TransUnion: Auto insurance shopping up 12% YOY

By onMarket Trends

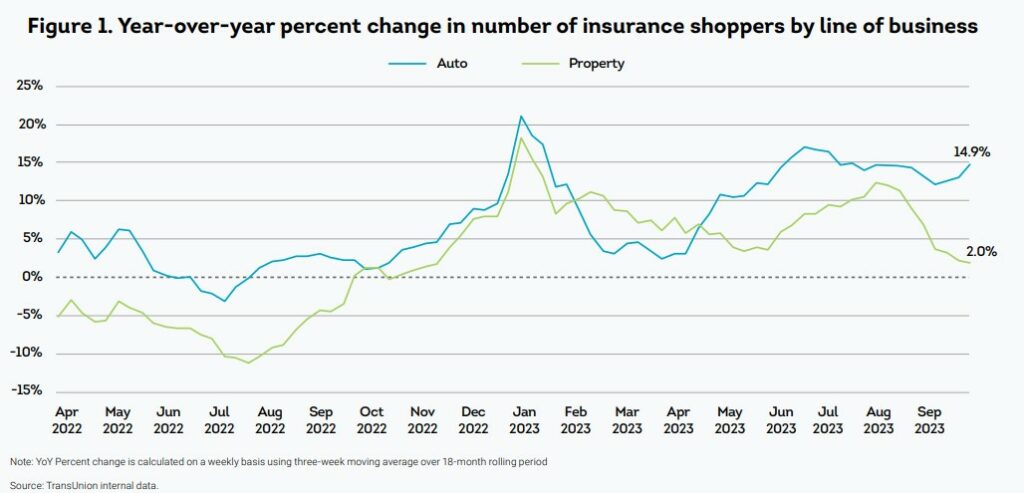

Auto insurance shopping was up 12% year-over-year during Q3, TransUnion said in its latest quarterly report.

Released Tuesday, TransUnion’s Insurance Personal Lines Trends and Perspectives Report found auto insurance rates remained flat compared to this year’s Q2, and that the search for lower premiums remained the top reason for customer shopping. Separately, Triple-I has forecasted that premiums will rise 10.4% this year.

“In addition to raising rates, insurers are employing other measures to improve their profitability, like suspending distribution and toughening underwriting standards,” said Stothard Deal, vice president of strategic planning for TransUnion’s insurance business. “These efforts have likely motivated consumers to expand their shopping activity with new insurers.”

The report found that new vehicle sales also played into the year-over-increase, saying that a strong labor market coupled with return-to-work policies likely motivated people to invest in new vehicles, thus necessitating the need to shop for insurance.

