Limit of liability language can help turn totals to repairables

By onBusiness Practices | Insurance | Legal | Repair Operations

A Texas public adjuster earlier this year used GEICO’s own policy language to prevent the insurer from totaling a vandalized Cadillac with an actual cash value above the cost of repairs.

The incident demonstrates how a carrier’s contractually established liability limits and joint right to appraisal can be leveraged by an auto body shop or customer who’d prefer not to total a vehicle. Particularly in Texas, which doesn’t consider a vehicle a total loss until the repair bill reaches 100 percent of the car’s cash value.

Auto Claim Specialists recently provided us with data from more than 700 total loss appraisal clause actions found vehicles were actually worth around $3,500 more than the insurance company had initially estimated. That discrepancy is large enough to suggest that invoking the appraisal clause can flip some ostensibly totaled vehicles back to being repairable.

For example, let’s say a body shop writes a car for $10,000 and the insurer values the car at $9,000. It appears to be a total loss. But the customer invokes the appraisal clause, and the insurer and consumer representatives conclude the car’s actually worth another $3,500. It’s now cheaper for the insurer to fix the vehicle for $10,000 than to total and buy it for $12,500.

If the insurer’s policy liability limit says the carrier owes the lower of the two prices — the cost to repair a vehicle versus the car’s actual cash value — then the shop and consumer can demand such a vehicle be fixed. (So can the insurer, for that matter.)

Cash value and repair cost

Auto Claims Specialists recently handled a total loss decision and valuation dispute which illustrates these concepts. In this case, GEICO had actually estimated a higher vehicle cash value than a Texas shop’s repair bill right from the start. The consumer’s invocation of the appraisal clause produced an even wider disparity — yet GEICO at first still insisted on totaling the vehicle.

GEICO had estimated it would cost $6,649.21 to fix the vandalized 2014 Cadillac CTS. Paris, Texas-based Scott’s Collision calculated the repair cost at $13,600.79 (after tax).

Scott’s Collision owner David Norris described the damage to the CTS as “solely vandalism.” No question of vehicle safety existed, he said.

According to Auto Claims Specialists managing director Robert McDorman, GEICO totaled the vehicle anyway — only to have CCC in January calculate its actual cash value to be $15,041.

“A quick look at the math clearly shows $13,600.79 is less … still, GEICO resisted and told the insured they had no options, and the vehicle was being deemed a Total Loss,” McDorman wrote in an email May 22. “Scott’s Collision was in the middle of the repair and had already ordered all parts. Scott’s Collision referred the client to us, we invoked the right of appraisal in the contest of the repair or replace.”

Norris said the customer viewed the CTS as his final vehicle and last hurrah. The customer felt, “‘I want to drive that car before I die,'” Norris said.

Under the typical “right to appraisal” (RTA) process, either the customer or insurer can use an “appraisal clause” within a policy to resolve a dispute over the amount owed in a claim. Both parties hire separate appraisers, such as Auto Claim Specialists, to evaluate the totaled vehicle or repairable vehicle damage. If the two sides’ appraisers agree on a dollar value, that amount is binding on the customer and insurer. If the appraisers can’t come to a resolution, they agree to hire an “umpire,” who also conducts their own assessment. If the two appraisers agree or one appraiser and the umpire agree on an amount, that value is binding.

In this case, McDorman and GEICO’s designated appraiser SCA Appraisal in March agreed the CTS was worth $19,500 — beating CCC and GEICO’s estimate by more than $4,000 and the repair bill by nearly $6,000.

“CCC’s valuation solution delivers fair, market-driven valuations for customers,” CCC said in a statement. “CCC uses extensive data from local markets across the U.S. to derive values that are individual to the loss vehicle.”

Limit of liability

Yet GEICO refused to let the vehicle be repaired, according to McDorman. “GEICO still argued the Cadillac would remain a Total Loss,” he wrote in an email.

Auto Claims Services sent an ultimatum to GEICO to cover the rest of the repair bill or it would recommend the consumer take legal action. McDoramn quoted the insurer’s own limits of liability as compelling vehicle repair:

“LIMIT OF LIABILITY

1. Our limit of liability for loss will be the lesser of the:

a. Actual cash value of the stolen or damaged property.

b. Amount necessary to repair or replace the property with other of like kind and quality; or

c. Amount stated in the Declarations of this policy.” (Original formatting unclear.)

“GEICO is contractually required to comply with the appraisal process and to pay the sum determined to be the lesser of the actual cash value of the damaged property or the amount necessary to repair the property,” McDorman wrote in the letter.

The insurer ultimately agreed to the repair. “That’s what we all want,” Norris said.

Norris said GEICO paid the vehicle owner the entire total loss value anyway.

“They overpaid the repair claim,” he said. The shop issued a refund check back to the customer.

“He’s driving his car,” Norris said.

Norris noted that the “beautiful part” about the outcome involved GEICO covering all of the operations and rates the insurer says they “never pay for.”

“They paid it all,” he said. They paid it all and then some.”

GEICO did not respond to a request for comment.

“I’m not here to fix a total loss,” Norris said. Instead, he expressed objection to situations where a vehicle is “portrayed and forced into total loss” but “they’re really not.”

Scott’s Collision doesn’t often encounter situations where a total loss is flipped back to a repairable one following the use of an appraisal clause. He said the shop fixes about 35 cars a month, and the “great majority of them are very repairable vehicles.”

