NAIC, CFA reports show 2020 insurer profitability

By onCollision Repair | Insurance | Market Trends

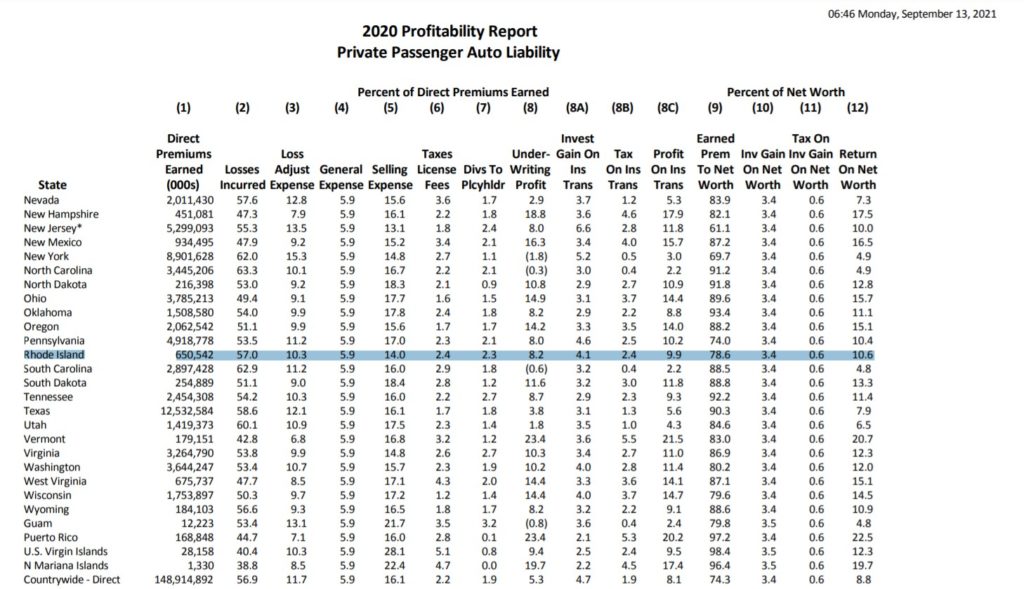

The National Association of Insurance Commissioners (NAIC) “Report on Profitability by Line by State in 2020 – 2021 Edition” states private passenger auto insurers countrywide collected more than $250.6 billion in premiums last year and are asking for more money from customers going into 2022.

“The auto insurers made just enormous amounts of unexpected profit and so it has been described by Consumer Federation of America and The Center for Economic Justice as not just windfall profits, but excess premium profit,” said Erica Eversman, a NAIC consumer representative and Automotive Education & Policy Institute founder.

The purpose of the NAIC report, released on Dec. 21, is to estimate and allocate profitability in Property & Casualty Insurance (P&C) by state and by line of insurance, which when combined with other information can be used to further analyze competition and market performance, according to the report.

NAIC also states in the data used in the report was obtained from annual financial statements and exhibits filed with the NAIC by 2,870 P&C insurers and it’s estimated that in excess of 95% of the premiums written in the U.S. are represented.

The NAIC warns the report can’t and shouldn’t be used to determine whether current rates are adequate to cover future costs.

Investment gains on insurance transactions by states ranged from a high of 17.1% in Michigan to a low of 1.7% in Arkansas, North Dakota and Guam. However, the report notes that in 2019 and 2020, Michigan auto liability losses incurred decreased significantly, likely due to Michigan’s no-fault reform in which companies reduced their reserves for the mandatory fee schedule effective on all procedures rendered on or after July 2, 2021. It also recognizes “reporting anomalies” from Michigan Catastrophic Claims Association (MCCA) data.

Return on net worth countrywide was 10.2%, up from 6.9% in 2019 and from 4.8% in 2011. The U.S. state with the highest return on net worth was North Dakota at 22.9% while Florida had the lowest at 3.7%. Only one other state, Mississippi, had a return below 5% while 27 states had returns between 10-15%.

