‘Who Pays?’: 80+% of auto body shops say insurers paying scans ‘most,’ ‘all’ of the time

By onAnnouncements | Business Practices | Education | Insurance | Market Trends | Repair Operations | Technology

A fall survey of several hundred collision repairers found virtually all of them seeking payment for pre- and post-repair scans and insurers frequently agreeing to cover that bill.

More than eighty percent of the shops responding to the October 2019 “Who Pays for What?” reported insurers covering pre- or post-repair diagnostics “most” or “all” of the time when shops invoiced it. Both operations saw double-digit percentage point gains over 2018 in insurers willing to pay with such frequency.

The “Who Pays?” studies by Collision Advice and CRASH Network examine whether eight of the nation’s largest insurers “pay” for various not-included operations when the shop requests it and how frequently shops charge for such items. Technically, the shop would be charging the consumer — the party truly on the hook for the final bill — with the insurer in turn reimbursing the claimant for some or all of what they paid the shop. So the “Who Pays?” results matter to consumers as well.

Help the collision industry by taking the current “Who Pays for What?” survey focusing on refinish operations before Feb. 1. All answers are kept confidential; data is published only in the aggregate.

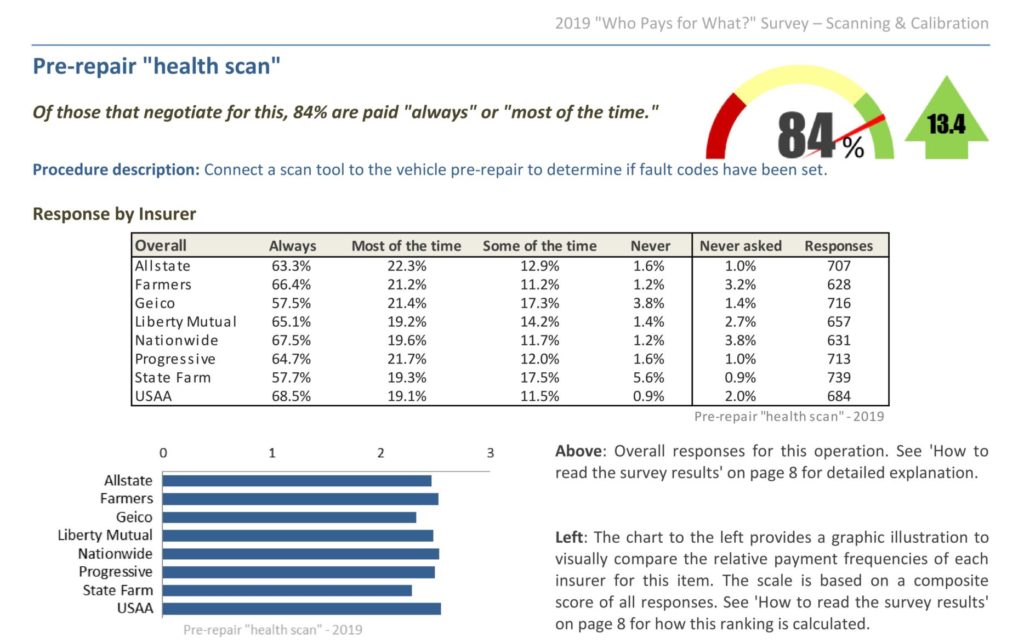

More than 95 percent of shops in October 2019 said they billed for a pre-repair health scan, a procedure deemed a best practice to avoid delays and surprises during the repair process and called mandatory by many OEMs. 84 percent said insurers paid them for doing so either “always” or “most of the time” — a 13.4 percentage point gain over 2018. (The margin of error is 3.4 percentage points with a 95 percent confidence level if 805 shops are represented.)

“It’s encouraging to see this has gone up so much,” Anderson wrote of the results in the study. “I think this is in part because virtually all automakers are calling for pre-repair scanning, but I think, too, that the industry is becoming more educated about the importance of this procedure.”

