Shape future committee work, discuss ADAS, scanning at Palm Springs CIC

By onAnnouncements | Associations | Business Practices | Education | Insurance | Legal | Market Trends | Repair Operations | Technology

The Collision Industry Conference on Friday announced an agenda packed with ADAS and scanning sessions for next week’s meeting in Palm Springs, Calif.

It seems to be a sign of how large vehicle electronics now loom over collision repair and the repairers, insurers and other industry stakeholders participating in CICs. In fact, the first agenda item specifically referencing traditional metal or refinish work doesn’t come until noon — and that’s just the fact that the lunch was sponsored by paint giant AkzoNobel.

In this vein, the new Data Access, Privacy & Security Committee has asked the industry to answer a brief 3-minute online survey regarding the ownership and security of data generated during a vehicle scan. Take it here.

The second half of the meeting is largely dedicated to CIC’s future. The annual January gathering serves as the planning meeting for the event, and attending the Thursday, Jan. 17, event will allow a stakeholder to focus CIC’s various committees on the issues he or she cares about.

CIC meetings are nonbinding summits in which the collision repair ecosystem can debate and learn about issues that affect the industries within. Anyone is welcome, and there’s still time to register at the advance rate of $65 instead of the $75 door rate.

Here’s a look at the agenda highlights:

Scanning and ADAS

8 a.m.: New CIC Chairman Jeff Peevy (Automotive Management Institute) will open his first CIC. In November, Peevy said he has been a neutral industry participant for 20 years, and “I will continue that.” However, he said he would charge attendees and the industry with the “safety of the passengers in the vehicles that ride in the cars that we repair.”

8:30 a.m.: The Emerging Technologies Committee will present “How ADAS/Safety Systems are Impacting our Industry, a Statistical view,” according to the agenda. Committee Chairman Jack Rozint is a Mitchell senior vice president (sales, service and repair-auto physical damage), so this could be a good opportunity to learn about any research the information provider has conducted on the matter.

CCC research published in 2018’s “Crash Course” suggested advanced driver assistance systems worked successfully to decrease not only the frequency but also the severity when a vehicle was involved in a front-end collision.

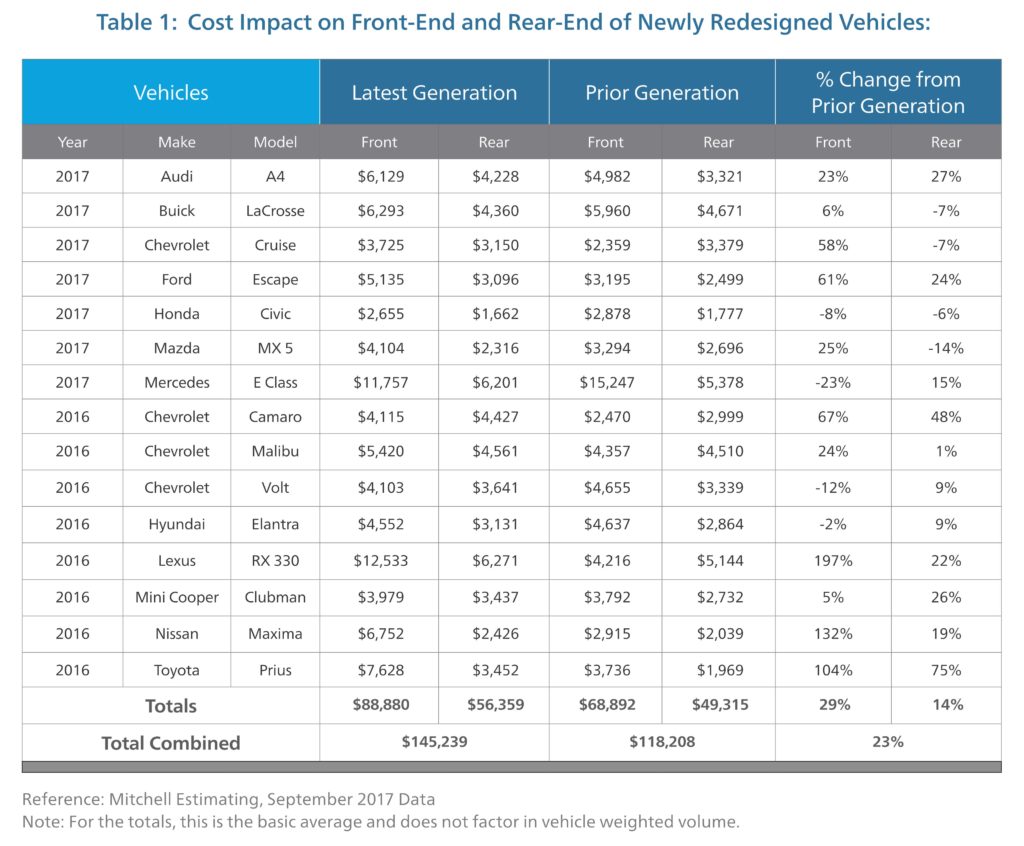

In 2017, a Mitchell analysis of 15 popular luxury and mainstream vehicles found the cost of front-end collisions rose 29 percent and rear-end repair bills rose 14 percent following a major redesign. “The primary cost drivers are the increased use of sensors, radar systems (especially on the luxury vehicles), and headlamps on the redesigned vehicles,” Mitchell auto physical damage consulting and professional services Vice President Hans Littooy wrote then.

