Auto insurance shopping, carrier switching increases again in Q1

By onInsurance

J.D. Power and TransUnions’s Q1 2023 loyalty indicator and shopping trends (LIST) report found that insurance shopping continued to increase and GEICO, for the first time since the report has been released, didn’t have the highest number of new customers who switched from other carriers.

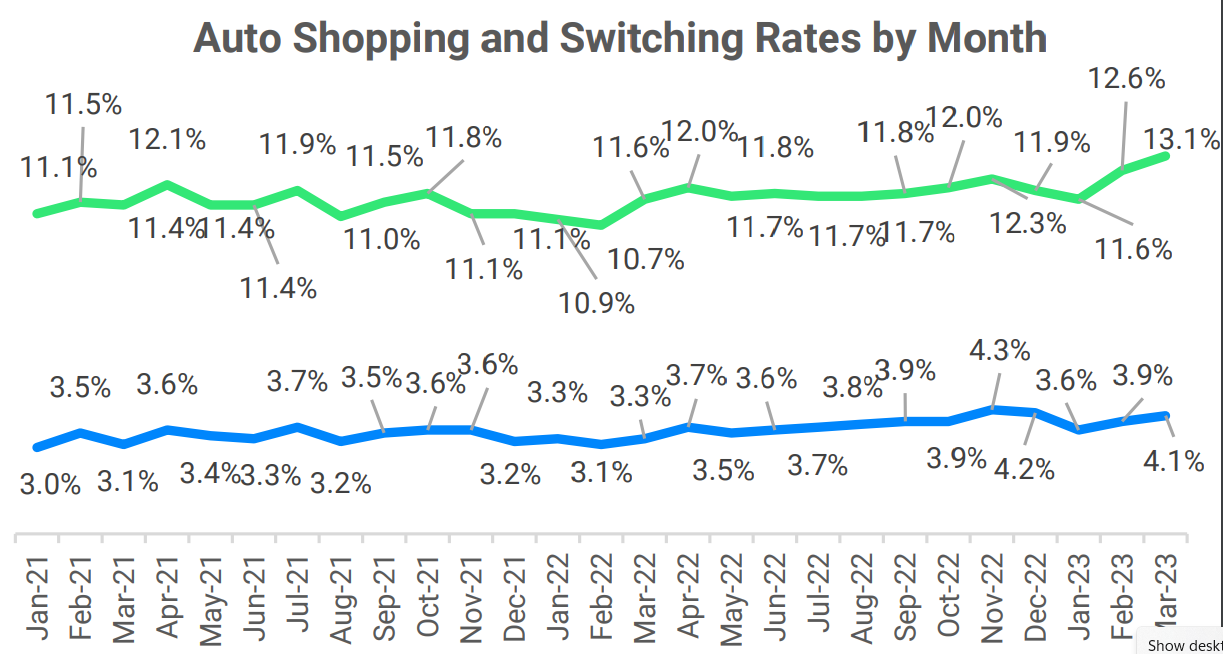

The report found a nearly half percent quote rate increase over Q4 2022 to 12.4%. However, a slowdown in shopping that began in December and lasted into January “made a dramatic turnaround” in February from 11.6% to 12.6% then 13.1% in January. The March figure is a new record.

The report also notes that insurance shopping tends to be higher in April so a new record may be achieved this month, J.D. Power said.

Q1 was the first time since the LIST report found GEICO didn’t capture the largest share of its largest competitor’s customers, which last happened in Q4 2022. In January, J.D. Power and TransUnion reported that shopping spiked 12% in Q4 despite holding steady the previous quarter.

According to the most recent report on Q1, American Family Insurance was the only carrier to lose business to USAA while USAA only lost business to Progressive. Allstate, Farmers Insurance, GEICO, and Liberty Mutual also lost business to Progressive. Some Nationwide, Progressive, and Travelers policyholders took their business to State Farm.

GEICO also lost business in California to State Farm as well as local carriers ACSC and CSAA when it closed down its locations in the state.

Erie had the highest customer loyalty while COUNTRY had the lowest. Of the major carriers, GEICO came in at No. 3 and Progressive at No. 4 in lowest customer loyalty. Nationwide came in at No. 7 for customer loyalty, State Farm at No. 9, Farmers at 18, and Allstate at 19. Liberty Mutual and American Family tied at 20.

J.D. Power recently ranked Erie Insurance No. 1 among property and casualty insurers for customer satisfaction. Erie also took the top spot among personal lines insurers.

J.D. Power notes that the personal insurance industry has been on a roller coaster ride over the last three years because of the COVID-19 pandemic.

“Typical new business seasonality has been mired by COVID-19 surges, inflation, and vehicle inventory challenges. Normal influencers of shopping events such

as tax refunds, vehicle purchases and marketing programs have been delayed or paused, while carriers seek a return to profitability with rate increases,” the report reads.

TransUnion Senior Director of Personal Lines Market Strategy Michelle Jackson said the primary reason for auto and property lines insurance shopping recently has been due to premium increases.

For example, Allstate began filing auto insurance rate actions in late 2021, raising its rates by 10% since the fourth quarter of that year. Last August, it implemented rate increases of 14.5% across eight locations, resulting in a total premium impact of 3.2%. Since the start of 2022 through last October, the carrier has implemented 72 rate increases averaging approximately 10.3% across 51 locations.

Allstate CEO Tom Wilson was compensated with a $1.38 million salary, $2.39 million annual cash incentive, and $11.6 million in long-term equity despite Allstate’s claims it has struggled to keep its auto insurance sector profitable amid inflation and supply chain challenges.

State Farm’s auto insurance underwriting loss was $3.5 billion in 2021. By year-end 2022, its net worth was $131.2 billion compared to $143.2 billion at 2021 year-end and $126.1 billion at 2020 year-end.

GEICO cut 7% of its 41,000-person workforce last year and raised premiums due to “struggling with accident claims and properly pricing policies to reflect risk,” according to Reuters. Berkshire predicts GEICO will generate an underwriting profit in 2023. The company recently announced plans to outsource much of its in-house IT operations as a cost-cutting move, according to WGLT.

J.D. Power says GEICO is struggling to maintain its share of customers in response to closing down sales channels in states where they were rate inadequate, according to the Q1 LIST report, which Progressive has benefited from with an increase in customers.

The report notes that inflation remains high and retention rates are the lowest they have been in six years, from 90% in 2018 to 87% in Q1 2023.

Auto insurance carriers are expected to raise premiums by an average of 8.4% this year after a slight 0.6% increase in 2022, according to ValuePenguin’s State of Auto Insurance in 2023 report.

Insurify’s latest report on auto insurance trends predicts that the average annual car insurance rate will rise by another 7% to $1,895 this year, based on historical trends and the current state of the industry. In 2022, the nationwide average cost of car insurance rose by 9% to $1,777, according to the report.

Images

Featured image credit: glegorly/iStock

Graph taken from J.D. Power and TransUnion’s Q1 2023 loyalty indicator and shopping trends (LIST) report courtesy of both companies.

More information