SBA issues interim rules for PPP loan forgiveness, but Congress might still ease them

By onAnnouncements | Business Practices | Legal | Market Trends | Repair Operations

As some of the initial borrowers exhaust their Paycheck Protection Program loan funds, the Small Business Administration has issued its interim final rule on how companies can avoid having to pay it back.

According to law firm FordHarrison, the guidance came out May 22.

However, the interim final rule might not be so final. It’s possible Congress could loosen the PPP loan terms, based upon a bill the U.S. House passed Thursday 417-1.

Of course, some of the changes in House Resolution 7010, the Paycheck Protection Program Flexibility Act of 2020, might be too late for early adopter collision businesses which already spent their PPP funds, but it might aid other shops who received loans later in the spring. The PPP process opened April 3.

PPP loans

The nearly $660 billion PPP initiative started by the CARES Act helped small businesses and employees weather the economic slump from the COVID-19 pandemic response by permitting cheap, loose and forgivable credit.

It involved 1 percent, two-year, SBA-guaranteed loans for up to about 2.5 months of payroll (capped at $10 million). Individual employee earnings above $100,000 don’t count as payroll.

The SBA has said loan principal and interest should be forgiven if the business spends 75 percent of the funds on payroll (which is also defined to include costs like benefits) and the rest on payroll, mortgage or other pre-existing debt interest, rent or utilities during the eight-week period immediately after the loan.

The business must also restore employee pay and full-time employee headcount to sufficient pre-pandemic levels (non-seasonal businesses can use either Feb. 15-June 30, 2019, or Jan. 1-Feb. 29, 2020 as the benchmark) by June 30.

Pay cuts of more than 25 percent remaining after that date reduce the proportion of the loan which will be forgiven, as do persisting decreases in full-time employees.

“Borrowers seeking forgiveness must document their average number of FTE employees during the covered period (or the alternative payroll covered period) and their selected reference period,” the SBA interim final rule states. “For purposes of this calculation, borrowers must divide the average number of hours paid for each employee per week by 40, capping this quotient at 1.0. For example, an employee who was paid 48 hours per week during the covered period would be considered to be an FTE employee of 1.0.

“For employees who were paid for less than 40 hours per week, borrowers may choose to calculate the full-time equivalency in one of two ways. First, the borrower may calculate the average number of hours a part-time employee was paid per week during the covered period. For example, if an employee was paid for 30 hours per week on average during the covered period, the employee could be considered to be an FTE employee of 0.75. Similarly, if an employee was paid for ten hours per week on average during the covered period, the employee could be considered to be an FTE employee of 0.25. Second, for administrative convenience, borrowers may elect to use a full-time equivalency of 0.5 for each part-time employee. The Administrator recognizes that not all borrowers maintain hours-worked data, and has decided to afford such borrowers this flexibility in calculating the full-time equivalency of their part-time employees.”

The agency won’t double-dip the reductions — it won’t count a laid off worker as also having their salary reduced to $0. It’ll handle headcount drops in the aggregate and payroll cuts individually.

“For example, if a borrower had 10.0 FTE employees during the reference period and this declined to 8.0 FTE employees during the covered period, the percentage of FTE employees declined by 20 percent and thus only 80 percent of otherwise eligible expenses are available for forgiveness,” the SBA said of workforce reductions.

In contrast, here’s how the SBA would handle a pay cut from $1,000 a week to $700 per week for a full-time employee working the same hours: “In this case, the first $250 (25 percent of $1,000) is exempted from the reduction. Borrowers seeking forgiveness would list $400 as the salary/hourly wage reduction for that employee (the extra $50 weekly reduction multiplied by eight weeks).”

The loans went live April 3, which means some of the first batch of recipients have hit the eight-week mark to spend the money and are nearing the point where they’d use the forgiveness process.

The SBA has confirmed this eight-week period could start either the day the borrower received the cash or the first day of their first payroll cycle.

“A borrower has a bi-weekly payroll schedule (every other week),” the interim final rule states. “The borrower’s eight-week covered period begins on June 1 and ends on July 26. The first day of the borrower’s first payroll cycle that starts in the covered period is June 7. The borrower may elect an alternative payroll covered period for payroll cost purposes that starts on June 7 and ends 55 days later (for a total of 56 days) on August 1. Payroll costs paid during this alternative payroll covered period are eligible for forgiveness. In addition, payroll costs incurred during this alternative payroll covered period are eligible for forgiveness as long as they are paid on or before the first regular payroll date occurring after August 1. Payroll costs that were both paid and incurred during the covered period (or alternative payroll covered period) may only be counted once.”

