‘Who Pays?’: Major auto insurers more likely to OK repairs without reinspections; fewer quick desk reviews

By onBusiness Practices | Insurance | Market Trends | Repair Operations

About 68 percent of collision repairers surveyed reported “always” or “usually” encountering insurer approval without coming out to their shops to reinspect.

Last year, this only proved true for 52 percent of the respondents polled in the “Who Pays for What?” study.

“Changes due to COVID-19 are likely having an impact on insurer wait times this year,” study authors CRASH Network and Collision Advice wrote in the 2020 report.

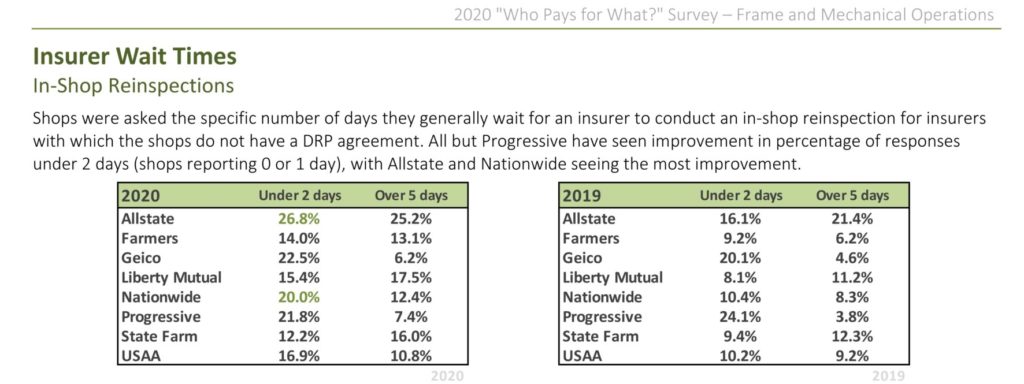

Non-DRP shops also reported that seven out of eight major insurers were more likely to make it out to reinspect a vehicle in less than two days. Progressive, the one exception, only reached 21.8 percent of shops in less than two days, compared to 24.1 percent last year. (This might be within the margin of error, which stood at 4.0 percent for questions answered by all 592 participating shops in an industry of 40,000.)

The “Who Pays?” study saw the most improvement in Nationwide and Allstate, which posted around 10- and 11-point gains in the number of shops reporting the carriers made an appearance in less than two days.

However, the study also found increases in the percentage of shops reporting the eight carriers took more than five days for a reinspection.

If those vehicles are sitting around collecting storage or racking up rental car time, it might be more cost-effective for insurers to just trust the shop, OK the bill and move on as in the earlier example. Considering that the Insurance Information Institute estimates fraud is only around 10 percent of claims costs, odds are good that the repairer’s being honest with the consumer (the true billpayer) and insurer and the customer’s being honest with the carrier.

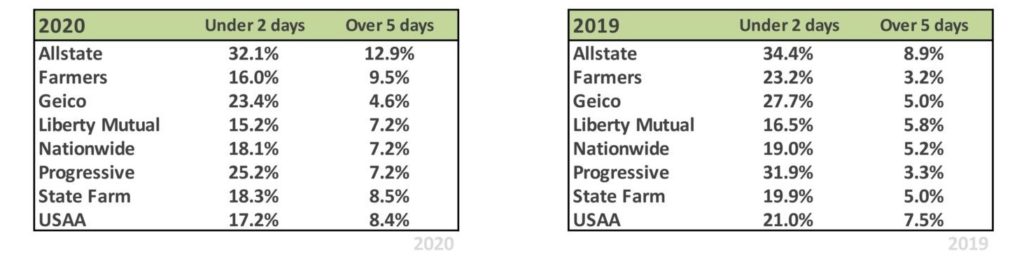

What’s fascinating is that desk review seemed to be taking longer this year. Lower percentages of shops in 2020 reported getting an answer from a desk reviewer in less than two days. The percentage of shops reporting a desk reviewer took more than five days increased for all insurers except GEICO.

