New York to require most private employers to offer a retirement plan or enroll in theirs

By onAnnouncements | Associations | Business Practices | Collision Repair | Legal | Market Trends

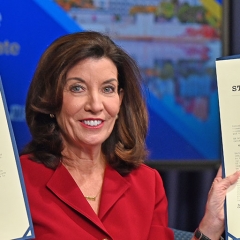

New York Gov. Kathy Hochul signed legislation ensuring and requiring retirement plan options for private sector employees on Thursday.

Assembly Bill A3213A mandates that private sector employers of 10 or more who don’t provide their employees with a retirement savings plan must automatically enroll them in New York State’s Secure Choice Savings Plan.

The Secure Choice Savings Plan that was established in 2018 is “a self-sufficient retirement savings program in the form of an automatic enrollment payroll deduction IRA.” The program – in which enrollment previously was entirely optional — is overseen by the New York State Secure Choice Savings board that’s composed of nine appointed members.

The Department of Taxation and Finance will oversee the development and implementation “as the board sees fit.”

Employees can opt out of the program at any time.

Employees can opt out of the program at any time.

This legislation is expected to affect 2.5 million private-sector employees in New York who are not offered retirement savings plans through their jobs.

“Part of ensuring that New Yorkers are financially stable is guaranteeing they have a reliable retirement plan,” Hochul said through a release. “This legislation allows all workers to have a sense of relief and security when it comes to retirement.”

Eddie Kizenberger Jr., Executive Director for the Long Island Auto Body Repairmen’s Association for 11 years, strongly disagreed with this move.

While Kizenberger said he “understands where this is coming from” and, “Obviously, retirement benefits for employees is super important,” he reeled off the current financial problems — chiefly a shortage of parts and workers leading to much longer storage and repair times — collision repair shops are facing.

“This is just adding another level of difficulty for the collision repair industry,” Kizenberger said. “New York has been one of the most small business unfriendly states in the country,” and he sees this as an example of that.

If you’re thinking this is only a New York requirement that doesn’t matter because you live far from there, think again.

This could very soon hit close to your home if it hasn’t already. Some 28 states have either adopted similar legislation or are considering it, according to the Pension Rights Center.

“Businesses offer retirement plans for different reasons,” said Scott Broaddus, Certified Financial Planner, accredited investment fiduciary, Equity Partner at Irongate Capital Advisors and the investment advisor for the Society of Collision Repair Specialists’ (SCRS) 401(k) program. “Some may use the match as a form of employee profit sharing. Others feel it’s necessary to recruit the best talent.

“But now some states are getting involved and passing legislation that will require companies to offer a retirement plan. With 25 percent of the workforce looking to retire in the next 10 years, I expect this will be a major focal point for states.”

According to a Collision Repair Education Foundation survey that polled over 675 shops, only a touch more than 50 percent of shop owners offer retirement savings benefits. That continues a dip that started in 2013.

The SCRS Multiple Employer Plan — which pools the resources and power of the collective membership — could be the solution.

“I work with nonprofits and associations all across the country who manage retirement plans for employees and their members,” Broaddus said. “Before deciding to offer a retirement solution to their members, SCRS spent 18 months learning about everything from plan designs to venders and options that already exist.

“They ultimately picked a plan that was tailormade for their membership, hired the vendors and negotiated pricing up-front that declines for all participants as the plan grows. SCRS Executive Director Aaron Schulenburg and the Investment Committee have been amazing advocates for the participants in this plan.”

For more information on the SCRS MEP, please go to: Now is the time to explore the SCRS 401(k) plan! – Society of Collision Repair Specialists

The New York requirement has been in the works since May 11, when the state General Assembly voted in favor, 125-22. On June 7, the state Senate voted 44-19 to approve.

“Governor Hochul is empowering millions of working New Yorkers to save for a financially secure and independent retirement – while providing small business an effective way to attract and retain employees,” said Beth Finkel, AARP’s New York State Director. “AARP applauds the Governor for signing this bill into law, and we thank her for her support of Secure Choice since before its enactment in 2018.”

On Aug. 9, New York City approved something similar – the Retirement Security for All acts – for private sector businesses that employ five or more.

Those employers who don’t offer retirement plans will need to automatically enroll their employees who are at least 21 and work at least 20 hours per week into the city-run savings plan.

That program has not yet been put into action as the city’s Retirement Savings Board has two years to formalize the program details and set a start date.

Images:

Featured: New York Gov. Kathy Hochul (governor.ny.gov)

Other images: Statue of Liberty, New York City (spyarm/iStock)

More information:

Decisely: Employers saving on association health, retirement plans like SCRS’ reinvest into staff

Webinar: Lower fees in pooled SCRS plans add up big for employees over time