CCC says photo AI boosting accuracy in predicting totals, talks loss stats

By onInsurance | Market Trends | Technology

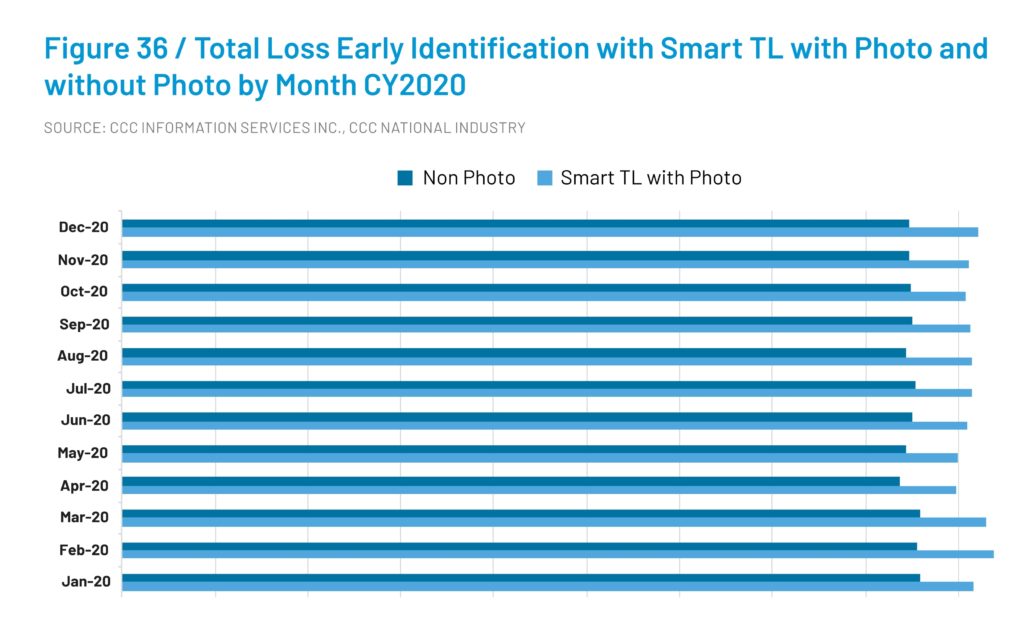

CCC has found the incorporation of artificial intelligence photo estimating into the predictive analytics Smart Total Loss tool allows the software to correctly identify nine out of every ten total losses.

It’s “not a false positive” situation where the system is incorrectly flagging repairable vehicles as totals, according to CCC director and industry analyst Susanna Gotsch, who presented the results in her free 2021 “Crash Course” industry resource earlier this year.

Rather, if you presented the CCC AI with data on 100 vehicles you knew to be totals, the software would be able to correctly identify more than 90 of them as such thanks to the addition of photos.

The old Smart Total Loss software was already pretty good at figuring out totals based on information collected about the vehicle and damage, but the addition of images takes it to a new level, according to the 2020 data in the “Crash Course.”

“They were all above 90,” Gotsch said of the 2020 accuracy percentages shown in the “Crash Course” chart. Gotsch in April said the system is now in the 95 percent range.

We asked CCC about the availability of such technology to auto body shops. Repairers also might find a value in quickly triaging totals or using CCC as a “second opinion” to support their argument to an adjuster that the vehicle taking up a bay is an obvious total loss.

“AI-powered claims are reducing the number of total loss vehicles sent to repair facilities, reducing churn, and saving countless hours for repair facilities,” CCC wrote. “Better, faster decisions have a positive impact on the entire ecosystem as well as drivers.

“We are also working with repair customers on their priority use cases for AI-powered solutions. We will have announcements to share.”

Gotsch discussed both national total loss data and her company’s ability to immediately predict that vehicle condition during our interview this spring.

