Tex. bill requires OEM procedures, proof of ‘like kind and quality,’ neutral labor rate surveys

By onAnnouncements | Associations | Business Practices | Insurance | Legal

A sweeping auto insurance reform measure approved by the Texas House Insurance Committee in 2019 is back for the Lone Star State’s 2021 legislative session.

House Bill 1131 contains virtually identical language to the substitute version of HB 1348 the committee reported favorably in a 6-1 vote. But the 2019 bill never received a vote on the House floor that year.

Both bills were sponsored by Rep. Travis Clardy, R-Nacogdoches. No other representatives have signed on as co-sponsors yet this year to HB 1131, but 2019’s HB 1348 ultimately drew four other authors: Reps. Leo Pacheco, D-San Antonio (the original co-sponsor); Julie Johnson, D-Farmers Branch; Stan Lambert, R-Abilene; and Hubert Vo, D-Alief. All of them serve in the Legislature this session.

HB 1131 declares that a carrier can’t “disregard a repair operation or cost identified by an estimating system, including the system’s procedural pages and any repair, process, or procedure recommended by the original equipment manufacturer of a part or product. ”

In addition to demanding insurers acknowledge repair procedures, the bill defines “(r)easonable and necessary amount” as “the amount determined by the original equipment manufacturer ’s manufacturer and estimating systems required to repair a vehicle to the condition before the covered damage to the vehicle occurred.”

But it allows insurers to disregard OEM procedures in the case of installing a part “that is of like kind and quality as an original equipment manufacturer part or product.” The Insurance Committee added this language back in 2019 to the predecessor HB 1348.

The bill also defines “like kind and quality” and what constitutes an acceptable “prevailing rate” survey. It bans certain steering tactics, though it grants insurers an exemption with regards to repairers who exclusively handle auto glass.

Defining ‘like kind and quality’ and prevailing rate

“(L)ike kind and quality” is defined as follows:

An insurer described by Subsection (a) may not consider a specified part or product for the repair of a motor vehicle to be of like kind and quality as an original equipment manufacturer part or product for any purpose unless the insurer or the manufacturer of the specified part or product has conclusively demonstrated that the specified part or product:

(1) meets the fit, finish, and quality criteria established for the part or product by the original equipment manufacturer of the part or product;

(2) is the same weight and metal hardness established for the part or product by the original equipment manufacturer of the part or product; and

(3) has been tested using the same crash and safety test criteria used by the original equipment manufacturer of the part or product.

“Prevailing rate” would involve a “transparent and unbiased” one “conducted by a third party” that uses the “posted retail labor rates and not direct repair program shop rates that operate under a contract with an insurer.”

Antisteering measures

Besides clearing up who actually is charging a prevailing rate, HB 1131 would fight steering by banning insurers from requiring claimants to use preferred shops “in order for the beneficiary to obtain the repair without owing any out-of-pocket cost other than the deductible.” It also says a carrier can’t be:

(2) intimidating, coercing, or threatening the beneficiary to induce the beneficiary to use a particular repair person or facility; or

(3) offering an incentive or inducement, other than a warranty issued by a repair person or facility, for the beneficiary to use a particular repair person or facility.

The bill also restricts what insurers can tell claimants. They aren’t allowed to “offer, communicate, or suggest in any manner that a particular repair person or facility will provide faster repair times, faster service, or more efficient claims handling than another repair person or facility.”

Insurers get an exemption with regards to “a person who exclusively provides automobile glass replacement, glass repair services, or glass products.” The “repair person or facility” definition specifically excludes those glass-only shops.

The bill could face an uphill fight this session not because of its content but because of bad luck and timing.

Texas’ Legislature only meets every two years, and COVID-19 made it more difficult to lobby lawmakers during the off-session year of 2020.

This year, lawmakers will have to tackle “super-high priority stuff” like COVID-19, redistricting and the catastrophic Texas winter weather and power outages, Auto Body Association of Texas Executive Director Jill Tuggle said Thursday. It’ll be a “really, really tough” session, she said.

However, the trade group has been sharing consumer auto insurance complaints with lawmakers. Tuggle said legislation will require consumers and constituents — be they shops or customers — contacting legislators.

The bill was sent to the Insurance Committee on Thursday.

ABAT Vice President Eric McKenzie (Park Place Dealerships) said “I feel confident” HB 1131 would at least get a hearing this session. House Insurance Committee Chairman Tom Oliverson (R-Cypress), served as vice chairman during the 2019 hearing on HB 1348 and voted for the bill, according to McKenzie.

Vo, who co-sponsored that bill, is now the Insurance Committee’s vice chairman, which is probably another positive sign.

The 2019 hearing memorably included an appearance by John Eagle Collision plaintiff Marcia Seebachan, who testified in support of the bill. “It is unconscionable that companies can undermine this process by approving insufficient repairs,” Seebachan told the committee then.

Be heard: Texas legislator contact information can be found here and here.

Images:

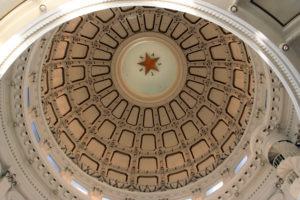

The Texas Capitol is shown. (BrandonSeidel/iStock)

A Texas welcome sign is shown. (dszc/iStock)