AI in insurance: Majority of surveyed policyholders trust fully automated claims processing

By onInsurance

Based on new research, the MarketWatch Guides Team finds that the insurance industry’s use of artificial intelligence (AI) may only increase due to customer demand and isn’t far off from making real-time underwriting possible.

Seventy-nine percent of tech-savvy car insurance customers would trust a claims process fully automated by AI, according to a Solera Innovation survey leading MarketWatch to believe insurance underwriting of the future may include myriad data points about a customer’s lifestyle and driving habits.

“A future where smart devices track myriad aspects of your life and share that data with insurance companies is just one possibility,” MarketWatch wrote. “But even if the technology exists, people may not want to share that level of information with companies. Would you share your smartwatch information with your insurance provider for the chance to get a discount?

“Car insurance companies will rely on AI more and more as time goes on. For the consumer, this should mean better customer experience, quicker underwriting approval, and faster claims processing.”

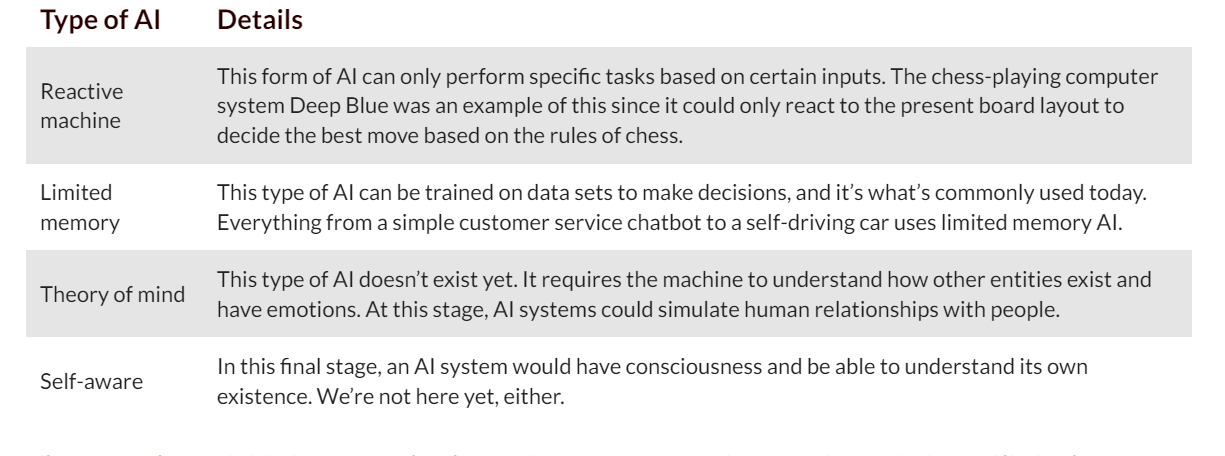

According to MarketWatch there are four types of AI based on functionality and carriers use them, or some of them, in varying ways:

Insurance carriers today are using limited memory AI, such as ChatGPT, which analyzes existing data, performs tasks, and can create new content based on its training, MarketWatch says.

In underwriting, AI benefits carriers in speeding up the decision-making process of determining customer risk and discovering claims patterns in certain locations or demographics that humans might not spot, according to MarketWatch. Its report says AI is also helpful in claims fraud detection, customer service, and telematics for usage-based insurance (UBI).

“But the future of AI in car insurance may look different altogether,” MarketWatch wrote. “Let’s think about risk assessment. Car insurance premiums are based on the risk profile of a driver. If you have recent tickets or at-fault accidents in your driving history, you’ll pay more for coverage. But the amount of data traditionally collected for a new customer is fairly basic. It includes the information you fill out to get a quote — your address, driving history, vehicle information, and age — and data like your credit-based insurance score.

“Two people who have the same facts on paper can still present different risk profiles. That’s why some companies have used AI to revamp the quote process to collect more data… Instead of just improving existing processes for car insurance companies, AI is helping companies offer things that wouldn’t be possible 10 years ago.”

MarketWatch calls photo capturing by AI “one exciting development” of the technology used in claims processing. However, collision repair shops dispute the accuracy of relying on photo-based estimates because photos may not be as accurate in showing damage compared to in-person inspections. That means initial repair estimates tend to vary greatly, usually lower, than estimates written in shops after inspection and disassembly.

However, 79% of “tech-savvy customers” surveyed for Solera’s 2022 Innovation Index said they would trust car insurance claims run entirely by AI. The survey defined “tech-savvy” car insurance customers as those who had used some type of digital claims technology within the previous year.

Ninety-two percent of the respondents said they want self-serve tools for managing claims.

A separate survey, conducted by AI-driven automotive data management company, CerebrumX Labs, of more than 2,000 insurance and fleet business leaders found that only 29% said they’re currently using AI tools for their insurance portfolios.

Roughly 71% of respondents said they aren’t using or are unsure of use at their companies.

Thirty-four percent said it’s difficult getting all members of the team onboard with AI adoption and usage strategies, while 29% pointed to budget constraints as reasons to not adopt AI.

Thirty-eight percent said they’re still relying on a manual review process for driving performance and claims data. As for UBI pricing programs, 28% said they’re using them.

“We believe this data tells us there is more education needed for the insurance industry in helping them understand how to leverage the right platforms to access and analyze the data needed for today’s AI-powered insurance programs,” said Sandip Ranjhan, CEO of CerebrumX. “It is important for insurance and fleet executives to ensure they have access to advanced platforms and technology that help collect data from disparate sources, including OEM and maintenance partners, to develop effective usage-based insurance programs that can benefit drivers.”

Another article by MarketWatch in a series called “The Future of Car Insurance,” focuses on EVs, noting that there are already more than 3 million on U.S. roads and, as of February, 130,000 public chargers nationwide, according to the Biden Administration.

But what about insurance claims on EVs?

MarketWatch says that while EV drivers typically pay higher-than-average insurance rates, costs to insure EVs should fall as vehicle prices — driven by high MSRPs and repair costs — moderate and auto insurers adjust coverage options.

“Insurance companies will need to revamp their underwriting models and risk assessments to factor in the unique characteristics of EVs,” said Nick Vitali, a licensed insurance agent MarketWatch spoke to. “Things like battery range, charging infrastructure, and the availability of qualified repair shops will play a part in determining premiums.”

MarketWatch researchers added, “Replacement parts and repairs are more expensive for EVs than for conventional gas-powered cars… this situation is compounded if an electric vehicle’s battery is damaged in an accident. Insurers will need to manage this risk with elevated rates for collision coverage for EVs.”

Car insurance providers will have to make some changes to the way they do business as EVs increase in popularity, including specialized training on handling EV claims, MarketWatch concluded.

Images

Featured image: Kwangmoozaa/iStock

Charts provided by MarketWatch

More information

Estimates, repair planning & billpayers: ‘Damage dictates repair’

Survey shows insurance employees implementing AI in claims processing

EV sales may not be mainstream yet but new report says insurance claims on the rise