The 8:30 session will also include a “special presentation on the impact new vehicle safety systems are having on the estimating process” by Accountable Estimatics CEO Roger Cada. This should be important for both insurers and repairers. The existence of ADAS might introduce additional labor operations, not all of which will carry an estimating system time.

9:30 a.m.: The Education and Training Committee will hold a panel discussion on “ADAS/Safety Systems Training Availability and Requirements.” I-CAR has some courses on the topic, and the OEMs no doubt do. It’ll be interesting to hear about those and what else is out there — and how well-prepared collision repairers and insurers are on the topic. Even a shop that tries to outsource ADAS calibration or even installation probably needs some training to avoid inadvertantly compromising the technology. (For example, incorrectly repairing or painting a fascia over a sensor.)

10:45 a.m.: AsTech industry relations director Jake Rodenroth has in the past peppered Emerging Technologies Committee presentations with entertaining — and alarming — real-world repair outcomes on tech-equipped vehicles. We’ll get more in that vein Jan. 17 when he presents “Repair Scenarios Created by ADAS/Safety System Vehicle Capabilities.”

“A technical look at various real-world situations created from scanning and/or the need to,” the CIC agenda describes the session.

11:15 a.m.: The Data Access Committee will “host a special presentation from attorney Patrick McGuire on the issues related to data generated from scanning and other safety systems related activities.”

Paramount is who owns the data and who can access it. This brings up a number of issues for shops, customers, insurers, OEMs and authorities. Here’s one example:

As CIC Definitions Committee Co-Chairman Chris Evans (State Farm) observed in a 2016 NACE panel, scan data is part of the “facts of the loss,” and it’s an appropriate thing for insurers to know. But you don’t want a situation like one panel emcee Mike Anderson of Collision Advice recounted, in which a customer sued a body shop after a scan legitimately revealed an issue wasn’t crash-related.

Collision Diagnostic Services that year shared a sample customer consent form which explains the need to scan and the fact that this data might be provided to an insurer. That way, a shop is theoretically protected. (Run it by a qualified attorney in your state first, of course.)

Other food for thought ahead of McGuire’s talk: If the OEM owns the data, can they restrict third-party repairer access to it? If the customer owns the data, can the OEM still look at it? Can a leasing dealership or auto loan financier? What should a shop do if police want a customer’s scan data? Until regulators, courts and industries get these issues hashed out, you’re going to want to check out presentations like McGuire’s.

1 p.m.: A special presentation by Greg Potter, executive manager of the Equipment and Tool Institute, will likely fit nicely into the electronics-heavy front half of the CIC. The ETI has a significant diagnostics focus.

The CIC agenda states Potter will discuss how his organization “works to facilitate the information flow between the OEM’s and aftermarket tool providers for the benefit of the industry.”

Other highlights

As noted above, other sessions at the Jan. 17 CIC will look to the future. Here’s some items to watch on that front.

2 p.m.: The Insurer-Repairer Relations Committee will poll the audience for direction on what it should examine.

2:40 p.m.: The Parts and Materials Committee is on the agenda with a session on “Future Plans and Discussion about OEM parts definitions.” This could be interesting if it examines the issue of the vaguely defined category of parts bearing designations like “Opt-OE,” “Alt-OE,” etc. — something the state of California recently emphasized wouldn’t be appropriate on an estimate.

3:30 p.m.: Collision Repair Education Foundation development director Brandon Eckenrode has an announcement related to the CIC’s Nashville, Tenn., meeting in April.

3:45 p.m.: The Governmental Committee will poll the audience too.

4 p.m: I-CAR CEO John Van Alstyne will also speak about about “important upcoming changes,” likely a reference at least in part to the organization’s significant overhaul of its Gold Class and Platinum programs.

Other CIC Week events

Palm Springs will also house other events for repairers and others in the area CIC Week, including:

12-5 p.m. Monday, Jan. 14: National Auto Body Council board meeting

7 a.m. Tuesday, Jan. 15: NABC golf fundraiser

8:30-10 a.m. Wednesday, Jan. 16: Society of Collision Repair Specialists open board meeting

8:30 a.m.-noon: Wednesday, Jan. 16: Collision Industry Electronic Commerce Association board meeting

6:30 p.m. Wednesday, Jan. 16: CIC reception

6-8 p.m. Thursday, Jan. 17: Collision Industry Foundation gala fundraiser

More information:

Jan. 17 Collision Industry Conference information and registration

Collision Industry Conference Jan. 17 agenda

Images:

Collision Industry Conference Chairman Jeff Peevy (Automotive Management Institute), right, addresses the CIC on Oct. 30, 2018. CIC Administrator Jeff Hendler (J.D. Hendler / Associates) is at left. (John Huetter/Repairer Driven News)

A Mitchell analysis of 15 popular luxury and mainstream vehicle found the cost of front-end collisions rose 29 percent and rear-end repair bills rose 14 percent following a major redesign. (Provided by Mitchell)