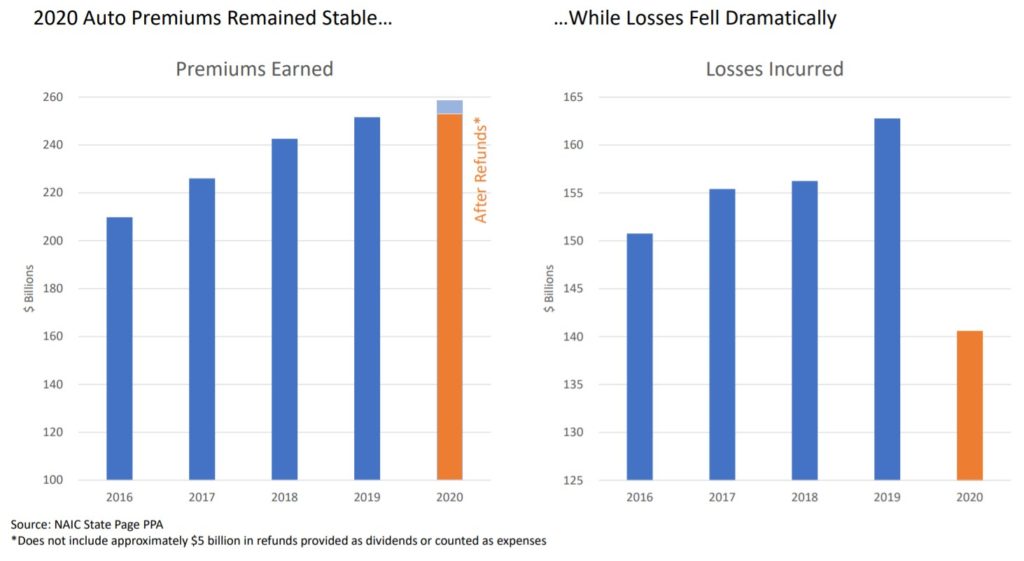

A CFA and CEJ Analysis of US Auto Ins 2020 profits claims a $29 billion windfall deserved more regulatory attention as Americans struggled throughout the COVID-19 pandemic. Referencing NAIC data, the CFA states in the report that 2020 auto premiums “remained stable while losses fell dramatically.”

When insurers have leftover money after keeping some reserved to cover pending claims they’re supposed to return the money to the policyholders, Eversman said.

“We know that a significant amount of that did not happen last year,” she said. “The auto insurers made $42 billion in profits. They returned $13 billion to their insureds. They basically kept $29 billion. That has been an issue of enormous contention over the last year to two years.”

Despite the windfall, Eversman said insurers are pointing the finger at consumers for premium increases because they think “consumers can’t be trusted to act properly.”

“They asked for increases in 2021 and are asking for them in 2022 because the auto insurers’ position is that motor vehicle parts are difficult to source, which is not untrue,” Eversman said. “Accordingly, vehicles that can be repaired are now often sitting in repair facilities waiting on parts and so the insurers are paying out far out more than anticipated in rental car costs and that their total loss costs are higher because vehicles are worth a lot more at the moment.”

In her work with dealers, Eversman said vehicles are being sold for $4,000 to $8,000 over sticker price. However, insurers claiming that higher premiums are due to repair and labor costs increasing is exaggerated, she said.

One such instance can be seen in recent Rhode Island legislation as the American Property Casualty Insurance Association make their cases to legislators against overriding Gov. Dan McKee’s July 16 veto of the Unfair Claims Practices Act (H6324 and S870) that would require insurers to pay for markups and other charges relating to auto body shops’ paint and material and sublet expenses. APCIA has claimed that an override of McKee’s veto could lead to higher auto insurance premiums.

Rhode Island insurers in 2020 earned nearly $10 million in private passenger auto premiums leading to a return on net worth of 10.6%, according to the NAIC report.

IMAGES

Featured image: Credit: skodonnell/iStock

Referencing NAIC data, the CFA states in the report that 2020 auto premiums “remained stable while losses fell dramatically.” (CFA report screenshot)

NAIC reported Rhode Island insurers had a return on net worth of 10.6% in 2020. (NAIC report screenshot)