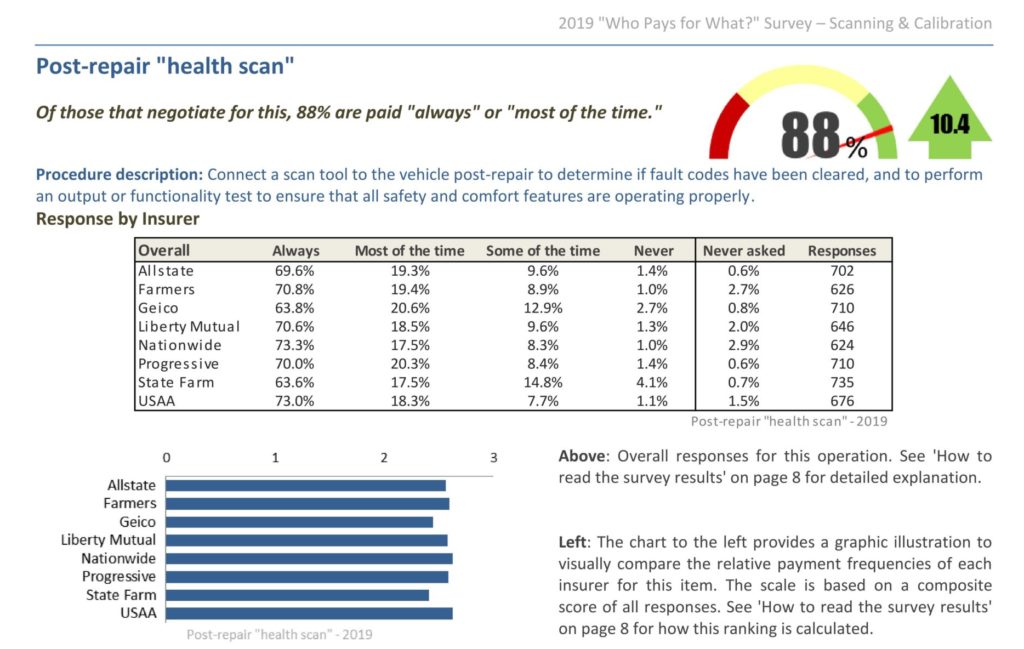

More than 95 percent of repairers also requested payment for post-repair scanning, and 88 percent of them had been paid “most of the time” or “always” — up 10.4 percentage points.

“It’s encouraging to see this has gone up so much,” Anderson wrote. “I think it’s important to understand that there are not dash lights for every function that may not be working on a vehicle. Some vehicles need to be driven a certain distance or have a set number of key cycles before a dash light is triggered. So the post-repair scan has to be done to ensure all the safety and comfort features of the vehicle are working properly. There is no dash warning light, for example, that tells you the Bluetooth feature isn’t working. There may be no dash light for blind-spot monitoring

or adaptive cruise control. So I look forward to the day when post-repair scans are being paid 100 percent. …

“It’s also interesting to note that there are very few shops NOT seeking to be paid for post-repair scanning,” Anderson wrote. “This is different from some of the other procedures where a significant percentage of shops aren’t getting paid because they’re not seeking to be paid. In this case, when shops aren’t being paid, it’s generally because of friction from the insurance carriers. But also remember that an insurer refusing to pay for a post-repair scan does not remove your shop’s liability for not conducting a scan.”

Shops do seem to understand their responsibility better, according to Collision Advice and CRASH Network:

In the survey conducted this past fall, just 11% of shops said they might skip a post-repair scan because no dash lights are lit – not a legitimate reason – but in the same survey in 2016, nearly half of all shops (44%) said that was a reason they might skip the scan. Likewise, three years ago about 1 in 5 shops said they didn’t perform scans because they don’t have the tools necessary to perform the scans. In the latest survey, just 2% used that as an excuse.

Payment practices have evolved as well. Back in 2016, a “Who Pays” survey found that more than 30% of all shops said that one of the reasons they didn’t perform a post-repair vehicle scan was that insurers didn’t pay them for the procedure. Three years later, just 12% of shops say a lack of insurer payment is one of the reasons they might not perform a vehicle scan.

October 2017 “Who Pays for What?” data also revealed 50 percent of surveyed shops failed to perform a post-repair diagnostic check at least once because they felt the damage was too minimal. Fifty-three percent had the same story regarding pre-repair scanning when polled by Collision Advice and CRASH Network for the study.

“That scares me,” Anderson said during a talk at the August 2018 NACE MSO Symposium.

“Who in a shop thinks they are more knowledgeable about the vehicles than the automaker engineer to make those types of decisions?” Anderson wrote in the January 2018 “Who Pays?” report. “Even a minor hit can have an effect on the parking sensors or cameras used for adaptive cruise control. And you will not know that unless you perform a scan. You are making arbitrary decisions that could affect someone’s life.”

A comparison of the carriers in the new “Who Pays?” finds No. 1 State Farm and No. 2 GEICO lagging slightly behind their rivals in terms of consistency of reimburshing shops for pre- and post-scans. This is interesting, as State Farm and USAA historically are the most likely to pay shops for various operations studied in “Who Pays?” polls. Nevertheless, both State Farm and GEICO remain highly likely to pay a shop reimbursing for the work.

Anderson recommended repairers “capture the ‘freeze frame’ or ‘snapshot’ data (which shows when trouble codes were set, or how many times the keys have been turned on/off since the code was set) as documentation to substantiate the line item(s) on the estimate or invoice.”

More information:

Collision Advice and CRASH Network, Jan. 7, 2020

Images:

An OBD-II connector is shown. (albln/iStock)

An October 2019 “Who Pays for What?” study found more than 80 percent of several hundred repairers reporting that leading insurers were reimbursing pre- and post-repair scans “most” or “all” of the time. (Provided by Collision Advice and CRASH Network)