Volvo electrification goals advance with manufacturing addition of Giga Presses; gigacasting process

By onAnnouncements | Business Practices | Collision Repair

Volvo will install two 9,000-ton Giga Press die casting machines at its Slovakia factory to enable megacasting under a newly-inked contract with Idra Srl.

Idra Srl, a European die casting company, said that the new machines being delivered to Volvo could help position the automaker’s Kosice plant as a strategic hub for megacasting, also referred to by Tesla as gigacasting.

“[This equipment] represents a remarkable leap forward in automotive manufacturing technology,” Idra Srl said in a press release. “This cutting-edge equipment will enable the production of complex and lightweight vehicle components with precision and efficiency, paving the way for enhanced vehicle performance and safety.”

Noting that the machines will be housed at Volvo’s new state-of-the-art electric vehicle (EV) plant in Košice, Idra Srl said the equipment is “set to revolutionize the automotive manufacturing industry.”

When reached by Repairer Driven News, Volvo declined to comment on whether the design would affect repairability or safety.

Volvo announced plans to build its new $1.2 billion Slovakian plant last year and said that when production begins in 2024 the facility will be capable of making up to 250,000 vehicles per year. Production of its next generation EV cars is scheduled to begin in 2026.

The OEM said at the time that the plant will be climate neutral and build only EVs as it moves to become fully electric by 2030 and climate neutral by 2040.

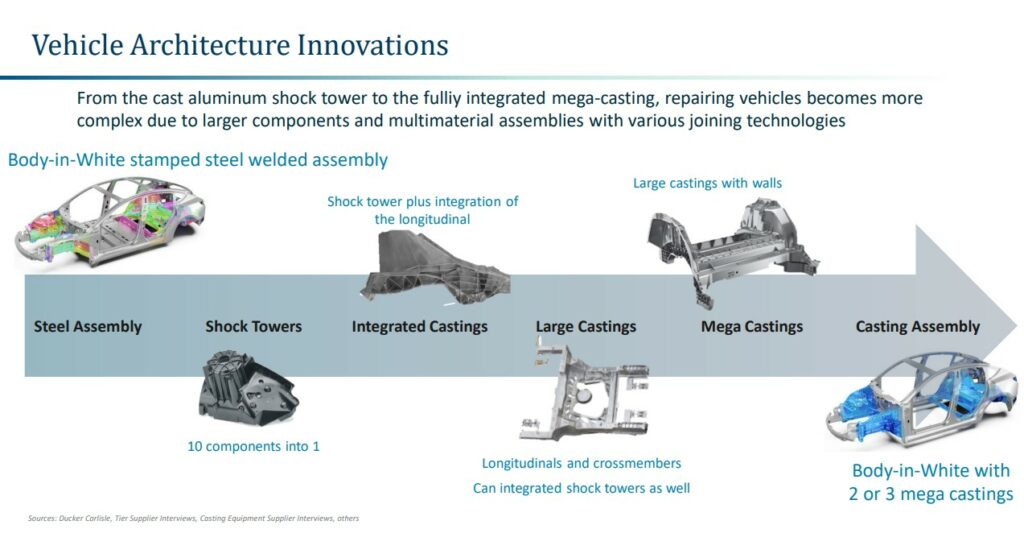

Megacasting is one of the processes being used by OEMs to reduce production time.

Earlier this year Toyota’s new megacasting process was demonstrated at its Myochi plant in Japan where it fabricated the rear third of a unibody at an event attended by Nikkei Asia.

In an example given by Toyota and reported on by The Drive, a unibody built with traditional methods required 86 parts, 33 steps, and hours on an assembly line. The cast equivalent took three minutes, according to Nikkei Asia.

“The Giga Press, among the largest die casting machines in Europe, represents a remarkable leap forward in automotive manufacturing technology,” Idra SRl said. “This cutting-edge equipment will enable the production of complex and lightweight vehicle components with precision and efficiency, paving the way for enhanced vehicle performance and safety.”

Meanwhile, a Reuters report indicated that Tesla is working on an upgrade of its gigacasting tech to die-cast almost all vehicle underbody parts in one piece.

However, it’s unknown when and where the upgrade will happen.

In June, a separate Reuters article explored why OEMs are exploring gigacasting technology and noted that it can both improve performance and lower EV production costs.

It said Tesla’s successful approach has led to significant cost savings.