“My advice for shops is that when submitting an estimate or supplement for review, two things can really impact the wait time: line notes and photo documentation,” Collision Advice CEO Mike Anderson wrote.

The data seems to raise questions about the desk review process. It’s possible that desk reviewers undertook more claims because of COVID-19, which dragged down their times while freeing up field staff to improve their physical inspection times in the manner shown above.

However, repairable claim workloads were also down 24.7 percent in July, which should have tempered this burden. (The 2020 “Who Pays?” survey in question ran July 1 to Aug. 5, and the 2019 survey took place during a similar timeframe.)

But desk reviewers mostly couldn’t make a decision in less than two days in 2019 either, based on the “Who Pays?” data.

For example, Allstate in 2019 posted the best sub-two-days percentage out of all eight carriers — far better than most of them that year. But two-thirds of repairers still reported they and their customers had to wait two or more days for Allstate.

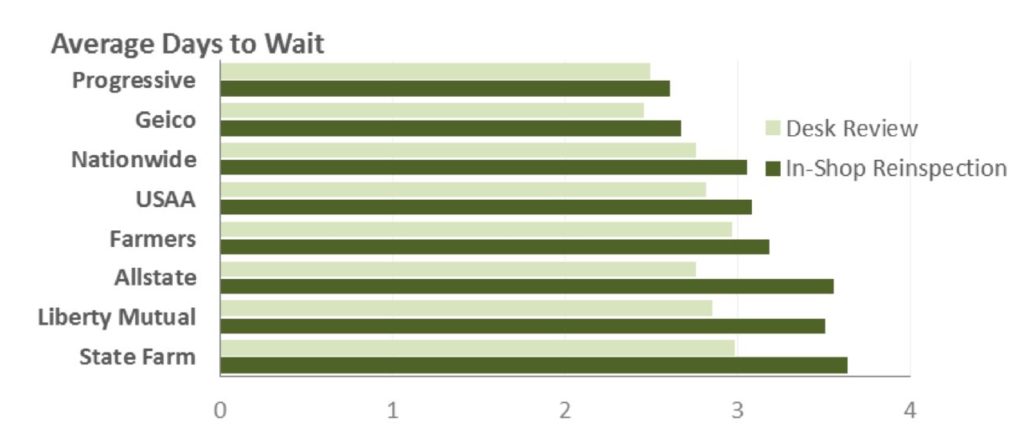

Average 2020 waits for desk reviews were around 2.5-3 days. Average in-shop reinspection times were around 2.75 days to a little more than 3.5 days.

“While there is not a considerable difference between insurers when it comes to desk review response times, there is a full day difference in response time between the fastest insurer, Progressive (average 2.6 days), and the slowest insurer, State Farm (3.6 days), for in-shop reinspections,” the Who Pays? study states.

The “Who Pays?” data also showed some insurers have a pretty small spread between average desk review time and average physical inspection time. However, for Allstate, Liberty Mutual and State Farm, it was the better part of a day.

Help the collision industry by taking the current “Who Pays for What?” survey by the end of the month and answering questions on topics like shop supplies and advanced driver assistance system calibration. All answers are kept confidential; data is published only in the aggregate.

More information:

Take the anonymous fourth-quarter “Who Pays?” survey

Images:

About 68 percent of collision repairers surveyed reported “always” or “usually” encountering insurer approval without coming out to their shops to reinspect. (Aquir/iStock)

Lower percentages of non-DRP shops in 2020 reported getting an answer from a desk reviewer in less than two days when polled in a 2020 “Who Pays for What?” survey. (Provided by Collision Advice and CRASH Network)

Non-DRP shops reported in a 2020 “Who Pays for What?” survey that seven out of eight major insurers were more likely to make it out to reinspect a vehicle in less than two days than in 2019. (Provided by Collision Advice and CRASH Network)

The average desk review and in-person inspection wait times were fairly close for some insurers, according to shops polled in a 2020 “Who Pays for What?” survey. (Provided by Collision Advice and CRASH Network)