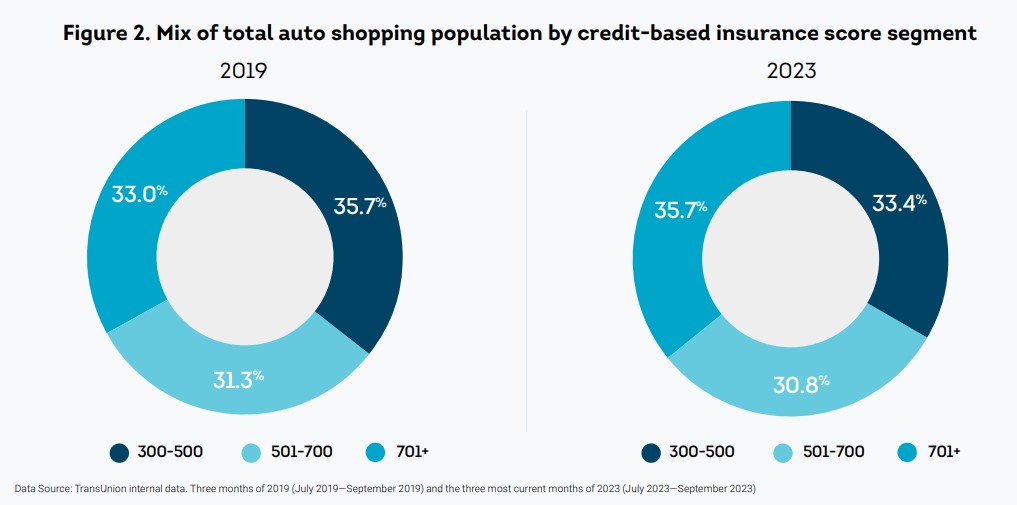

Among shoppers, those with higher credit-based insurance scores (CBIS) were more likely to shop for better deals, which is interesting given that the roles were reversed in 2019, TransUnion said.

When addressing what could be driving the trend, TransUnion said it could be that many people paid down debt and improved their credit scores during the height of COVID-19. In other words, it isn’t necessarily that more shoppers with good credit are shopping, but rather that the credit of those who’ve always been inclined to shop around has improved.

“Another potential factor is that recent rate increases are largely driven by base rate changes, impacting all customer segments,” the report said. “Some insurers had been shoring up profitability by targeting riskier and mispriced customer segments; now that lower-risk customers are getting hit with hikes, they’re more likely to shop for a better rate.

“Some households squeezed by inflation and rising premiums are responding by foregoing insurance altogether.”

Although there was no data in this report, TransUnion’s separate Q3 insurance consumer survey found that 15% of drivers have let their insurance lapse.

The earlier report, conducted by TransUnion and J.D. Power, found that among those without insurance, nearly 30% cited the inability to pay for coverage as the primary reason for not having it.

Looking ahead, TransUnion said in its latest report that rate increases are likely to continue among home and auto policies, although possibly at a less aggressive level.

“The pace of shopping may subside as the variance in prices between carriers narrows,” it said. “Increasing new vehicle sales will continue to positively impact auto shopping rates.”

Separately in October, new J.D. Power research found that P&C independent insurance agents were increasingly frustrated with rising carrier premiums and, instead of telling their clients first, were shopping for better rates ahead of policy renewals.

Not only could the impact be felt in repair center customers’ pockets but also in marketing and community relationship changes with agents who refer clients to businesses.

Year over year, personal lines satisfaction grew by 17 points to 774 on a 1,000-point scale and commercial lines reached 762, up six points. However, J.D. Power’s 2023 U.S. Independent Agent Satisfaction Study found that more agents are willing to move policies for a lower price to retain clients, even if they’re content with the existing carrier. More than 4,500 agents were surveyed.

Earlier this month, a public forum hosted by the Nevada Division of Insurance (DOI) heard that auto insurers are likely to remain challenged through 2025 because of “significant U.S. inflation” that has tripped the cost of repairs in recent years.

Michael DeLong, research and advocacy associate with the Consumer Federation of America (CFA), during the forum called out insurers for raising rates during the pandemic when fewer people were driving and practicing discriminatory pricing against minorities and low-income drivers.

“I also wanted to point out that it’s not just because of inflation; auto insurance rates have been going well up above the rate of inflation,” DeLong told the panel. “And as the rate of inflation has gone down in recent months, auto insurance premiums keep going up.”

A CFA report released in August found that drivers with fair or poor credit scores are, in some cases, paying more than twice as much as those with excellent credit and the same driving record. It indicated that compared to drivers with excellent credit, those with poor credit are paying 143% more in Florida, 172% more in Minnesota, and 263% more in Michigan.

“On average, a consumer with poor credit has to pay twice as much for auto insurance as a driver with excellent credit, even if everything else, including their driving safety history, are the same,” Douglas Heller, CFA’s director of insurance and the report’s co-author, said at the time.

He added: “Not only is this unfair to safe drivers, because of longstanding and institutional biases, the use of credit history for insurance pricing leads to disproportionately higher premiums for lower-income drivers and people of color.”

Images

Featured image courtesy of glegorly/iStock

Graphics courtesy of TransUnion