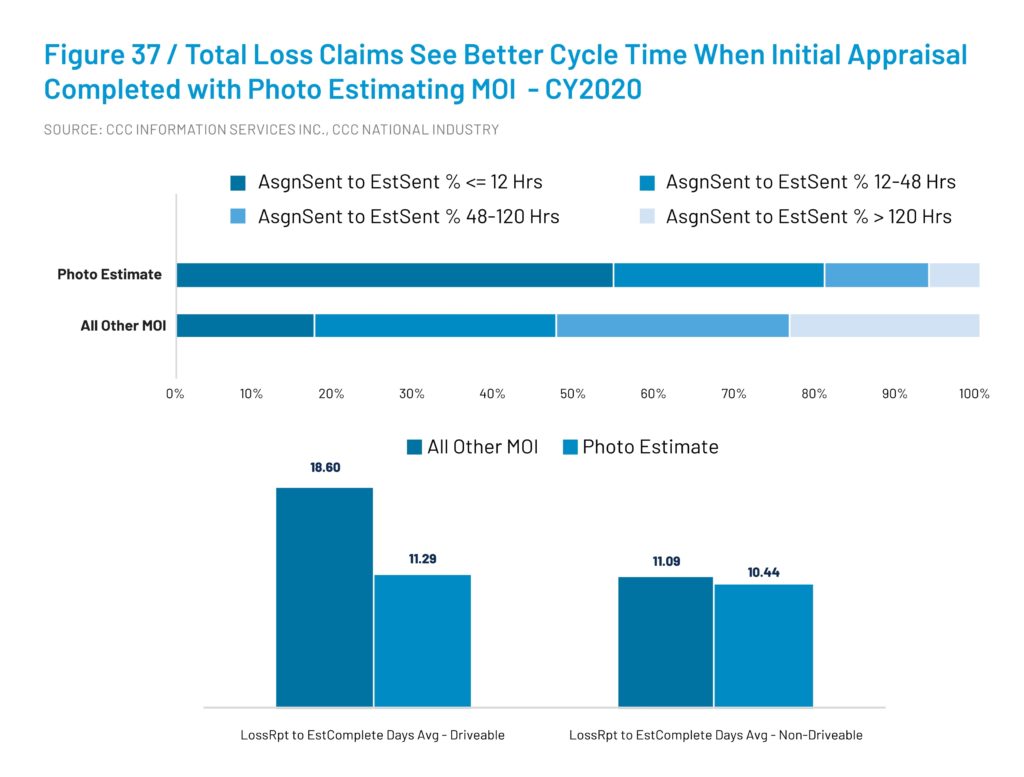

In a different study, CCC also found that photo estimating in general led to far quicker cycle times last year on vehicles ultimately found to be total losses.

“We see better cycle time anyway,” Gotsch said.

This was particularly the case on vehicles seen as driveable.

More than half the total loss claims involving photo estimating could move from assignment to estimate in 12 hours or less — compared to less than 20 percent of all other methods of inspection. More than 80 percent of photo estimated totals had an estimate in two days or less — compared to not even half of all estimates completed in some other fashion.

We asked why photo estimates had cycle times longer than 12 hours at all. Gotsch explained that the statistics depicted in the CCC analysis also included time where the ball was in the consumer’s court instead of the insurer’s.

She said the longest cycle time lags, “especially for driveable claims, are those where you’re waiting for the customer” to make a decision. For example, the time between the claim is reported to the customer determining which method of inspection they even wished to use.

“We see better cycle time anyway, when we have photo,” she said.