“Typically, more than a hundred individually stamped metal parts have been welded together to make a car body,” Reuters said. “Fewer parts, lower costs and a simplified production line have contributed to Tesla’s industry-leading profitability, analysts have said. For Tesla, the use of a single component in the rear of the Model Y – its best-selling model – allowed it to cut related costs by 40%, the company has said.”

Reuters added that the cost of investing in megacasting machines could make it prohibitive for some established automakers.

“Tesla records most of its sales with just two models: the Model 3 and Model Y. High sales volume on just two platforms make it easier to justify the investment in new production technology. Other EV startups also have that advantage,” the article said. “For legacy automakers with more complicated product lineups and factory machinery that is already amortized, the decision to invest tens of millions of dollars in new casting technology can be a harder call, analysts have said.

“Cars with body sections cast into single pieces could also be harder or more expensive to repair after an accident. That could add to the cost of operation for EVs.”

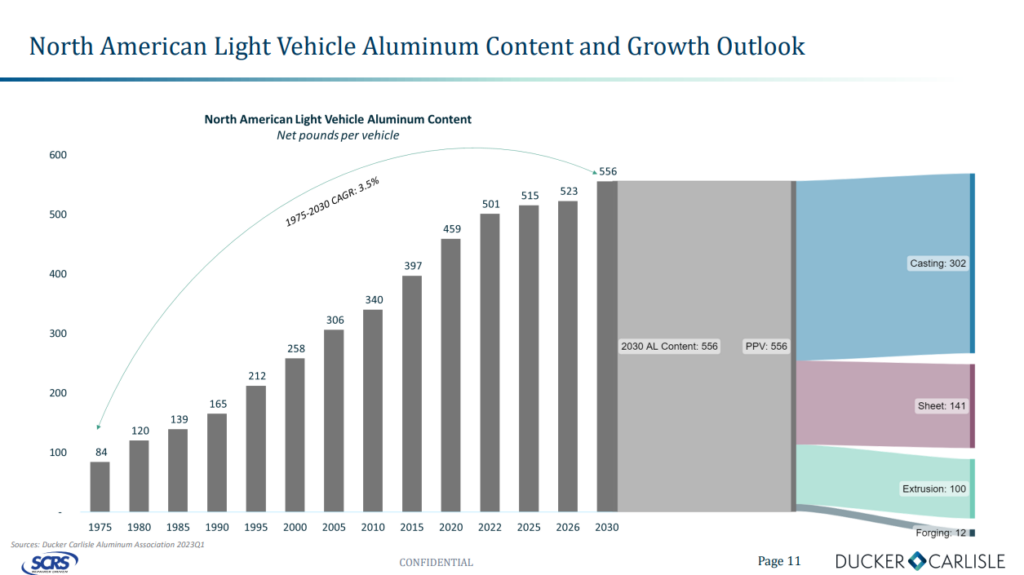

In presentations given by Ducker Carlisle during the OEM Collision Repair Technology Summit at SEMA, Automotive and Materials Principal Abey Abraham and Director and Global Automotive Practice Leader Bertrand Rakoto shared that it’s predicted 85% of the market will be light-duty trucks within the next few years, meaning more lightweighting to offset the often-heavy makeup of the vehicles.

“The change in the mix, the change in the market structure, in North America is also because, since COVID, we’ve seen the average price point of a vehicle jumping from $37,000 for an average new vehicle sold to $46,000,” he said. “The higher price points means also larger vehicles of course, but also for carmakers, they can make a little more margin.”

And more margin means more money for additional technology, more aluminum casting in the body-in-white, plastic fenders, and more, Rakoto added.

“Right now, the price point for BEVs is $66,000 [on] average, which means automakers have to pack a little more technology in there or the vehicles are a little more expensive to make,” Rakoto said.

Abraham noted that the automakers’ preference for monolithic material vehicles, made mostly of varying steel thicknesses, is no longer considered.

“In the last 15 years, we’ve seen a lot of innovation in steel and, of course, aluminum isn’t a new material to the industry either,” he said. “The use of aluminum today for its purposes are pretty stellar. In the past, we’ve seen aluminum used for performance gains, better handling, better acceleration, better braking and that transitions to nowadays as well.

“Aluminum is a very comfortable material to work with right now for both the OEMs and the repair markets but as we continue to evolve with the joining technologies, it’s not just welding a vehicle anymore.”

Images

Featured image courtesy of Idra Srl

Graphics courtesy of Ducker Carlisle