The SBA interim final rule states that money paid to furloughed employees counts as “payroll costs,” as do hazard pay and bonuses.

“The Administrator, in consultation with the Secretary, has determined that this interpretation is consistent with the text of the statute and advances the paycheck protection purposes of the statute by enabling borrowers to continue paying their employees even if those employees are not able to perform their day-to-day duties, whether due to lack of economic demand or public health considerations. This intent is reflected throughout the statute, including in section 1106(d)(4) of the Act, which provides that additional wages paid to tipped employees are eligible for forgiveness. The Administrator, in consultation with the Secretary, has also determined that, if an employee’s total compensation does not exceed $100,000 on an annualized basis, the employee’s hazard pay and bonuses are eligible for loan forgiveness because they constitute a supplement to salary or wages, and are thus a similar form of compensation.”

Forgiveness process

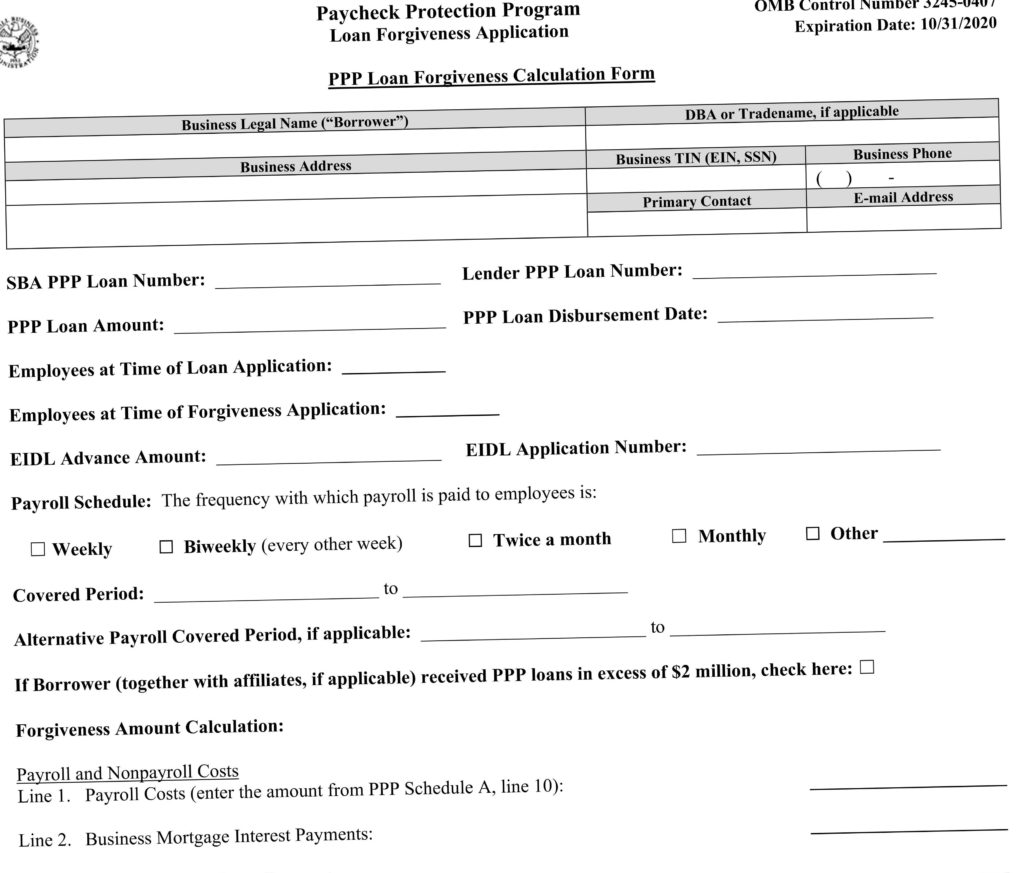

According to the SBA, you’ll need to complete the form issued by the agency May 15 (or an equivalent document) and bring it to your lender, who will make the decision on if the loan deserves forgiveness, subject to SBA review. Documentation necessary is spelled out on the form.