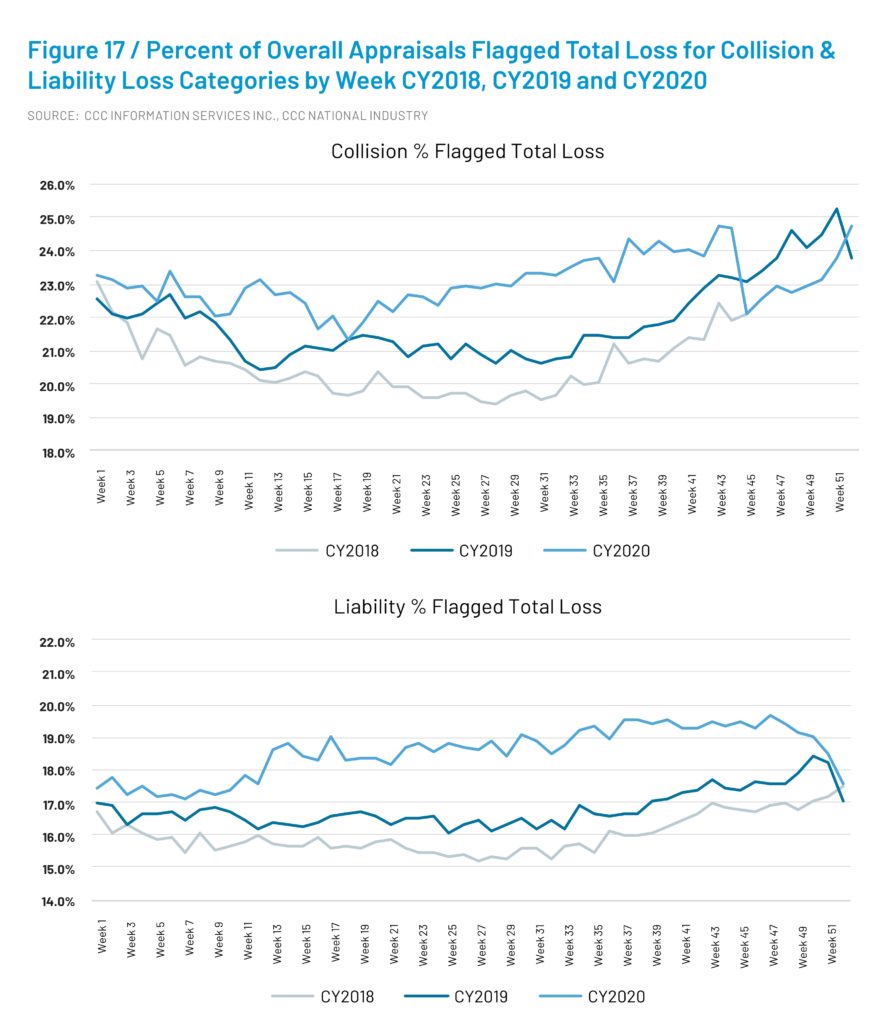

CCC found 20.5 percent of all claims to be total losses last year, up from 19.2 percent in 2019 and way up from 15 percent in 2010. It’s been projected in part that pandemic restrictions reduced congestion, allowing Americans room to drive faster and crash harder last year.

“With drivers behind the wheel of bigger vehicles, driving at faster speeds, it should come as no surprise that accident severity and subsequently repair cost and total loss frequency were higher,” CCC wrote. “As we’ll discuss later, this combination of heavier vehicles and higher speeds was a key variable leading to increases in the average Delta-v of accidents during the pandemic.”

