Future technology: What shops likely will see soon & by 2035

By onBusiness Practices | Collision Repair | Education | Market Trends | Repair Operations

As vehicle technologies continue to evolve, two collision repair industry experts shared during the SEMA Show in November how they think collision repair shops will be affected in the years to come.

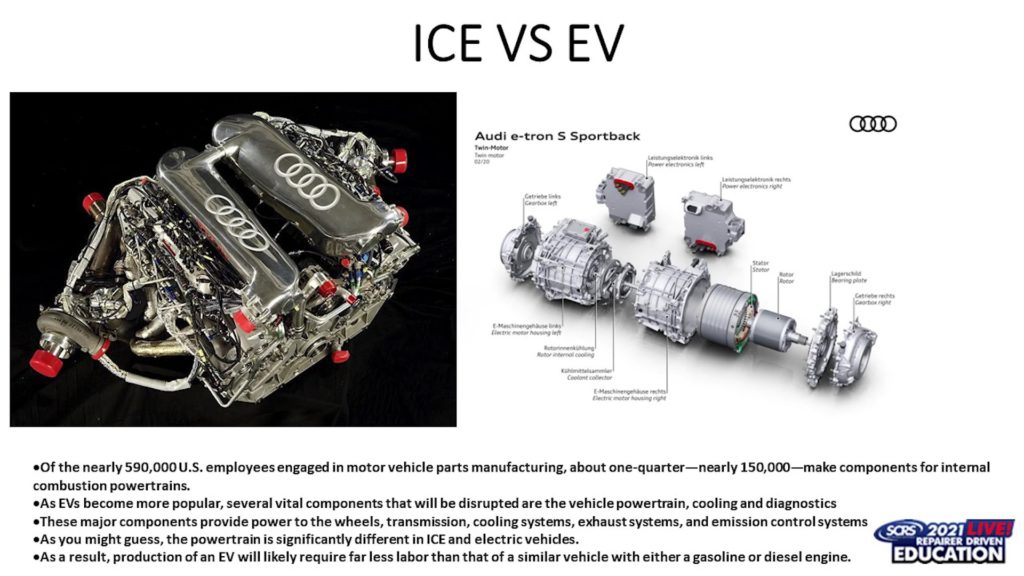

Lucid Motors North American Body Repair Program Operations Manager Jake Rodenroth focused on how electric vehicles will “disrupt” repair shops and what customers will prefer and expect based on current behaviors. Auto Techcelerators founder and CEO Frank Terlep discussed what he sees coming in the industry in the short-term – within the next year to five to 10 years, as well as by 2035 and how shops should prepare for those changes. Terlep noted General Motors and Ford have vowed to phase out internal combustion engine (ICE) vehicles – GM by 2035 and Ford by 2030 — and that some states will also ban gas-powered vehicles by 2035.

The sessions are two of more than 20 featured in the 2021 SEMA Show Repairer Driven Education series, all of which are now available to view online at rde.scrs.com.

Rodenroth said because of the added weight of electric drivetrains, weight has to be reduced somewhere else.

“As repairers, we’re going to see a lot of new joining methods, sectioning locations …and even some repair technology when we get into fixing dents and such,” he said.

Rodenroth predicts OEM factories and suppliers will change dramatically and new manufacturers will emerge. He also thinks dealer service volume will decline by 35% while tire replacement, glass and visibility services, and length of ownership will all increase with EVs. Joint ventures between OEMs will also continue, such as those between BMW and Toyota on the Supra and Subaru and Toyota on an SUV. Presumably, the reference was to the 2019 announcement from the OEMs about their joint development of a battery-electric drivetrain platform for a C-Class SUV.

OEMs, including Lucid, will offer 2WD and 4WD versions of EV models by using the same platform and expanding its track and width.

Range anxiety is an issue that’s being worked on but is still in the early stages. “I’m hoping that with higher voltage like we’re putting into Lucid, that it’s going to bring the charging time down to something that’s reasonable – 25-30 minutes to get almost 80% range,” Rodenroth said.

