiple employer 401(k) plan, each targeting a separate type of auto body shop.

The first webinar is aimed at collision repair companies which already offer a retirement benefit to employees but are curious about finding a better one. The second targets auto body shops which don’t offer retirement at all to workers but might wish to do so.

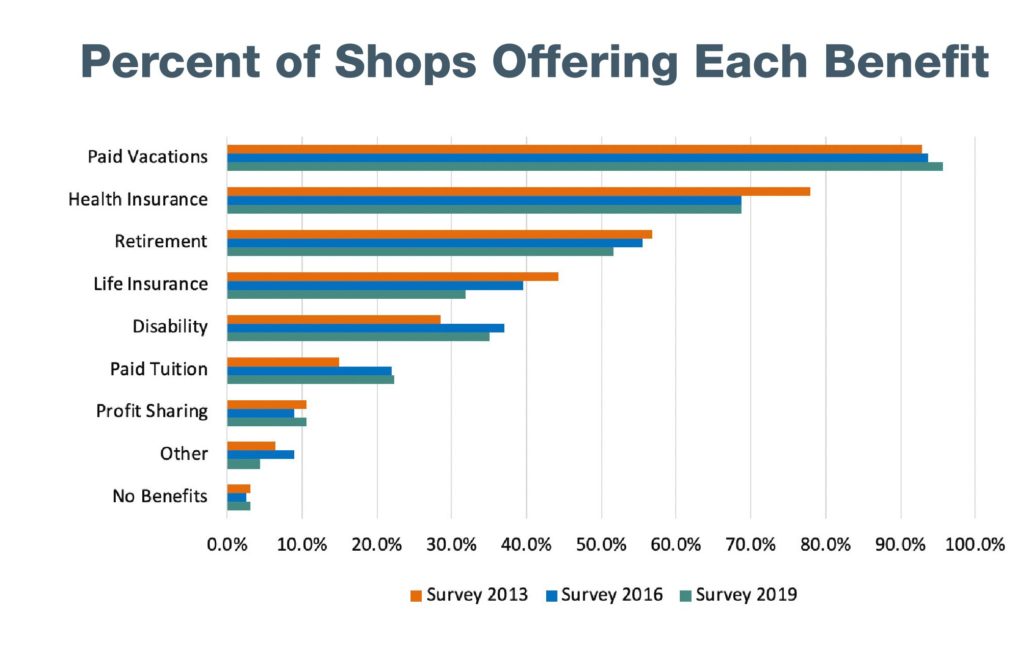

A 2019 Collision Repair Education Foundation and I-CAR study found large proportions of repairers offering benefits like health insurance and retirement but significant numbers still failing to do so. Benefits were also seen as a viable strategy for solving collision repairer ecosystem tech shortages, based on Gerber Collision’s actions and an informal Raymond James Canada and Supplement Advisory poll.

SCRS has offered a 401(k) option to collision repairers since April 2019. By using the combined buying power of all the participating shops, it can command a better deal from 401(k)-related vendors than a single repairer could obtain on its own. This can mean lower fees for employees, allowing them to save more money over time.  Other SCRS 401(k) benefits might include reduced administrative work and fiduciary risk.

Other SCRS 401(k) benefits might include reduced administrative work and fiduciary risk.

So it might be worth your time — literally — to check out one or both of the webinars. They’re open to anyone; you don’t have to be an SCRS member to tune in to either one. (However, you do have to ultimately join SCRS to adopt its 401(k) at your company.)

Both webinars will be live and take questions from the audience too. “The goal is to answer your questions about how this benefit can help you,” SCRS wrote in a news release Wednesday.

‘Everything You Need to Know About Switching From an Existing Plan’

Collision repairers which already offer a 401(k) (and anyone else who’s interested) might want to check out the first webinar, “Everything You Need to Know About Switching From an Existing Plan,” scheduled for 2 p.m. ET Feb. 26.

“In this webinar, SCRS’ plan advisors will walk through topics designed to help inform businesses with an existing retirement solution in place, to learn about the benefit and process of adopting the SCRS plan,” SCRS wrote in a news release Wednesday.

SCRS said the webinar would cover:

• New tax benefits from the SECURE ACT.

• What have we seen from members who have switched to SCRS plan, and how it has met expectations relative to key factors in the decision?

• How to navigate existing relationships with your current plan

• Educating employees and answering questions that have been common for participating businesses.

• Transition process: what is needed, timeline, integration and what to expect.

• What is needed for from your business to review and compare against your plan in 2020?

• Review of the current fee schedule and outline of fee reductions as the plan grows in size. (Minor formatting edits.)

Register for that webinar here.

‘Starting a New Retirement Plan with SCRS’

The second webinar is aimed at those of you who don’t offer any sort of retirement. (Though anyone is welcome here too.) “Starting a New Retirement Plan with SCRS” is scheduled for 2 p.m. ET March 17.

“In this webinar, SCRS’ plan advisors will walk through topics designed to help inform businesses who do not currently offer retirement services, to learn about the benefit and process of starting one within the SCRS plan,” SCRS wrote.

According to SCRS, the second webinar will explore:

• New tax benefits for businesses adding a retirement plan in 2020.

• State mandates of retirement plans.

• An overview of the basics of the SCRS plan.

• How the SCRS plan can reduce administration and overhead for participating business owners.

• An overview of what is needed from your business to review your options.

• An overview of the plan fees and performance. (Minor formatting edits.)

For more information about SCRS, call 877-841-0660, email info@scrs.com, or visit www.scrs.com.

Have a webinar of your own? Post it on our free, interactive industry events page.

More information:

“SCRS to Host Two Webinars on 401k Member Benefit”

Society of Collision Repair Specialists, Feb. 12, 2020

Images:

The Society of Collision Repair Specialists logo hangs above its booth at SEMA 2019. (John Huetter/Repairer Driven News)

A smaller percentage of shops reported offering life insurance and retirement in 2019 than in 2016, according to a Collision Repair Education Foundation and I-CAR study that polled more than 675 shops. (Provided by CREF)