TransUnion: Fewer traffic tickets means more fatalities, higher insurance rates

By onInsurance

Recent TransUnion research has found that while traffic tickets have decreased nationwide since the beginning of the COVID-19 pandemic in 2020, traffic deaths have increased.

Compared to the 2019 average, citations have decreased by 13% and deaths have increased by 22%, according to the study.

TransUnion found that a decrease in traffic enforcement to slow the spread of COVID-19 and as a safety precaution following the death of George Floyd, as well as three primary behavioral factors, contributed to the rise in fatalities.

Since 2019, there has been a 21% increase in the number of fatal crashes involving unrestrained occupants, an 18% increase in alcohol-impaired fatal crashes, and a 17% increase in fatal crashes involving speeding.

“Among many important takeaways from this research is the plain fact that traffic enforcement plays a role in maintaining safety on the road,” said Mark McElroy, TransUnion executive vice president and head of insurance business. “That said, insurers can play a vital role in reversing this trend by educating their customers and promoting safe driving practices.

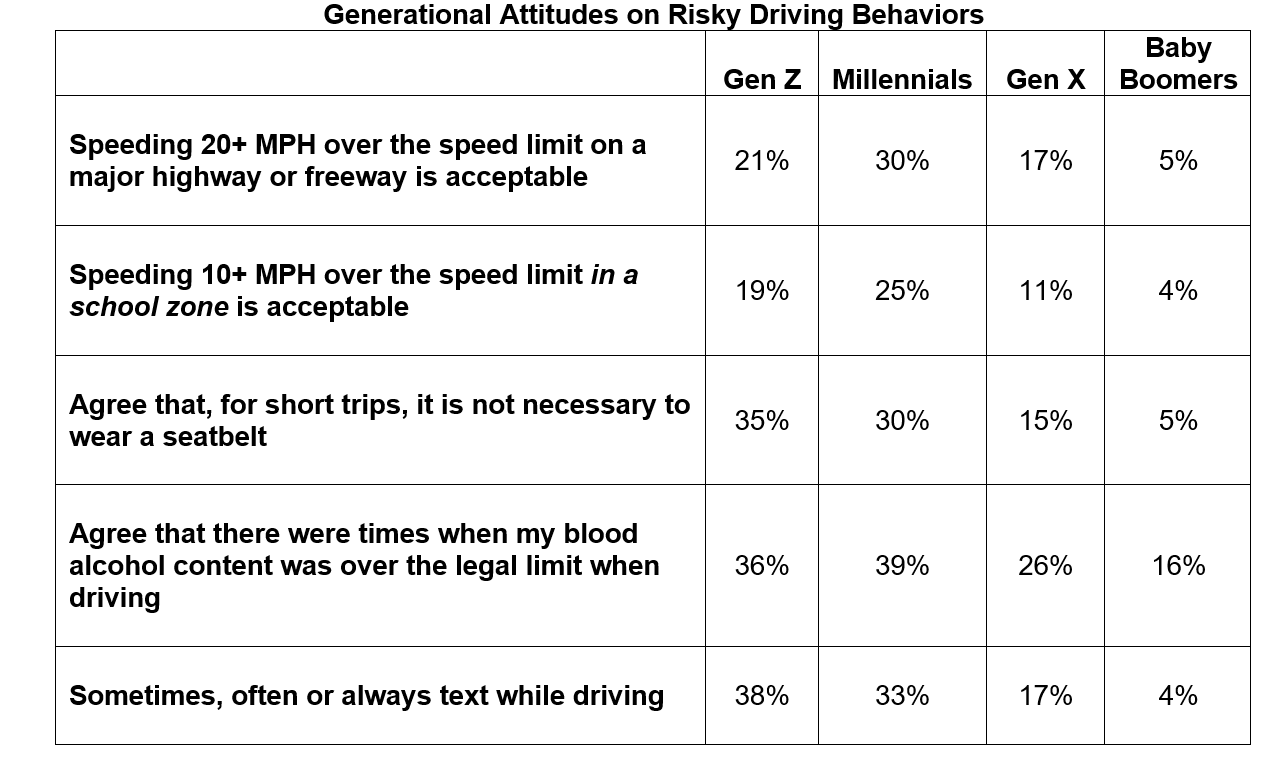

“Younger drivers are often more prone to risky behaviors but it is especially concerning to see Millennials — who are predominantly in their 30s and 40s — express such a lax attitude toward safety,” said McElroy. “It’s important they understand that this behavior is contributing to 50,000 preventable deaths every year.”