The feds have vowed to review every loan exceeding $2 million “in addition to other loans as appropriate” for need following embarrassing disclosures of large national brands receiving PPP loans. However, they’ll also presume anyone borrowing $2 million or less did so in good faith. That said, the feds can still examine any PPP loan they desire.

The lender has up to 60 days to make a decision after you apply for forgiveness, according to the CARES Act and the interim final rule. The SBA has 90 days to pay back the lender after that call has been made.

“As a general matter, the lender will review the application and make a decision regarding loan forgiveness,” the interim final rule states. “The lender has 60 days from receipt of a complete application to issue a decision to SBA. If the lender determines that the borrower is entitled to forgiveness of some or all of the amount applied for under the statute and applicable regulations, the lender must request payment from SBA at the time the lender issues its decision to SBA. SBA will, subject to any SBA review of the loan or loan application, remit the appropriate forgiveness amount to the lender, plus any interest accrued through the date of payment, not later than 90 days after the lender issues its decision to SBA. If applicable, SBA will deduct EIDL Advance Amounts from the forgiveness amount remitted to the Lender as required by section 1110(e)(6) of the CARES Act. If SBA determines in the course of its review that the borrower was ineligible for the PPP loan based on the provisions of the CARES Act, SBA rules or guidance available at the time of the borrower’s loan application, or the terms of the borrower’s PPP loan application (for example, because the borrower lacked an adequate basis for the certifications that it made in its PPP loan application), the loan will not be eligible for loan forgiveness. The lender is responsible for notifying the borrower of the forgiveness amount. If only a portion of the loan is forgiven, or if the forgiveness request is denied, any remaining balance due on the loan must be repaid by the borrower on or before the two-year maturity of the loan. If the amount remitted by SBA to the lender exceeds the remaining principal balance of the PPP loan (because the borrower made scheduled payments on the loan after the initial deferment period), the lender must remit the excess amount, including accrued interest, to the borrower.”

If your lender incorrectly deems you to not deserve forgiveness, you can appeal to the SBA.

“When the lender issues its decision to SBA determining that the borrower is not entitled to forgiveness in any amount, the lender must provide SBA with the reason for its denial, together with (1) the PPP Loan Forgiveness Calculation Form; (2) PPP Schedule A; and (3) the (optional) PPP Borrower Demographic Information Form (if submitted to the lender),” a separate recent interim final rule on SBA PPP review states. “The lender must confirm that the information provided by the lender to SBA accurately reflects lender’s records for the loan, and that the lender has made its decision in accordance with the requirements set forth in 2.a. The lender must also notify the borrower in writing that the lender has issued a decision to SBA denying the loan forgiveness application. SBA reserves the right to review the lender’s decision in its sole discretion. Within 30 days of notice from the lender, a borrower may request that SBA review the lender’s decision by reviewing the loan.”

The SBA also said in that second final rule that a borrower can “appeal SBA’s determination that the borrower is ineligible for a PPP loan or ineligible for the loan amount or the loan forgiveness amount claimed by the borrower. … SBA intends to issue a separate interim final rule addressing this process.”

PPP and Congress

On May 21, the Society of Collision Repair Specialists, the U.S. Chamber, and more than 130 other trade groups asked congressional leaders, Treasury Secretary Steven Mnuchin, and Small Business Administration Administrator Jovita Carranza for three changes to the Paycheck Protection Program.

“The current rules made sense when the program was created, and it was anticipated that stay-at-home orders would last only a few weeks,” the groups wrote. “However, their implementation in the current environment is making it harder for small businesses to survive. Small businesses that close permanently will never be able to rehire their employees.”

The trade groups asked lawmakers and officials to end the Small Business Administration’s “75%-25% rule,” let businesses spend the money over a longer period than the first eight weeks of the loan’s life and still have it forgiven, and “extend the June 30 safe harbor date for rehiring and restoration of pay.”

The Democrat-controlled House’s HEROES Act, which passed 208-199, contained all three of the trade groups’ ideas, adding specifics to the latter two.

While that $3 trillion bill appears to be dead in the Republican-controlled Senate, altering the PPP terms appears to have bipartisan appeal, considering the near-unanimous House vote on H.R. 7010 Thursday.

