A.I. photo estimating startup Tractable: CCC lawsuit should be dismissed, arbitrated

By onBusiness Practices | Insurance | Legal | Market Trends | Repair Operations | Technology

Artificial intelligence photo estimating company Tractable last week requested a court dismiss CCC’s lawsuit alleging the startup inappropriately posed as an appraiser to probe CCC’s intellectual property and sent estimates misrepresented as from CCC.

But Tractable also on Dec. 20 urged the U.S. Northern District of Illinois court to hold off on dismissing the case and force CCC and Tractable into arbitration based upon CCC’s own terms of use. Tractable also reiterated its claim that the lawsuit was just a CCC attack on an A.I. photo estimating competitor.

Tractable’s motion to dismiss said the company was behaving like any other appraiser using CCC.

“Tractable works with insurers to provide artificial intelligence software to review auto repair appraisals and provide appraisals based on photographs of damage,” the company wrote. “… Consistent with the terms of the License, Tractable acted as an independent appraiser for the insurer and used CCC ONE to provide estimates to the insurer. Tractable received data from the insurance company reflecting car damage, entered its appraisals of the damage into the CCC ONE software, and communicated the estimates to the insurer. Tractable communicated the estimates in CCC’s format, which includes CCC’s marks.”

This is interesting if Tractable was writing actual estimates at least in part with its artificial intelligence. Asked if the estimates discussed in the CCC case were A.I.-generated through its software and just rekeyed into CCC, CEO Alexandre Dalyac replied in an email:

“Indeed, we interacted with the CCC software just like any human would. Our only reason in using the CCC software was to provide a proof-of-concept of our service to insurers that was integrated with their workflow.”

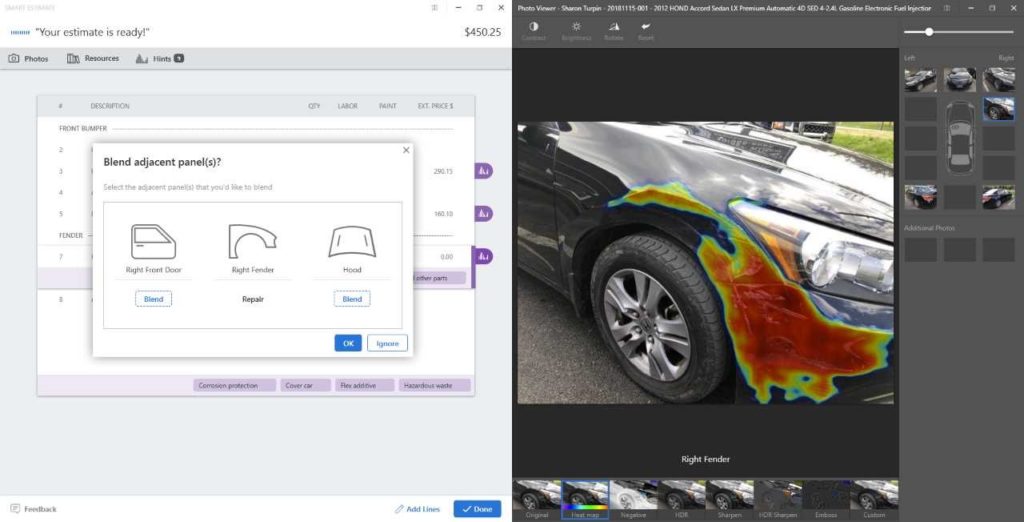

CCC will have its own A.I. photo estimating system available in the first quarter of 2019.

Reaching the “big data” threshold of partially A.I.-produced estimates in general should make for some interesting conversations between body shops, insurance companies and customers next year.

Tractable had been partnered with Mitchell, but the two parted ways this year, Mitchell confirmed Nov. 15. It declined to comment on the lawsuit or discuss its relationship with Tractable.

Appraiser license

Tractable signed up for an independent appraiser license in August 2017 so it could “access an insurance client’s claim processing workflow for a pilot project,” it wrote in the motion to dismiss memo. Tractable said it was “doing business as JA Appraisal” and sought a license for “Jason Chen” of JA Appraisal.

Employee Xing Xin, who was granted the license under the name “Jason Chen,” said in an affidavit that he told CCC he wasn’t using his own legal name but was granted the license anyway. However, none of the evidence presented by Tractable indicates it told CCC that it was behind JA Appraisal.

“Had CCC been aware of Tractable’s true intentions, CCC would not have granted Tractable (or “JA Appraisal”) a license to use CCC ONE,” CCC wrote in its Oct. 30 lawsuit. “Tractable knew this, and in order to surreptitiously take advantage of the integrated platform of CCC ONE, Tractable registered for the license under the fake name ‘JA Appraisal’ under the customer type ‘independent appraiser.’”

Tractable added more users until CCC terminated the license, according to CCC and Tractable.

CCC called JA Appraisal “a front for Tractable,” noting that its address was “associated with a guitar repair shop,” and no company by that name was registered in California. It alleged Tractable was “attempting to, on information and belief, gain access to CCC’s data and information and attempting to discern CCC’s algorithms and processes.”