TransUnion conducted its research using traffic court record data between January 2019 and January 2023 from its TruVision Driving History solution and compared it against death rates calculated by the U.S. Department of Transportation and the National Highway Traffic Safety Administration (NHTSA) during the same timeframe.

Data from a survey conducted by TransUnion in March shows that younger drivers hold “certain attitudes that represent the potential for increased risk,” including 30% of Millennials believing it’s OK to go more than 20 miles per hour over the speed limit on a major highway. And 35% of Gen Z drivers said they don’t think it’s not necessary to wear a seatbelt for short car trips. Comparatively, 5% of Baby Boomers answered similarly to the same questions.

TransUnion also shared that P&C carriers should use driver court records to more accurately set rates and predict future insurance losses.

“For example, 42% of accidents in 2019 involved drivers who had traffic violations during the past three years,” TransUnion states in its study. “In 2022, that increased to 51% — meaning the predictive power of using prior violation history to project future auto insurance losses has increased during this period despite a lower number of total violations issued.”

All of the above have influence over insurance premiums and losses, according to TransUnion.

Because of an increase in violations since 2020 auto insurance carriers a making less in surcharge premiums, which contributes to negative premium trends, according to the study. That adds up to an estimated $200 million loss per year because of lower premiums, TransUnion concluded.

“On top of that, the rise in severe accidents resulting in fatalities has caused the amount that insurers have paid for medical bills, legal fees, repairs, and replacements to skyrocket,” TransUnion said. “The result underscores the importance for insurers to access court records through solutions like TruVision Driving History but also for police departments to increase enforcement to document and curb dangerous driving behaviors.

McElroy added that without traffic violation data, insurers aren’t able to accurately assess and underwrite driver risk.

“With the compounding cost from accidents, carriers are now increasing rates for everyone, meaning we are all paying for this problem,” he said.

McElroy also told RDN insurance carriers are addressing their losses in a varying mix of solutions.

“P&C carriers have pursued a mix of rate and non-rate actions designed to address high loss cost trends,” he said. “While the range of actions has varied for each carrier, TransUnion has seen an increased focus on data solutions designed for targeted non-rate actions for in-force policies, such as verifying driving record activity and additional policy information that includes undisclosed drivers, rated location, and insurable interest. These types of targeted non-rate actions can help to limit the level of base rate increases that often extend across all policyholders.”

Meanwhile, Allstate said last week they’ve lost a combined $1.68 billion pre-tax in April and May from catastrophe losses. Post-tax, the carrier said it lost $700 million in May alone. The losses are on top of more than $1 billion lost in March.

To offset losses Chief Financial Officer Mario Rizzo said Allstate has strategic partnerships with part suppliers and repair facilities “to mitigate the cost of repair and use predictive modeling to optimize repair versus total loss decisions and likelihood of injury and attorney representation.”

Allstate began filing auto insurance rate actions in late 2021. Rates were raised by 10% between Q4 2021 and October 2022. From January to October 2022, the carrier implemented 72 rate increases averaging approximately 10.3% across 51 locations.

According to Zacks Equity Research, Allstate hiked rates by 7.6% in ten locations in February, which provided a total premium impact of 0.5%. In the first two months of 2023, the company implemented rate hikes at an average of 8.8% in 22 locations. The rate hikes in February are likely to boost annualized written premiums by $127 million, according to the Zacks report.

Another carrier, GEICO, has sought approval for a nearly 20% rate increase in New Jersey, according to NJ.com.

Progressive is also making up profit by increasing rates. Rates were hiked 4% during Q1. Rates increased by a total of more than 13% last year.

A J.D. Power study released earlier this month shows that nearly one-third of auto insurance policyholders have experienced rate increases throughout the past year.

Images

Featured image credit: ThomasShanahan/iStock

“Generational Attitudes on Risky Driving Behaviors” chart provided by TransUnion