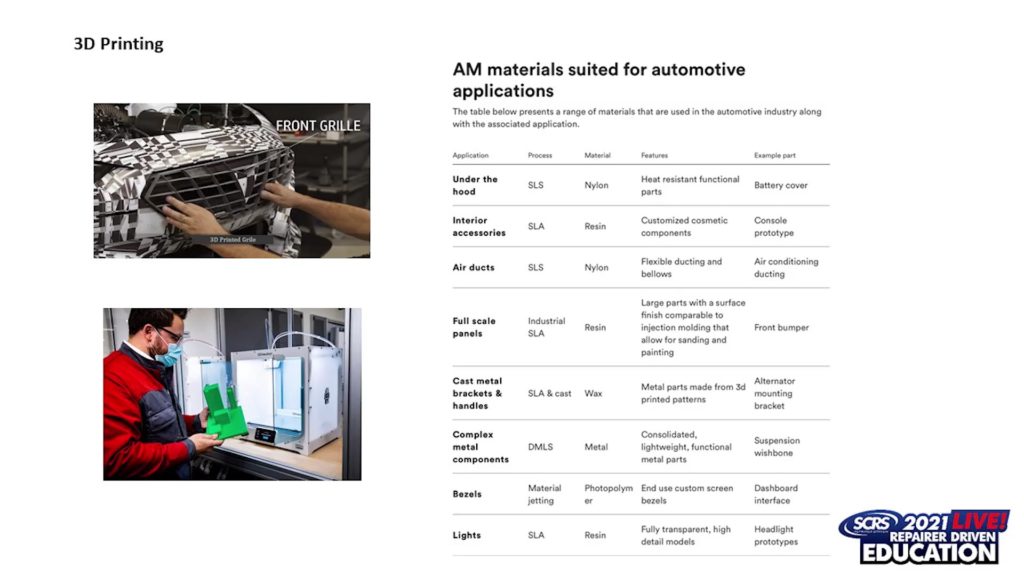

He also predicts alternative and clean fuel ventures by oil companies, like Exxon’s work with Porsche, that won’t decrease horsepower, and the capability of shops to eventually 3D print some parts, including bumper brackets and fasteners, they need with OEM-licensed technology.

Both Rodenroth and Terlep said OEMs are catering to Millennial and Gen Z consumers who expect online and app connectivity. And shops need to have an online presence to reach them because both generations look online for everything, including where to take their cars for repairs.

Technician certification and continuing education are also musts. Terlep said learning and research will happen daily with every repair because of calibrations. Repairers will have to become proficient at advanced driver assistance system (ADAS) and calibrations because by 2035 there will be 250 million ADAS-equipped vehicles at Level 2.5 to Level 4 chock full of sensors and cameras.

“You’re still going to be fixing the external stuff because people are going to crash their cars …but you’re going to be much more into the electronic business than ever or you’re going to partner with somebody or you’re going to own an electronic repair business that services your collision repair business,” Terlep said.

Rodenroth noted new cars are coming out every six months. “If you apply old methodology to new cars you put yourself in a really bad position.”

Terlep predicts three new roles at repair shops – research lead, EV technician, and ADAS/calibration technician, which he noted to attract employees to fill those positions the industry has to “get their act together in terms of messaging.”

“We’re not a body shop anymore,” Terlep said. “We’re fixing computers. If you’re going to the right school with the right message, I think you’re going to get different people, but you better have a role for them. …I think the industry needs to create its own school.”

As an example of how software-focused the automotive space is becoming, Reuters reported in January that Toyota is planning to launch its own operating system that could handle advanced operations, like autonomous driving, for its vehicles by 2025.

Rodenroth and Terlep also said in their sessions that photo estimating and automated insurance claims aren’t going to go away. According to Rodenroth, photo estimating can be used to control the number of WIP and when justifying damage. Terlep said photo estimating can make employees more productive.

The use of artificial intelligence (AI) in vehicles – while still in its early stages for collision repair, according to Terlep – will increase suddenly in terms of business, he said.

Rodenroth said AI is here to stay, and in shops can be used to search owner manuals and repair procedures by voice. “I think as repairers we have to have a voice on how can it help us repair a more complex vehicle using technology? And so things like using AI to navigate service manuals will be really cool stuff.”

Terlep took that a step further and said he thinks the repair industry is in need of augmented reality, which companies will eventually “jump in” to offer it and it will be used more and more, for example, with repair procedures being viewed on repairers’ AR glasses and scanning of vehicles conducted with the glasses.

By 2035, vehicles will communicate to repairers “much clearer” about what’s wrong with them and a tool will no longer be needed to get DTCs, Terlep said. Collision centers being part of OEM-certified repair networks will become more important.

Terlep noted that repair costs will double in five to 10 years and in five years. His prediction: the average repair order will be $6,000-$7,000 because the cost of parts will go up and technicians will need to make more money since the repair work will be more complex. OEM-certified repair networks will become more important as well.

Telematics will eventually be all-encompassing to connect everything to the car and more OEMs will offer user-based insurance. ADAS will also become increasingly connected, including to the infrastructure of its surroundings, such as stoplights, and to drivers’ homes.

Rodenroth and Terlep said shops need to invest in EV charging stations if they’re going to work on EVs. Terlep also recommended a dedicated space within the shop, or for those who have more than one location a dedicated facility, for EV repairs. Terlep predicts a shift in the repair industry to specializations because of the long list of OEM ADAS that already exist and will continue to grow.

As for autonomous vehicles (AVs), Terlep doesn’t see them being widely owned by consumers by 2035, but there will be a lot of AV fleets, robo-taxis, delivery and commercial trucks, and trains, especially in and near larger cities. Terlep also predicts there will be AV ships in use by then.

IMAGES

Featured image credit: sefa ozel/iStock

“ICE vs. EV” and “3D printing” (Screenshot of Jake Rodenroth’s SEMA Show presentation)

“Artificial intelligence 2035” and “ADAS Today” (Screenshots of Frank Terlep’s SEMA Show presentation)

More information

GM, Lucid, Rivian executives discuss repair guidance for EVs in OEM Summit at 2021 SEMA Show

GM & Ford boast solid 2021 financials, will continue focus on EVs