“CCC routinely grants its software licenses to anyone who will pay and, in Tractable’s experience, never inquired into its counterpart’s identity and affiliations,” Tractable countered in its motion to dismiss. “… failure to register a doing business as name is ministerial and does not invalidate a contract. … Were the licensee’s identity or affiliations a material term, the License would so state on its face. Yet nowhere does the License require customers to represent or warrant anything about their corporate affiliation, party name, or authority to enter into the License.”

CCC began to investigate the matter after customers began mentioning connections between it and Tractable, starting in April.

“In or around April of 2018, one of CCC’s customers informed CCC at an industry conference that a company called Tractable had represented that it could write its own vehicle damage estimates offline and populate its estimates into CCC ONE, using the platform to communicate Tractable’s purported estimate to insurers,” CCC wrote. “Tractable purportedly did this in a way that made the estimate appear as though it was generated through CCC ONE. CCC did not believe Tractable’s purported use of CCC ONE was technologically possible, particularly since Tractable never obtained a license from CCC to use CCC ONE.”

Two more CCC customers in September and October 2018 said they saw Tractable estimates “that appeared to be written by CCC ONE.”

CCC accused Tractable of “generating its own estimates for these workfiles using its AI technology and manually overriding CCC’s system to input those estimates into the CCC ONE platform, making the estimates appear as if they were prepared through CCC ONE. Upon information and belief, Tractable would then communicate the estimates to insurance companies in the CCC ONE proprietary format that is unique to CCC.”

Tractable argued Dec. 20 that the estimates appeared to be from CCC because CCC’s software automatically put CCC’s trademark there.

“Tractable created estimates in the software and sent them to an insurer, consistent with the License,” the company wrote. “… CCC’s software places CCC’s mark on the estimates, not Tractable.” Dalyac wrote that Tractable only used CCC’s software because insurers couldn’t import EMS estimates written in third-party software. (This appeared to be a reference to insurer CCC licensees.)

CCC’s license also forbids altering any “proprietary notice of CCC” on documentation, which Tractable said meant “CCC expressly consented to—indeed mandated—the retention of CCC’s marks and notices on the estimates Tractable prepared using the CCC software.” (Emphasis Tractable’s.)

Tractable said CCC’s account shows “insurance customers were not confused; insurers knew that Tractable had prepared the estimate using CCC’s software (which was factually accurate).” (Emphasis Tractable’s.) Repair shops also were sophisticated customers who wouldn’t be confused, Tractable said.

Test file allegation

But Tractable did more than write what CCC estimated as 1,000 estimates for an insurer, according to CCC.

The information provider wrote that Tractable created about 1,100 workfiles “based upon a mix of real data, such as vehicle identification numbers, and created data, such as fake customer names.” Among the red flags, according to CCC, was the existence of “estimates for low dollar amounts that do not represent normal distribution of claim dollars in the industry, but are more typical of photo estimates written for low-velocity impacts.”

It accused Tractable of using those files to “perform structured tests of CCC ONE in an attempt to replicate its algorithms and mimic its software logic and/or database.”

“The proprietary CCC ONE platform is the cornerstone of CCC’s business, and as such, its data and algorithms are highly confidential,” CCC also told the court. “CCC ONE contains a wealth of data, including (as relevant here) prices of replacement parts, hours of labor to replace/repair parts and vehicle refinish time … Much of this data is derived from relationships with third-party sources that CCC has cultivated over decades as well as highly proprietary algorithms and calculations. The CCC ONE platform was created and is maintained for the benefit of CCC. The value of the integrated CCC ONE platform is well in excess of hundreds of millions of dollars.”

CCC also said its independent appraiser license is only for independent appraisers working with insurance companies to create an auto repair estimate.

“This limitation is an essential element of a legitimate license agreement, which expressly prohibits the appraiser from (among other things): copying or making derivative works of the programs; electronically transmitting the programs and/or services from one computer to another over a network, including the Internet; deriving or attempting to derive the source code, source files, or structure of all or any portion of the programs and/or services by reverse engineering, disassembly, decompilation or any other means; or using the programs and/or services and documentation for the benefit of any entity other than the independent appraiser,” CCC wrote.

Tractable noted that CCC hadn’t sued it under breach of contract for violating the terms of use.

Tractable denied that it had conducted any structured tests to duplicate CCC’s logic or algorithms. “CCC cannot plausibly plead that Tractable performed such tests (because those facts are untrue),” it wrote.

CCC’s software didn’t keep anything secret since the company sold it to “thousands of customers,” Tractable said, also noting that in any case, reverse engineering was legal.

Tractable’s litigation doesn’t discuss the CCC allegation that it sought to copy the CCC ONE database itself, which CCC called incredibly valuable.

“The proprietary CCC ONE platform is the cornerstone of CCC’s business, and as such, its data and algorithms are highly confidential,” CCC told the court. “CCC ONE contains a wealth of data, including (as relevant here) prices of replacement parts, hours of labor to replace/repair parts and vehicle refinish time … Much of this data is derived from relationships with third-party sources that CCC has cultivated over decades as well as highly proprietary algorithms and calculations. The CCC ONE platform was created and is maintained for the benefit of CCC. The value of the integrated CCC ONE platform is well in excess of hundreds of millions of dollars.”

