CCC sees 50% increase, 5 million claims with deep learning AI processing

By onAnnouncements | Business Practices | Insurance | Market Trends | Technology

CCC on Thursday announced the number of claims handled in a manner incorporating deep machine learning grew more than 50 percent in 2020.

It said more than five million claims received “a CCC deep learning AI solution.” And the number of claims handled with more than one artificial intelligence option “has more than doubled” from 2019, according to CCC.

“The growth we’re seeing in AI adoption is tied to our proven ability to deliver actionable insights with advancing precision,” CCC technology Senior Vice President John Goodson said in a statement. “The CCC Cloud platform is built for speed and scale, and today processes 2.7 billion transactions per day. We are powering AI innovations at scale and are proud to help each client use AI to provide a tailored experience for their customers.”

CCC said the number of insurers using at least one of its artificial intelligence option grew more than 30 percent in 2020.

“Innovation has driven AI into multiple phases of the claims process, and today includes estimating, audit, total loss handling, AI-based data validation, and more as the industry progresses towards its vision of straight-through processing,” CCC wrote in a news release.

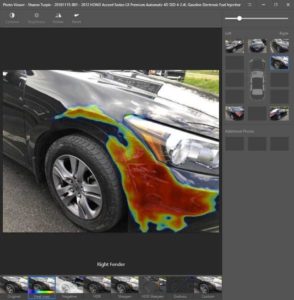

We asked if the AI in the announcement referred to more traditional technology like estimate review or CCC Valuation or newer systems like CCC Smart Estimate. CCC technology Senior Vice President John Goodson said the news release was “focused on the application and customer adoption of deep learning AI, which can be found in solutions spanning key decisions across the claim lifecycle, including Smart Estimate, Smart Total Loss, Heat Maps, and Smart Audit.”

CCC also has artificial intelligence for auto casualty claims, but Goodson said the gains in AI usage CCC described Wednesday were predominantly auto physical damage-related.

“The exponential growth in customer adoption of deep learning AI is focused on APD claims,” he said in a statement.

CCC said it had tailored more than 300 “active AI models” to meet carriers’ specific demands.

It’s been suggested auto body shops could use AI photo estimates to flag total losses immediately, assuming insurers with their own incentive to do so don’t beat them to the punch. CCC referenced such a use case in its news release Thursday.

“Artificial intelligence is contributing to safer, more accurate, and accelerated decisions across the APD claims lifecycle and across the P&C insurance ecosystem,” CCC markets and consumer success Executive Vice President Barrett Callaghan said in a statement. “Policyholders are benefiting from expedited processing. Lienholders can now be notified of a total loss days earlier. And AI is helping to ensure repair facilities big and small receive a greater percentage of repairable vehicles, eliminating noise and increasing productivity. The benefits of increased AI adoption span the network.”

The data CCC released is interesting in light of another industry expert’s recent automation prediction.

LexisNexis Risk Solutions claims Vice President Bill Brower recently projected in PropertyCasualty360 and Claims Magazine the insurance industry would handle nearly all auto physical damage claims virtually by 2025 — and completely automate 50 percent of noninjury ones. CCC’s mention of a “straight-through processing” goal appears to also suggest this latter trend.

The interesting question will be whether the process can be automated beyond the initial estimate or total loss decision.

Collison repair best practices call for a 100 percent teardown, scanning, bench measurements and OEM procedure research to produce the true, complete estimate/blueprint. This battery of examinations and research isn’t possible during a curbside or photo-based estimate, regardless of if a human or AI is looking over the vehicle.

Thus, all or nearly all initial estimates are going to be incomplete — and statistically, they are today.

CCC’s 2020 “Crash Course” found a supplement rate of 82.3 percent among vehicles fixed by DRP shops during the year ending Sept. 30, 2019. The average supplement came in at 14.5 percent of the $3,251 average total repair cost. That’s an extra $471.40 that the insurer will be asked to reimburse at some point.

So at some point — apparently, even on lower-dollar claims — someone besides the AI will be writing an estimate and submitting it back to the insurer, who’ll either need to bring in a human or another AI to evaluate it.

Of course, this might not be so difficult. We don’t have an auto physical damage stat, but the Insurance Information Institute’s projected overall insurance fraud rate is only 10 percent. The Insurance Research Council puts the auto bodily injury fraud rate at 13-17 percent.

Thus, an insurer could deploy a second AI doing nothing but blindly approving 50 percent of all supplements at random. They could be truly automated on Brower’s 50 percent of claims yet from the law of averages be confident they’re mostly paying valid expenses. And that’s without deploying measures like AI fraud detection software to actually refine results.

More information:

“AI Adoption by Auto Insurers Grows Exponentially in 2020”

CCC, March 4, 2021

CCC artificial intelligence webpage

CCC’s artificial intelligence photo estimating system Smart Estimate is represented in a 2018 screenshot. (Screenshot provided by CCC)