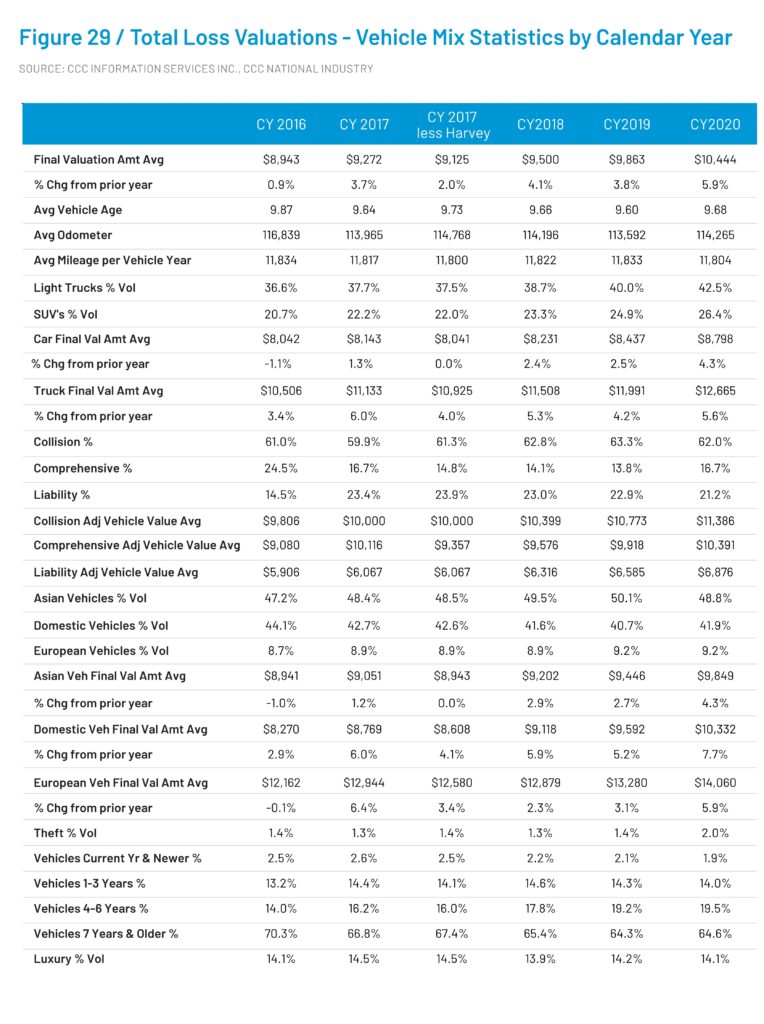

A trend toward more totals also already existed due to factors like Americans buying bigger vehicles and keeping older ones, higher repair costs and more severe weather, according to CCC.

How much higher could things go? “It’s very easy to see it reaching 25 percent,” Gotsch said of totals. She noted that “things have become so disposable.”

However, increasing penetration of tech like advanced driver assistance systems should reduce crash severity, Gotsch said.

One of the main factors spurring total losses is vehicle age, Gotsch said. 64.6 percent of all totals in 2020 were at least seven years old. “The depreciation cost becomes a major factor,” she said.

Get a $5,000 car into a minor crash, and “it becomes pretty easy to total those,” Gotsch said. But 35 years from now, older models would all have ADAS and be able to avoid the kind of minor crashes that yield purely economic total losses, Gotsch said.

Things could improve on the total front even sooner than that. Autobraking is supposed to come standard on everything in 2022, but Gotsch has said 74 percent of all light-duty vehicles built in the U.S. between Sept. 1, 2019, and Aug. 31, 2020, already had that technology installed anyway. So by 2027, three-fourths of all 7-year-old cars theoretically still have the tech to avoid one of the most common types of collision. By 2029, all 7-year-old cars will be able to brake themselves.

More information:

CCC, March 2021

Images:

Photos can help insurers immediately identify total losses through artificial intelligence, and they can also cut the cycle time of total loss claims, CCC has found. (PraewBlackWhile/iStock)

The old CCC Smart Total Loss software was already pretty good at figuring out totals based on information collected about the vehicle and damage, but the addition of AI photo estimating images takes it to a new level, according to 2020 data in the 2021 “Crash Course.” (Provided by CCC)

CCC has found that photo estimating in general led to far quicker cycle times in 2020 on vehicles ultimately found to be total losses. (Provided by CCC)

CCC found 20.5 percent of all claims to be total losses last year, up from 19.2 percent in 2019 and way up from 15 percent in 2010. It’s been projected in part that pandemic restrictions reduced congestion, allowing Americans room to drive faster and crash harder last year. (Provided by CCC)

CCC found 20.5 percent of all claims to be total losses last year, up from 19.2 percent in 2019 and way up from 15 percent in 2010. (Provided by CCC)