“At its core, representation begins with listening,” PPP Flexibility Act co-sponsor Rep. Dean Phillips, D-Minn., said on the House floor. “… Our small business owners, the institutions of our Main Streets and the glue of our communities, are asking us to take action, to solve problems and to engage in some good old-fashioned teamwork. … This bill will help people in the ways that they need, and we have not a moment to lose.”

“For the past two months, I’ve heard from business owners in Central Texas who want to keep their employees on the payroll, continue serving their communities, and — mostly — stay afloat until they are allowed to be fully back open for business,” co-sponsor Rep. Chip Roy, R-Texas, said in a statement Thursday. “The Paycheck Protection Program (PPP) has helped many of them do just that, but I have heard from far too many business owners that the program, as it stood, needed changes to make it work for them. … Fortunately, our bipartisan bill puts Americans first and will ensure our favorite small business are around on the other side. I am thankful to my colleagues for their overwhelming support today, and I look forward to its swift passage in the Senate.”

The PPP Flexibility Act by would give small business PPP borrowers more than eight weeks to spend their loans and have all the debt forgiven. Recipients would have 24 weeks or until Dec. 31, whichever comes first. They’d also have until Dec. 31 instead of June 30 to rehire employees and still be eligible for full debt forgiveness. Both of these provisions existed with the HEROES Act.

While the HEROES Act dropped the “75%-25% rule” entirely, the PPP Flexibility Act merely reshapes it into a 60-40 split.

“To receive loan forgiveness under this section, an eligible recipient shall use at least 60 percent of the covered loan amount for payroll costs, and may use up to 40 percent of such amount for any payment of interest on any covered mortgage obligation (which shall not include any prepayment of or payment of principal on a covered mortgage obligation), any payment on any covered rent obligation, or any covered utility payment,” H.R. 7010 states.

Thursday’s measure also increases the maturity of the loan to five years, up from the current two, just as the HEROES Act did.

The bill also echoes the SBA’s guidance that a business unable to rehire an employee during the time period won’t be penalized. It also will give a pass to employers who cut staff and have “an inability to hire similarly qualified employees for unfilled positions on or before December 31, 2020.”

Both of these were in the HEROES Act, as was an allowance for businesses who weren’t as busy as they were before the pandemic. However, the PPP Flexibility Act is a little stricter on what kinds of lower-performing businesses qualify for that exemption.

The HEROES Act merely said a business could ignore a reduction in headcount for loan forgiveness purposes if it “is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.”

The PPP Flexibility Act will let job cuts slide if a company in good faith “is able to document an inability to return to the same level of business activity as such business was operating at before February 15, 2020, due to compliance with requirements established or guidance issued by the Secretary of Health and Human Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safety and Health Administration during the period beginning on March 1, 2020, and ending December 31, 2020, related to the maintenance of standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID–19.”

The new bill also allows borrowers to defer payments “including payment of principal, interest, and fees, until the date on which the amount of forgiveness … is remitted to the lender.” The CARES Act had set deferral to between six months to a year; the SBA chose to make it six months.

USA Today reported Thursday that the Senate could examine the bill next week

“Florida GOP Sen. Marco Rubio, who chairs the Senate Small Business Committee, has said he expects most of those proposed changes from the House to be acceptable to the Senate,” USA Today wrote. “One possible disagreement could emerge over the House provision extending the loan amount to 24 weeks, Senators have discussed a short period, such as 16 weeks.”

Be heard: Congressional contact information can be found here.

Small Business Administration interim final rule on PPP forgiveness

Small Business Administration, May 22, 2020

Small Business Administration interim final review on PPP loan review

SBA, May 2020

PPP loan forgiveness application and instructions (Form 3508)

Small Business Administration, May 15, 2020

SBA “Coronavirus Relief Options” page

SBA Paycheck Protection Program (PPP) webpage

List of PPP lenders in your state

Paycheck Protection Program FAQs

USA Today, May 28, 2020

Images:

Small Business Administration Administrator Jovita Carranza is sworn in. (Provided by Small Business Administration)

The form to apply for Paycheck Protection Program loan forgiveness is shown. (Provided by Small Business Administration)

U.S. Rep. Dean Phillips, D-Minn. (Provided by Phillips’ office)

U.S. Rep. Chip Roy, R-Tex. (Provided by Roy’s office)