Despite misconceptions, body shops may have ‘excellent’ chance at payroll tax credit

By onAnnouncements | Business Practices

Collision repair shop owners and managers should not let common misconceptions keep them from seeking relief through the federal employee retention tax credit (ERTC), Brad Mewes, chief financial officer of The Mewes Group, advises.

“People think they either had to have suffered massive losses, or they had to be completely shut down by the government to get these credits. And that’s just not the case,” Mewes told Repairer Driven News.

Another common misconception: If a business lost money in 2020, and did not pay corporate taxes, there is nothing to refund. This refund, Mewes points out, specifically applies to payroll taxes, which every company with W-2 employees is required to pay.

The ERTC is something employers may want to think about as they prepare their CY2021 tax returns, for “a clean tax report” in which taxes and credits all line up. Otherwise, the returns can be retroactively amended next year, Mewes said.

Another reason to act now: to head off any possible changes in the law. Mewes noted that the recently enacted $1.2 trillion infrastructure bill backdated the ERTC provision to Sept. 30, 2021, rather than allowing businesses to use it through the end of the year. “They said, ‘we said you were going to have it [for the fourth quarter], but we’ve changed our mind and you don’t have it anymore.'”

The tax credit — which is really treated like a refund — can be quite substantial. Mewes said one auto body business he’s consulted with received a $3 million payment; the smallest has been $50,000. “They can be very meaningful amounts,” he said. “The numbers compound very quickly.”

The Mewes Group recently distributed “Do I qualify for the employee retention tax credit?,” a roadmap to determining possible eligibility for the ERTC.

The only required qualifier, Mewes said, is that a business had to have had W-2 employees on its payroll. That, and meeting at least one of the following qualifications, is enough to give a business an “excellent” shot at the credit:

- You experienced a sales decrease in 2020 or 2021.

- You had to change the way you do business, limit capacity, shut down as a result of government COVID regulations.

- Your suppliers were unable to deliver critical supplies to you because they were shut down.

- You started a business in 2020.

With supply chain disruptions making headlines over the past few weeks, and many shops affected by them, it might be logical to suppose that this could be a straightforward path to ERTC money. And yet, Mewes said, that’s not necessarily so.

“Just because you can’t get a part doesn’t mean you qualify for supply chain disruption. You have to be able to demonstrate that your vendors themselves were either fully or partially shut down as a result of their compliance with the COVID mandates,” Mewes said.

“So what I caution a lot of body shop owners right now is that, yes, it’s hard to get parts, but it’s not hard to get parts because of compliance with COVID mandates. It’s hard to get parts because there’s a semiconductor shortage.

“There are supply chain snafus just due to demand issues, planning issues,” he said. “But if somebody came to you and said, ‘Prove to me that the part you’re saying you couldn’t get was directly as a result of your vendor’s inability to have that because they were complying with COVID mandates,’ I suspect a lot of shops will have a hard time proving that.”

“There are supply chain snafus just due to demand issues, planning issues,” he said. “But if somebody came to you and said, ‘Prove to me that the part you’re saying you couldn’t get was directly as a result of your vendor’s inability to have that because they were complying with COVID mandates,’ I suspect a lot of shops will have a hard time proving that.”

In contrast, shops will have a simpler time showing that government COVID regulations forced them to alter the way they’ve done business.

“Was there a restriction to capacity a your customer-facing office? Did you have to implement increased sanitizing practices? Did you have to employ these hand sanitizing methods from the CDC? Did you have to implement enhanced vehicle sanitizing methods? Did you have to have contactless pickup [and] contactless drop off?”

“There’s all these things that we did over the past year and a half that almost, they almost feel normal now, right?,” Mewes said. “We’ve almost forgotten that that just because they feel normal, they’re not normal.”

In essence, he said, what the government is saying with ERTC is this: “Hey, listen, we get it. We get that we’ve asked you to make a bunch of changes in your business. And because we’ve asked you to make all these changes, we want to help basically compensate you for telling you how to run your business.”

Mewes noted that the ERTC has been overshadowed by the federal Paycheck Protection Program (PPP), particularly since, at the beginning, the Coronavirus Aid, Relief, and Economic Security (CARES) Act gave businesses the choice of applying under one or the other, but not both.

That all changed with House Resolution 133, passed in December 2020. Retroactive to March 27, 2020, the law allowes employers who received PPP loans to claim the ERTC for qualified wages that are not treated as payroll costs in obtaining forgiveness of the PPP loan, the IRS said.

(Please note: Nothing in this article is meant as formal tax advice. It’s for informational purposes only. Consult a qualified financial professional before taking any action.

More information

Law changes make body shops eligible for 2020, 2021 Employee Retention Tax Credits

IRS: New law extends COVID tax credit for employers who keep workers on payroll

IRS: COVID-19-Related Employee Retention Credits: How to Claim the Employee Retention Credit FAQs

Images

Featured image: Employers might want to take a look at their eligibility for the federal employee retention tax credit. (hamzaturkkol/iStockphoto)

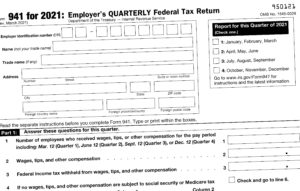

An Internal Revenue Service payroll tax Form 941 is shown as of March 2021. (Provided by IRS)

The Internal Revenue Service building on Constitution Avenue in Washington, D.C. (drnadig/iStockphoto)