However, “it does happen,” Norris said, estimating perhaps a dozen incidents over the past 1.5 years. He said he refers customers to McDorman, and “it’s always been a success.”

Norris said he wanted shops to know there’s a “lot more vehicles to repair out there” It’s about finding out what a customer “really truly wants,” Norris said. If they want their vehicle fixed, this can be achieved, and shops will have more work. “It’s that simple,” Norris said.

Learn more about appraisal clauses at Repairer Driven Education

Auto Claims Services managing director Robert McDorman will teach body shops about appraisal clauses during the Society of Collision Repair Specialists’ Repairer Driven Education Nov. 1-5 during SEMA 2021. Register for “Complete Understanding Of The Right Of Appraisal” on Nov. 3 for $75, or buy a full-series pass for $375. Visit www.scrs.com/rde to learn more and register.

Incentives

Norris said he’s currently battling an insurer over a truck at risk of being declared a total, though he was “100 percent confident” it’ll ultimately be resolved repairable. Though the repair will be pricey — “north of $40,000” — it’s still thousands of dollars cheaper than the vehicle value, according to Norris.

But on top of that compelling argument for repairing the truck, there’s another reason the consumer would desire to fix the vehicle. Norris said the owner bought the truck back when 0 percent financing was available — a “great deal.”

Even if the insurer paid the owner a proper settlement for the totaled truck, “the consumer is still taking it in the shorts,” Norris said. The hot vehicle market right now means the consumer would never get financing terms that good, nor would they have an easy time finding a replacement truck at all, according to Norris.

“It’s a bad deal all the way around,” he said.

Meanwhile, the insurer could command a good price for the totaled truck on the salvage market, according to Norris. In fact, since the cost to repair is lower than the vehicle’s cash value, the state of Texas would permit the carrier to sell the truck without a salvage title — despite totaling it.

“There is little doubt since the GEICO estimate was below the Actual Cash Value GEICO would most likely have not transferred the title into their name as a salvage title if the Total Loss went through,” McDorman wrote of the Cadillac claim. “Meaning this vehicle would have been marketed by the Salvage Auction as having a clean title. The odds of this vehicle falling into the hands of a less than reputable rebuilder increase substantially. …

“(I)t was in their best economic interest regardless of what their LIMITS OF LIABILITY in the policy stated.”

GEICO did not respond to a request for comment.

Norris suggested that a repair bill creeping up near the total loss threshold tempts an insurer to think, “‘What makes more sense for us?'”

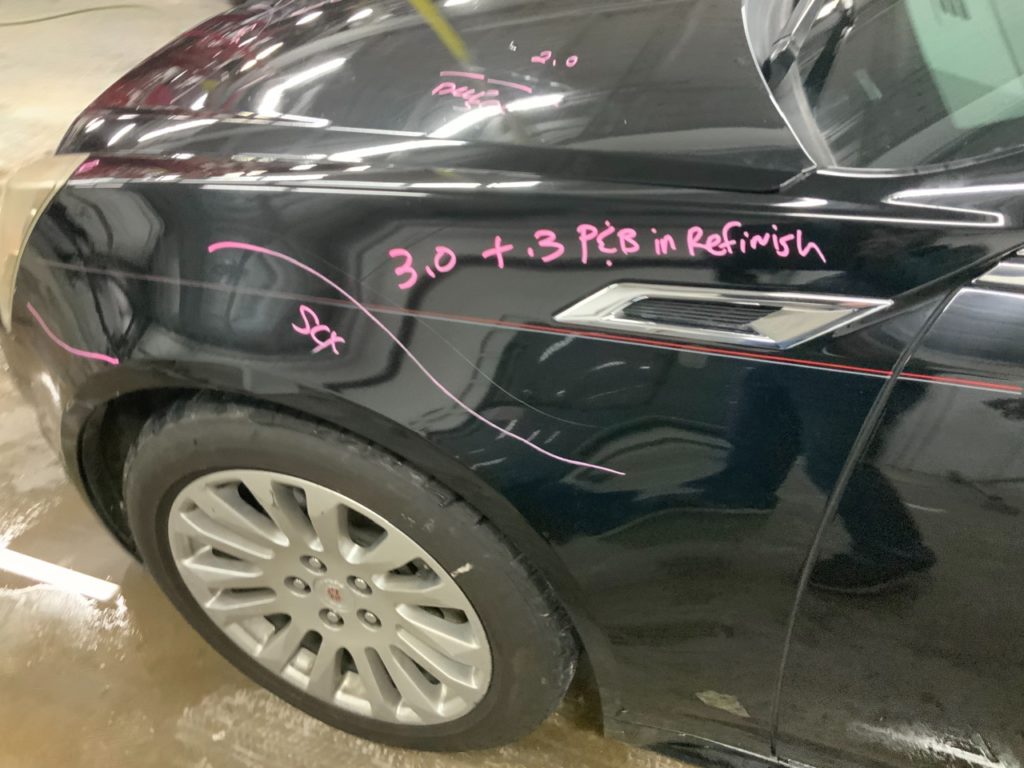

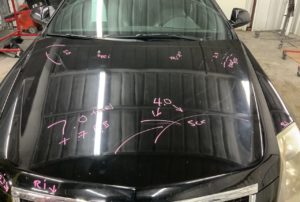

Featured images: This vandalized 2014 Cadillac CTS allegedly originally had been declared a total loss by GEICO despite having a cash value above the cost of repairs. (Provided by Scott’s Collision)