Asked about the allegation that Tractable was copying the actual data, which is different than reverse-engineering, Dalyac replied: “Again, we used CCC in the exact same way thousands of other estimators use the service. We never did nor intend to use the software to build any kind of database. To be clear: our systems do not contain any CCC intellectual property.”

Tractable also said that calling itself “JA Appraisal” wasn’t misrepresentation. Misrepresentation is not allowed under trade secret law, according to the company.

Damages sought

CCC’s lawsuit accused Tractable of one count of violating the Defend Trade Secrets Act of 2016, one count of violating the Computer Fraud and Abuse Act, common law fraud and unjust enrichment.

It also accused Tractable of trademark infringement (since Tractable allegedly wasn’t authorized to use the CCC or CCC ONE trademarks) and false designation (for allegedly using those marks to “confuse, mislead, and deceive insurers, vehicle repair shops, and others into believing” its estimates were really tied to CCC.)

Finally, it alleged state-level counts of violating the Illinois Trade Secrets Act of 2016, Illinois Uniform Deceptive Trade Practices Act and trespass.

“CCC have launched a lawsuit without attempting any dialogue for resolution,” Dalyac said. “We believe CCC sees Tractable as such a threat that they are taking extreme steps to slow down our market adoption. Efforts to stymie innovation hurt insurers and the overall industry.”

CCC demanded the court order Tractable to quit using the CCC ONE platform and CCC’s trademarks; destroy or return anything it received from CCC; and never mislead anyone that Tractable’s products are related to CCC. CCC also seeks statutory, punitive and compensatory damages and restitution as well as attorneys fees. CCC also noted it deserved “exemplary damages” for Tractable’s alleged “willful and malicious” violations of the state and federal Trade Secrets Acts and treble damages for Tractable’s alleged “knowing, deliberate, malicious and willful” trademark violations.

Images:

Artificial intelligence photo estimating company Tractable in December requested a court dismiss CCC’s lawsuit alleging the startup inappropriately posed as an appraiser to probe CCC’s intellectual property and sent estimates misrepresented as from CCC. (the-lightwriter/iStock)

CCC in December said some insurers were testing its artificial intelligence photo estimating system Smart Estimate, which it planned to start selling to all car carriers in the first quarter of 2019. (Screenshot provided by CCC)

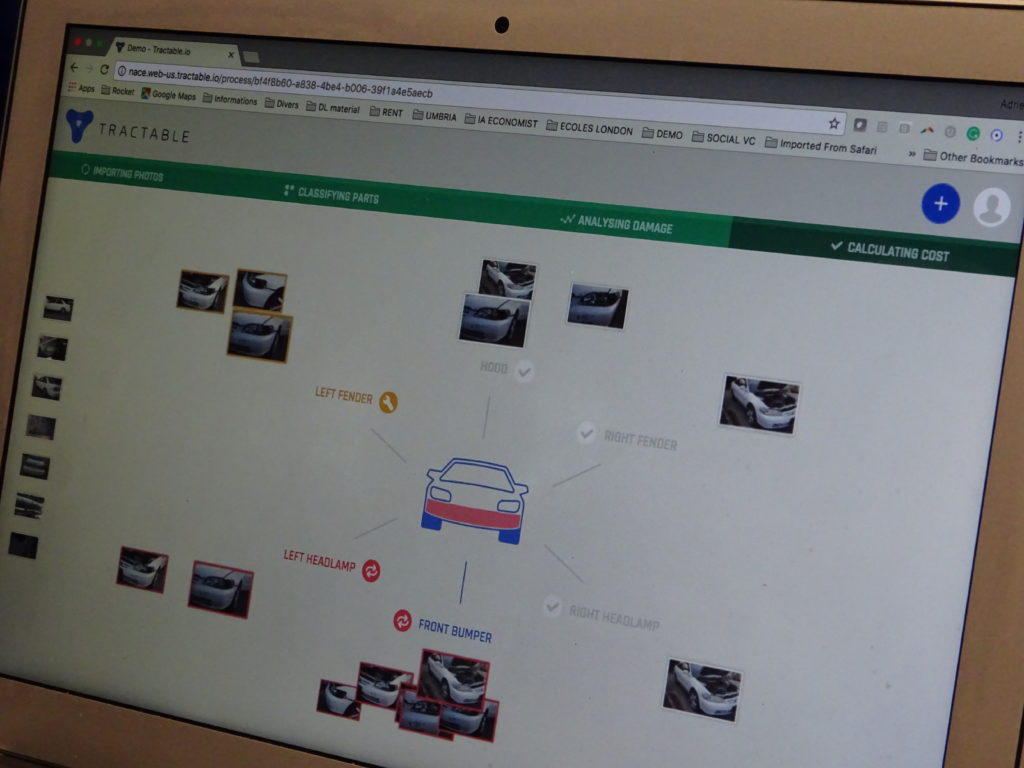

Tractable uses artificial intelligence to identify parts of a car and the damage to those parts based on photos of the vehicle. (John Huetter/Repairer Driven News)